A Houston Texas Real Estate Lien Note refers to a legal document that serves as a written promise by a borrower to repay a loan secured by real estate property located in Houston, Texas. It is a crucial record that outlines the terms and conditions of the loan agreement and acts as evidence of the debt owed by the borrower to the lender. The Real Estate Lien Note typically includes information such as: 1. Identification of the parties involved: The note specifies the names and contact details of both the borrower (also known as the mortgagor) and the lender (also known as the mortgagee). 2. Loan amount and interest rate: The note clearly states the principal loan amount disbursed by the lender to the borrower and the interest rate at which the loan is charged. The interest rate determines the cost of borrowing and is typically expressed as an annual percentage. 3. Repayment terms: The repayment terms describe how the loan is to be repaid. This includes specifying the monthly installments, the due date for each payment, and the duration of the loan, commonly referred to as the loan term. 4. Late payment penalties: The note may outline the penalties or fees that the borrower will incur if they fail to make their payments on time. This serves as an incentive for prompt repayment and helps protect the lender's interests. 5. Default and foreclosure provisions: The note may include provisions that define the consequences of default by the borrower, such as late payments or nonpayment. It may provide the lender with the right to initiate foreclosure proceedings to recover the debt if the borrower fails to meet their obligations. 6. Other terms and conditions: The note may also contain additional provisions, such as clauses allowing the borrower to prepay the loan without penalty, restrictions on transferring the property without lender consent, or requirements for the borrower to maintain property insurance. Different types of Houston Texas Real Estate Lien Notes may include: 1. First lien note: This type of lien note holds priority over other liens on the property, meaning it will be settled first in the event of foreclosure or sale. 2. Second lien note: A second lien note is subordinate to a first lien note and is usually created when a borrower takes out a second mortgage or home equity loan on their property. In case of foreclosure, the first lien note will be settled before the second lien note. 3. Wraparound lien note: This type of lien note consolidates multiple mortgages into one, with the new loan taking into account the outstanding balance on the existing loans. It may offer flexibility in terms of interest rates and payment schedules. In conclusion, a Houston Texas Real Estate Lien Note is a legally binding document that details the terms and conditions of a loan secured by real estate property located in Houston, Texas. It protects the rights and interests of both the borrower and the lender and ensures transparency and clarity throughout the loan repayment process.

Houston Texas Real Estate Lien Note

Description

How to fill out Houston Texas Real Estate Lien Note?

Getting verified templates specific to your local laws can be difficult unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both personal and professional needs and any real-life scenarios. All the documents are properly grouped by area of usage and jurisdiction areas, so searching for the Houston Texas Real Estate Lien Note gets as quick and easy as ABC.

For everyone already acquainted with our service and has used it before, obtaining the Houston Texas Real Estate Lien Note takes just a couple of clicks. All you need to do is log in to your account, choose the document, and click Download to save it on your device. This process will take just a couple of additional actions to make for new users.

Follow the guidelines below to get started with the most extensive online form catalogue:

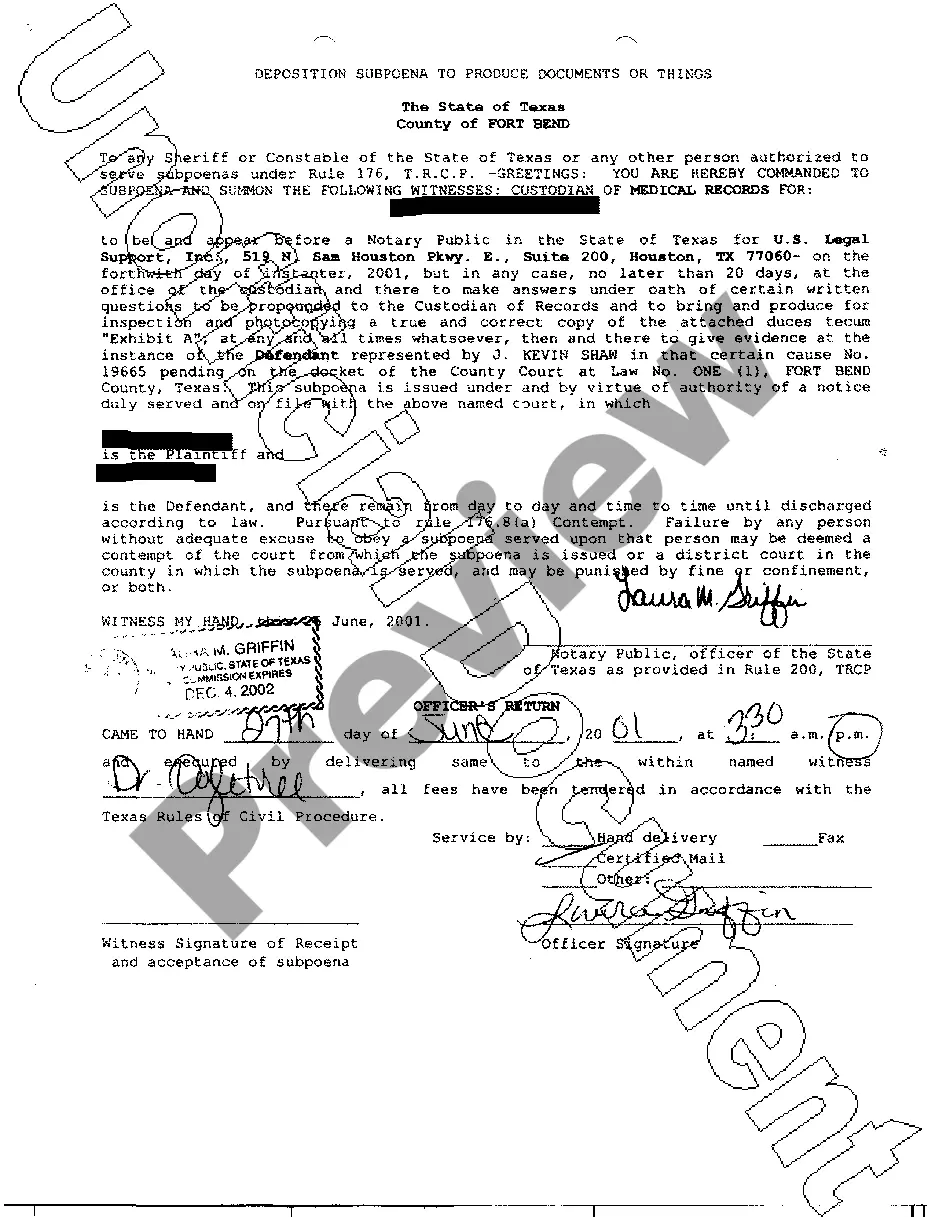

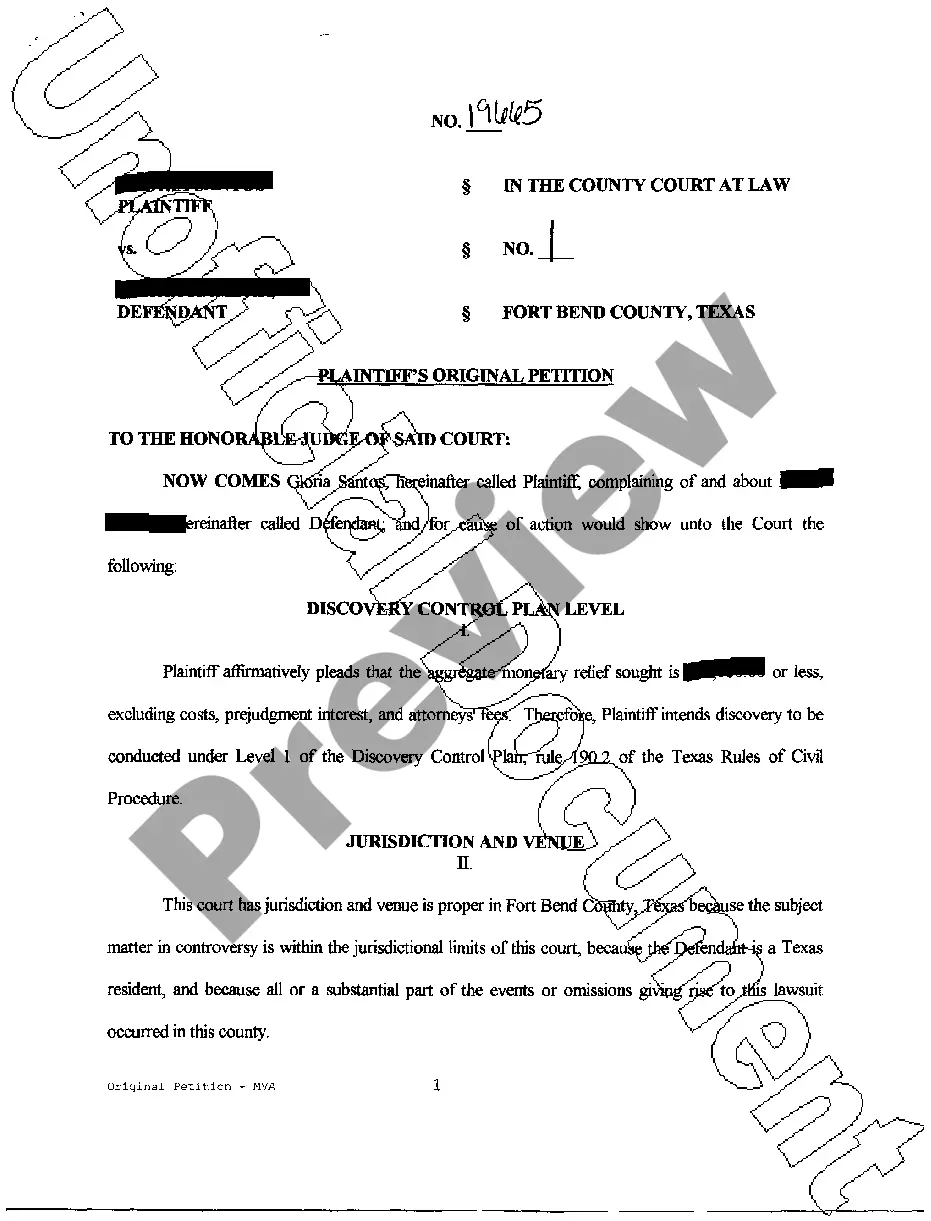

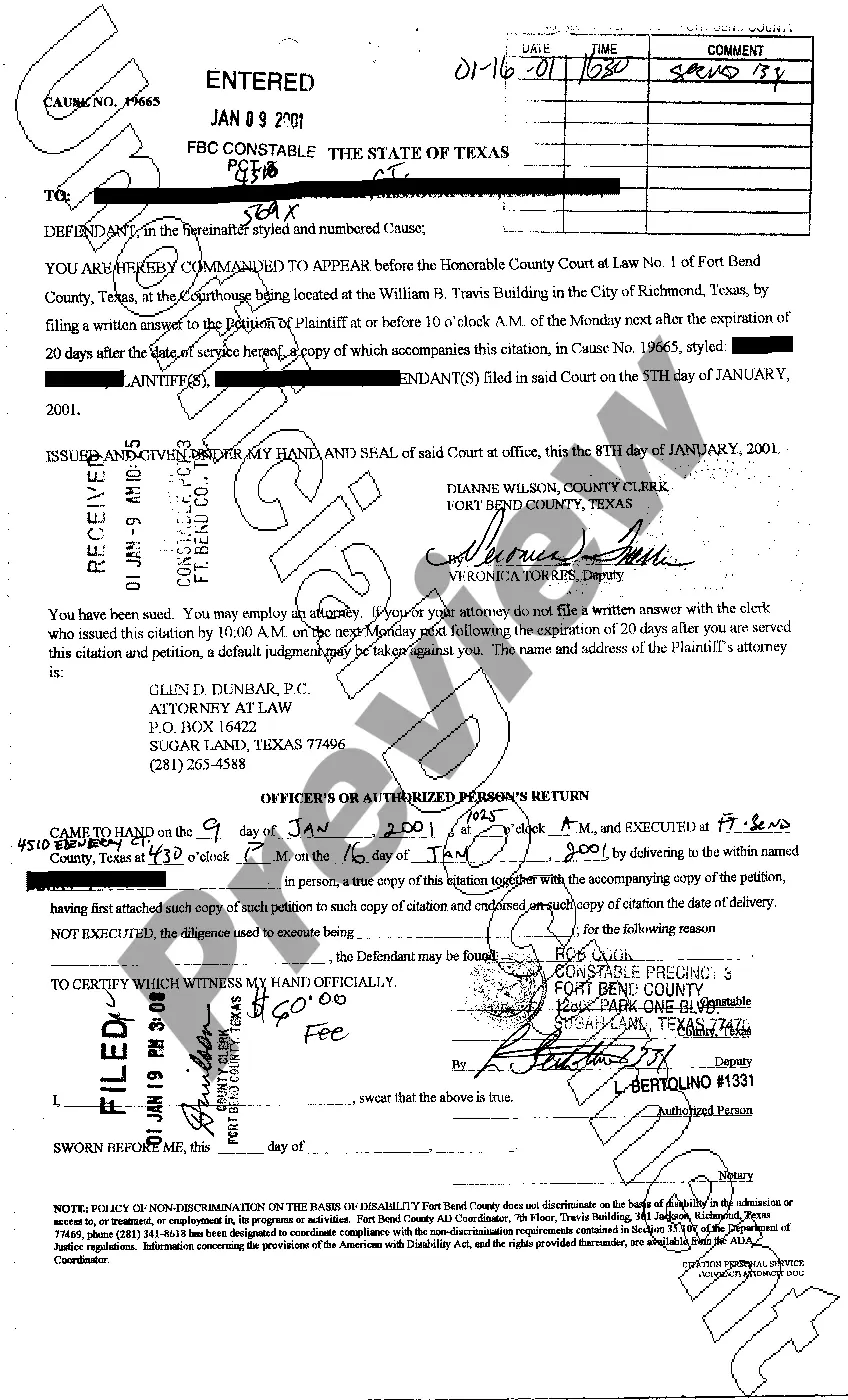

- Check the Preview mode and form description. Make certain you’ve selected the right one that meets your requirements and totally corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you see any inconsistency, use the Search tab above to get the correct one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and choose the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the service.

- Download the Houston Texas Real Estate Lien Note. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Benefit from the US Legal Forms library to always have essential document templates for any needs just at your hand!