McAllen Texas Real Estate Lien Note: Explained and Types In McAllen, Texas, a real estate lien note refers to a legal document that serves as evidence of a debt owed by a property owner to a creditor. This debt is typically associated with the purchase, improvement, or financing of real estate properties within the McAllen area. Real estate lien notes play a crucial role in ensuring that creditors have legal rights to claim the property or its proceeds in case of default. Types of McAllen Texas Real Estate Lien Notes: 1. Mortgage Lien Note: This is the most common type of real estate lien note in McAllen. When a property is financed through a mortgage loan, the borrower signs a promissory note, which details the terms of the loan. This promissory note is secured by a mortgage lien on the property, allowing the lender to foreclose and sell the property if the borrower fails to repay the debt. 2. Deed of Trust: Another type of real estate lien note used in McAllen is a deed of trust. Similar to a mortgage lien, a deed of trust secures the repayment of a loan by granting the lender a security interest in the property. However, in McAllen, Texas, this instrument involves three parties: the borrower, the lender, and a trustee. The trustee, often a title company, holds legal title to the property on behalf of the lender until the loan is fully repaid. 3. Mechanics' Lien Note: In the construction industry, contractors, subcontractors, and suppliers may establish mechanics' liens to secure unpaid debts for labor, materials, or services provided for property improvements. A mechanics' lien note in McAllen protects the rights of these parties and allows them to prioritize their claims over other types of liens on the property. 4. Tax Lien Note: When a property owner fails to pay their property taxes, the McAllen taxing authorities may place a tax lien on the property. A tax lien note represents this claim and can be sold to investors. The investors then have the right to collect the outstanding tax debt from the property owner, including interest and penalties if applicable. 5. Judgment Lien Note: In case of a court judgment against a property owner in McAllen, a judgment lien note may be created to secure the amount owed to the winning party. The judgment lien can be filed with the County Clerk's office and, once recorded, becomes a claim on the property, potentially affecting its sale or refinancing. Understanding the different types of McAllen Texas Real Estate Lien Notes is essential for both property owners and creditors. Property owners should be aware of the potential consequences of defaulting on any of these debt obligations, while creditors can use lien notes to protect their financial interests and enforce collection if necessary. It is important to consult with legal professionals experienced in real estate and lien law to ensure compliance with the specific regulations and requirements in McAllen, Texas.

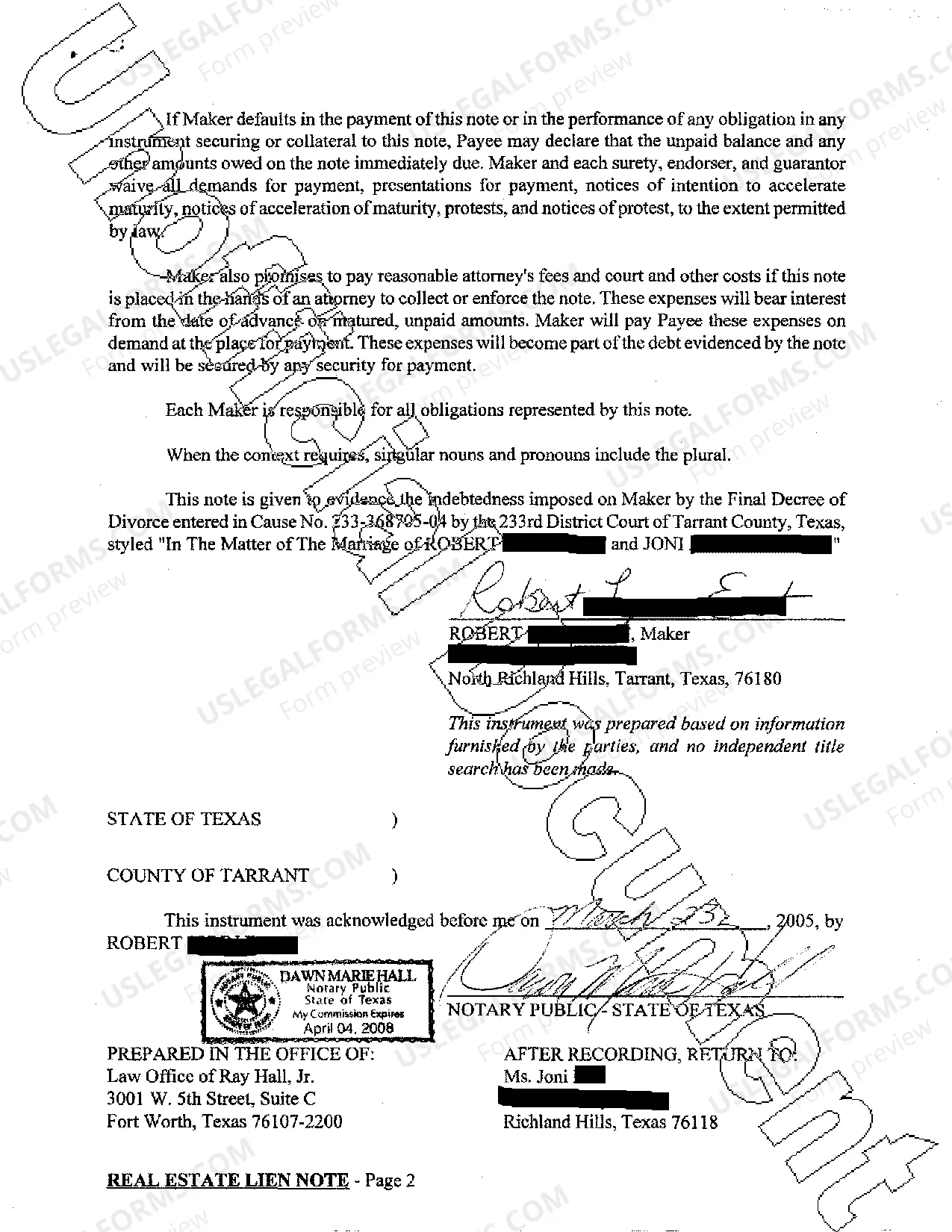

McAllen Texas Real Estate Lien Note

Description

How to fill out McAllen Texas Real Estate Lien Note?

Are you looking for a trustworthy and inexpensive legal forms supplier to buy the McAllen Texas Real Estate Lien Note? US Legal Forms is your go-to solution.

No matter if you need a basic arrangement to set rules for cohabitating with your partner or a set of documents to advance your divorce through the court, we got you covered. Our website offers over 85,000 up-to-date legal document templates for personal and business use. All templates that we offer aren’t generic and framed in accordance with the requirements of particular state and county.

To download the form, you need to log in account, find the needed template, and hit the Download button next to it. Please remember that you can download your previously purchased form templates at any time in the My Forms tab.

Is the first time you visit our platform? No worries. You can create an account in minutes, but before that, make sure to do the following:

- Check if the McAllen Texas Real Estate Lien Note conforms to the laws of your state and local area.

- Go through the form’s details (if provided) to find out who and what the form is intended for.

- Start the search over in case the template isn’t good for your specific scenario.

Now you can create your account. Then select the subscription option and proceed to payment. Once the payment is completed, download the McAllen Texas Real Estate Lien Note in any provided format. You can return to the website at any time and redownload the form free of charge.

Finding up-to-date legal documents has never been easier. Give US Legal Forms a try today, and forget about wasting your valuable time researching legal paperwork online for good.