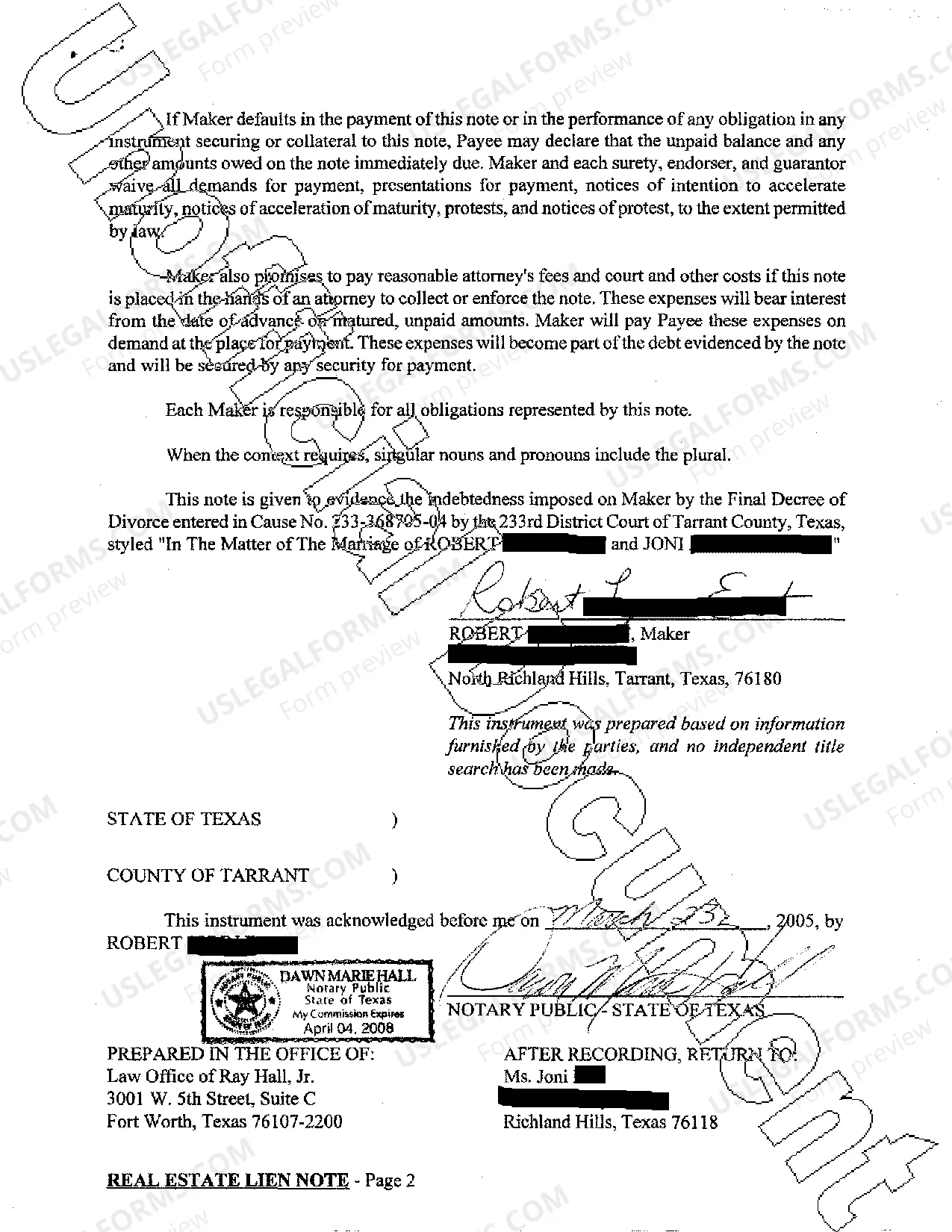

McKinney Texas Real Estate Lien Note

Description

How to fill out Texas Real Estate Lien Note?

Finding authenticated templates tailored to your regional regulations can be difficult unless you utilize the US Legal Forms repository.

This is an online database of over 85,000 legal documents catering to both personal and professional requirements as well as various real-world scenarios.

All the files are accurately organized by type of use and jurisdiction, making it as simple as ABC to search for the McKinney Texas Real Estate Lien Note.

Maintaining organized paperwork in adherence to legal standards is of utmost importance. Take advantage of the US Legal Forms repository to always have crucial document templates at your fingertips!

- Ensure to verify the Preview mode and form description.

- Confirm you have selected the right one that fulfills your requirements and fully aligns with your local jurisdiction standards.

- Search for an alternative template, if necessary.

- If you notice any discrepancies, make use of the Search tab above to find the correct one.

- If it meets your criteria, proceed to the next step.

Form popularity

FAQ

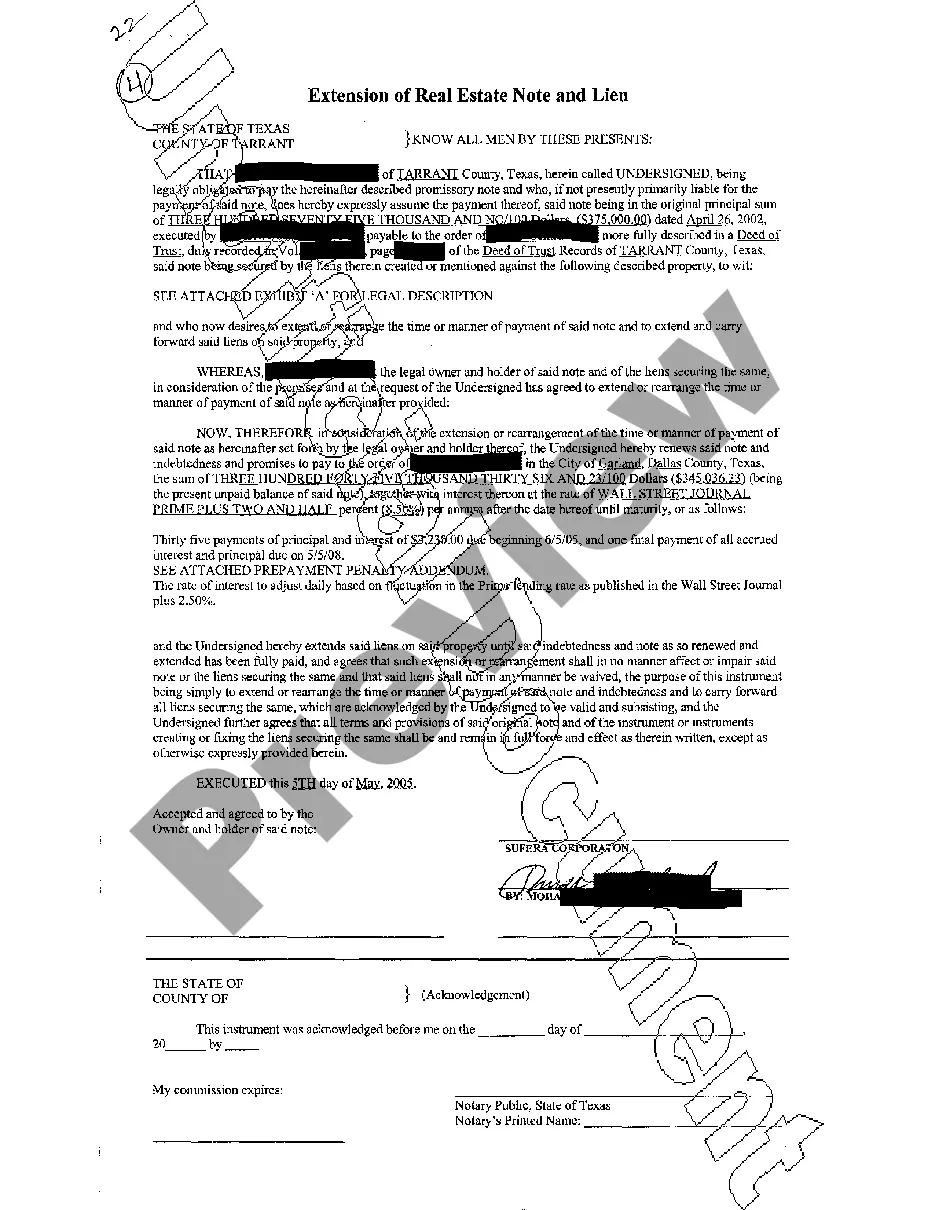

To file a release of lien on a property in Texas, you need to obtain a release document from the lienholder. After the debt is satisfied, complete the document and file it with the county clerk’s office. Using services like US Legal Forms can help simplify this task, especially when dealing with MCkinney Texas Real Estate Lien Notes.

Yes, in Texas, it is possible for someone to place a lien on your house without your prior knowledge. This often happens due to unpaid debts or legal judgments. To protect yourself, regularly check public records and consider using platforms like US Legal Forms, which can help you stay informed about any McKinney Texas Real Estate Lien Notes that may affect your property.

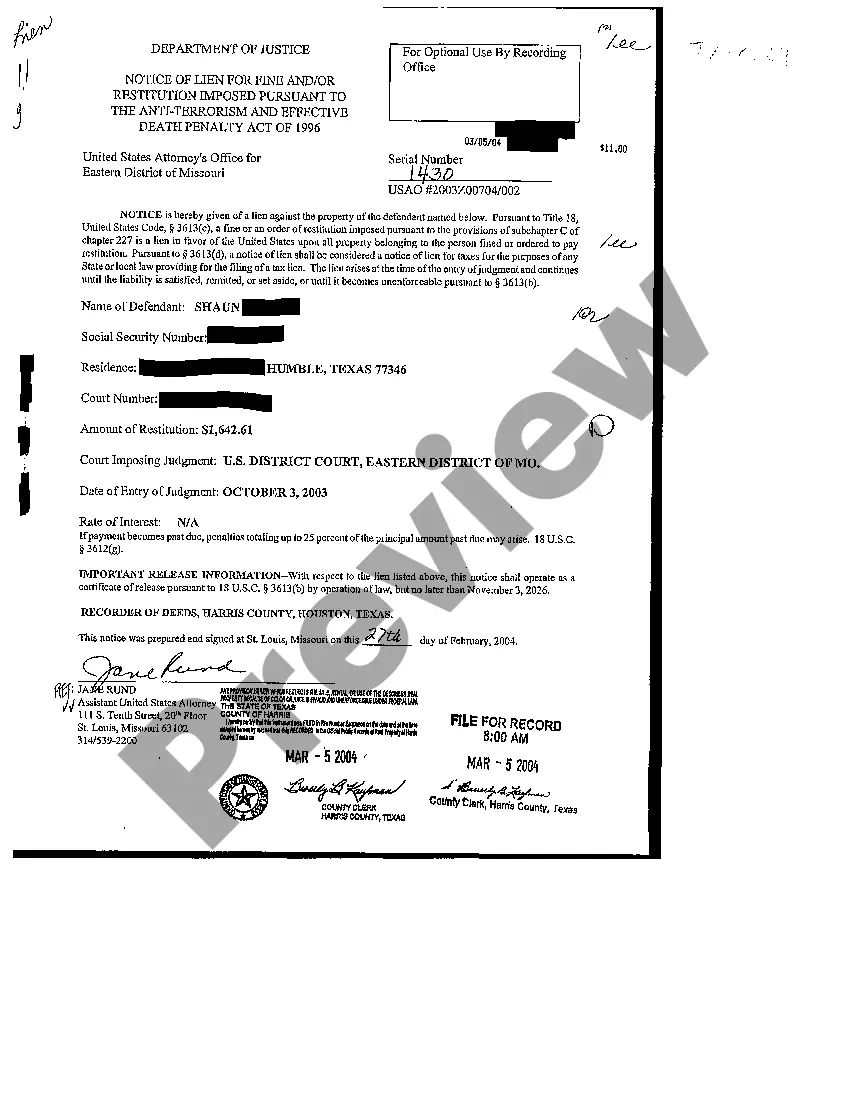

To place a lien on a property in Texas, you must draft a lien document detailing the nature of the debt and the involved parties. File the document with the county clerk’s office where the property is located. If you're dealing with a McKinney Texas Real Estate Lien Note, consider leveraging US Legal Forms for templates that can simplify the process.

To find a lien on your property in Texas, you can start by visiting your county clerk's office. They maintain public records of property liens, including those related to McKinney Texas Real Estate Lien Notes. You can also search online through local databases, or utilize platforms like US Legal Forms that provide guidance for conducting thorough lien searches.

To send a lien notice in Texas, you should prepare the notice and then deliver it to the property owner and any other interested parties. This can typically be done via certified mail to ensure you have proof of delivery. When working with a McKinney Texas Real Estate Lien Note, it's essential to keep records of your correspondence to establish transparency and protection for your claim.

Yes, you can file a lien online in Texas through the Texas Secretary of State's website or the specific county's online system. Many counties, including Collin County where McKinney is located, offer electronic filing options to facilitate this process. Using an online platform can streamline the filing of your McKinney Texas Real Estate Lien Note, making it quicker and more efficient.

To file a notice of lien in Texas, you need to prepare the appropriate lien document, which typically includes details about the property, the debt, and the lienholder’s information. Next, you will file the notice with the county clerk in the county where the property is located. For those dealing with McKinney Texas Real Estate Lien Note, ensure that all information is accurate to avoid delays in processing.

The steps to file a lien in Texas include drafting the lien document, securing the necessary signatures, and filing it with the county clerk. Make sure to include all pertinent details, such as the property description and the amount owed. Utilizing a McKinney Texas Real Estate Lien Note can streamline this process. Additionally, it is advisable to send notice to the property owner to maintain transparency.

To place a lien on a property in Texas, start by preparing the lien documents that specify the amount owed. Then, file them with the county clerk where the property is located. A McKinney Texas Real Estate Lien Note is a useful tool to facilitate this process. Make sure to inform the property owner and follow state regulations to avoid any legal issues.

To look up property liens in Texas, you can visit the county clerk’s office or access their online databases. You’ll find records of liens filed within that specific jurisdiction. For a more comprehensive search, consider using services that specialize in McKinney Texas Real Estate Lien Notes to ensure you gather all relevant information. This will help you make informed decisions.