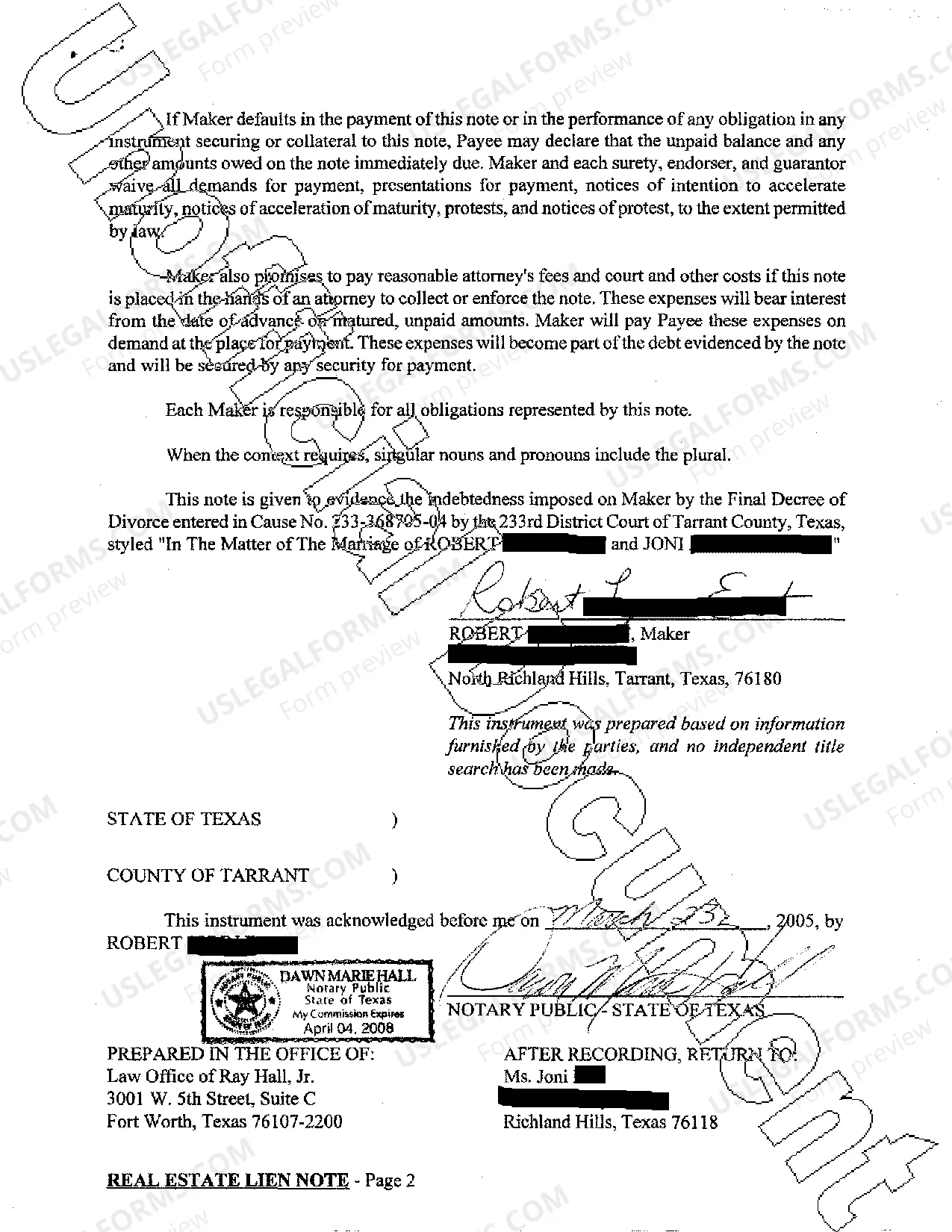

Plano Texas Real Estate Lien Note is a legal document that serves as evidence of a debt secured by a property located in Plano, Texas. The lien note outlines the terms and conditions of the loan, including the repayment schedule, interest rate, and any other relevant details. This document acts as a lien against the property, meaning that the lender has a legal claim on the property until the debt is fully paid off. Keywords: Plano Texas, real estate lien note, legal document, debt, secured, property, terms and conditions, repayment schedule, interest rate, lien, lender, claim, paid off. There are different types of Plano Texas Real Estate Lien Notes, including: 1. Mortgage Lien Note: This is the most common type of lien note, wherein the lender uses the property itself as collateral against the loan. If the borrower defaults on their payments, the lender has the right to foreclosure. 2. Deed of Trust: Another type of lien note, a deed of trust involves three parties — the borrower, the lender, and a third-party trustee. The trustee holds the property title until the debt is paid, acting as a neutral party to protect both the borrower and the lender's interests. 3. Mechanic's Lien Note: This type of lien note is specific to construction projects. It is filed by contractors or suppliers who have not been paid for their services or materials. It creates a legal claim on the property until the debt is satisfied. 4. Judgment Lien Note: A judgment lien note is created when a court awards a creditor a monetary judgment against the property owner. The lien note ensures that the creditor gets paid if the property is sold or refinanced. 5. Tax Lien Note: A tax lien note is imposed by the government when property taxes are not paid. It gives the government the right to collect the unpaid taxes by seizing and selling the property. 6. HOA Lien Note: Homeowners' associations (HOA) can file a lien note against a property when the homeowner fails to pay their dues or violates the association's rules. This note allows the HOA to collect the outstanding fees. In summary, Plano Texas Real Estate Lien Note is a vital legal document securing a debt against a property in Plano, Texas. It comes in various types, including mortgage lien notes, deeds of trust, mechanic's lien notes, judgment lien notes, tax lien notes, and HOA lien notes. These lien notes offer protection to lenders and creditors while ensuring the repayment of debts through the property's sale or refinancing.

Plano Texas Real Estate Lien Note

Description

How to fill out Plano Texas Real Estate Lien Note?

If you are searching for a valid form, it’s extremely hard to choose a better service than the US Legal Forms site – one of the most comprehensive libraries on the internet. With this library, you can get a large number of form samples for business and individual purposes by types and regions, or key phrases. Using our advanced search option, discovering the most up-to-date Plano Texas Real Estate Lien Note is as easy as 1-2-3. Additionally, the relevance of every document is verified by a group of skilled lawyers that regularly check the templates on our website and revise them in accordance with the latest state and county laws.

If you already know about our system and have an account, all you need to get the Plano Texas Real Estate Lien Note is to log in to your profile and click the Download option.

If you utilize US Legal Forms for the first time, just follow the guidelines listed below:

- Make sure you have found the sample you require. Look at its explanation and make use of the Preview function (if available) to see its content. If it doesn’t suit your needs, utilize the Search option at the top of the screen to find the proper document.

- Confirm your selection. Select the Buy now option. After that, select the preferred pricing plan and provide credentials to sign up for an account.

- Process the financial transaction. Use your bank card or PayPal account to finish the registration procedure.

- Receive the form. Choose the file format and save it on your device.

- Make modifications. Fill out, revise, print, and sign the acquired Plano Texas Real Estate Lien Note.

Each and every form you add to your profile does not have an expiration date and is yours permanently. You always have the ability to gain access to them via the My Forms menu, so if you need to get an additional version for modifying or printing, you can return and save it again anytime.

Make use of the US Legal Forms extensive collection to gain access to the Plano Texas Real Estate Lien Note you were looking for and a large number of other professional and state-specific samples in one place!