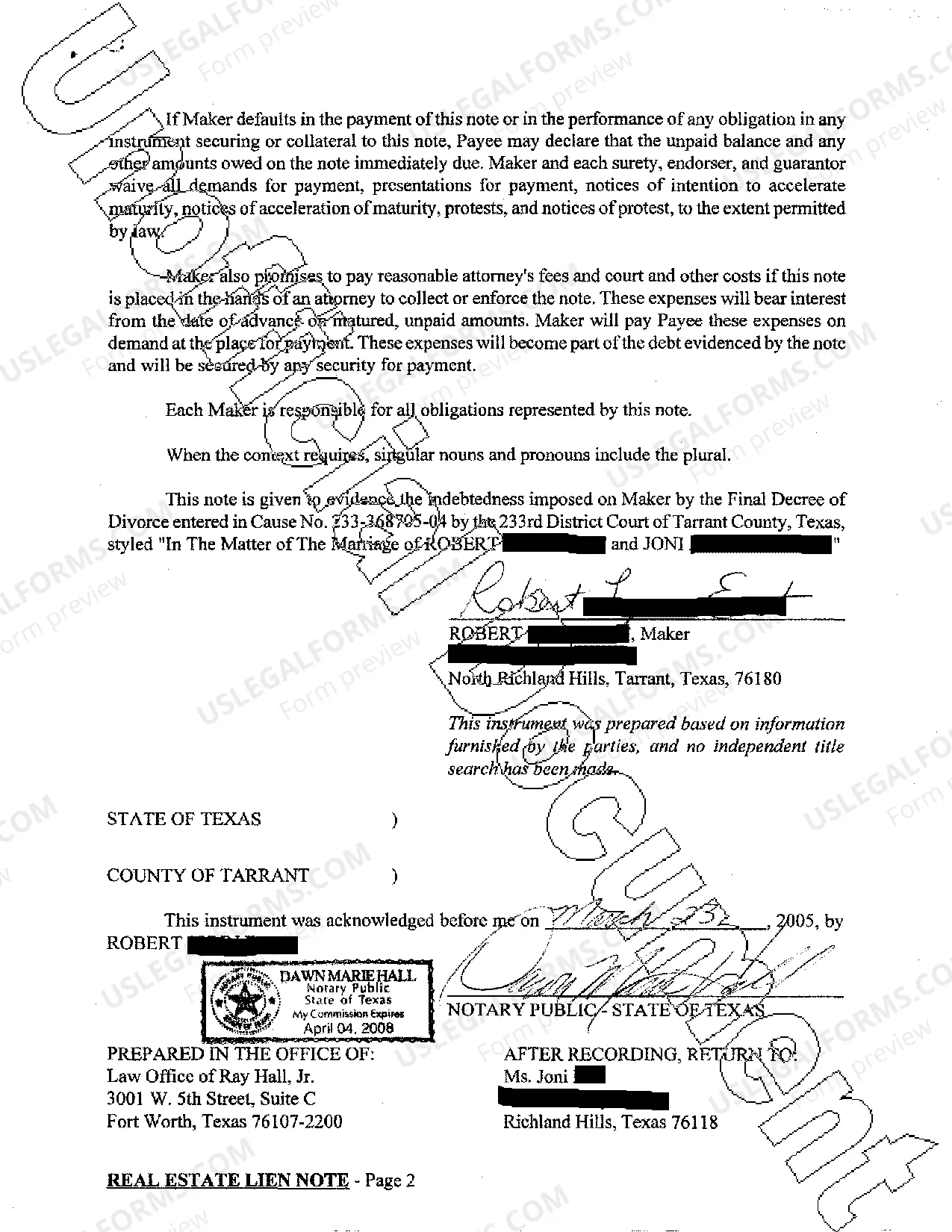

A San Antonio Texas Real Estate Lien Note refers to a legal document that serves as evidence of a debt owed by a borrower against a real estate property located in San Antonio, Texas. It is commonly used by lenders, such as banks or private investors, when providing financing for the purchase or refinancing of real estate. The purpose of a Lien Note is to outline the terms and conditions of the loan, including the principal amount, interest rate, repayment schedule, and any other relevant details. It establishes the borrower's obligation to repay the loan and grants the lender a lien against the property as collateral to secure the debt. There are different types of San Antonio Texas Real Estate Lien Notes that may be used, depending on the specific loan arrangement and purpose. Some common types include: 1. Mortgage Lien Note: This type of lien note is typically used in residential or commercial mortgage transactions. It outlines the terms of the loan and establishes that the lender has a lien or claim against the property as security until the loan is repaid. 2. Deed of Trust Lien Note: This type of lien note is commonly used in Texas real estate transactions instead of a traditional mortgage. It involves three parties: the borrower (trust or), the lender (beneficiary), and a neutral third party known as a trustee. The trustee holds legal title to the property until the loan is fully paid, serving as a neutral intermediary. 3. Mechanics Lien Note: This type of lien note is typically used in construction or renovation projects. It allows contractors, suppliers, or laborers who have provided services or materials for the project but have not been paid to place a lien against the property. The lien note outlines the unpaid debts and specifies the amount owed. Regardless of the specific type, a San Antonio Texas Real Estate Lien Note is a critical legal document that protects the interests of both the lender and the borrower. It ensures that the terms of the loan are clearly defined, and the lender has a legal claim on the property as collateral for the debt.

San Antonio Texas Real Estate Lien Note

Description

How to fill out San Antonio Texas Real Estate Lien Note?

Take advantage of the US Legal Forms and get immediate access to any form you need. Our helpful website with thousands of documents makes it easy to find and obtain almost any document sample you want. It is possible to download, fill, and sign the San Antonio Texas Real Estate Lien Note in just a matter of minutes instead of browsing the web for many hours looking for the right template.

Utilizing our library is a wonderful strategy to improve the safety of your record submissions. Our professional attorneys on a regular basis check all the documents to make certain that the templates are appropriate for a particular region and compliant with new acts and regulations.

How do you obtain the San Antonio Texas Real Estate Lien Note? If you already have a profile, just log in to the account. The Download button will appear on all the documents you look at. Furthermore, you can get all the earlier saved records in the My Forms menu.

If you don’t have a profile yet, follow the instructions listed below:

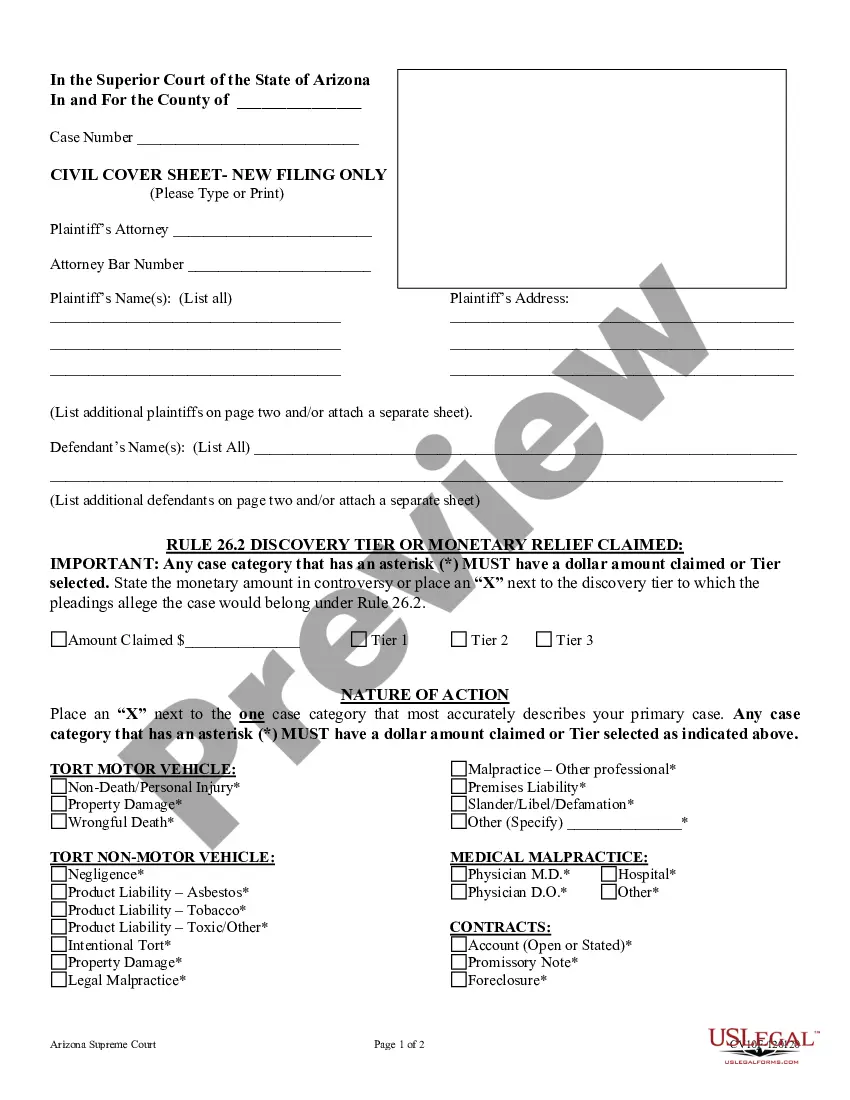

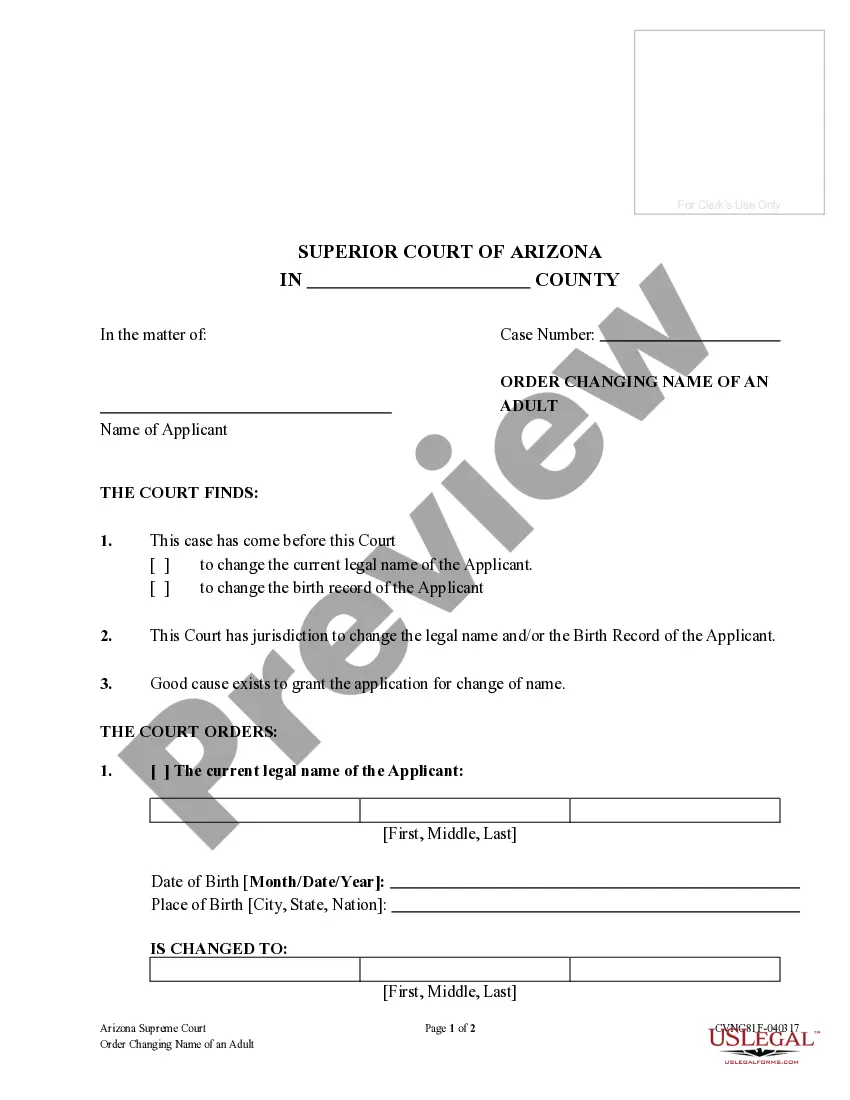

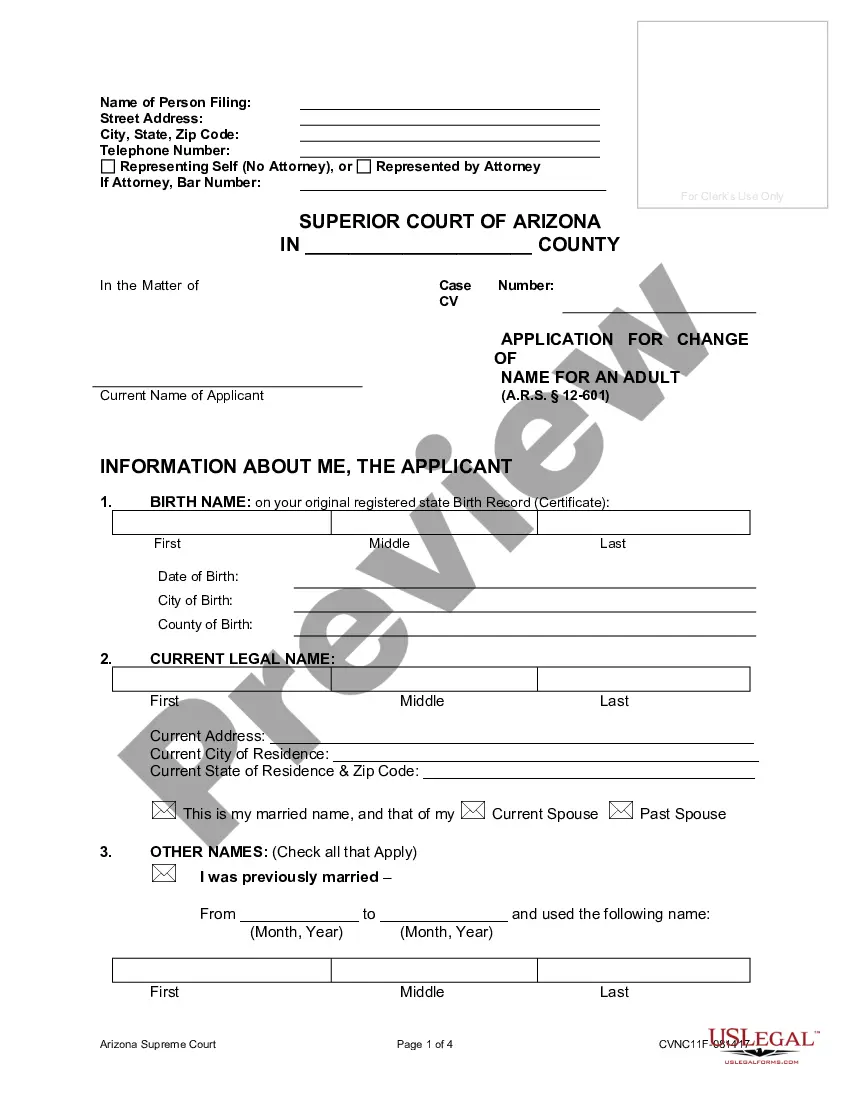

- Open the page with the template you require. Make certain that it is the form you were hoping to find: examine its headline and description, and use the Preview feature if it is available. Otherwise, make use of the Search field to look for the needed one.

- Start the downloading process. Click Buy Now and select the pricing plan that suits you best. Then, create an account and process your order with a credit card or PayPal.

- Download the file. Select the format to obtain the San Antonio Texas Real Estate Lien Note and change and fill, or sign it for your needs.

US Legal Forms is one of the most considerable and reliable document libraries on the internet. Our company is always happy to help you in virtually any legal process, even if it is just downloading the San Antonio Texas Real Estate Lien Note.

Feel free to take advantage of our service and make your document experience as convenient as possible!