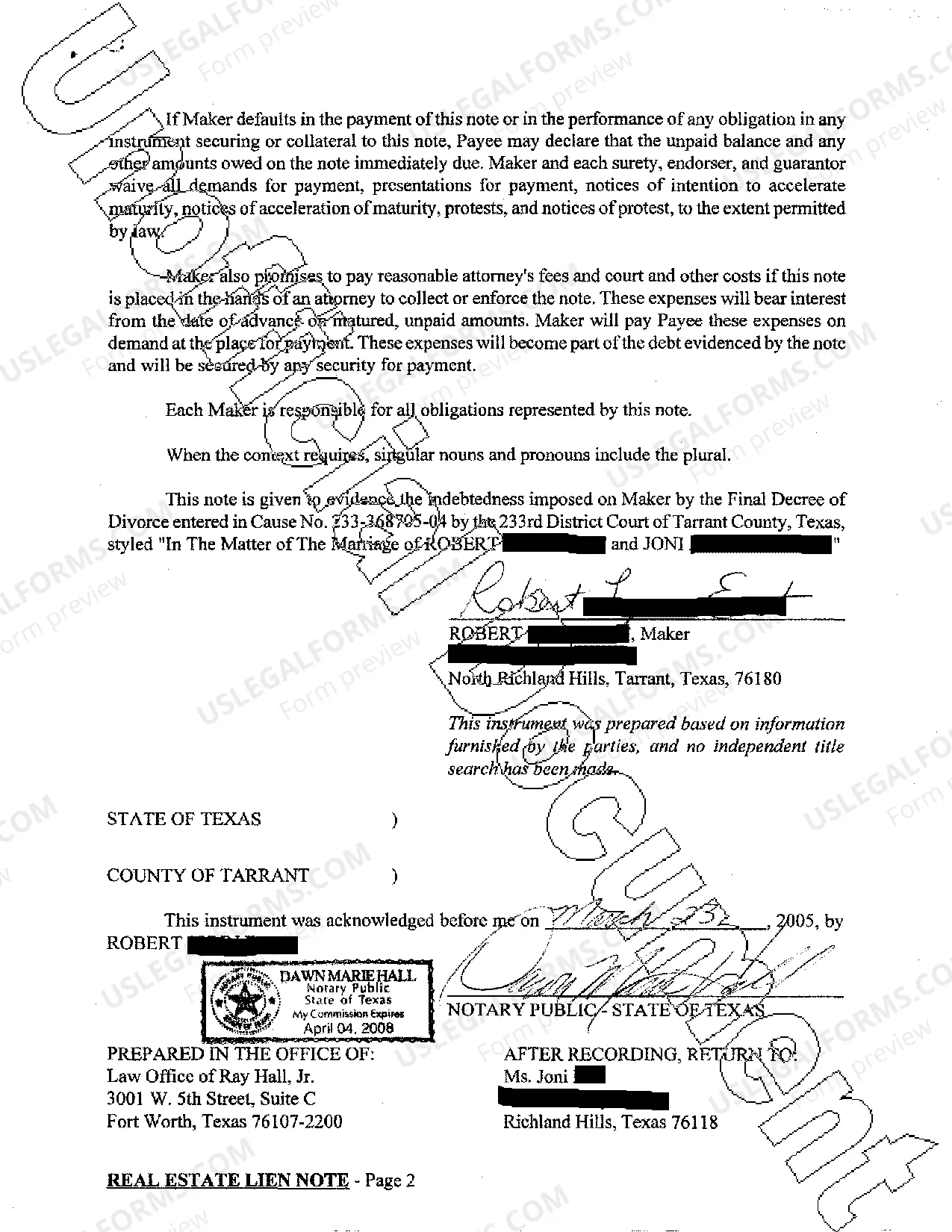

A Tarrant Texas Real Estate Lien Note is a legal document that serves as evidence of a debt owed on a property located in Tarrant County, Texas. It is an important aspect of the real estate industry, as it provides a mechanism for claiming and enforcing payment in cases where the property owner fails to meet their financial obligations. In Tarrant County, there are several types of Real Estate Lien Notes that can be encountered: 1. Mechanic's Lien Note: This type of lien note arises when a contractor or subcontractor performs work or supplies materials for the improvement of a property in Tarrant County. If they are not paid for their services, they can file a mechanic's lien note against the property to secure their payment. 2. Tax Lien Note: A tax lien note is created when a property owner fails to pay property taxes owed to the county. The county government uses this lien note as a means to prioritize the payment of delinquent taxes by potentially foreclosing on the property. 3. Mortgage Lien Note: A mortgage lien note is one of the most common types of real estate lien notes. It is created when a property owner obtains a loan to purchase the property, and that loan is secured by the property as collateral. If the property owner fails to make the required mortgage payments, the lender can utilize the lien note to initiate foreclosure proceedings. 4. Homeowner Association (HOA) Lien Note: If a homeowner fails to pay their assessments or fees to the homeowner association, an HOA lien note can be placed against the property. This type of lien note allows the HOA to seek payment through various legal means, including foreclosure, if necessary. 5. Judgment Lien Note: A judgment lien note is created when a court awards a creditor the right to place a lien on a property in order to satisfy a debt owed. These types of liens are typically issued after a successful lawsuit, such as a personal injury case or a dispute over unpaid debts. When dealing with Tarrant Texas Real Estate Lien Notes, it is crucial for property owners, contractors, lenders, and other stakeholders to understand the specific requirements and implications associated with each type of lien note. Resolving and navigating these liens notes may require professional assistance from attorneys, title companies, or real estate agents with expertise in Tarrant County real estate law.

Tarrant Texas Real Estate Lien Note

Description

How to fill out Tarrant Texas Real Estate Lien Note?

No matter the social or professional status, completing legal forms is an unfortunate necessity in today’s world. Very often, it’s almost impossible for someone with no law education to draft this sort of papers from scratch, mainly because of the convoluted terminology and legal nuances they involve. This is where US Legal Forms comes to the rescue. Our service provides a huge collection with more than 85,000 ready-to-use state-specific forms that work for pretty much any legal case. US Legal Forms also is an excellent resource for associates or legal counsels who want to to be more efficient time-wise using our DYI forms.

Whether you need the Tarrant Texas Real Estate Lien Note or any other document that will be good in your state or area, with US Legal Forms, everything is at your fingertips. Here’s how you can get the Tarrant Texas Real Estate Lien Note in minutes employing our trusted service. If you are presently a subscriber, you can proceed to log in to your account to download the appropriate form.

However, if you are new to our platform, make sure to follow these steps prior to obtaining the Tarrant Texas Real Estate Lien Note:

- Ensure the template you have found is suitable for your location since the rules of one state or area do not work for another state or area.

- Review the form and read a quick outline (if available) of cases the paper can be used for.

- In case the form you chosen doesn’t suit your needs, you can start again and look for the necessary form.

- Click Buy now and pick the subscription plan you prefer the best.

- with your credentials or register for one from scratch.

- Pick the payment method and proceed to download the Tarrant Texas Real Estate Lien Note as soon as the payment is through.

You’re good to go! Now you can proceed to print out the form or complete it online. Should you have any issues locating your purchased forms, you can easily find them in the My Forms tab.

Whatever case you’re trying to solve, US Legal Forms has got you covered. Give it a try today and see for yourself.