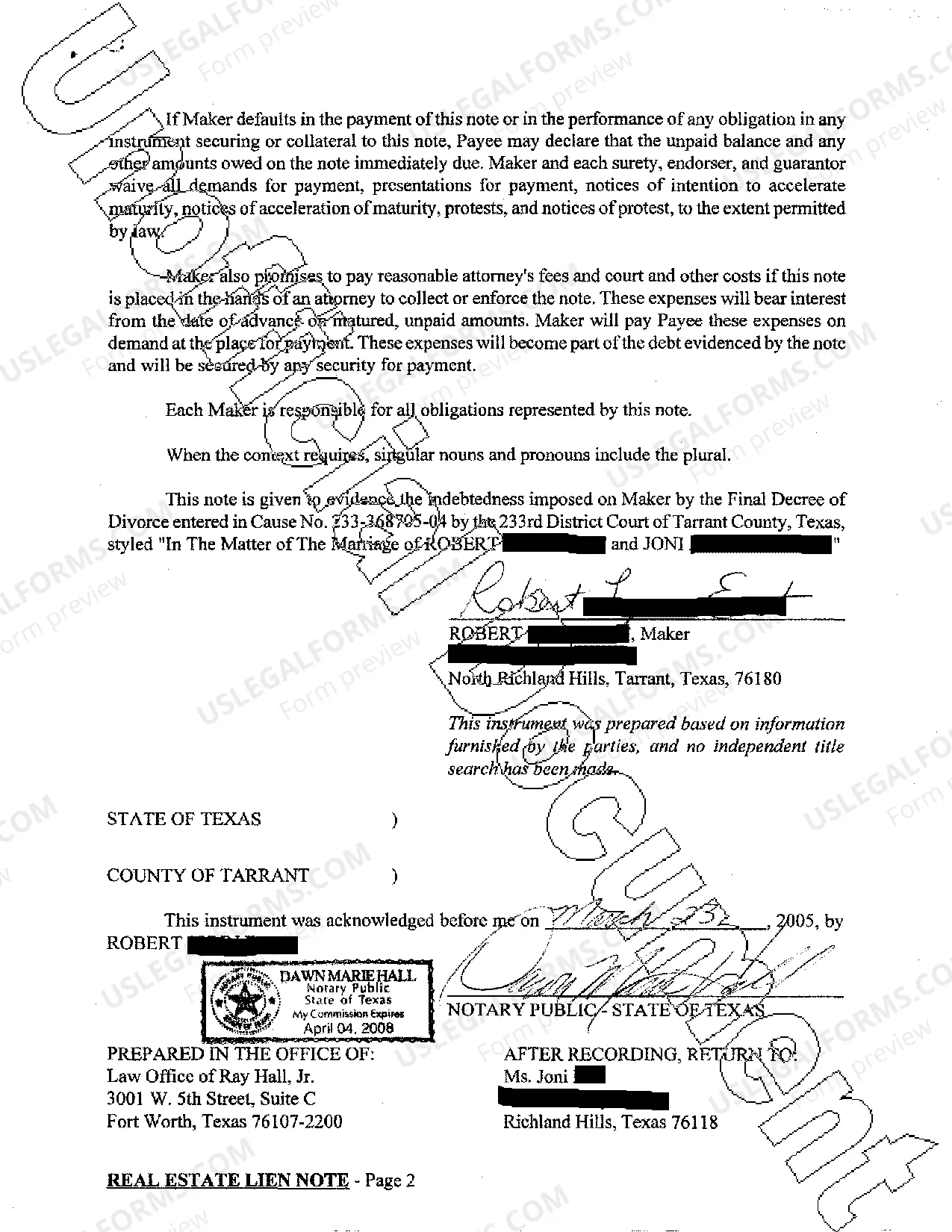

A Wichita Falls Texas Real Estate Lien Note is a legal document that serves as a written agreement between a property owner and a lender, securing the loan with the property as collateral. It is a crucial part of the home purchasing and financing process, ensuring that the lender has a claim on the property in case the borrower defaults on the loan. These lien notes come in various types, each serving a specific purpose: 1. Mortgage Lien Notes: These are the most common types of lien notes used in real estate transactions in Wichita Falls, Texas. They establish a lender's right to the property until the loan is fully paid off. If the borrower fails to make payments as agreed upon, the lender can foreclose on the property to recover the outstanding debt. 2. Deed of Trust Lien Notes: Similar to mortgage lien notes, a deed of trust lien note is a legal instrument used to secure a loan with the property as collateral. In this case, however, a trustee holds the legal title to the property until the loan is repaid. If the borrower defaults, the trustee has the authority to sell the property in a non-judicial foreclosure process. 3. Mechanics' Lien Notes: These lien notes are specific to construction projects in Wichita Falls, Texas. Contractors, subcontractors, suppliers, or other service providers can file a mechanics' lien note against a property if they are not fully paid for their services or materials provided. This lien note ensures that the claimant has a legal right to be paid from the property's value, even if the owner sells or refinances the property. 4. Tax Lien Notes: When a property owner fails to pay their property taxes, the county government can issue a tax lien note against the property. This note secures the government's right to the overdue taxes and gives them the authority to foreclose on the property if the taxes remain unpaid. In summary, Wichita Falls Texas Real Estate Lien Notes are vital legal documents used to secure loans for properties in the area. These include mortgage lien notes, deed of trust lien notes, mechanics' lien notes, and tax lien notes. It is essential to understand the purpose and implications of each lien note type to navigate real estate transactions successfully.

Wichita Falls Texas Real Estate Lien Note

Description

How to fill out Wichita Falls Texas Real Estate Lien Note?

Do you need a trustworthy and inexpensive legal forms supplier to get the Wichita Falls Texas Real Estate Lien Note? US Legal Forms is your go-to option.

No matter if you need a simple arrangement to set regulations for cohabitating with your partner or a package of documents to move your separation or divorce through the court, we got you covered. Our platform offers more than 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t universal and frameworked based on the requirements of specific state and county.

To download the document, you need to log in account, find the required form, and hit the Download button next to it. Please keep in mind that you can download your previously purchased form templates anytime from the My Forms tab.

Is the first time you visit our platform? No worries. You can create an account in minutes, but before that, make sure to do the following:

- Find out if the Wichita Falls Texas Real Estate Lien Note conforms to the regulations of your state and local area.

- Go through the form’s description (if provided) to learn who and what the document is good for.

- Start the search over if the form isn’t good for your legal scenario.

Now you can create your account. Then pick the subscription plan and proceed to payment. As soon as the payment is done, download the Wichita Falls Texas Real Estate Lien Note in any provided file format. You can return to the website at any time and redownload the document without any extra costs.

Finding up-to-date legal documents has never been easier. Give US Legal Forms a go now, and forget about wasting your valuable time learning about legal paperwork online for good.