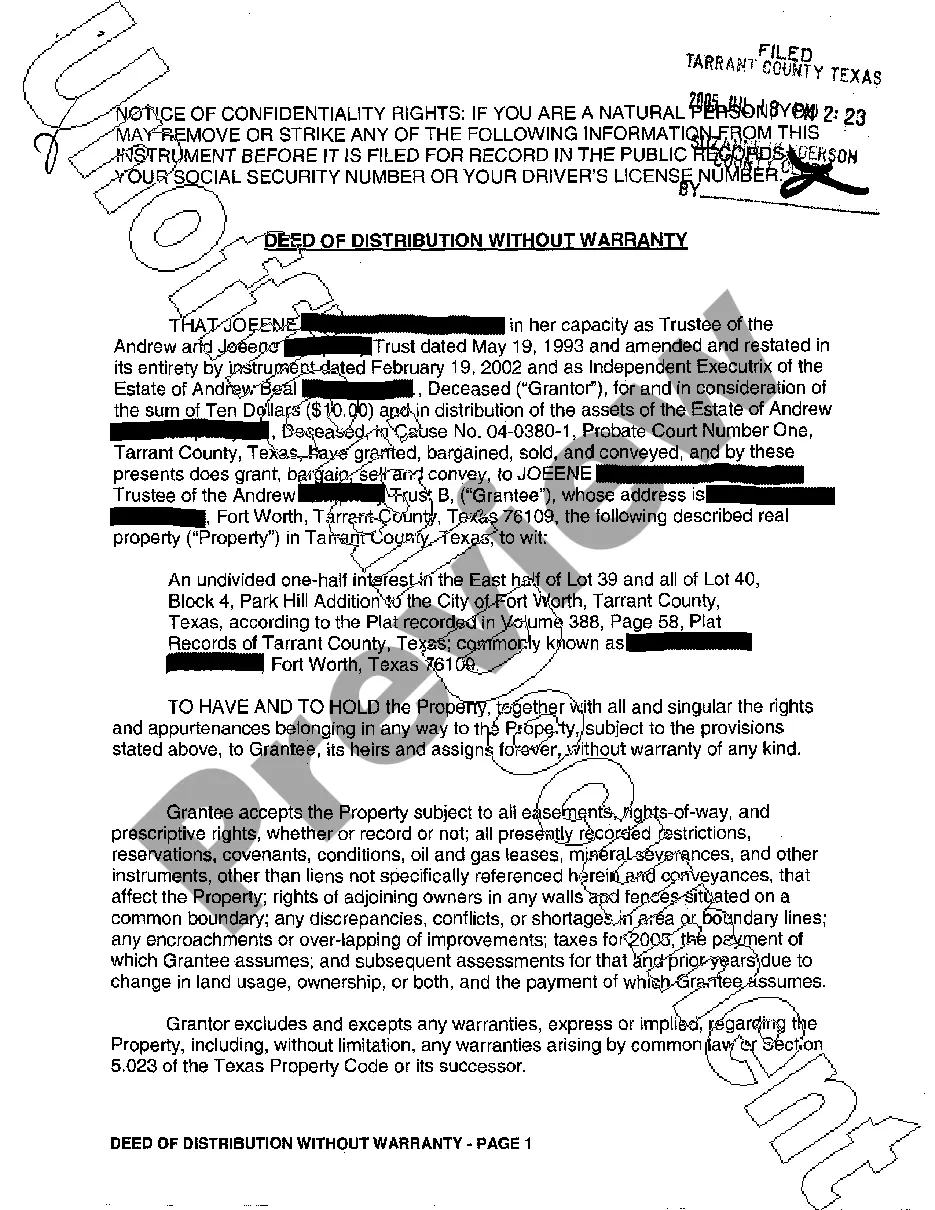

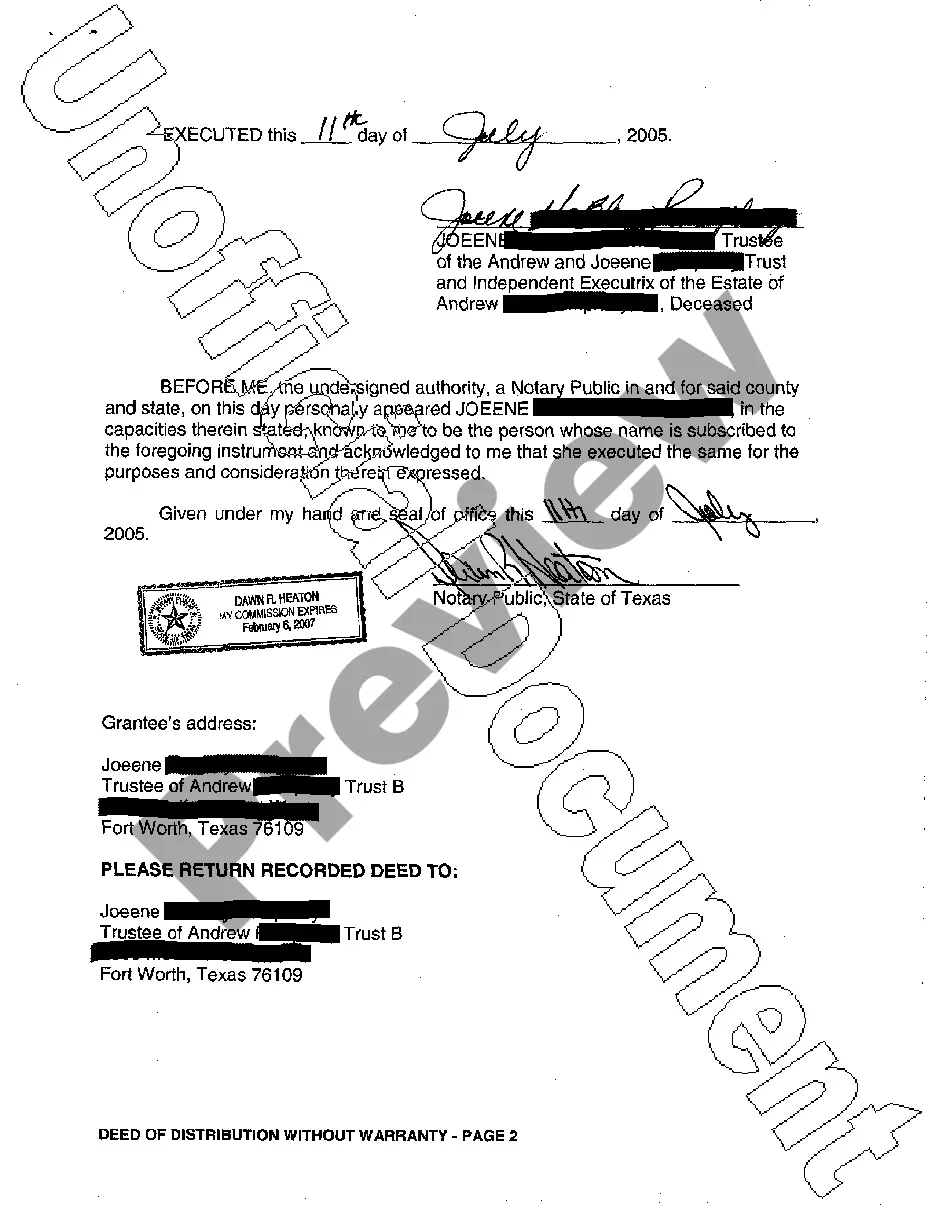

Collin Texas Deed of Distribution Without a Warranty is a legal document that helps transfer property ownership rights in Collin County, Texas, without providing any warranty or guarantee by the granter (seller) to the grantee (buyer). This type of deed is commonly used when the seller wants to release their interest in the property without making any promises regarding the property's condition or any potential title issues. By utilizing a Collin Texas Deed of Distribution Without a Warranty, both parties involved in the transaction acknowledge and understand that the property is being transferred "as-is" without any legal assurances. This means that the granter is not liable for any past, present, or future property defects, outstanding liens, encumbrances, or other related issues. Different types of Collin Texas Deeds of Distribution Without a Warranty may include: 1. General Collin Texas Deed of Distribution Without a Warranty: This is a standard form of the deed used to transfer property ownership when the seller does not want to provide any warranties to the buyer. 2. Executor's Collin Texas Deed of Distribution Without a Warranty: This deed is used when the transfer of property is made by an executor or administrator of a deceased person's estate, distributing the property to one or more heirs or beneficiaries. 3. Guardian's Collin Texas Deed of Distribution Without a Warranty: When a legal guardian transfers property on behalf of a minor or incapacitated person, this type of deed ensures that no warranties are provided by the guardian. 4. Tax Sale Collin Texas Deed of Distribution Without a Warranty: This deed is executed when a property sold in a tax sale is being transferred, indicating that the transfer is made without any warranty by the taxing authority. It is essential to understand that a Collin Texas Deed of Distribution Without a Warranty may pose some risks for the buyer, as they are assuming all responsibility for the property's condition and title issues. It is advisable for buyers to conduct thorough due diligence and title searches before entering into such transactions. Consulting with a qualified real estate attorney or professional is highly recommended ensuring the legality and protection of both parties involved.

Collin Texas Deed of Distribution Without a Warranty

Description

How to fill out Collin Texas Deed Of Distribution Without A Warranty?

If you are looking for a valid form template, it’s impossible to choose a more convenient place than the US Legal Forms website – one of the most comprehensive online libraries. With this library, you can find a huge number of form samples for organization and personal purposes by categories and states, or key phrases. Using our high-quality search function, discovering the latest Collin Texas Deed of Distribution Without a Warranty is as easy as 1-2-3. In addition, the relevance of each and every record is verified by a group of professional lawyers that on a regular basis check the templates on our website and revise them in accordance with the most recent state and county demands.

If you already know about our system and have an account, all you should do to get the Collin Texas Deed of Distribution Without a Warranty is to log in to your user profile and click the Download button.

If you use US Legal Forms the very first time, just follow the guidelines listed below:

- Make sure you have found the form you want. Check its explanation and make use of the Preview option (if available) to explore its content. If it doesn’t suit your needs, utilize the Search option near the top of the screen to get the appropriate record.

- Affirm your selection. Select the Buy now button. Next, pick your preferred pricing plan and provide credentials to register an account.

- Make the financial transaction. Make use of your bank card or PayPal account to complete the registration procedure.

- Get the form. Choose the format and save it on your device.

- Make adjustments. Fill out, modify, print, and sign the acquired Collin Texas Deed of Distribution Without a Warranty.

Each and every form you save in your user profile does not have an expiration date and is yours permanently. You can easily access them via the My Forms menu, so if you need to receive an additional duplicate for editing or printing, feel free to return and save it once more anytime.

Make use of the US Legal Forms extensive catalogue to gain access to the Collin Texas Deed of Distribution Without a Warranty you were looking for and a huge number of other professional and state-specific samples on one website!