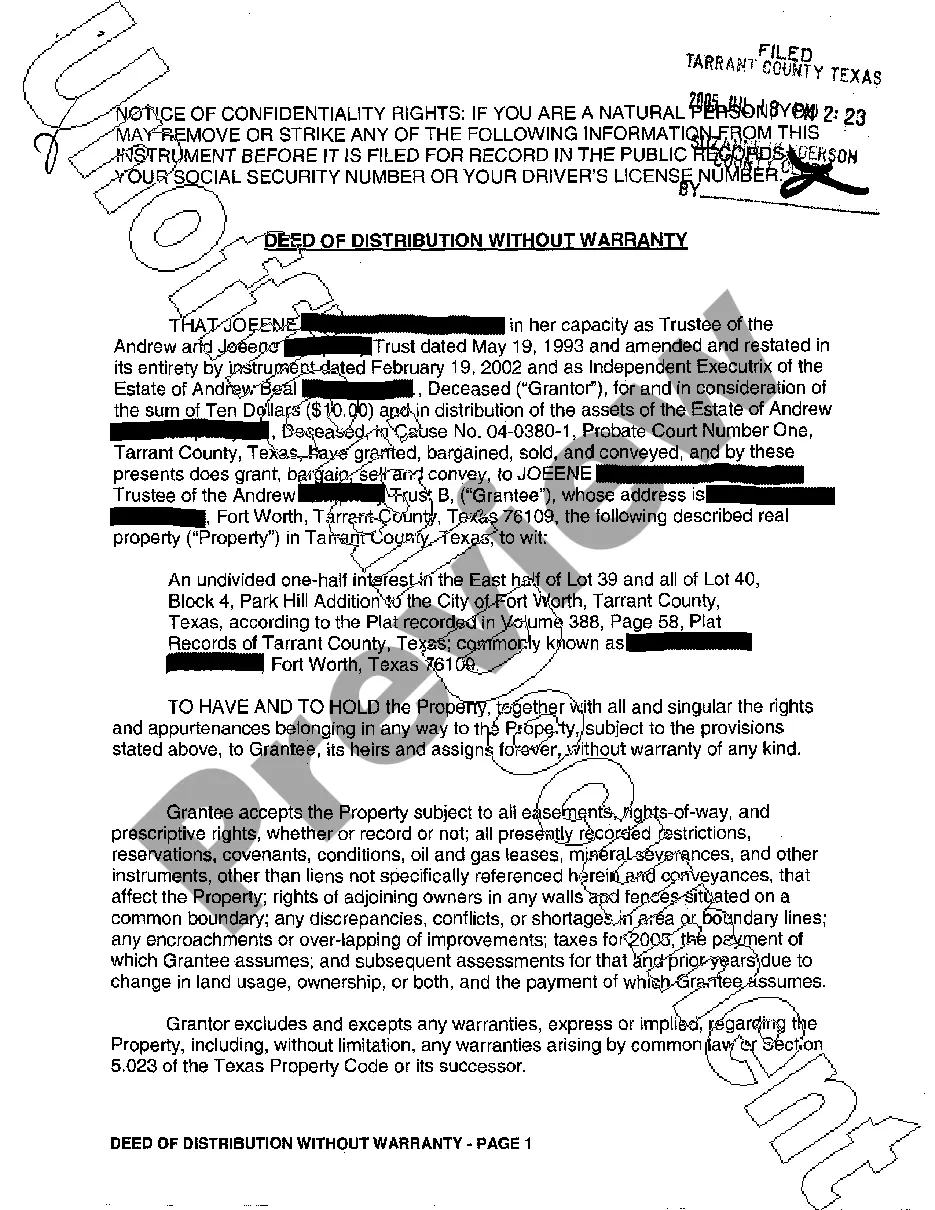

The Mesquite Texas Deed of Distribution Without a Warranty is a legal document used to transfer ownership of property from a deceased person's estate to the rightful heirs. This type of deed is often utilized when the deceased person did not leave a will or there is disagreement among the heirs regarding the distribution of assets. While there may not be specific types of Mesquite Texas Deed of Distribution Without a Warranty, the term refers to a specific legal instrument used in the state of Texas. A Mesquite Texas Deed of Distribution Without a Warranty establishes the transfer of property rights without any guarantee or warranty from the person distributing the assets. This means that the person distributing the property does not assure or guarantee title or the status of the property being transferred. The recipient of the property assumes all risks and must rely on their own due diligence and legal advice to ascertain the ownership and condition of the property. In the case of property distribution without a warranty, it is crucial for the recipients to thoroughly research the property, including any potential liens or encumbrances. This type of deed does not provide any legal recourse for the recipients if issues arise after the property is transferred. Hence, it is essential for the recipients to consult with an attorney or a legal professional who can guide them through the process and help protect their interests. Key benefits of using a Mesquite Texas Deed of Distribution Without a Warranty include ease of property transfer when there is no clear will or agreement among the heirs, reduced legal complexities, and the potential for a smoother distribution process. However, it's important to note that this type of deed can also introduce some risks and uncertainties, especially if the status of the property is unknown. In summary, a Mesquite Texas Deed of Distribution Without a Warranty is a legal instrument used in the state of Texas to transfer property without any guarantees or warranties. Recipients must conduct their own due diligence and seek legal advice to ensure a smooth transfer of assets.

Mesquite Texas Deed of Distribution Without a Warranty

Description

How to fill out Mesquite Texas Deed Of Distribution Without A Warranty?

If you are looking for a valid form template, it’s extremely hard to find a better place than the US Legal Forms site – one of the most considerable libraries on the web. Here you can find thousands of document samples for organization and individual purposes by types and regions, or key phrases. With our advanced search option, getting the most up-to-date Mesquite Texas Deed of Distribution Without a Warranty is as elementary as 1-2-3. In addition, the relevance of every record is verified by a group of skilled lawyers that on a regular basis check the templates on our platform and revise them in accordance with the newest state and county requirements.

If you already know about our platform and have a registered account, all you should do to receive the Mesquite Texas Deed of Distribution Without a Warranty is to log in to your user profile and click the Download button.

If you use US Legal Forms the very first time, just follow the instructions listed below:

- Make sure you have opened the sample you want. Look at its description and make use of the Preview feature (if available) to explore its content. If it doesn’t meet your requirements, utilize the Search option near the top of the screen to discover the appropriate document.

- Confirm your decision. Choose the Buy now button. After that, pick the preferred pricing plan and provide credentials to register an account.

- Make the financial transaction. Use your bank card or PayPal account to finish the registration procedure.

- Obtain the template. Pick the file format and download it to your system.

- Make changes. Fill out, revise, print, and sign the acquired Mesquite Texas Deed of Distribution Without a Warranty.

Every single template you add to your user profile has no expiration date and is yours permanently. You can easily gain access to them using the My Forms menu, so if you need to receive an extra version for modifying or printing, you may return and download it again anytime.

Take advantage of the US Legal Forms extensive catalogue to gain access to the Mesquite Texas Deed of Distribution Without a Warranty you were seeking and thousands of other professional and state-specific samples on a single website!