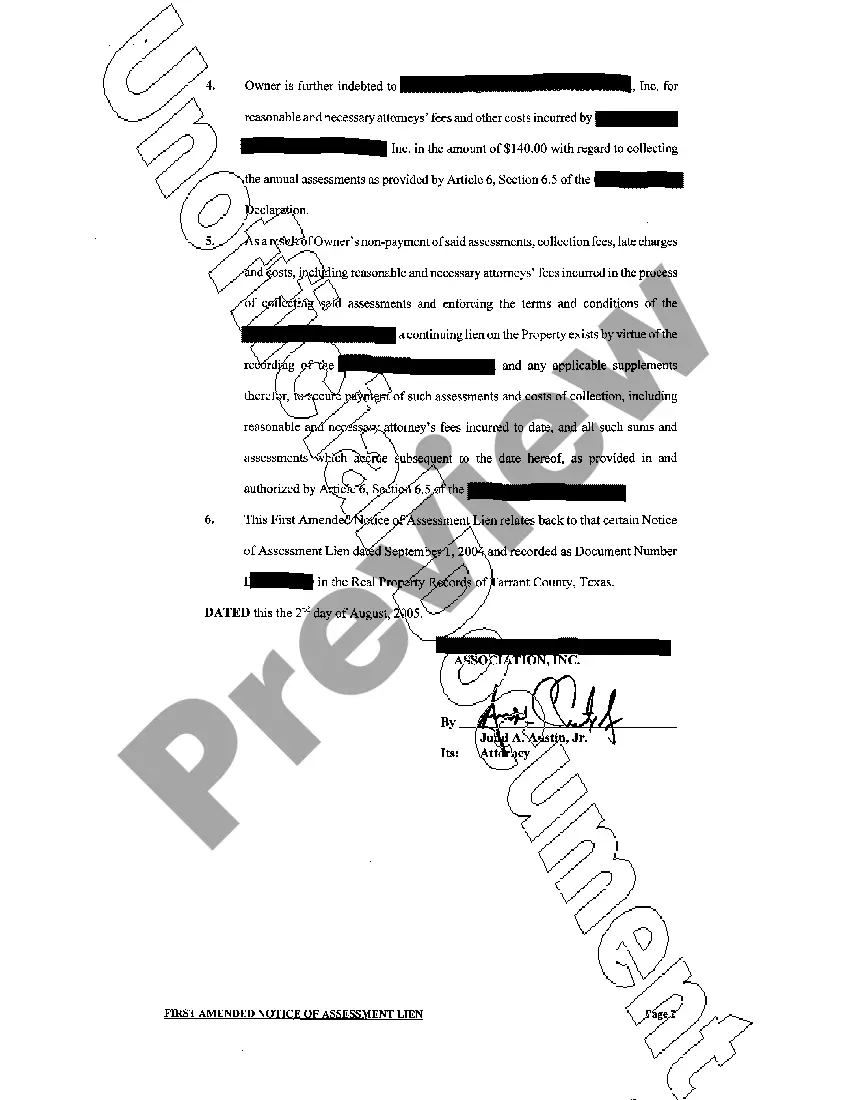

Corpus Christi Texas First Amended Notice of Assessment Lien The Corpus Christi Texas First Amended Notice of Assessment Lien is a legal document that serves as an official notification to property owners regarding delinquent taxes or unpaid assessments on their property within the Corpus Christi area. This type of lien is filed by the local tax assessor's office and is meant to ensure the collection of outstanding taxes and charges. Keywords: Corpus Christi Texas, First Amended Notice of Assessment Lien, delinquent taxes, unpaid assessments, property owners, tax assessor's office, outstanding taxes, charges. There are a few different types of Corpus Christi Texas First Amended Notice of Assessment Lien, each serving a specific purpose. These types may include: 1. Delinquent Property Tax Lien: This type of lien is filed when property owners fail to pay their property taxes on time. It provides notice of the outstanding tax liability and serves as a claim against the property until the taxes are paid. 2. Special Assessment Lien: If there are outstanding assessments for public improvements or services, such as infrastructure development or maintenance, the local tax assessor's office may file a Special Assessment Lien. This lien ensures that the property owner is responsible for the payment of these specific assessments. 3. Municipal Utility Lien: In cases where property owners have unpaid utility bills, including water, sewer, or garbage charges, a Municipal Utility Lien may be filed. This lien ensures that these outstanding balances are paid and attaches to the property. 4. Property Code Violation Lien: When a property owner is non-compliant with city codes, such as building or safety regulations, a Property Code Violation Lien can be filed. This type of lien alerts the property owner to address the violations and pay any associated fines or penalties. 5. HOA Assessment Lien: In cases where a property is part of a homeowner's association (HOA), an HOA Assessment Lien may be filed if the homeowner fails to pay their HOA dues or assessments. This lien ensures that the outstanding balance is satisfied. It is important for property owners to address any Corpus Christi Texas First Amended Notice of Assessment Lien promptly to avoid further complications or potential foreclosure actions. Seeking legal advice or contacting the local tax assessor's office is recommended to understand the specific details and requirements regarding the assessment lien.

Corpus Christi Texas First Amended Notice of Assessment Lien

Description

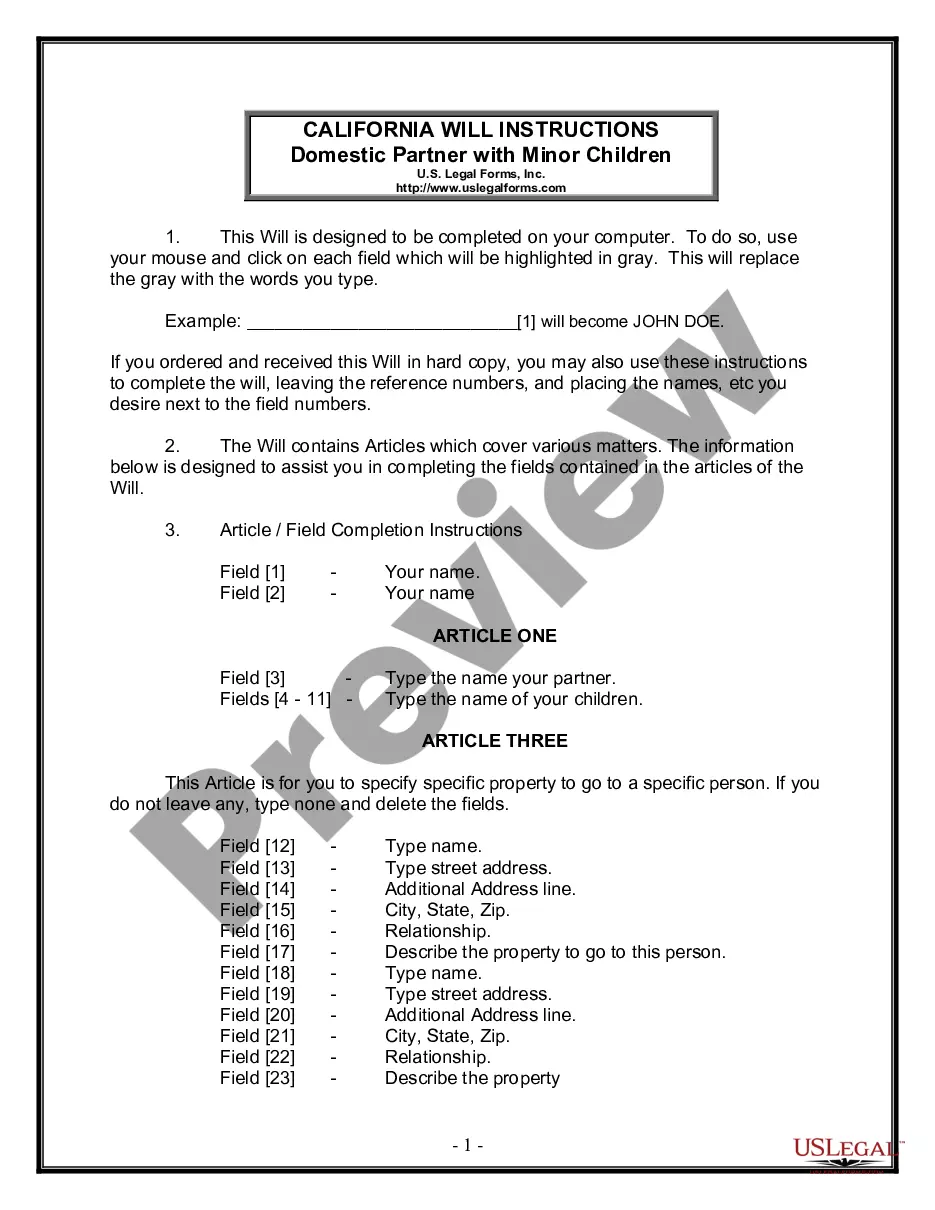

How to fill out Corpus Christi Texas First Amended Notice Of Assessment Lien?

Locating authenticated templates tailored to your regional regulations can be difficult unless you utilize the US Legal Forms collection.

It’s an online reservoir of over 85,000 legal forms catering to both personal and professional requirements as well as various real-life situations.

All the documents are systematically organized by usage area and jurisdiction, making it as simple and straightforward as ABC to find the Corpus Christi Texas First Amended Notice of Assessment Lien.

Maintaining documentation organized and in compliance with legal requirements holds significant importance. Leverage the US Legal Forms library to always have crucial document templates readily available for any needs!

- Inspect the Preview mode and form description.

- Ensure you have selected the correct template that fulfills your needs and fully aligns with your local jurisdiction regulations.

- Look for another template, if required.

- If you identify any discrepancies, utilize the Search tab above to find the proper one. If it meets your criteria, proceed to the next step.

- Complete the purchase.

Form popularity

FAQ

Texas law does not automatically give a property owners' association the right to impose fines or use a self-help remedy. These powers must be granted by the declaration of covenants, conditions, and restrictions.

Assessment Liens and Foreclosure A property owners' association can foreclose on the lien and trigger the sale of the property. The ability to create assessment liens is a power that is not automatically granted by Texas law. It must be specifically stated in the Declaration of Covenants, Conditions, and Restrictions.

For example, the statute of limitations for covenant enforcement in Texas is 4 years. The statute of limitations is important because it determines the validity of the HOA's enforcement of a lien, as the association must enforce the lien within the given time period or else it will no longer be enforceable by law.

Unhappy homeowners can sue the HOA and the board members individually for any number of reasons; for example, if the HOA fails to properly maintain a common area, or discriminates when enforcing a rule.

Statute of Limitations ? The statute of limitations for a violation of a restriction is five (5) years from the time the association ?discovered or, through the exercise of reasonable diligence, should have discovered the violation.? (Code. Civ. Pro § 336(b).)

Texas state law gives your homeowners' association or condo associations the right to put a lien on your property if you fail to pay these assessments, fees or fines. You can also be sued personally. If you believe the HOA lien is unfair, understand your options under Texas state law.

Texas doesn't have a comparable law for HOAs. So, an HOA declaration will often state that a lien is automatically created when the declaration is recorded. Many HOAs record notices of assessments lien in the county records as well.