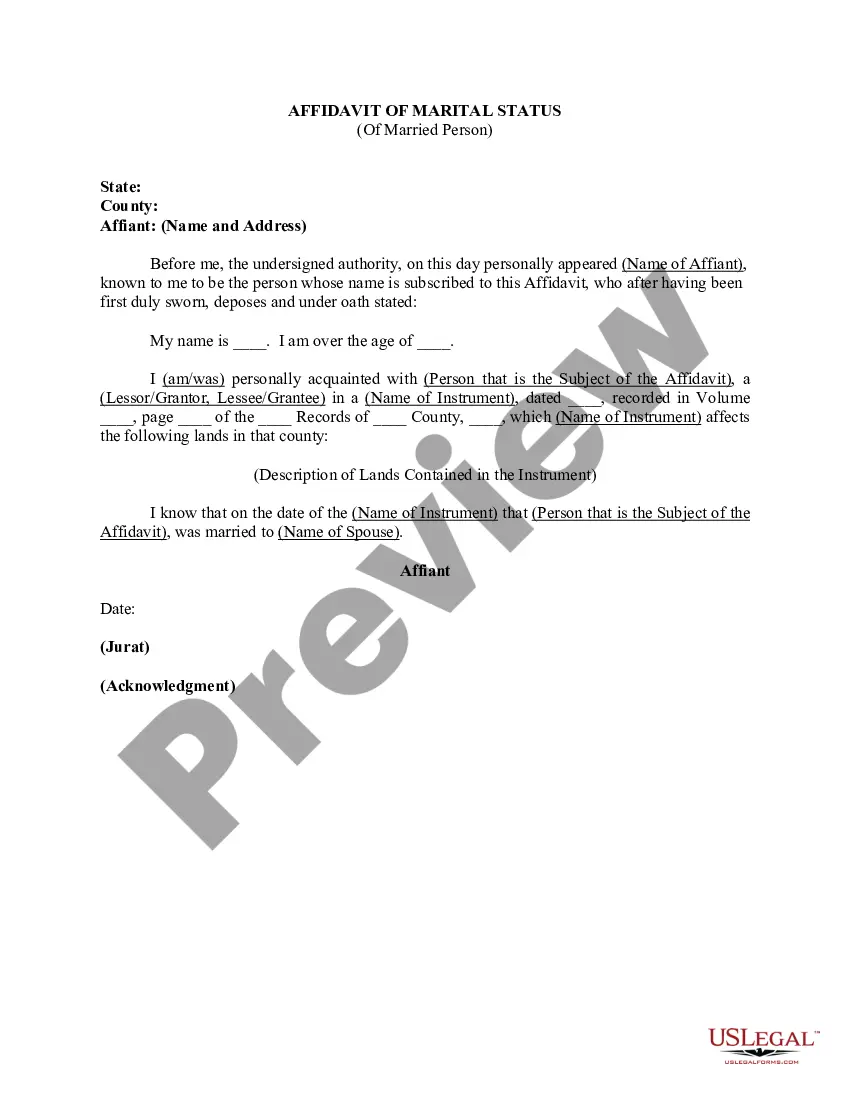

Dallas Texas First Amended Notice of Assessment Lien is a legal document issued by the Dallas County Tax Assessor's office to notify property owners of an outstanding tax lien on their property. This notice is an important step in the tax collection process and serves as a warning that the delinquent property taxes need to be paid promptly to avoid further actions. The First Amended Notice of Assessment Lien is typically issued when a property owner fails to pay their property taxes by the designated deadline. It includes detailed information about the outstanding amount, penalties, and interest accrued up to that point. This notice also specifies the timeframe within which the property owner must respond and settle the debt. There are different types of Dallas Texas First Amended Notice of Assessment Lien, and they can vary based on the specific circumstances of the tax delinquency. Some common types of amended notices include: 1. First Amended Notice of Assessment Lien for Residential Properties: This type of notice is issued when the delinquent property tax is related to a residential property, such as a single-family home, condominium, or townhouse. 2. First Amended Notice of Assessment Lien for Commercial Properties: This notice is specific to tax delinquencies on commercial properties, including office buildings, retail spaces, industrial properties, and other non-residential properties. 3. First Amended Notice of Assessment Lien for Vacant Land: If the tax delinquency is related to empty land or undeveloped property, this type of notice will be issued. 4. First Amended Notice of Assessment Lien for Rental Properties: When the tax delinquency is associated with a property used for rental purposes, such as an apartment building or rental house, this notice will be served. It's important for property owners to address the First Amended Notice of Assessment Lien promptly to avoid further complications. Failure to pay or resolve the delinquent taxes can lead to additional penalties, interest, and potentially the foreclosure of the property. Seeking professional legal advice or contacting the Dallas County Tax Assessor's office is highly recommended understanding the specific steps and requirements for resolving the tax lien.

Dallas Texas First Amended Notice of Assessment Lien

Description

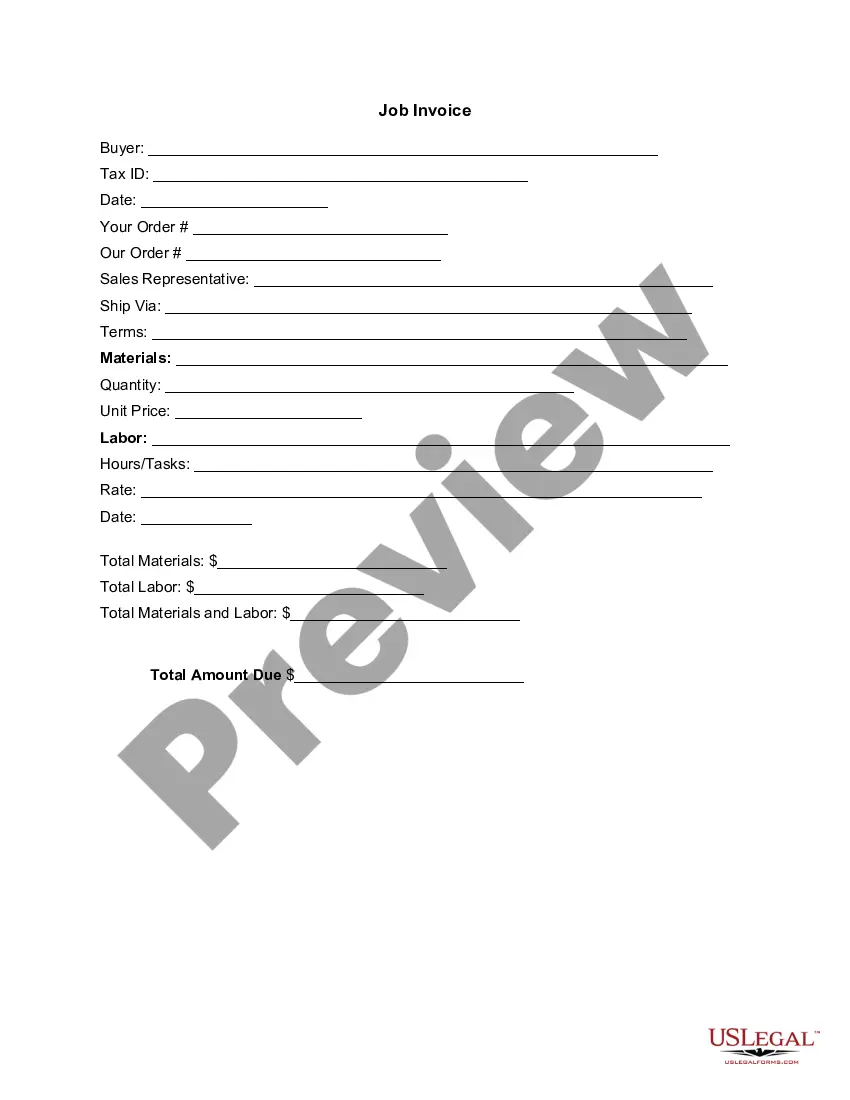

How to fill out Dallas Texas First Amended Notice Of Assessment Lien?

Do you need a reliable and affordable legal forms supplier to get the Dallas Texas First Amended Notice of Assessment Lien? US Legal Forms is your go-to choice.

No matter if you require a basic agreement to set rules for cohabitating with your partner or a set of forms to move your separation or divorce through the court, we got you covered. Our website provides more than 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t generic and framed based on the requirements of separate state and area.

To download the document, you need to log in account, locate the needed form, and hit the Download button next to it. Please take into account that you can download your previously purchased document templates anytime from the My Forms tab.

Are you new to our website? No worries. You can set up an account in minutes, but before that, make sure to do the following:

- Find out if the Dallas Texas First Amended Notice of Assessment Lien conforms to the regulations of your state and local area.

- Read the form’s details (if available) to learn who and what the document is good for.

- Start the search over if the form isn’t good for your legal scenario.

Now you can register your account. Then choose the subscription option and proceed to payment. Once the payment is done, download the Dallas Texas First Amended Notice of Assessment Lien in any available format. You can return to the website at any time and redownload the document without any extra costs.

Finding up-to-date legal forms has never been easier. Give US Legal Forms a go now, and forget about wasting your valuable time learning about legal papers online once and for all.

Form popularity

FAQ

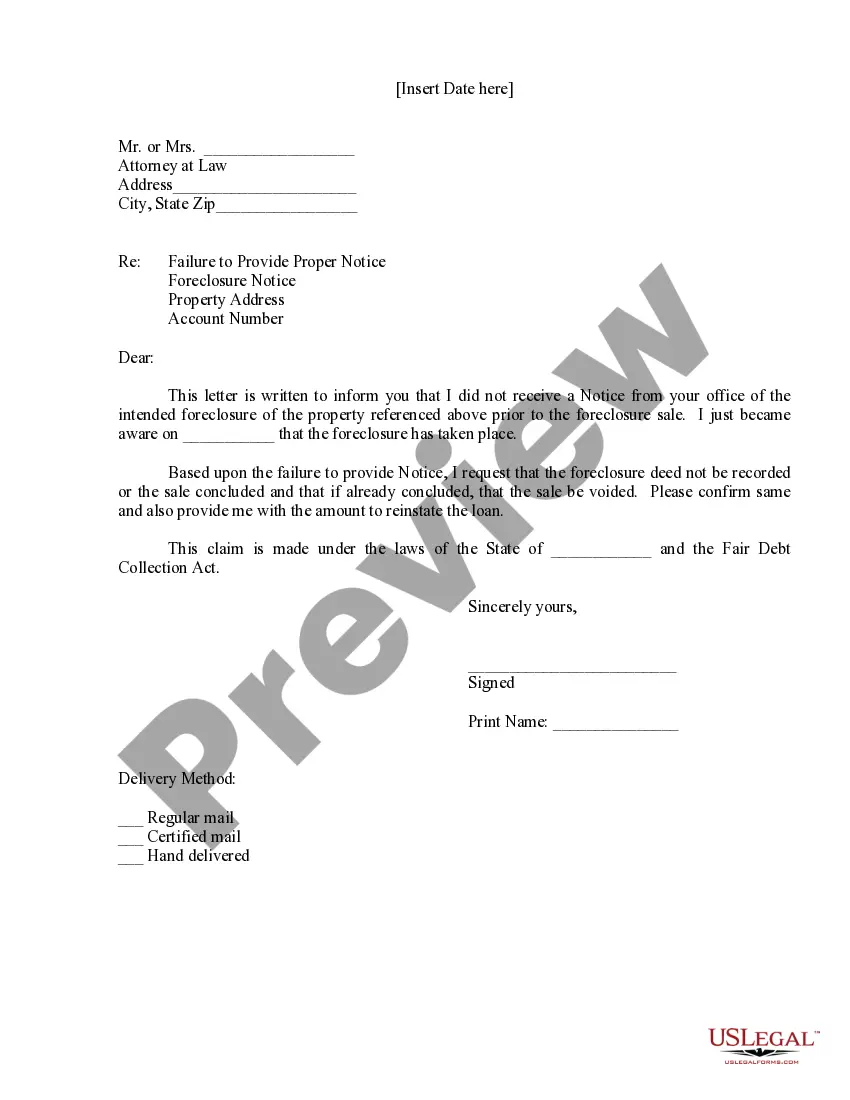

Collection agencies hold contracts with credit bureaus, and therefore, the unpaid debt will be recorded on your credit file. It is important to note that the homeowner is legally entitled to access the information that consumer reporting agencies collect, as well as dispute any inaccuracies.

Assessment Liens and Foreclosure A property owners' association can foreclose on the lien and trigger the sale of the property. The ability to create assessment liens is a power that is not automatically granted by Texas law. It must be specifically stated in the Declaration of Covenants, Conditions, and Restrictions.

Texas law does not automatically give a property owners' association the right to impose fines or use a self-help remedy. These powers must be granted by the declaration of covenants, conditions, and restrictions.

Texas doesn't have a comparable law for HOAs. So, an HOA declaration will often state that a lien is automatically created when the declaration is recorded. Many HOAs record notices of assessments lien in the county records as well.

A few of the possible defenses to an HOA foreclosure include: The HOA improperly calculated the owed assessments. The Declaration of Covenants, Conditions, and Restrictions (CC&Rs) don't authorize the HOA's charges. The HOA didn't follow state law.The HOA didn't record the lien (if required by state law).

For example, the statute of limitations for covenant enforcement in Texas is 4 years. The statute of limitations is important because it determines the validity of the HOA's enforcement of a lien, as the association must enforce the lien within the given time period or else it will no longer be enforceable by law.

Assessment Liens and Foreclosure A property owners' association can foreclose on the lien and trigger the sale of the property. The ability to create assessment liens is a power that is not automatically granted by Texas law. It must be specifically stated in the Declaration of Covenants, Conditions, and Restrictions.

If HOAs fail to maintain, repair, or replace common areas as required by the CC&Rs or other governing documents, residents are entitled to take action against the HOA.

Interesting Questions

More info

L. Notice of Contractual Assessment Lien, Notice by Assessor. (a) As used herein, the term `Notice of Contractual Assessment Lien” shall mean a public notice of a private action brought to enforce a lien against residential property or liens for unpaid assessments and fines, not for the purpose of enforcing the lien in the court of law, except that it shall be sufficient if the Assessor's office or other office or person having control over the land so notified makes a personal appearance and states that the assessment and fine lien has been taken up and filed as provided for by law. As used in this section, the Assessor's office or other office or person having control over the land and the notice issued shall at the same time be called upon as defendant.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.