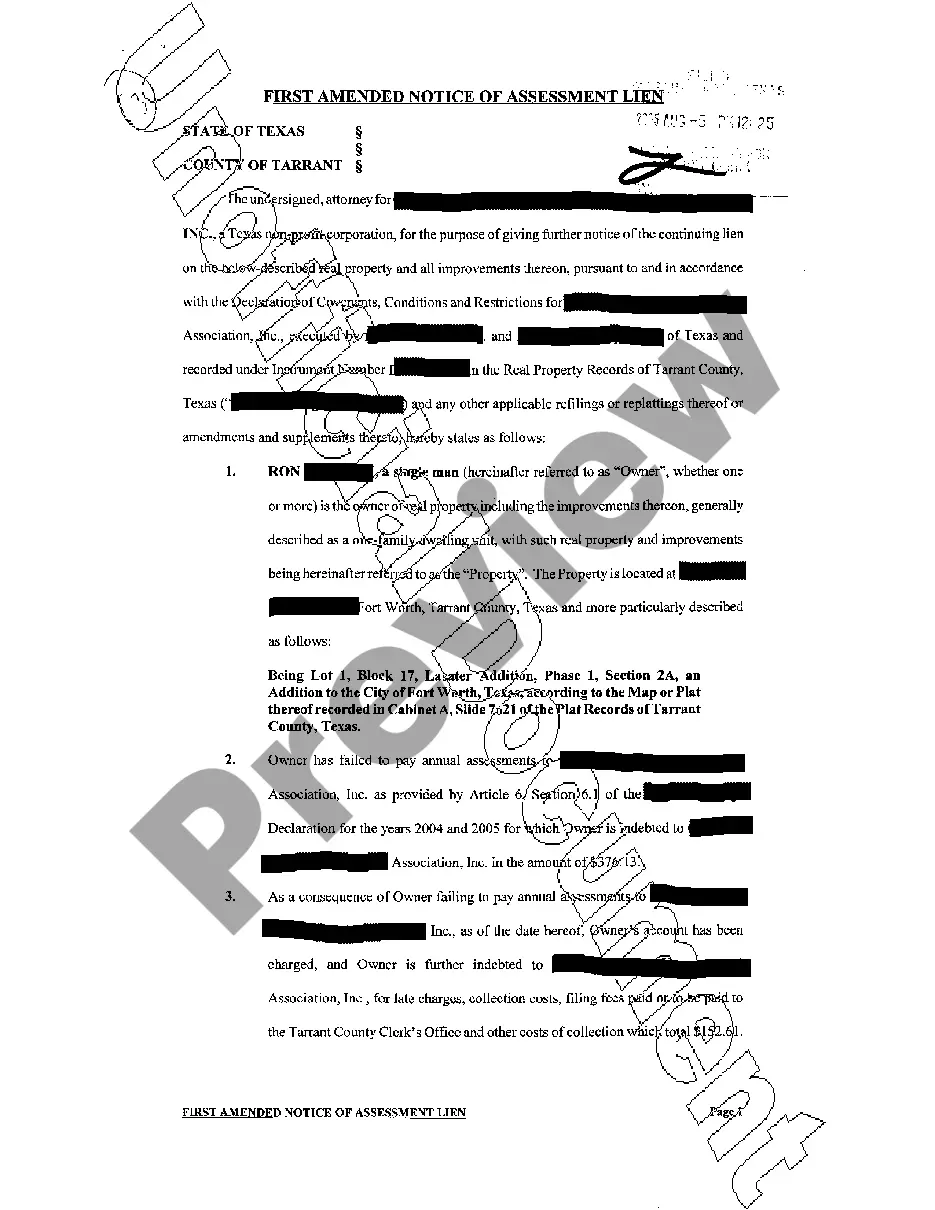

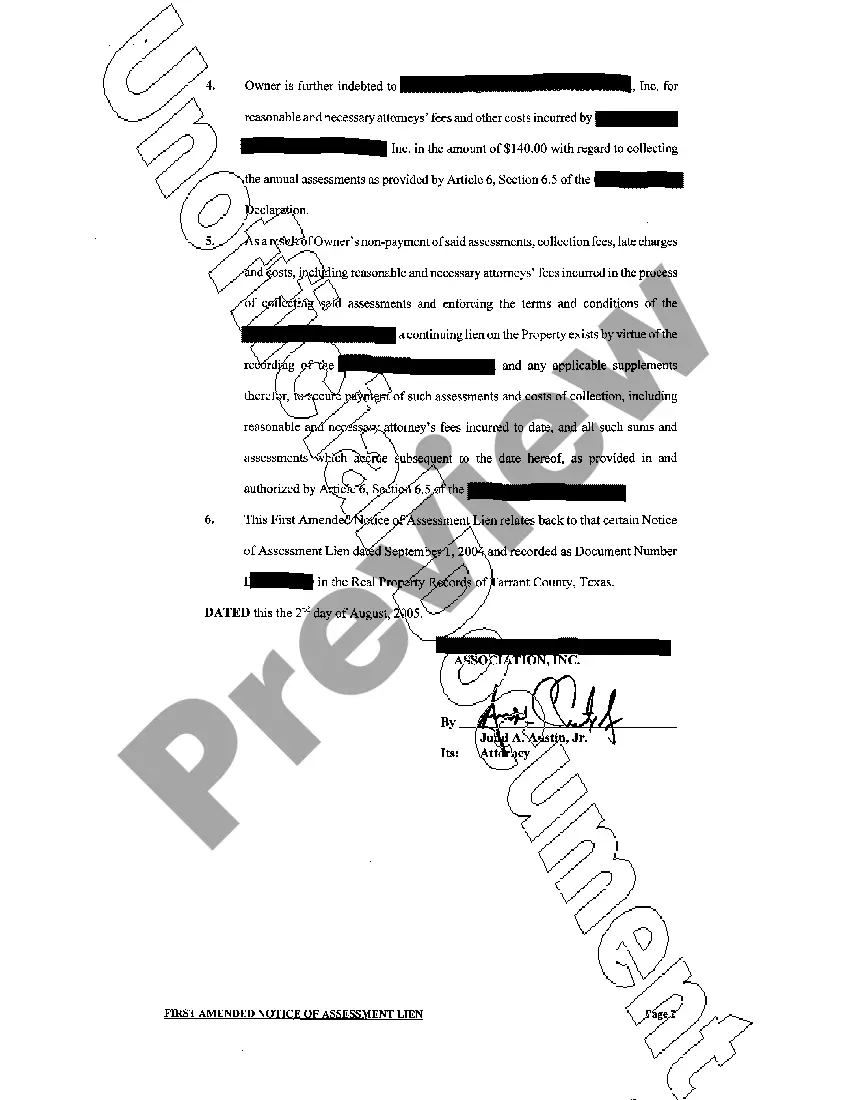

The Fort Worth Texas First Amended Notice of Assessment Lien is a legal document that is issued by the tax authorities in Fort Worth, Texas to notify a taxpayer that they have an outstanding balance due on their assessed taxes. This document serves as a formal notice of the tax lien placed on the taxpayer's property as a result of the unpaid taxes. The purpose of issuing the First Amended Notice of Assessment Lien is to inform the taxpayer about the specific amount of taxes owed, including any interest and penalties accrued, and to provide them with an opportunity to pay off the debt within a certain timeframe. Failure to resolve the outstanding balance may result in further legal actions, such as the seizure or sale of the taxpayer's property to satisfy the debt. It is essential for the taxpayer to take this notice seriously and address the outstanding tax liability promptly. Ignoring or neglecting to respond to the notice can have severe consequences, including damage to one's credit history, potential foreclosure on the property, and potential legal proceedings. If there are different types of Fort Worth Texas First Amended Notice of Assessment Lien, they may include variations such as: 1. First Amended Notice of Assessment Lien (Real Property): This type of lien specifically pertains to unpaid taxes on real estate properties owned by the taxpayer. 2. First Amended Notice of Assessment Lien (Personal Property): This lien type applies to outstanding taxes on personal property, such as vehicles, boats, or other assets. 3. First Amended Notice of Assessment Lien (Business Tax): This category is applicable to businesses that have unpaid taxes related to their operations, including sales tax, business property tax, or other relevant taxes. It is crucial for the taxpayer to carefully review the First Amended Notice of Assessment Lien and seek professional advice from tax attorneys or certified public accountants to understand their rights and options for resolving the outstanding tax liability. Promptly addressing the lien can help prevent further legal actions and protect one's assets and financial standing.

Fort Worth Texas First Amended Notice of Assessment Lien

State:

Texas

City:

Fort Worth

Control #:

TX-JW-0133

Format:

PDF

Instant download

This form is available by subscription

Description

First Amended Notice of Assessment Lien

The Fort Worth Texas First Amended Notice of Assessment Lien is a legal document that is issued by the tax authorities in Fort Worth, Texas to notify a taxpayer that they have an outstanding balance due on their assessed taxes. This document serves as a formal notice of the tax lien placed on the taxpayer's property as a result of the unpaid taxes. The purpose of issuing the First Amended Notice of Assessment Lien is to inform the taxpayer about the specific amount of taxes owed, including any interest and penalties accrued, and to provide them with an opportunity to pay off the debt within a certain timeframe. Failure to resolve the outstanding balance may result in further legal actions, such as the seizure or sale of the taxpayer's property to satisfy the debt. It is essential for the taxpayer to take this notice seriously and address the outstanding tax liability promptly. Ignoring or neglecting to respond to the notice can have severe consequences, including damage to one's credit history, potential foreclosure on the property, and potential legal proceedings. If there are different types of Fort Worth Texas First Amended Notice of Assessment Lien, they may include variations such as: 1. First Amended Notice of Assessment Lien (Real Property): This type of lien specifically pertains to unpaid taxes on real estate properties owned by the taxpayer. 2. First Amended Notice of Assessment Lien (Personal Property): This lien type applies to outstanding taxes on personal property, such as vehicles, boats, or other assets. 3. First Amended Notice of Assessment Lien (Business Tax): This category is applicable to businesses that have unpaid taxes related to their operations, including sales tax, business property tax, or other relevant taxes. It is crucial for the taxpayer to carefully review the First Amended Notice of Assessment Lien and seek professional advice from tax attorneys or certified public accountants to understand their rights and options for resolving the outstanding tax liability. Promptly addressing the lien can help prevent further legal actions and protect one's assets and financial standing.

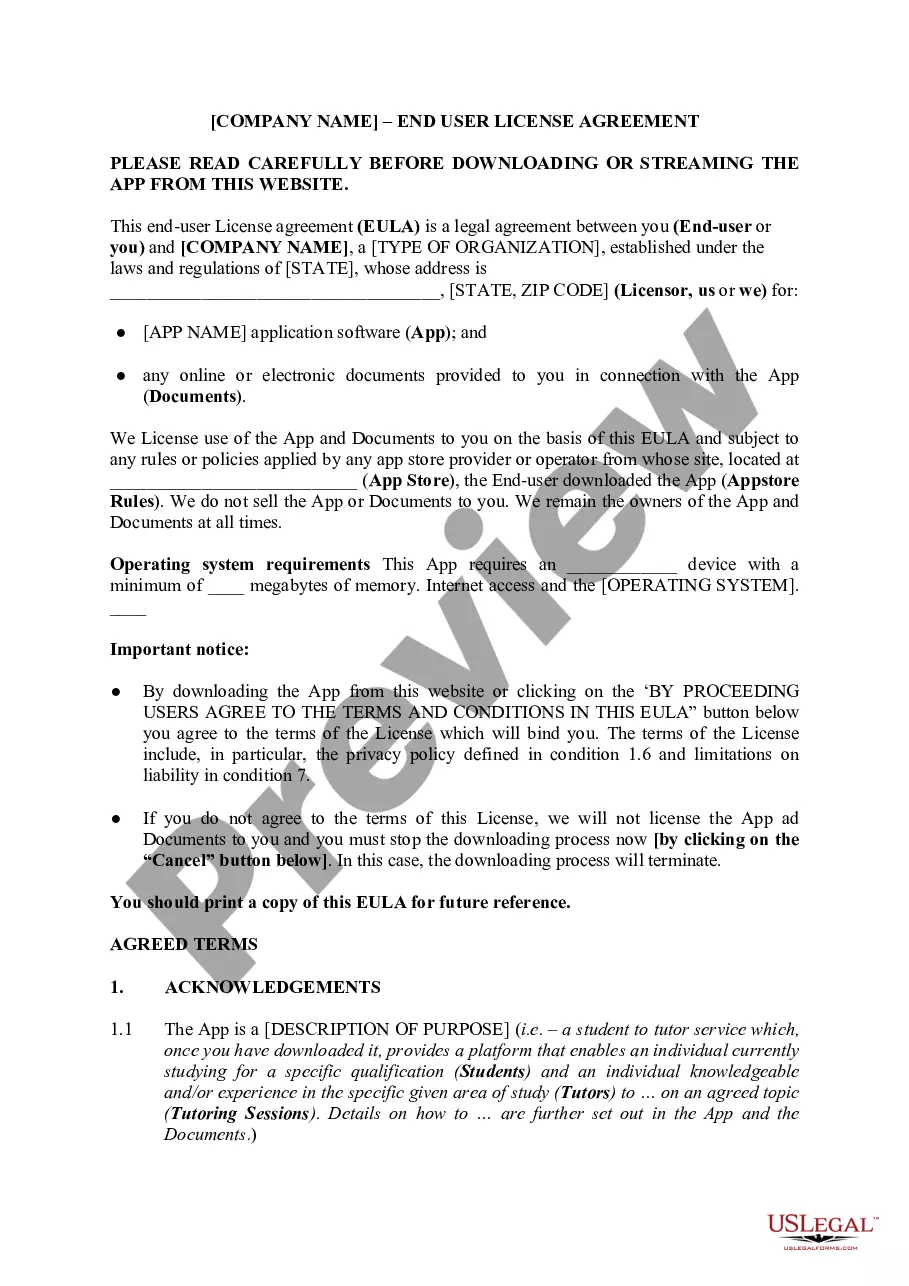

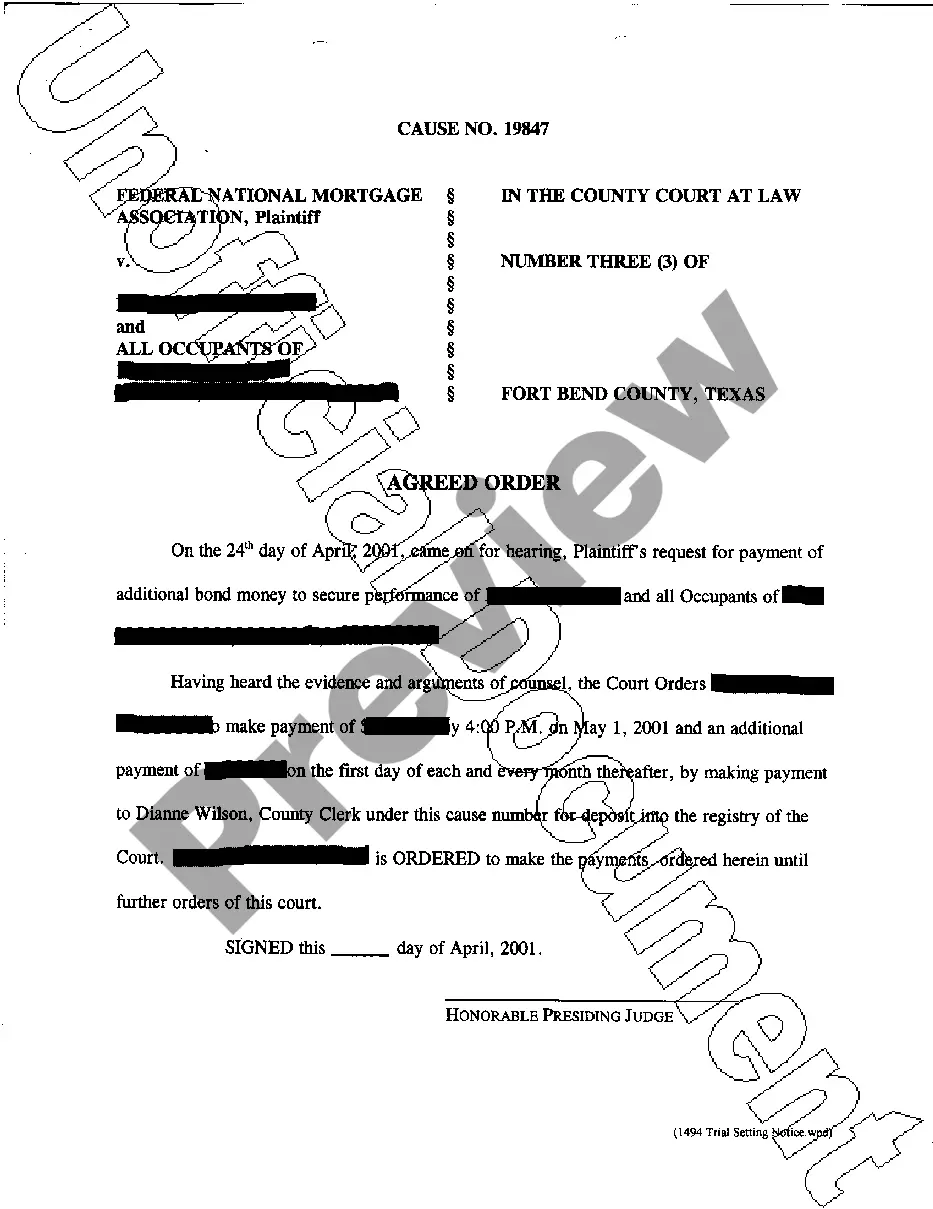

Free preview

How to fill out Fort Worth Texas First Amended Notice Of Assessment Lien?

If you’ve already utilized our service before, log in to your account and save the Fort Worth Texas First Amended Notice of Assessment Lien on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it according to your payment plan.

If this is your first experience with our service, follow these simple actions to get your file:

- Make sure you’ve found a suitable document. Read the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t fit you, use the Search tab above to find the proper one.

- Buy the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Get your Fort Worth Texas First Amended Notice of Assessment Lien. Choose the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to every piece of paperwork you have bought: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to easily find and save any template for your personal or professional needs!