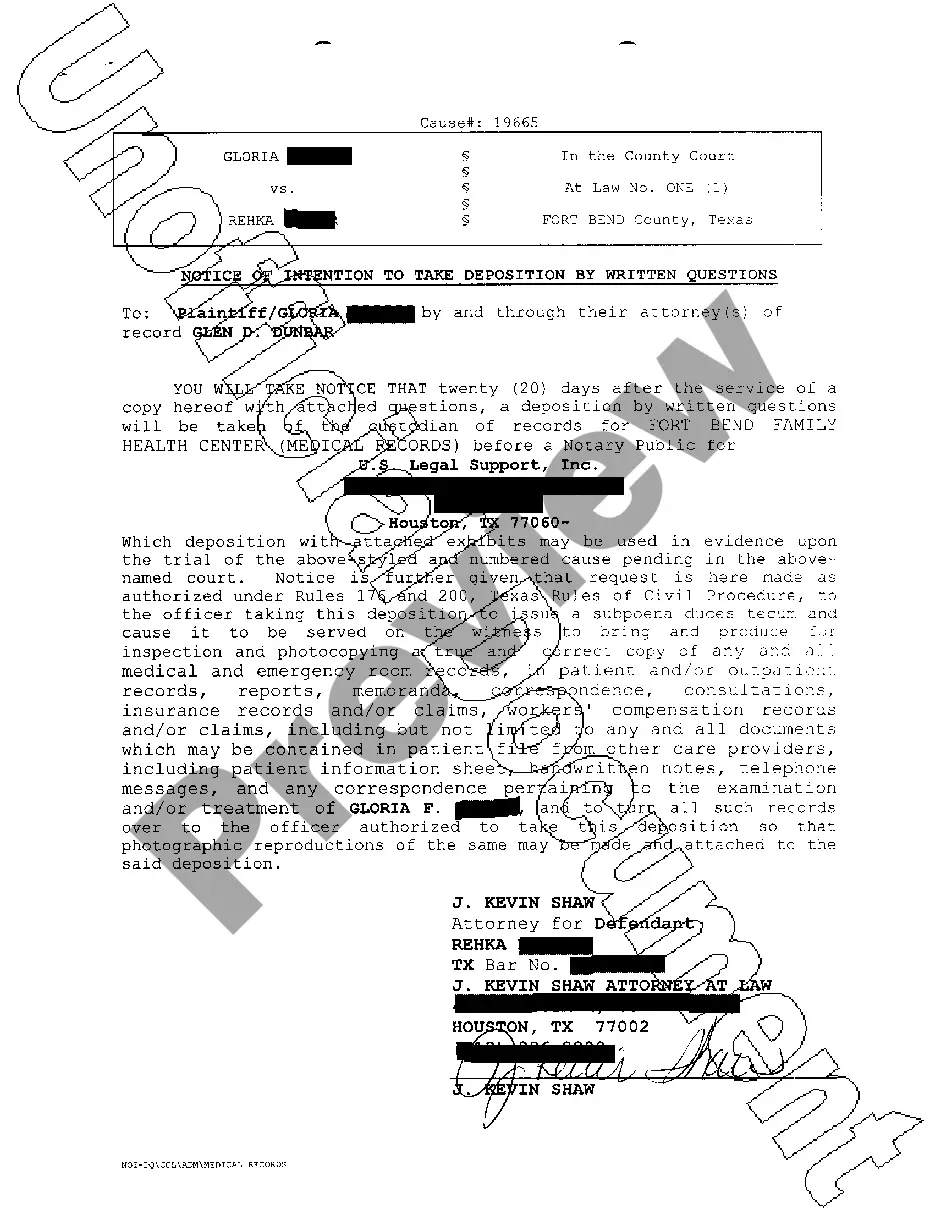

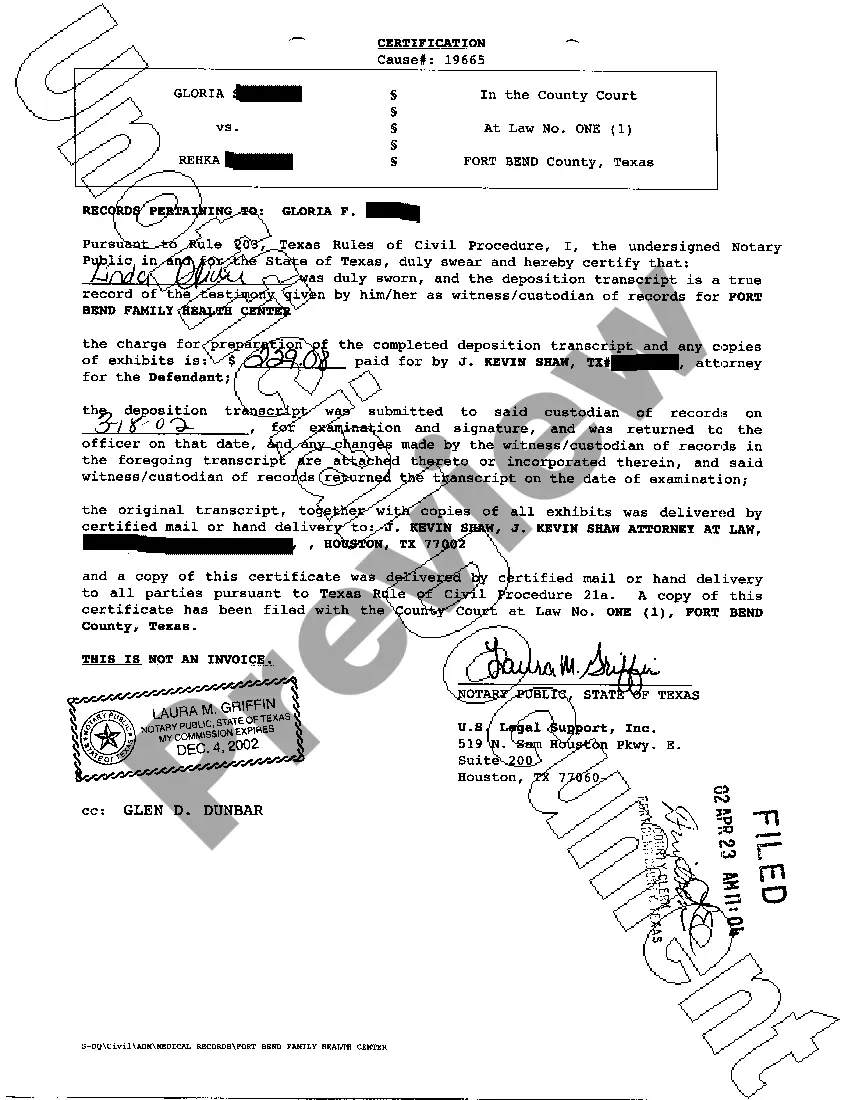

The Houston Texas First Amended Notice of Assessment Lien refers to a legal document filed by the city of Houston, Texas to inform property owners of an outstanding tax assessment lien on their property. This lien is typically imposed when the property owner fails to pay their property taxes on time or in full. The First Amended Notice of Assessment Lien serves as a formal notification to the property owner that the city has a legal claim against their property due to the unpaid taxes. It specifies the amount owed, including the principal amount of the unpaid taxes, as well as any penalties, interest, and fees that may have accrued. This notice is crucial as it establishes the city's priority lien position, meaning that the city's claim takes precedence over other creditors or parties with an interest in the property. In other words, if the property is sold or foreclosed upon, the city's tax lien must be satisfied before any other claims can be paid. There are variations of the First Amended Notice of Assessment Lien, including: 1. Residential Property Notice of Assessment Lien: This type of lien is specific to residential properties, such as single-family homes, townhouses, or condominiums. 2. Commercial Property Notice of Assessment Lien: This lien is applicable to commercial properties, including office buildings, retail spaces, industrial properties, and other non-residential properties. 3. Multiple Property Notice of Assessment Lien: In cases where a property owner owns multiple properties in Houston, the city can file a single notice of assessment lien that covers all the properties collectively. It is important for property owners to address the First Amended Notice of Assessment Lien promptly. Failure to address the outstanding taxes can result in further penalties, interest accrual, and potentially lead to foreclosure proceedings initiated by the city. Property owners have the right to dispute the assessment or enter into payment arrangements with the city to resolve the lien.

Houston Texas First Amended Notice of Assessment Lien

Description

How to fill out Houston Texas First Amended Notice Of Assessment Lien?

We always strive to minimize or prevent legal issues when dealing with nuanced law-related or financial matters. To do so, we sign up for attorney solutions that, usually, are very expensive. Nevertheless, not all legal matters are as just complex. Most of them can be dealt with by ourselves.

US Legal Forms is an online collection of up-to-date DIY legal documents addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your matters into your own hands without using services of legal counsel. We provide access to legal form templates that aren’t always publicly available. Our templates are state- and area-specific, which significantly facilitates the search process.

Benefit from US Legal Forms whenever you need to find and download the Houston Texas First Amended Notice of Assessment Lien or any other form easily and securely. Simply log in to your account and click the Get button next to it. In case you lose the document, you can always re-download it from within the My Forms tab.

The process is equally effortless if you’re unfamiliar with the platform! You can register your account within minutes.

- Make sure to check if the Houston Texas First Amended Notice of Assessment Lien adheres to the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s outline (if available), and if you notice any discrepancies with what you were looking for in the first place, search for a different form.

- Once you’ve made sure that the Houston Texas First Amended Notice of Assessment Lien is proper for you, you can choose the subscription plan and make a payment.

- Then you can download the document in any suitable format.

For more than 24 years of our existence, we’ve helped millions of people by providing ready to customize and up-to-date legal documents. Take advantage of US Legal Forms now to save efforts and resources!