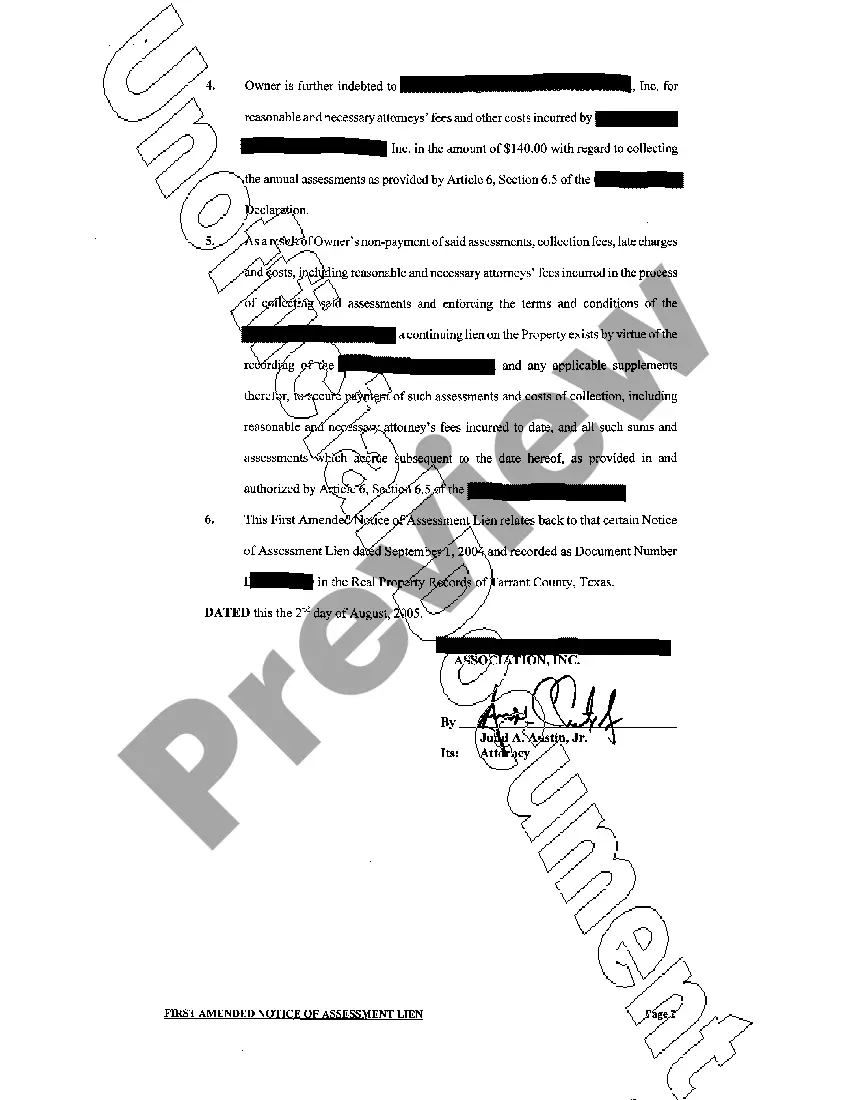

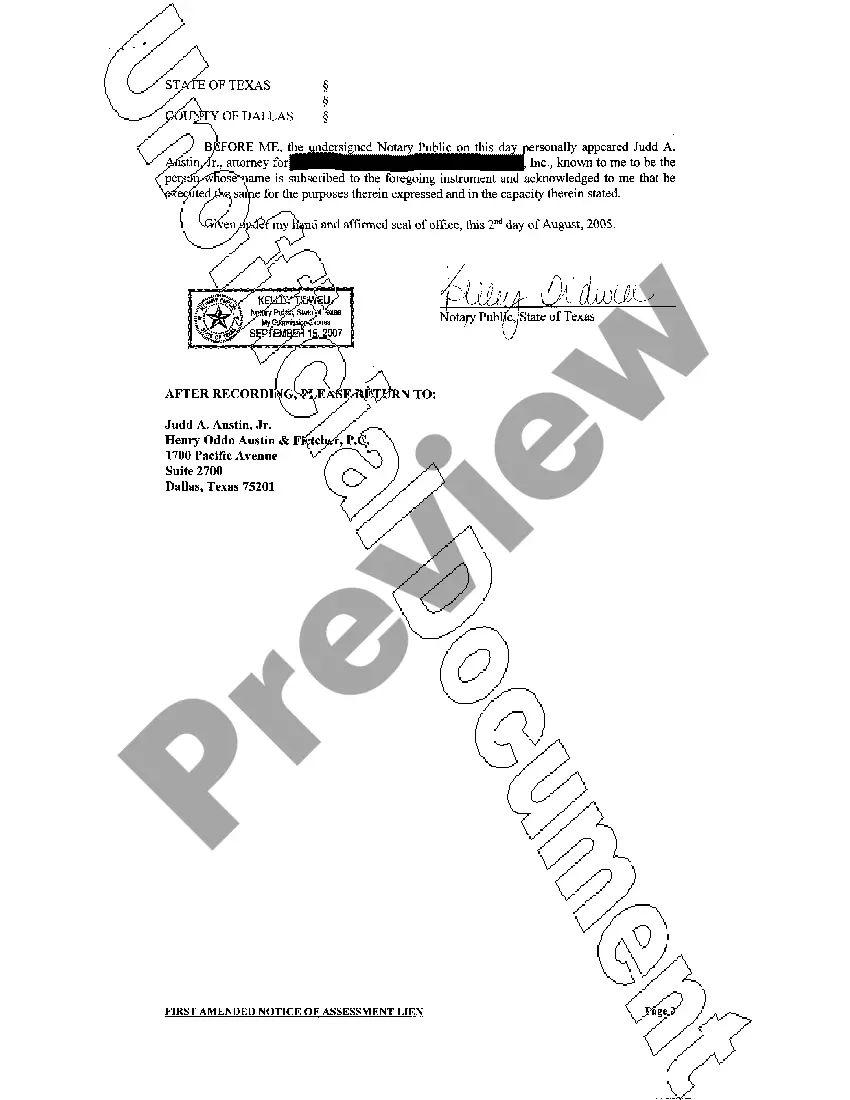

The San Angelo Texas First Amended Notice of Assessment Lien is a legal document issued by the local government that indicates a particular property has unpaid taxes or assessments. This lien is placed on the property as a means of securing the outstanding debt. Keywords: San Angelo, Texas, First Amended Notice, Assessment Lien, property taxes, unpaid taxes, assessments, outstanding debt, local government. There can be different types of San Angelo Texas First Amended Notice of Assessment Liens, such as: 1. Property Tax Lien: This type of lien is placed on a property when the owner fails to pay property taxes on time. The local government then files a First Amended Notice of Assessment Lien to recover the unpaid taxes. 2. Special Assessment Lien: Special assessments are charges levied on property owners to fund public infrastructure improvements or services such as street repairs, sewer system upgrades, or sidewalk construction. If property owners fail to pay these assessments, the local government may file a First Amended Assessment Lien against the property. 3. Municipal Lien: In some cases, a city or municipality may place a lien on a property to recover unpaid fines or penalties. This could be due to violations of local ordinances, building code violations, or unpaid utility bills. The First Amended Notice of Assessment Lien is used to secure the outstanding debt. 4. Tax Lien Certificate: If a property owner continues to ignore or neglect payment of property taxes or assessments, the local government may sell a tax lien certificate to a third party. This allows the third party to pay the owed debt in exchange for the lien on the property. The First Amended Notice of Assessment Lien is usually issued during this process. It is important for property owners to address and resolve any First Amended Notice of Assessment Lien promptly. Failure to satisfy the outstanding debt may result in further legal actions, including foreclosure or sale of the property to recover the unpaid taxes or assessments.

San Angelo Texas First Amended Notice of Assessment Lien

State:

Texas

City:

San Angelo

Control #:

TX-JW-0133

Format:

PDF

Instant download

This form is available by subscription

Description

First Amended Notice of Assessment Lien

The San Angelo Texas First Amended Notice of Assessment Lien is a legal document issued by the local government that indicates a particular property has unpaid taxes or assessments. This lien is placed on the property as a means of securing the outstanding debt. Keywords: San Angelo, Texas, First Amended Notice, Assessment Lien, property taxes, unpaid taxes, assessments, outstanding debt, local government. There can be different types of San Angelo Texas First Amended Notice of Assessment Liens, such as: 1. Property Tax Lien: This type of lien is placed on a property when the owner fails to pay property taxes on time. The local government then files a First Amended Notice of Assessment Lien to recover the unpaid taxes. 2. Special Assessment Lien: Special assessments are charges levied on property owners to fund public infrastructure improvements or services such as street repairs, sewer system upgrades, or sidewalk construction. If property owners fail to pay these assessments, the local government may file a First Amended Assessment Lien against the property. 3. Municipal Lien: In some cases, a city or municipality may place a lien on a property to recover unpaid fines or penalties. This could be due to violations of local ordinances, building code violations, or unpaid utility bills. The First Amended Notice of Assessment Lien is used to secure the outstanding debt. 4. Tax Lien Certificate: If a property owner continues to ignore or neglect payment of property taxes or assessments, the local government may sell a tax lien certificate to a third party. This allows the third party to pay the owed debt in exchange for the lien on the property. The First Amended Notice of Assessment Lien is usually issued during this process. It is important for property owners to address and resolve any First Amended Notice of Assessment Lien promptly. Failure to satisfy the outstanding debt may result in further legal actions, including foreclosure or sale of the property to recover the unpaid taxes or assessments.

Free preview

How to fill out San Angelo Texas First Amended Notice Of Assessment Lien?

If you’ve already used our service before, log in to your account and download the San Angelo Texas First Amended Notice of Assessment Lien on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple actions to obtain your document:

- Make certain you’ve located a suitable document. Look through the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t fit you, utilize the Search tab above to get the appropriate one.

- Purchase the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Obtain your San Angelo Texas First Amended Notice of Assessment Lien. Choose the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to every piece of paperwork you have bought: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to rapidly find and save any template for your personal or professional needs!