The Tarrant Texas First Amended Notice of Assessment Lien is a legal document that pertains to property taxes in Tarrant County, Texas. This lien is issued by the county's appraisal district to notify property owners of unpaid or delinquent property taxes. It serves as a formal notice to the property owner that a lien has been placed on their property due to the outstanding tax debt. The purpose of the Tarrant Texas First Amended Notice of Assessment Lien is to inform property owners of the consequences and actions that may be taken if the outstanding tax amount is not paid promptly. The lien acts as a legal claim against the property, giving the county the right to seize or sell the property to recover the unpaid taxes. This First Amended Notice of Assessment Lien is used when an original notice has already been issued, but certain updates or amendments are required. It may be amended to reflect changes in the amount owed, interest accrued, or any modifications in the property's assessed value. Keywords: Tarrant Texas, First Amended Notice of Assessment Lien, property taxes, Tarrant County, Texas, appraisal district, unpaid taxes, delinquent property taxes, outstanding tax debt, lien, property owner, tax amount, interest accrued, assessed value. Different types of Tarrant Texas First Amended Notice of Assessment Lien may include: 1. Updated Tax Amount Notice: This type of amended lien is issued when there are changes made to the original tax amount stated in the initial notice. It reflects any adjustments in the assessed value or changes in tax rates, resulting in an updated outstanding tax amount. 2. Interest Accrual Notice: If the property owner has failed to make timely payments towards their delinquent taxes, interest may accrue over time. The First Amended Notice of Assessment Lien can be revised to include the accumulated interest, providing an updated total amount owed. 3. Assessed Value Revision Notice: In some cases, the assessed value of a property may be incorrect or disputed. If the county's appraisal district reevaluates the property's value and determines it needs adjustment, a First Amended Notice of Assessment Lien may be issued to reflect the revised assessed value and subsequently, the adjusted tax amount. By understanding the purpose and types of the Tarrant Texas First Amended Notice of Assessment Lien, property owners can take necessary actions to rectify their outstanding taxes and avoid potential consequences such as property seizure or sale. It is crucial to promptly address any amendments or updates mentioned in the notice to ensure accurate representation of the tax debt and to prevent further complications.

Tarrant Texas First Amended Notice of Assessment Lien

Description

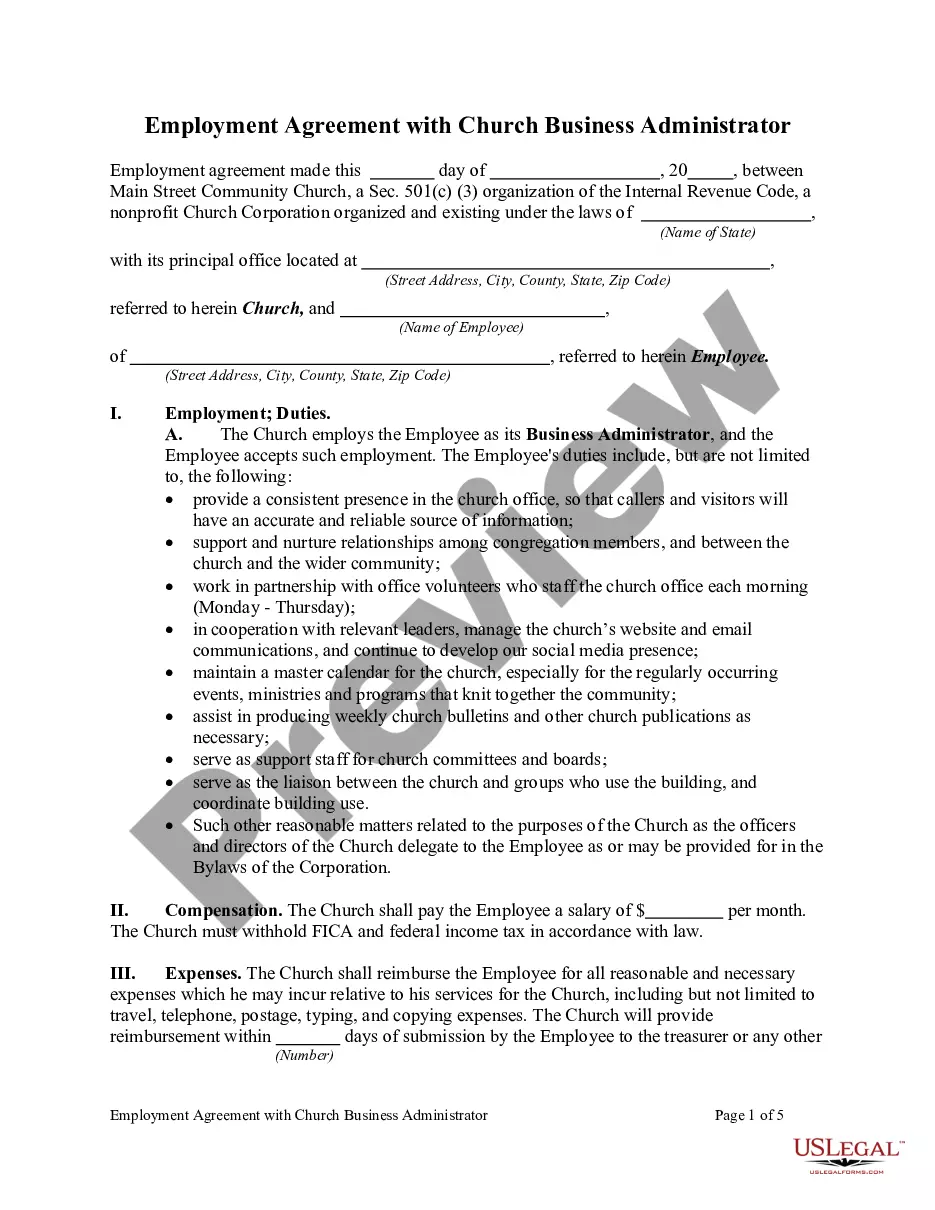

How to fill out Tarrant Texas First Amended Notice Of Assessment Lien?

Do you need a trustworthy and affordable legal forms supplier to get the Tarrant Texas First Amended Notice of Assessment Lien? US Legal Forms is your go-to solution.

No matter if you need a simple arrangement to set regulations for cohabitating with your partner or a set of forms to advance your separation or divorce through the court, we got you covered. Our website offers over 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t generic and frameworked based on the requirements of particular state and county.

To download the document, you need to log in account, locate the needed form, and hit the Download button next to it. Please take into account that you can download your previously purchased form templates anytime from the My Forms tab.

Are you new to our platform? No worries. You can set up an account in minutes, but before that, make sure to do the following:

- Check if the Tarrant Texas First Amended Notice of Assessment Lien conforms to the laws of your state and local area.

- Go through the form’s details (if available) to learn who and what the document is intended for.

- Start the search over in case the form isn’t suitable for your legal situation.

Now you can register your account. Then select the subscription plan and proceed to payment. Once the payment is completed, download the Tarrant Texas First Amended Notice of Assessment Lien in any available file format. You can get back to the website at any time and redownload the document without any extra costs.

Finding up-to-date legal forms has never been easier. Give US Legal Forms a go today, and forget about wasting hours learning about legal papers online for good.