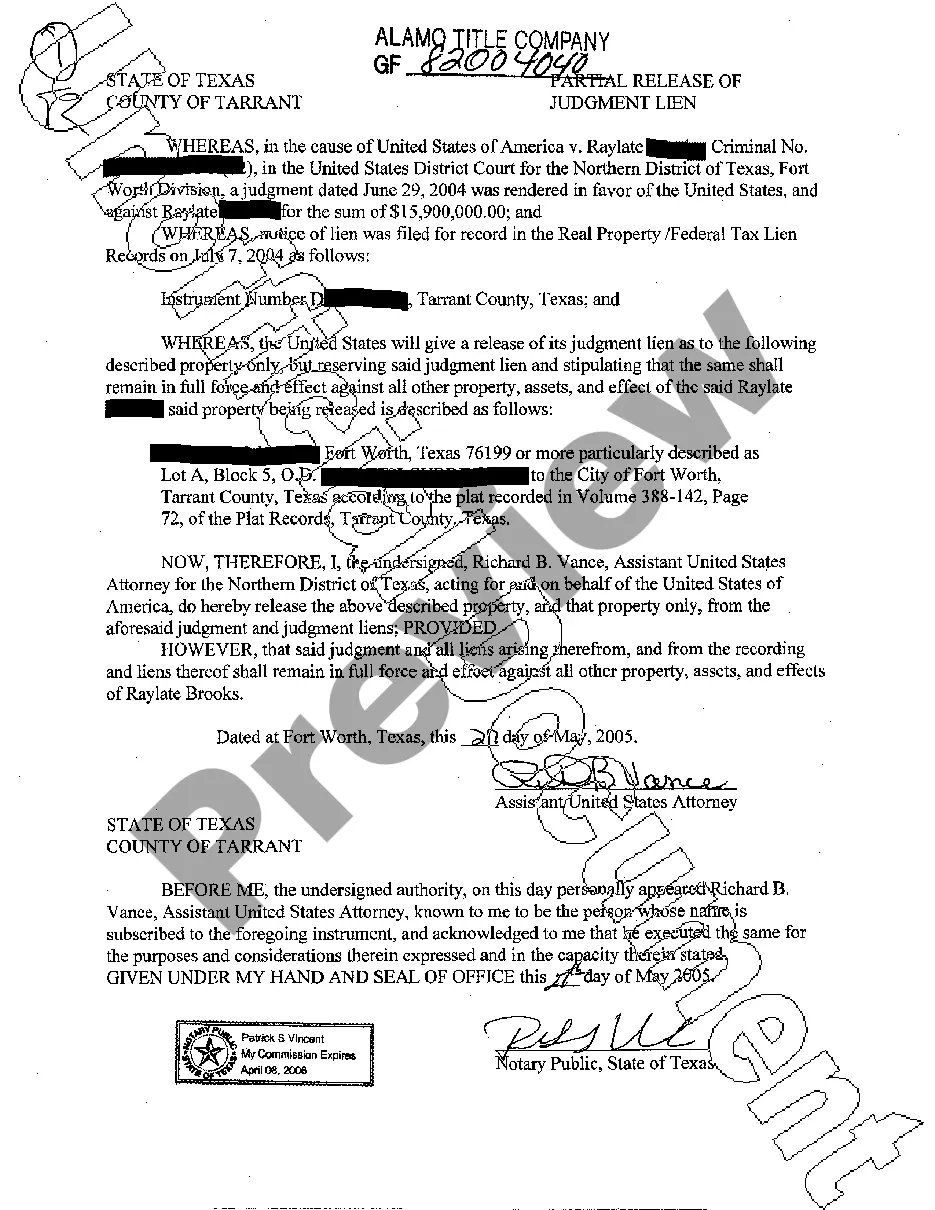

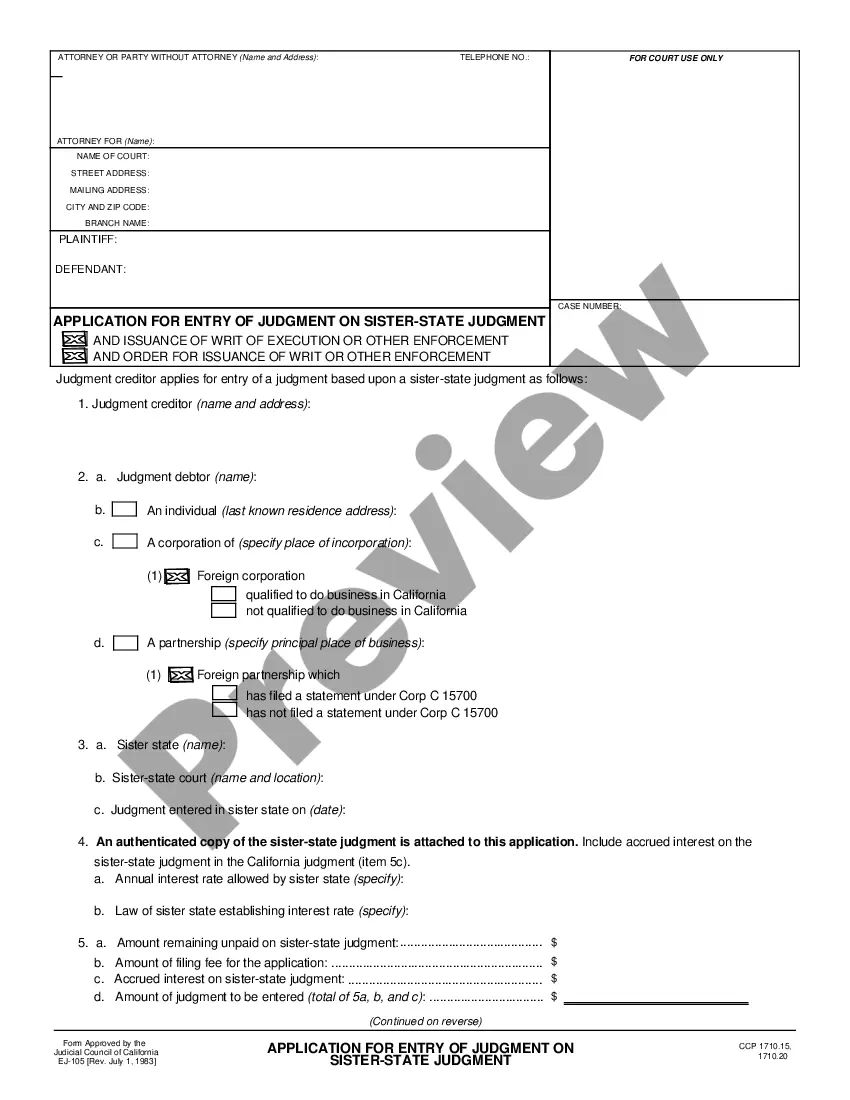

The Houston Texas Partial Release of Judgment Lien is a legal process that allows creditors to remove a portion of their judgment lien on a debtor's property. A judgment lien is imposed when a creditor obtains a court judgment against a debtor for an unpaid debt. This lien gives the creditor a legal claim on the debtor's property, allowing them to potentially seize and sell the property to satisfy the debt. However, in certain circumstances, a creditor may want to release a portion of their judgment lien on the debtor's property. This could occur when the debtor has made partial payments or reached a settlement agreement to satisfy a portion of the debt. By releasing a portion of the judgment lien, the creditor acknowledges that a portion of the debt has been paid or settled, and the property is no longer encumbered by the full judgment amount. The Houston Texas Partial Release of Judgment Lien follows the laws and regulations set forth in the Texas Property Code. It requires the creditor to file a Partial Release of Judgment Lien with the appropriate county clerk's office where the original judgment was filed. This document should include specific details such as the debtor's name, the original judgment amount, the property affected by the lien, and the amount being released or satisfied. Different types of Partial Release of Judgment Lien in Houston, Texas may include: 1. Partial Release for Partial Payment: This type of release occurs when the debtor has made partial payments towards the judgment amount, and the creditor agrees to release a portion of the lien in recognition of those payments. 2. Settlement Release: A settlement release takes place when the debtor and creditor reach an agreement to settle the debt for less than the full judgment amount. In this case, the creditor releases a portion of the judgment lien to reflect the agreed-upon settlement amount. 3. Release for Property Sale: If the debtor sells the property encumbered by the judgment lien, the creditor may release a portion of the lien to allow for a clean transfer of ownership. This release ensures that the new property owner is not burdened by the full judgment amount on the property. It is crucial for creditors and debtors to consult with legal professionals to ensure compliance with all relevant laws and regulations when seeking a Partial Release of Judgment Lien in Houston, Texas. Proper documentation and filing of the release are essential to protect the rights of both parties involved and to accurately reflect the updated status of the debt.

Houston Texas Partial Release of Judgment Lien

Description

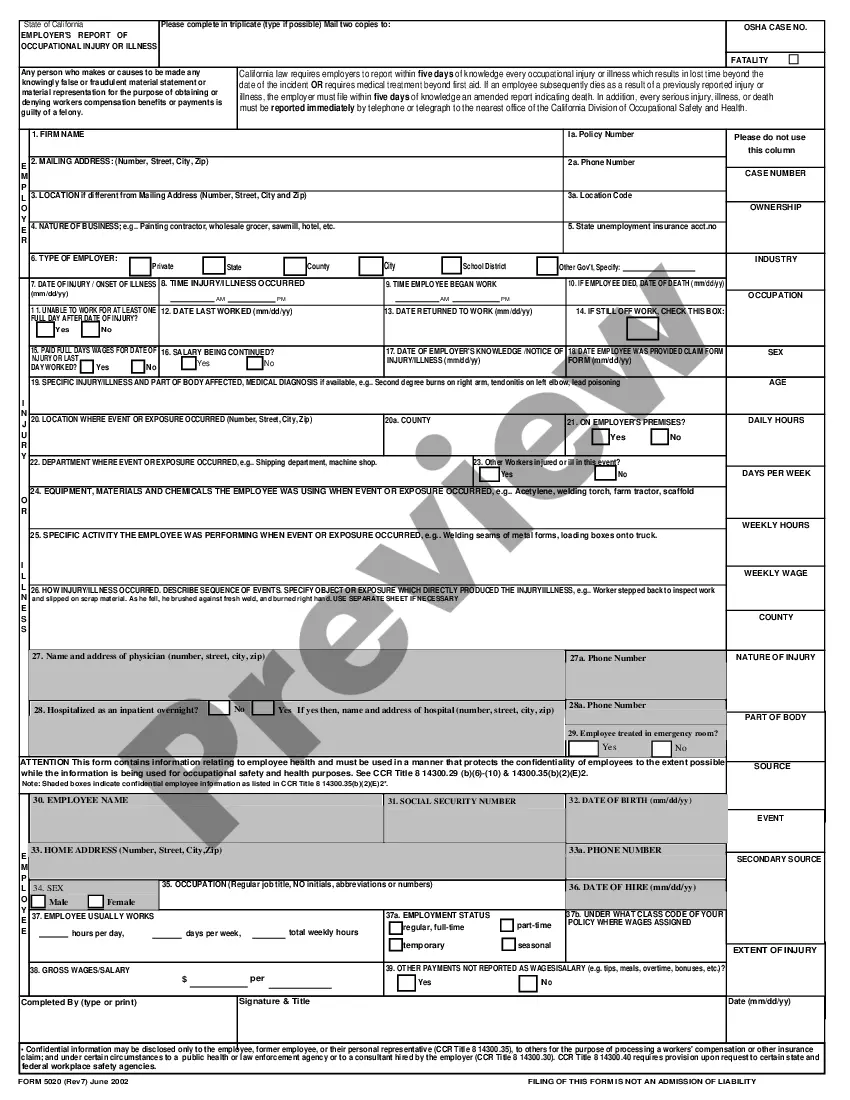

How to fill out Houston Texas Partial Release Of Judgment Lien?

If you are looking for a pertinent form template, it’s exceedingly challenging to discover a more user-friendly platform than the US Legal Forms site – one of the most comprehensive repositories on the web.

Here, you can locate countless document samples for business and personal purposes categorized by types and regions, or key terms.

With the sophisticated search feature, acquiring the latest Houston Texas Partial Release of Judgment Lien is as simple as 1-2-3.

Proceed with the payment. Use your credit card or PayPal account to finalize the registration process.

Obtain the form. Select the file format and download it to your device. Edit as necessary. Complete, modify, print, and sign the obtained Houston Texas Partial Release of Judgment Lien.

- Moreover, the relevance of every document is verified by a group of experienced attorneys who routinely assess the templates on our site and refresh them according to the latest state and county regulations.

- If you are already familiar with our platform and possess an account, all you need to do to obtain the Houston Texas Partial Release of Judgment Lien is to Log In to your account and hit the Download button.

- If this is your first time using US Legal Forms, simply adhere to the instructions outlined below.

- Ensure you have located the form you need. Examine its details and utilize the Preview function (if available) to review its content. If it doesn’t satisfy your needs, employ the Search field at the top of the page to find the suitable document.

- Validate your selection. Click on the Buy now button. Then, choose your desired subscription plan and enter your details to register for an account.

Form popularity

FAQ

Filing a Judgment Lien A judgment lien lasts for ten years. According to Section 52.001 of the Texas Property Code, a judgment lien cannot attach to any real property that is exempt from seizure or forced sale under Chapter 41 of the Texas Property Code.

There is no removal procedure for such liens other than entering into a payment arrangement with the taxing authority. The existence of a judgment lien or other type of lien is usually discovered when a title company checks the property records and produces a title commitment in anticipation of a sale or refinance.

The statutes of limitation for collecting (or foreclosing) on both the vendor's lien and deed of trust is four years in Texas. If no legal action has been filed for collection on the liens for four years after the liens ma- ture, there is indication the liens have been paid.

Three commons ways to fight a false lien are to: immediately dispute the lien through statutorily provided preliminary means, a demand to/against the claimant, or a full-blown lawsuit. force the claimant to file a lawsuit to enforce the lien in a shorter period if available where you live. just wait it out.

When a Texas mechanics lien has been paid and satisfied, the claimant must file a release of lien within 10 days after receiving a request for the release of the claim. However, there is no penalty provided by the statute. That doesn't mean that there are no consequences for failing to release it on time.

After the lien on a vehicle is paid off, the lienholder has 10 business days after receipt of payment to release the lien. If the lien was recorded on a paper title, the lienholder mails the title to you.

A release of a portion of real property from the lien of a deed of trust securing a loan on commercial real property in Texas. Lenders in Texas customarily use a partial release of lien to discharge a deed of trust lien against some but not all of the borrower's real property.

Add or Remove a Lien on a Vehicle To add or remove a lien on your vehicle title, visit your local county tax office. The title fee is $28 or $33, depending on your county, and must be paid at time of application. Please contact your local county tax office for the exact cost.

According to this law, a debtor must file an affidavit with the county to secure the release of a judgment lien against a primary residence. The debtor must first provide a 30-day notice letter to the creator of the judgment, containing a copy of the affidavit the debtor intends to file.

It's done by filing an abstract of judgement with the county you live in. You would have a very difficult time selling any property that has a lien like this on it. You can get a partial release of a lien that resulted due to a judgement against you in Texas if the property is a homestead.

Interesting Questions

More info

A homestead property is exempt from lien. The homestead owner or person who is designated by the lien holder when it was acquired may file a Release of Lien if the lien is due to the holder's failure to: Possess the property on the date of its acquisition, or. Maintain the property in quiet possession for one year from the date of possession (the period is extended until the interest due the holder on the bond or security deposit, whichever is less×. The lien must be discharged prior to the expiration of the intervals set out in the statute. The release may be obtained either through the County Clerk, or through the County Attorney for a bond or security deposit equal to the amount of the lien. Release of Lien on Real Property. A Release of Lien on a real property is available up to the value of the real property at the time of the Release of Lien.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.