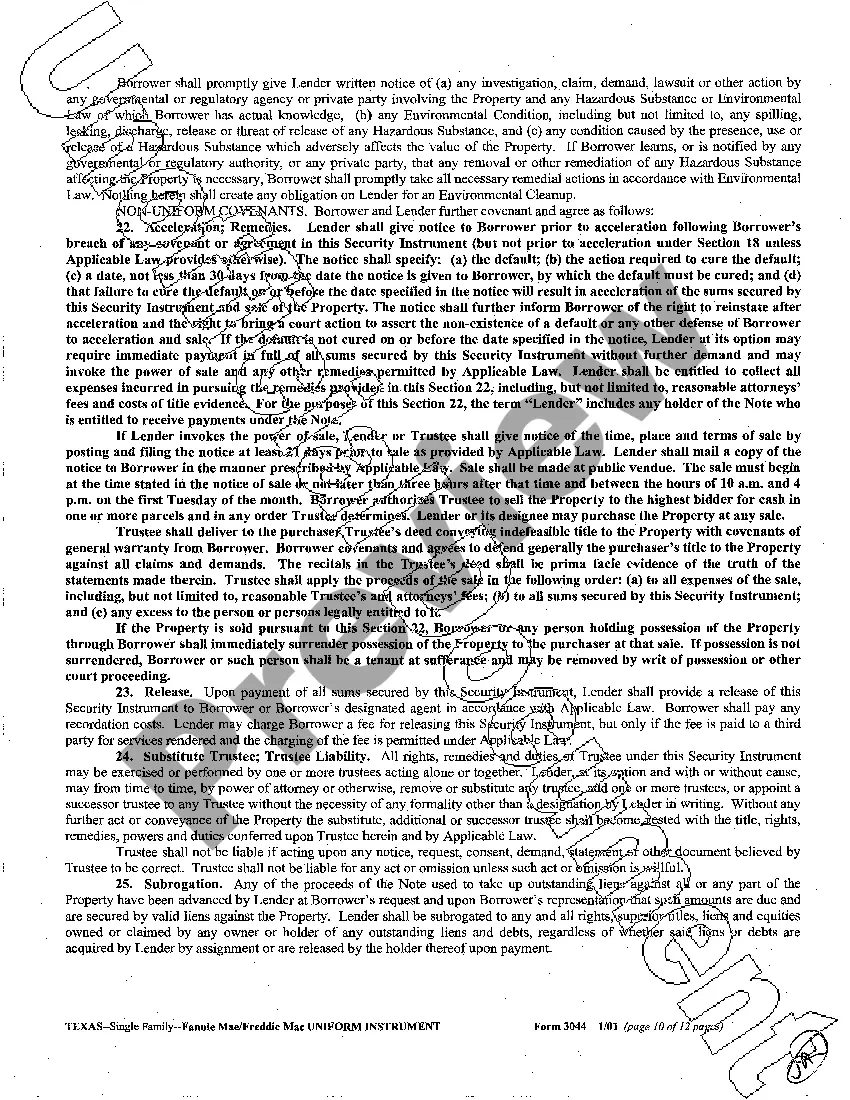

Arlington, Texas Sample Deed of Trust is a legally binding document that serves as security for a loan provided by a lender to a borrower in the Arlington, Texas area. This document outlines the terms and conditions of the loan, including the amount borrowed, the interest rate, and the repayment schedule. Additionally, it details the collateral, typically real estate property, that will be used to secure the loan. A Sample Deed of Trust in Arlington, Texas includes various key elements and keywords relevant to the process. These may include: 1. Parties Involved: The Deed of Trust will identify the parties involved, including the borrower (also known as the trust or), the lender (also referred to as the beneficiary), and the trustee (a neutral third party responsible for managing the collateral). 2. Loan Amount: The Deed of Trust will state the exact amount of money borrowed by the borrower from the lender. 3. Interest Rate: The document will specify the interest rate at which the loan will be repaid, whether it is a fixed or adjustable rate, and any applicable penalties for late payments. 4. Repayment Terms: The Deed of Trust will outline the repayment schedule, including the frequency of payments and the duration of the loan. It may include details on whether there are any early prepayment penalties or options for refinancing. 5. Collateral Description: The document will thoroughly describe the property that serves as collateral for the loan, including the address, legal description, and any associated rights or easements. 6. Default and Foreclosure: The Deed of Trust will provide information on what constitutes a default by the borrower, such as missed payments or violation of agreed-upon terms. It will also explain the lender's rights and procedures in the event of default, including the option to initiate foreclosure proceedings. 7. Additional Covenants and Provisions: The Deed of Trust may include additional clauses based on the specific requirements of the lender or local laws. These clauses may cover insurance requirements, property maintenance, payment escrow for taxes and insurance, and the right to cure defaults. Different types of Sample Deed of Trust in Arlington, Texas can arise based on the specific needs and circumstances of the loan agreement. Some examples include: 1. Commercial Deed of Trust: This type of deed is used for commercial properties, such as office buildings, retail spaces, or warehouses. 2. Residential Deed of Trust: Meant for residential properties, such as single-family homes, condominiums, or townhouses. 3. Land Deed of Trust: Used when the loan is primarily secured by undeveloped land or vacant lots. When entering into a financial agreement involving a loan in Arlington, Texas, it is essential to consult a legal professional to ensure compliance with local laws and regulations and to customize the Deed of Trust as required.

Arlington Texas Sample Deed of Trust

Description

How to fill out Arlington Texas Sample Deed Of Trust?

If you are searching for a valid form, it’s difficult to choose a better platform than the US Legal Forms website – probably the most extensive libraries on the web. Here you can find a large number of templates for company and personal purposes by categories and regions, or key phrases. With our advanced search option, getting the most up-to-date Arlington Texas Sample Deed of Trust is as easy as 1-2-3. Furthermore, the relevance of each record is verified by a team of skilled lawyers that on a regular basis review the templates on our website and revise them based on the most recent state and county demands.

If you already know about our platform and have a registered account, all you need to receive the Arlington Texas Sample Deed of Trust is to log in to your user profile and click the Download option.

If you make use of US Legal Forms for the first time, just follow the instructions below:

- Make sure you have discovered the sample you require. Check its information and utilize the Preview function (if available) to check its content. If it doesn’t suit your needs, use the Search field at the top of the screen to get the needed document.

- Confirm your decision. Click the Buy now option. Next, select the preferred pricing plan and provide credentials to sign up for an account.

- Make the financial transaction. Utilize your bank card or PayPal account to finish the registration procedure.

- Obtain the form. Indicate the file format and download it to your system.

- Make adjustments. Fill out, revise, print, and sign the obtained Arlington Texas Sample Deed of Trust.

Every single form you add to your user profile does not have an expiry date and is yours permanently. It is possible to gain access to them using the My Forms menu, so if you want to have an additional version for editing or printing, you can return and save it again whenever you want.

Take advantage of the US Legal Forms extensive library to gain access to the Arlington Texas Sample Deed of Trust you were looking for and a large number of other professional and state-specific templates on a single website!