Austin Texas Sample Deed of Trust

Description

How to fill out Texas Sample Deed Of Trust?

Obtaining verified templates tailored to your local regulations can be challenging unless you utilize the US Legal Forms library.

This is an online repository of over 85,000 legal documents for both personal and professional requirements covering various real-life situations.

All documents are accurately categorized by usage area and jurisdiction, making it as straightforward as ABC to find the Austin Texas Sample Deed of Trust.

Maintaining organized paperwork that adheres to legal standards is of great significance. Take advantage of the US Legal Forms library to always have crucial document templates ready for any requirement!

- Review the Preview mode and document description.

- Ensure you have selected the accurate one that satisfies your needs and fully aligns with your local jurisdiction stipulations.

- Search for an alternate template if necessary.

- If you notice any discrepancies, use the Search tab above to locate the appropriate one. If it meets your needs, proceed to the next step.

- Purchase the document.

Form popularity

FAQ

Individuals can write out their own, and use someone else as a witness. However, this may have errors or not be a legally binding document. The investment of getting a deed of trust when buying a property is often worth it in the long term.

You may obtain Texas land records, including deeds, from the county clerk in the Texas county in which the property is located. You can search online for a deed in some counties, or else request the deed from the clerk in person, by mail, phone, fax or email.

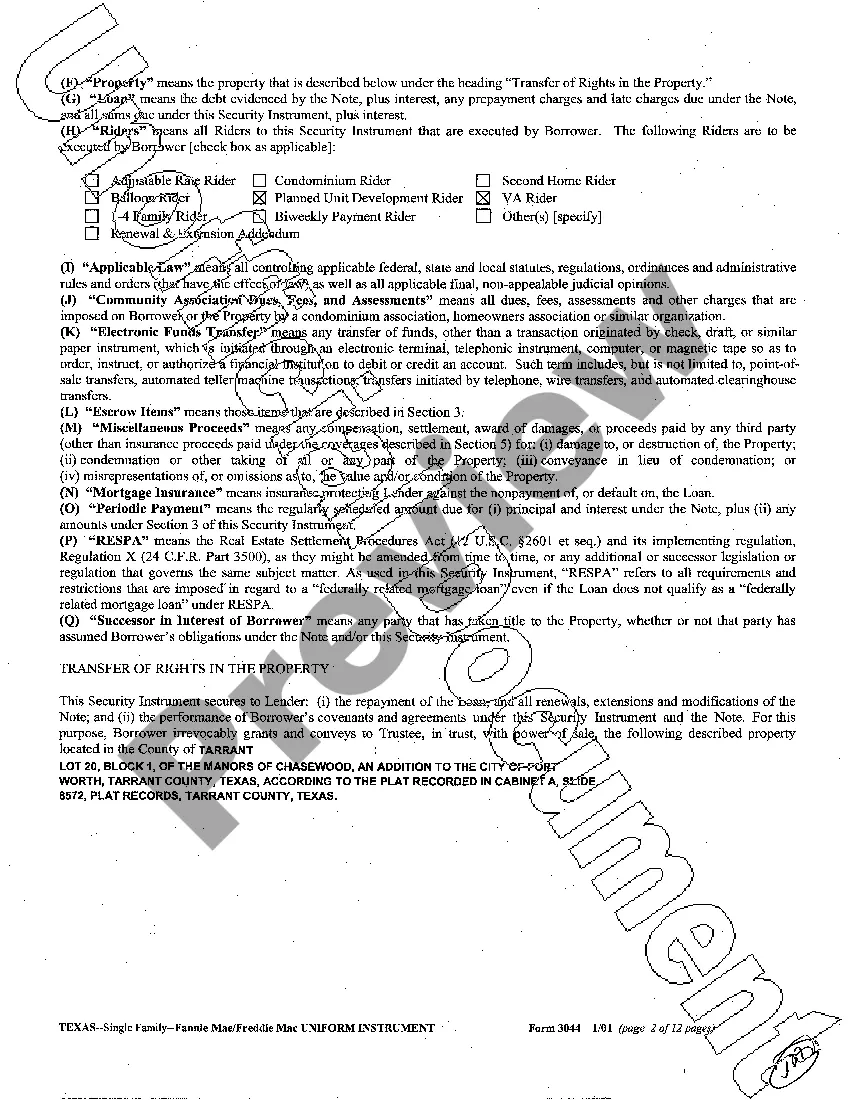

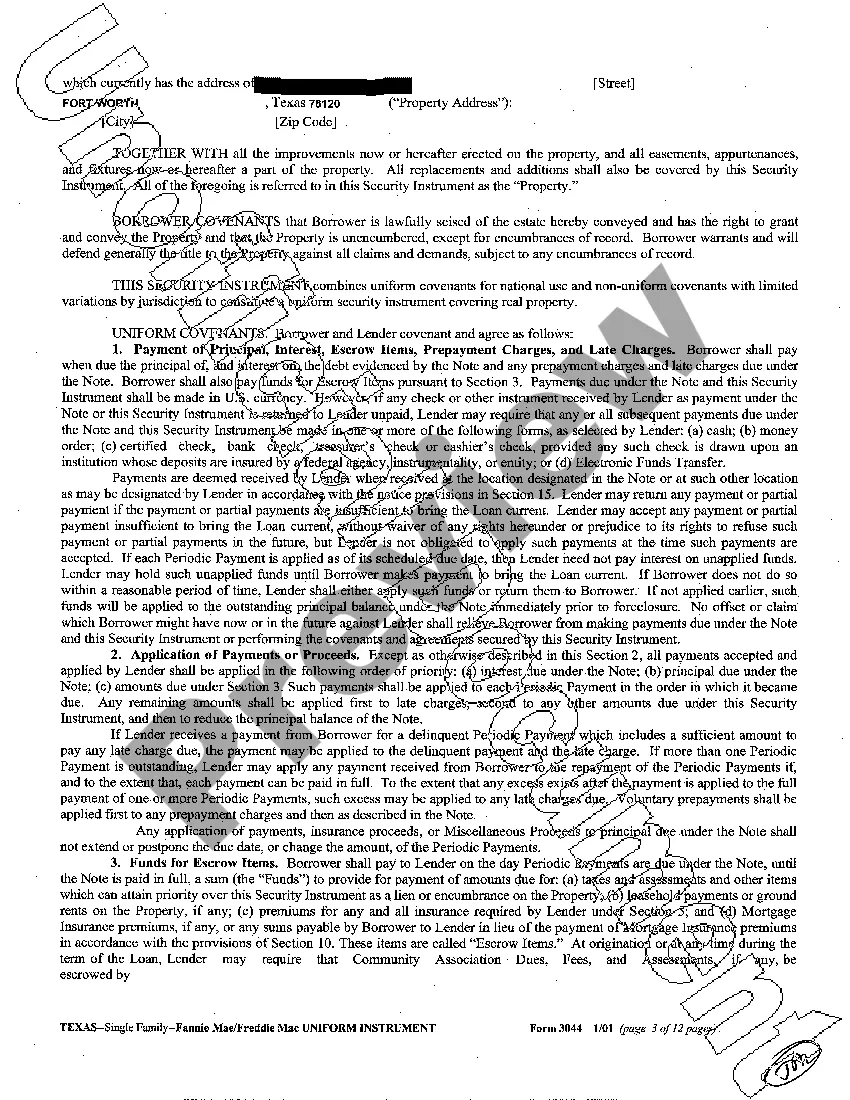

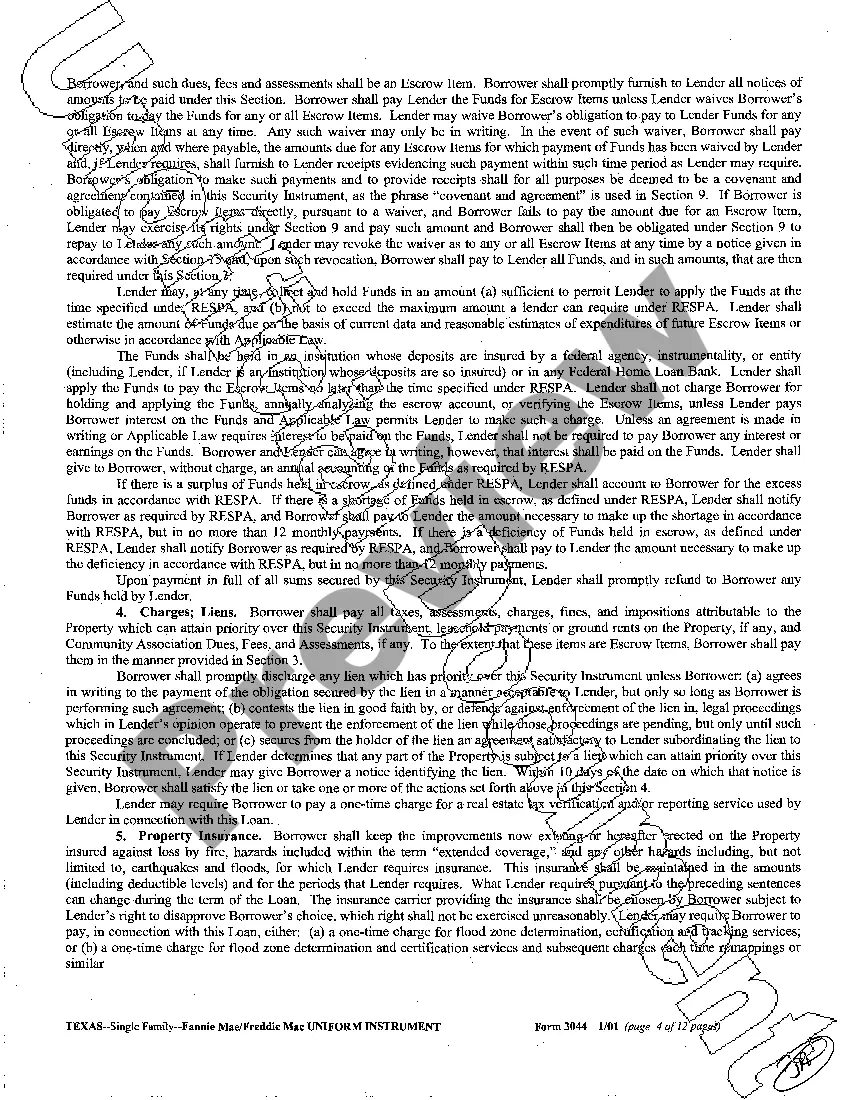

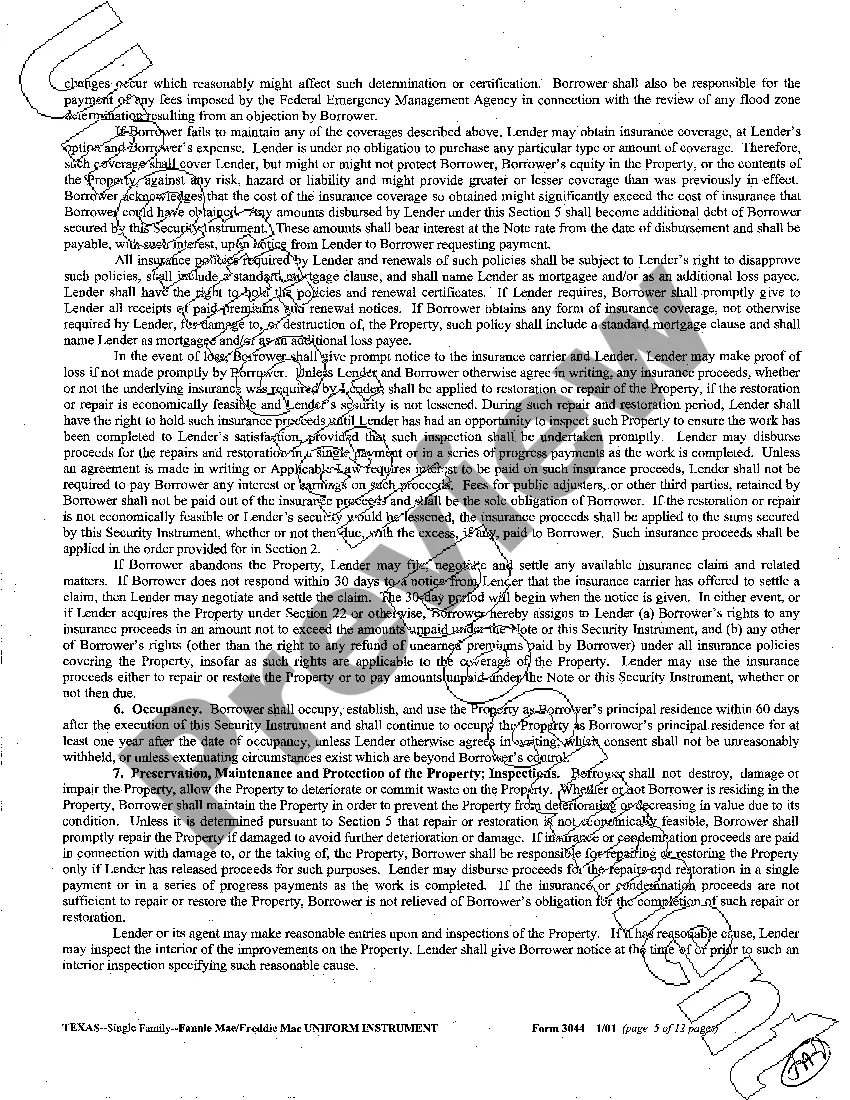

A deed of trust involves three parties: a lender, a borrower, and a trustee. The lender gives the borrower money. In exchange, the borrower gives the lender one or more promissory notes. As security for the promissory notes, the borrower transfers a real property interest to a third-party trustee.

The Note is signed by the people who agree to pay the debt (the people that will be making the mortgage payments). The Deed and the Deed of Trust are signed by those who will own the property that is being mortgaged.

The Deed of Trust must be in writing, signed by the property owner, and filed in the County Clerk property records. The Deed of Trust should describe the loan amount, name a Trustee, and describe the collateral securing the loan. A correct legal description of the property is essential for a valid Deed of Trust.

The County Clerk's office maintains Official Public Records beginning in 1836. The records include deeds, land patent records, mortgages, judgments and tax liens.

In Texas, a deed of trust, also known as a trust deed, is the commonly used instrument for the purpose of creating mortgage liens on real estate. A mortgage is an executed contract in which the legal or equitable owner of the real property pledges the title thereto as security for performance of an obligation.

A Deed of Trust in Texas transfers title of real property in trust. It is the equivalent to a mortgage used in other states and provides a secured interest for a lender against real estate. It is often used as part of a real estate transaction that includes a Warranty Deed with a Vendor's Lien and a Promissory Note.

How to Write Step 1 ? Obtain The California Deed Of Trust Form For Your Use.Step 2 ? Determine And Present Where This Deed Must Be Returned.Step 3 ? Report The Assessor's Parcel Number.Step 4 ? Record The Effective Date Of This Deed.Step 5 ? Produce The Debtor's Identity As The Trustor.

Beneficiary/Payee: --Deed of Trust lien becomes barred 4 years after original/extended maturity date of the secured obligation TEX. CIVIL PRACTICE & REMEDIES CODE §16.035.