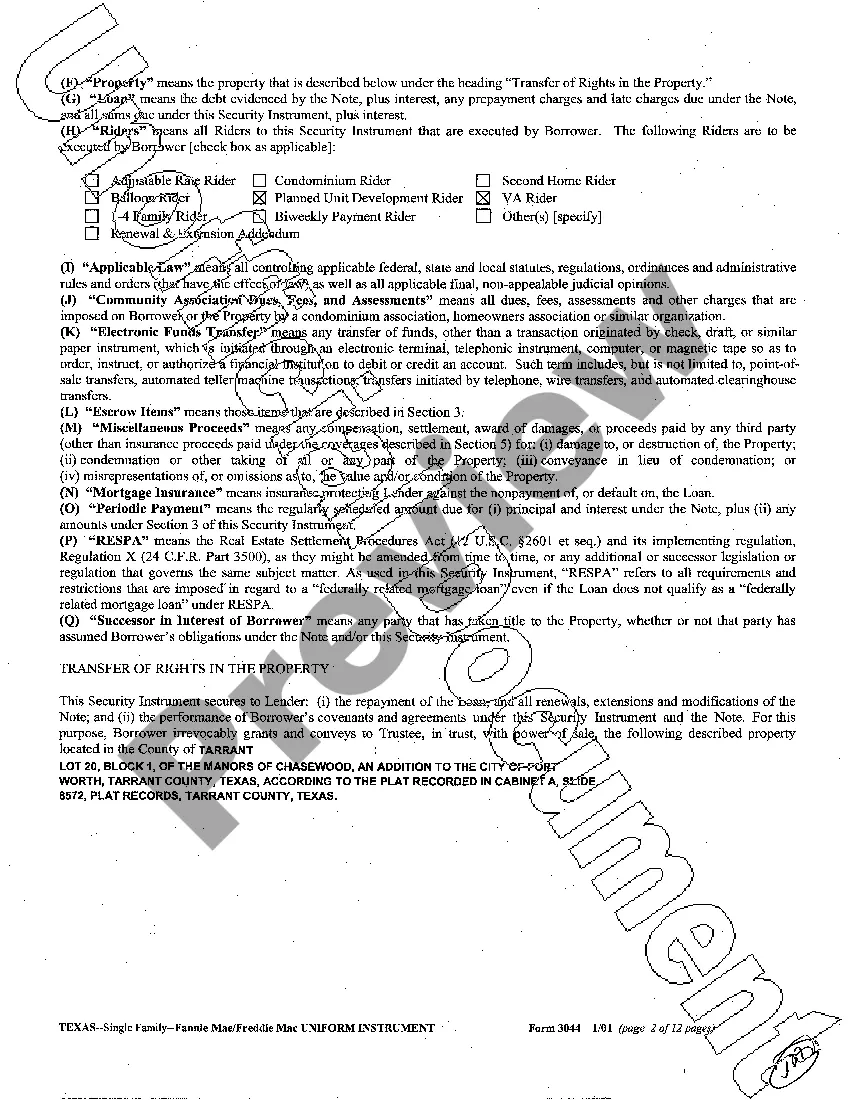

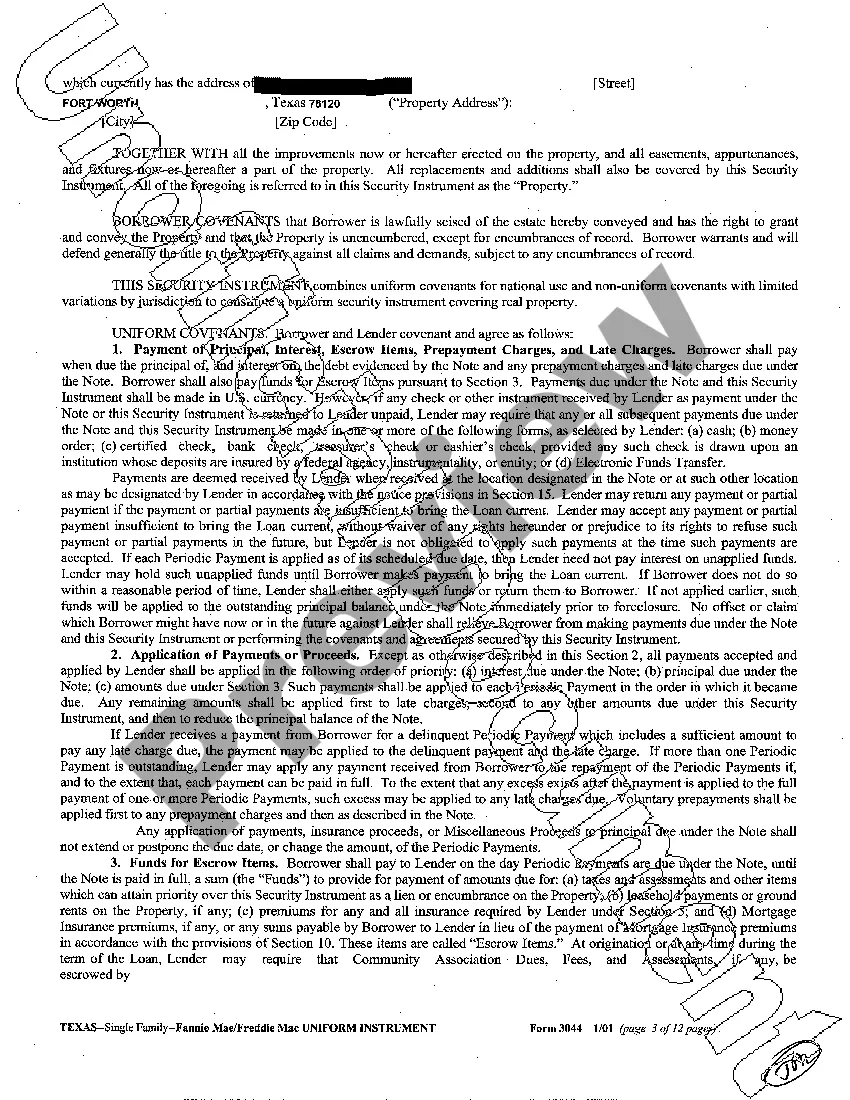

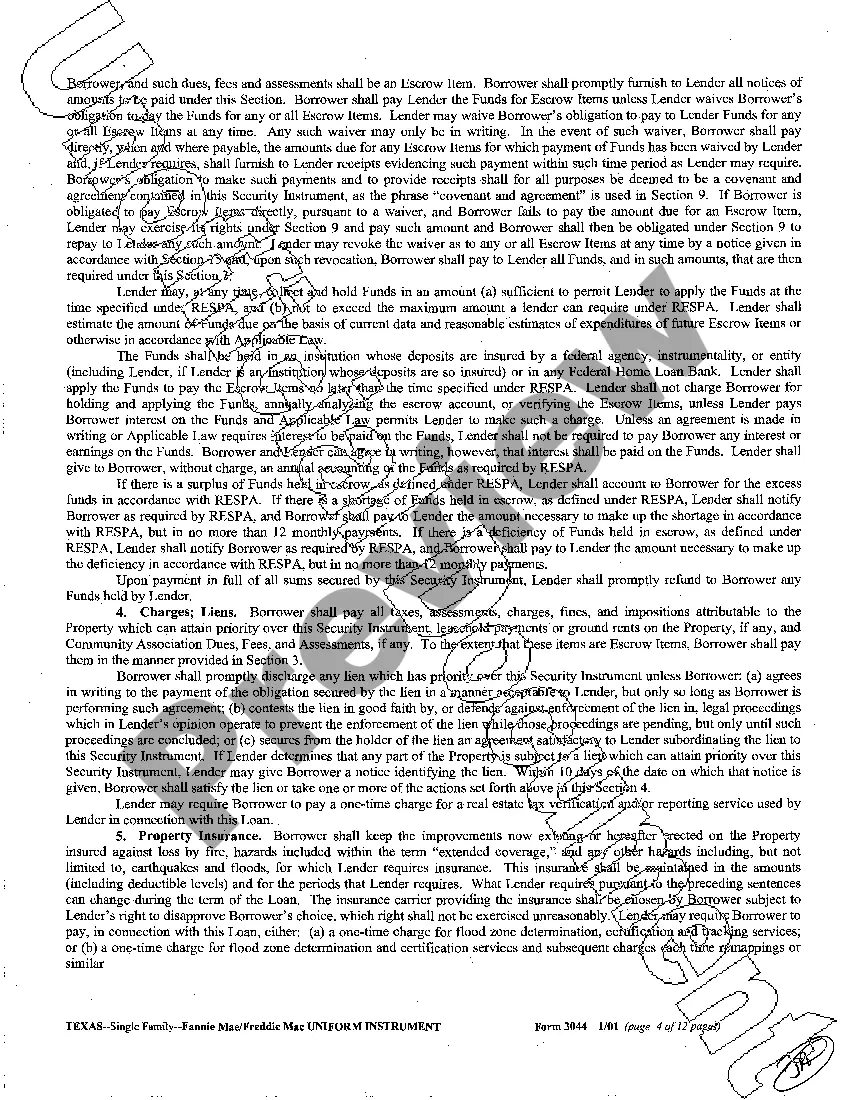

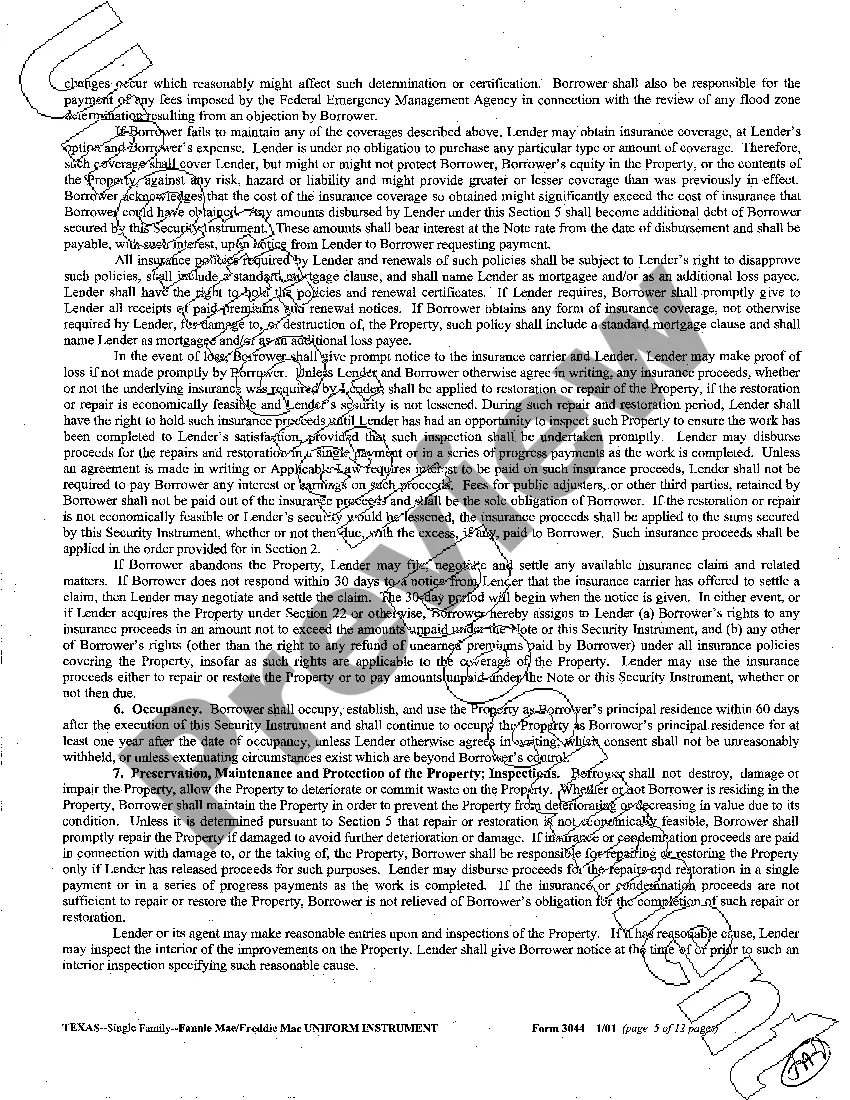

A McAllen Texas Sample Deed of Trust is a legally binding document used in real estate transactions to secure a property loan. It helps protect the lender's interests by providing them with a lien on the property until the debt is fully repaid. Here is a detailed description of the McAllen Texas Sample Deed of Trust and its different types: 1. McAllen Texas Sample Deed of Trust Overview: The McAllen Texas Sample Deed of Trust is a standardized legal document that outlines the terms and conditions of a property loan in the city of McAllen, Texas. It includes details about the borrower, lender, and the property being used as collateral. This legal instrument ensures that the lender has the right to foreclose on the property in the event of default. 2. Key Elements: This document typically contains the following essential elements: — Identification of parties: It identifies the borrower, lender, and the trustee responsible for overseeing the terms of the loan. — Property description: Accurate identification of the property being used as collateral, including its physical address, legal description, and boundaries. — Loan terms: Specifies the loan amount, interest rate, repayment terms, and any additional fees or charges. — Default and remedies: Outlines the conditions under which a default occurs and the steps the lender can take to recover the loan, such as foreclosure. — Right to reinstate: Defines the borrower's right to bring the loan current by paying the past-due amount and any associated costs. — Incorporation of other loan documents: References any additional agreements or documents related to the loan, such as promissory notes. — Signatures and acknowledgments: Requires signatures from all involved parties, and often needs to be notarized. 3. Types of McAllen Texas Sample Deed of Trust: a) Residential Deed of Trust: Used for residential properties, such as single-family homes, townhouses, or condominiums. b) Commercial Deed of Trust: Applicable to commercial real estate, such as office buildings, retail spaces, or industrial properties. c) Investment Property Deed of Trust: Specifically designed for properties purchased with the intention of generating rental income or future resale. d) Refinance Deed of Trust: Used when an existing loan is being refinanced, providing updated terms and conditions. e) Construction Deed of Trust: Tailored for loans used in construction projects, ensuring proper disbursement of funds as the project progresses. It is important to note that the exact content and format of a McAllen Texas Sample Deed of Trust may vary. Consultation with a real estate attorney or title company is advisable to obtain an accurate and up-to-date document specific to your circumstances.

McAllen Texas Sample Deed of Trust

Description

How to fill out McAllen Texas Sample Deed Of Trust?

If you are looking for a relevant form template, it’s difficult to choose a better service than the US Legal Forms website – one of the most considerable online libraries. Here you can get a large number of templates for business and personal purposes by types and states, or key phrases. Using our high-quality search function, finding the most recent McAllen Texas Sample Deed of Trust is as easy as 1-2-3. Additionally, the relevance of each record is verified by a group of expert attorneys that on a regular basis review the templates on our website and revise them in accordance with the newest state and county demands.

If you already know about our system and have an account, all you should do to get the McAllen Texas Sample Deed of Trust is to log in to your account and click the Download option.

If you make use of US Legal Forms the very first time, just follow the instructions listed below:

- Make sure you have chosen the form you want. Look at its explanation and make use of the Preview option to see its content. If it doesn’t meet your needs, use the Search field near the top of the screen to discover the needed file.

- Confirm your choice. Click the Buy now option. Following that, select your preferred pricing plan and provide credentials to sign up for an account.

- Process the transaction. Utilize your credit card or PayPal account to finish the registration procedure.

- Obtain the form. Select the format and download it to your system.

- Make changes. Fill out, modify, print, and sign the obtained McAllen Texas Sample Deed of Trust.

Each and every form you save in your account does not have an expiry date and is yours permanently. You can easily access them using the My Forms menu, so if you want to get an additional duplicate for modifying or creating a hard copy, you may return and export it once more at any time.

Make use of the US Legal Forms professional catalogue to get access to the McAllen Texas Sample Deed of Trust you were looking for and a large number of other professional and state-specific templates in one place!