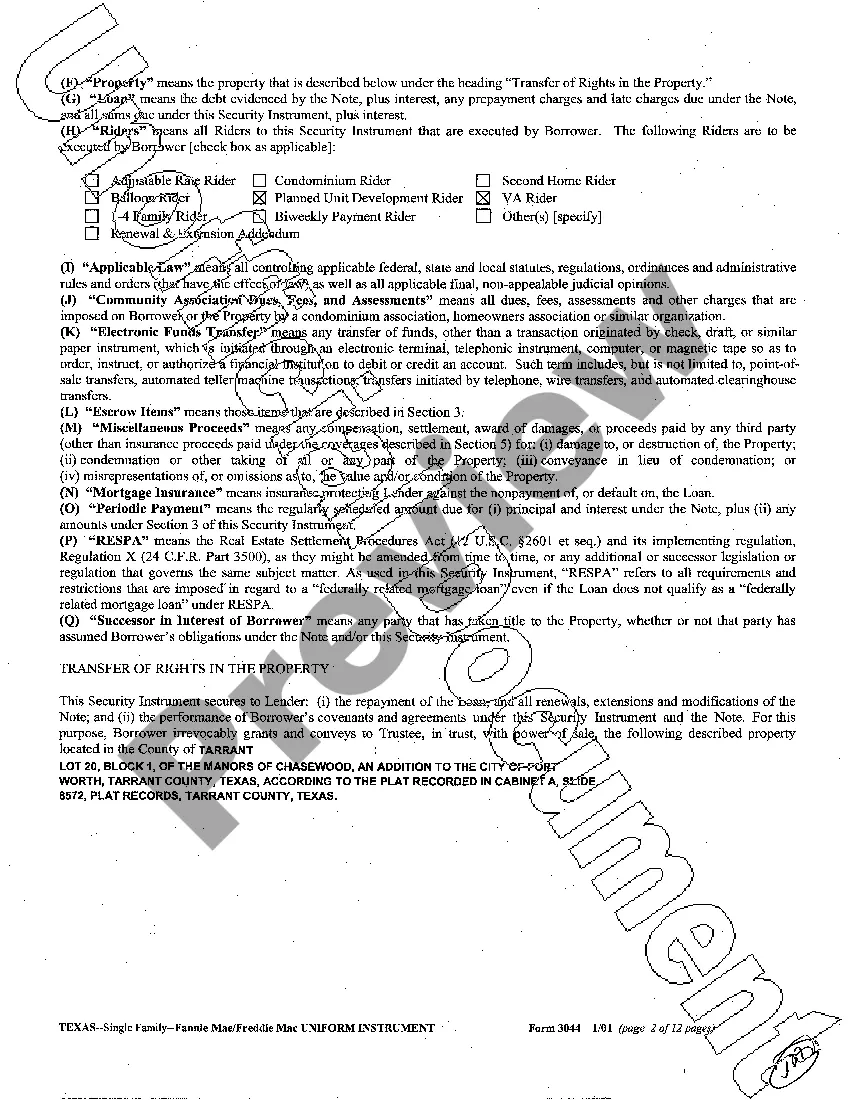

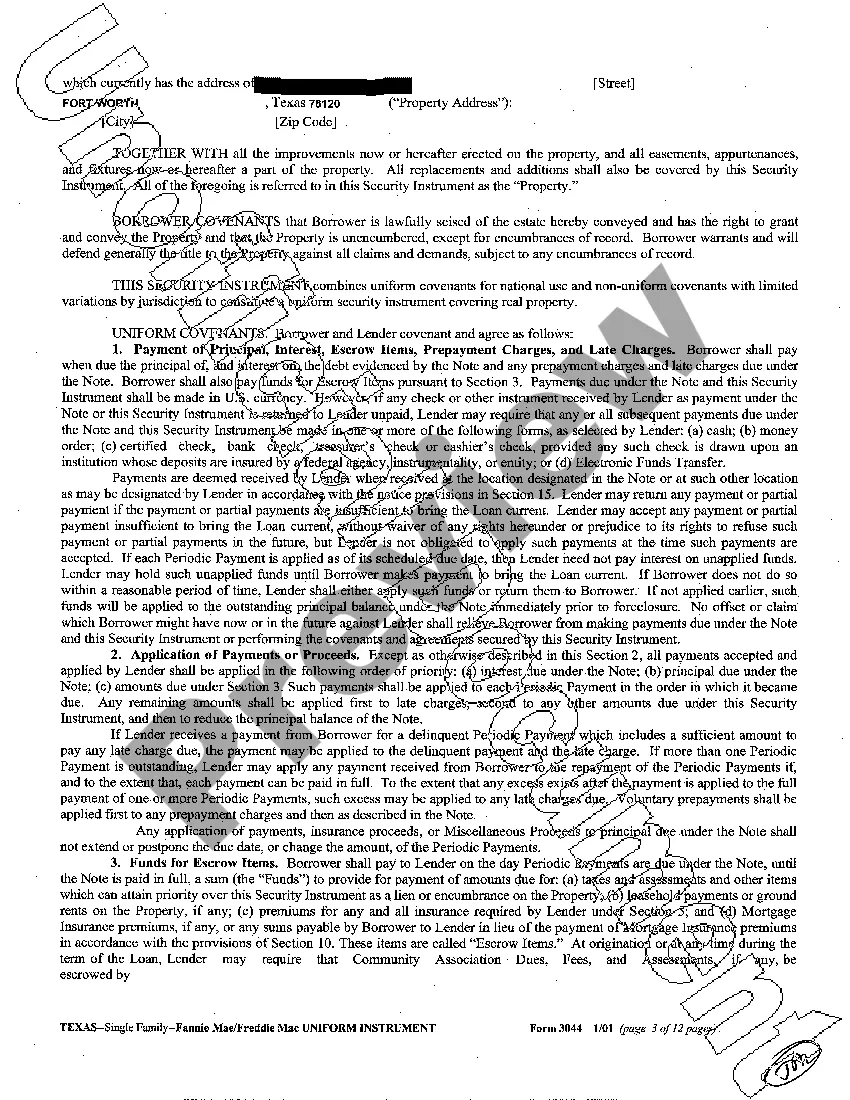

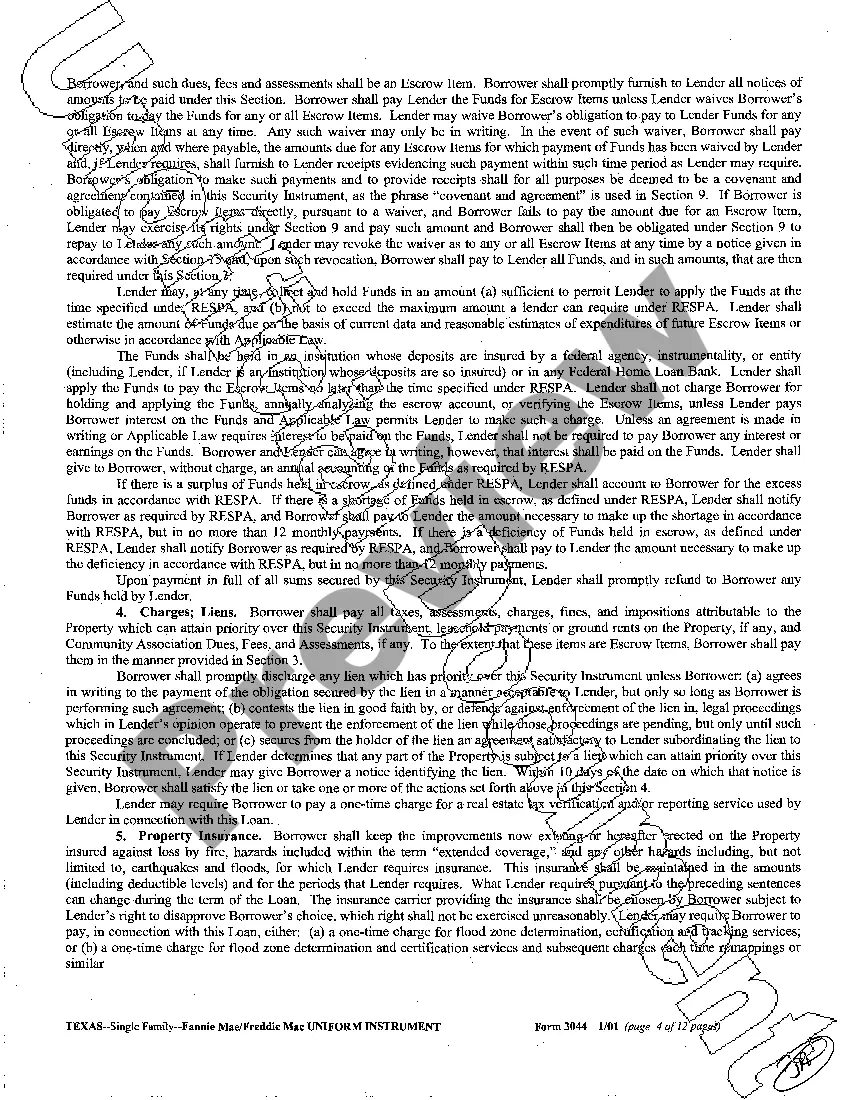

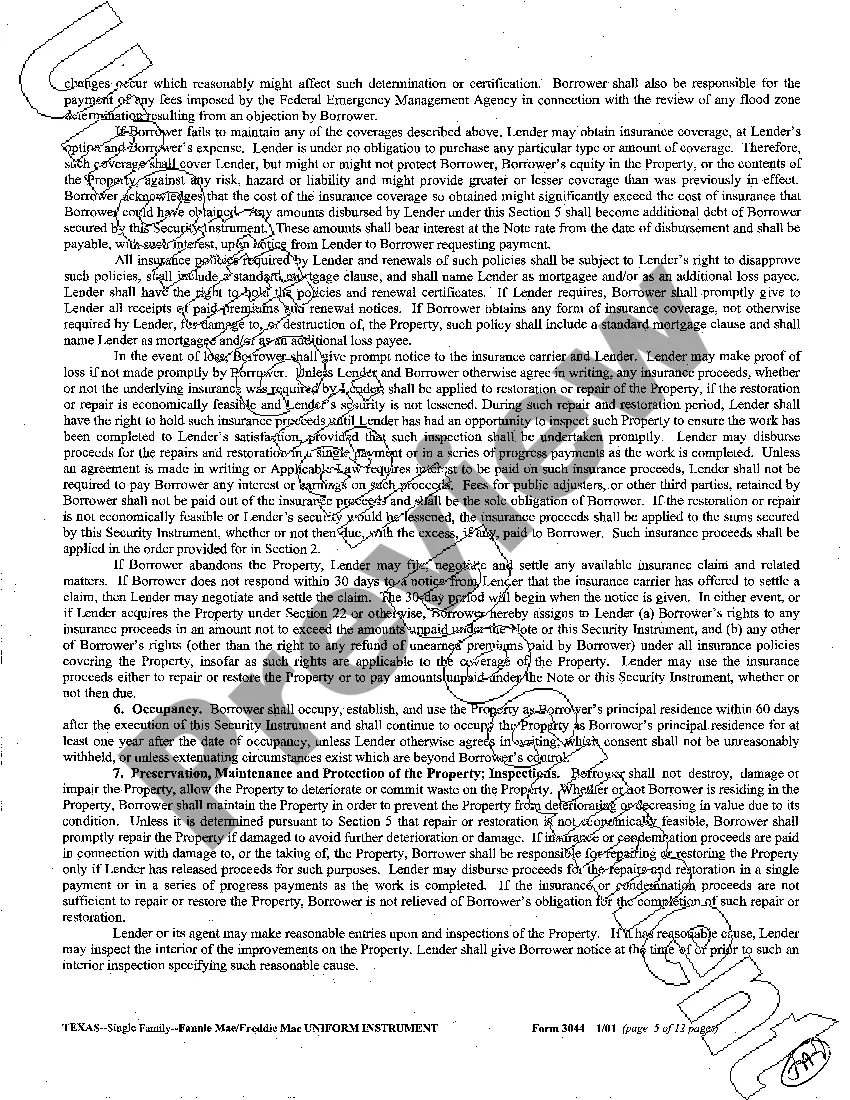

The Tarrant Texas Sample Deed of Trust is a legal document that outlines the terms of a real estate transaction involving a property located in Tarrant County, Texas. This document is commonly used when a borrower obtains a loan to purchase or refinance a property, and the lender requires collateral in the form of a deed of trust. The Tarrant Texas Sample Deed of Trust serves as a security instrument, providing the lender with a legal claim to the property in the event of the borrower's default on the loan. It lays out the rights and responsibilities of both the borrower (also known as the trust or) and the lender (also known as the beneficiary) and establishes a lien on the property. Some key elements typically found in a Tarrant Texas Sample Deed of Trust include: 1. Identification of the parties involved: The deed of trust will clearly state the names and contact information of the borrower, lender, and any other parties involved in the transaction, such as a trustee. 2. Property description: The document will provide a detailed description of the property, including its address, lot number, and legal description as per official land records. 3. Loan terms: The deed of trust will specify the terms of the loan, including the principal amount, interest rate, repayment schedule, and any prepayment penalties or late fees. 4. Trustee: In Texas, a trustee is required to oversee the foreclosure process if the borrower defaults on the loan. The deed of trust will name the trustee and outline their role and responsibilities. 5. Default and foreclosure provisions: The document will outline the conditions under which the borrower would be considered in default, such as failure to make timely payments, and the steps the lender can take to initiate foreclosure proceedings. 6. Additional provisions: The Tarrant Texas Sample Deed of Trust may include other provisions that are relevant to the specific transaction, such as insurance requirements, property maintenance obligations, and rights of the parties in case of dispute resolution. Types of Tarrant Texas Sample Deed of Trust: 1. Residential Deed of Trust: This type of deed of trust is used when the property being financed is a residential property, such as a single-family home, townhouse, or condominium. 2. Commercial Deed of Trust: Commercial properties, including office buildings, retail spaces, and industrial sites, require a commercial deed of trust. The terms and provisions in this document may differ from those in a residential deed of trust due to the unique nature of commercial real estate transactions. 3. Refinance Deed of Trust: When a borrower refinances an existing loan, a refinancing deed of trust is used to replace the original deed of trust with updated terms and conditions. In conclusion, the Tarrant Texas Sample Deed of Trust is a vital legal document that facilitates real estate financing in Tarrant County, Texas. It provides the framework for a secure transaction between a borrower and a lender while protecting the rights and interests of both parties.

Tarrant Texas Sample Deed of Trust

Description

How to fill out Tarrant Texas Sample Deed Of Trust?

Getting verified templates specific to your local laws can be challenging unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both personal and professional needs and any real-life scenarios. All the documents are properly categorized by area of usage and jurisdiction areas, so searching for the Tarrant Texas Sample Deed of Trust becomes as quick and easy as ABC.

For everyone already familiar with our library and has used it before, getting the Tarrant Texas Sample Deed of Trust takes just a few clicks. All you need to do is log in to your account, opt for the document, and click Download to save it on your device. The process will take just a few more actions to make for new users.

Adhere to the guidelines below to get started with the most extensive online form library:

- Look at the Preview mode and form description. Make certain you’ve picked the right one that meets your requirements and totally corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you see any inconsistency, utilize the Search tab above to obtain the correct one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and select the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the service.

- Download the Tarrant Texas Sample Deed of Trust. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Benefit from the US Legal Forms library to always have essential document templates for any needs just at your hand!