Plano Texas Affidavit of Death and Heirship or Descent

Category:

State:

Texas

City:

Plano

Control #:

TX-JW-0143

Format:

PDF

Instant download

This form is available by subscription

Description

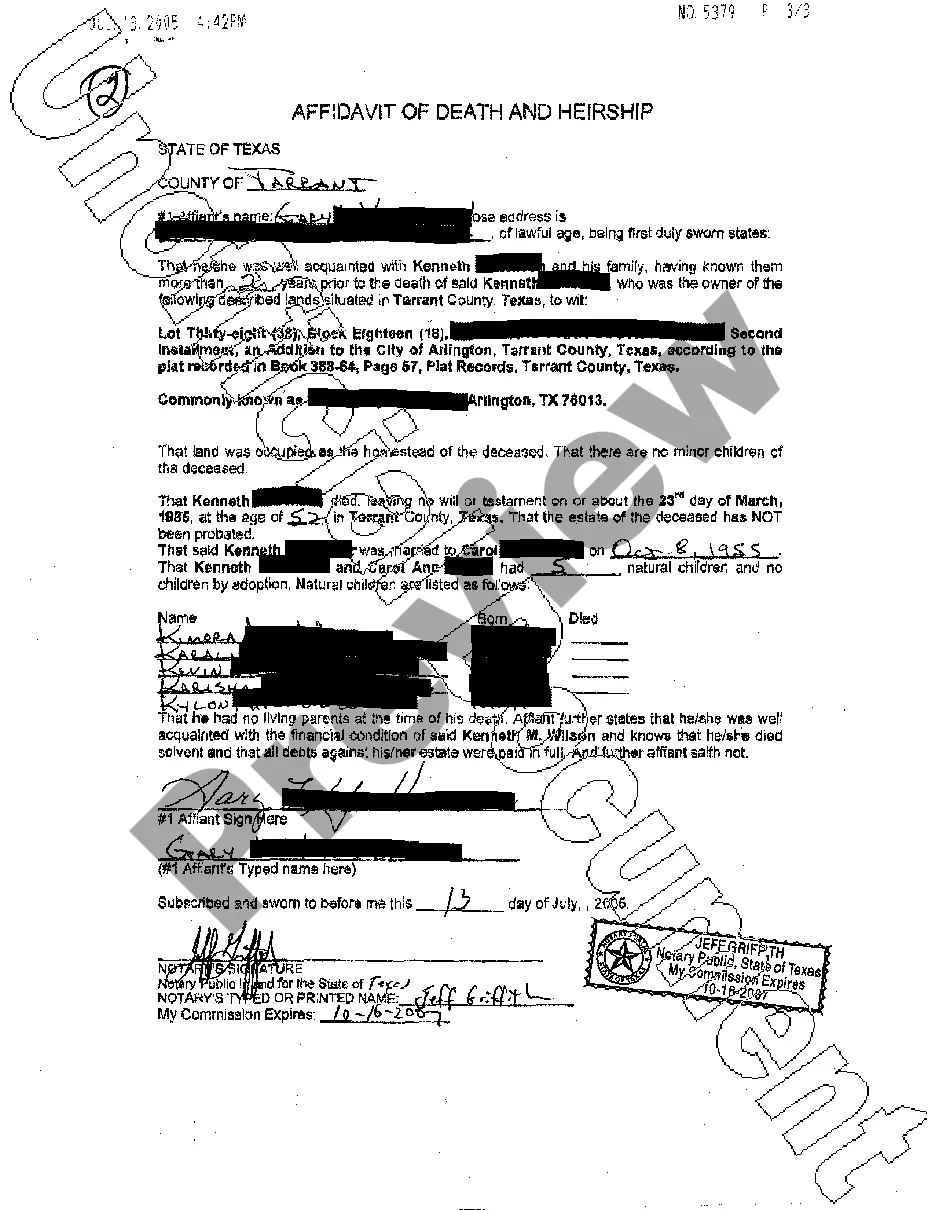

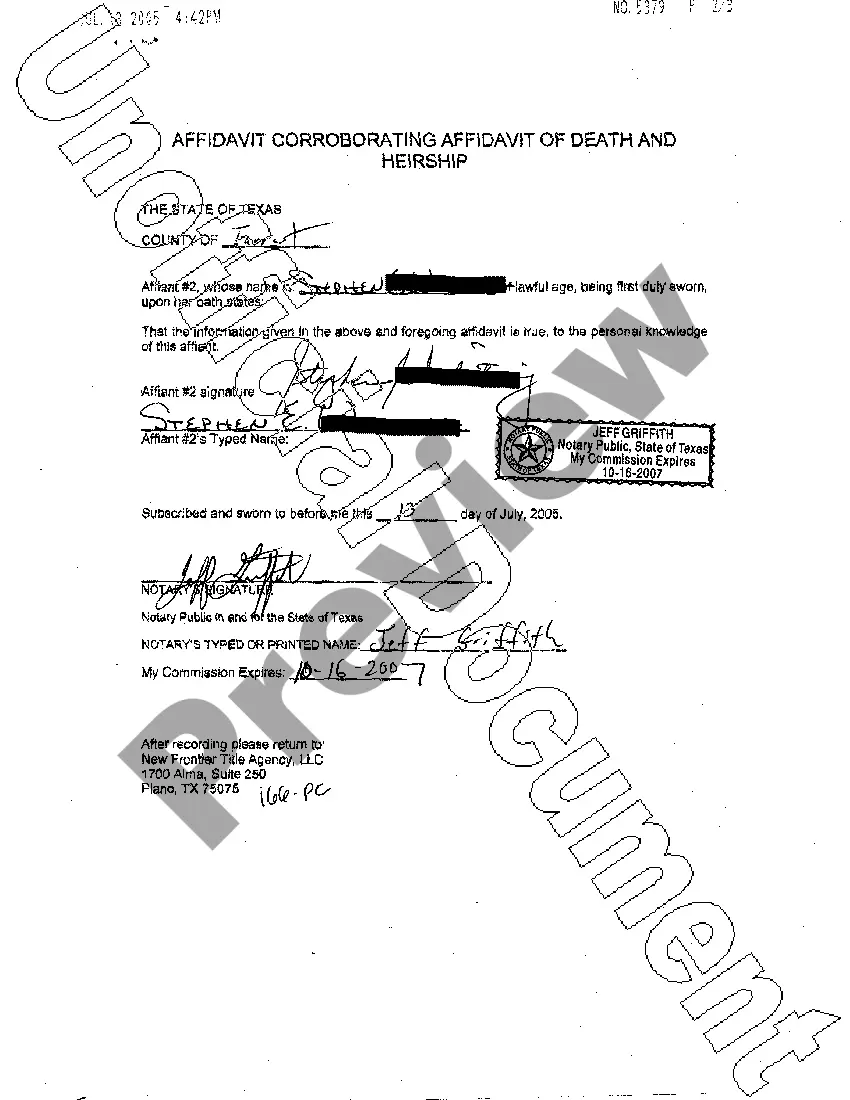

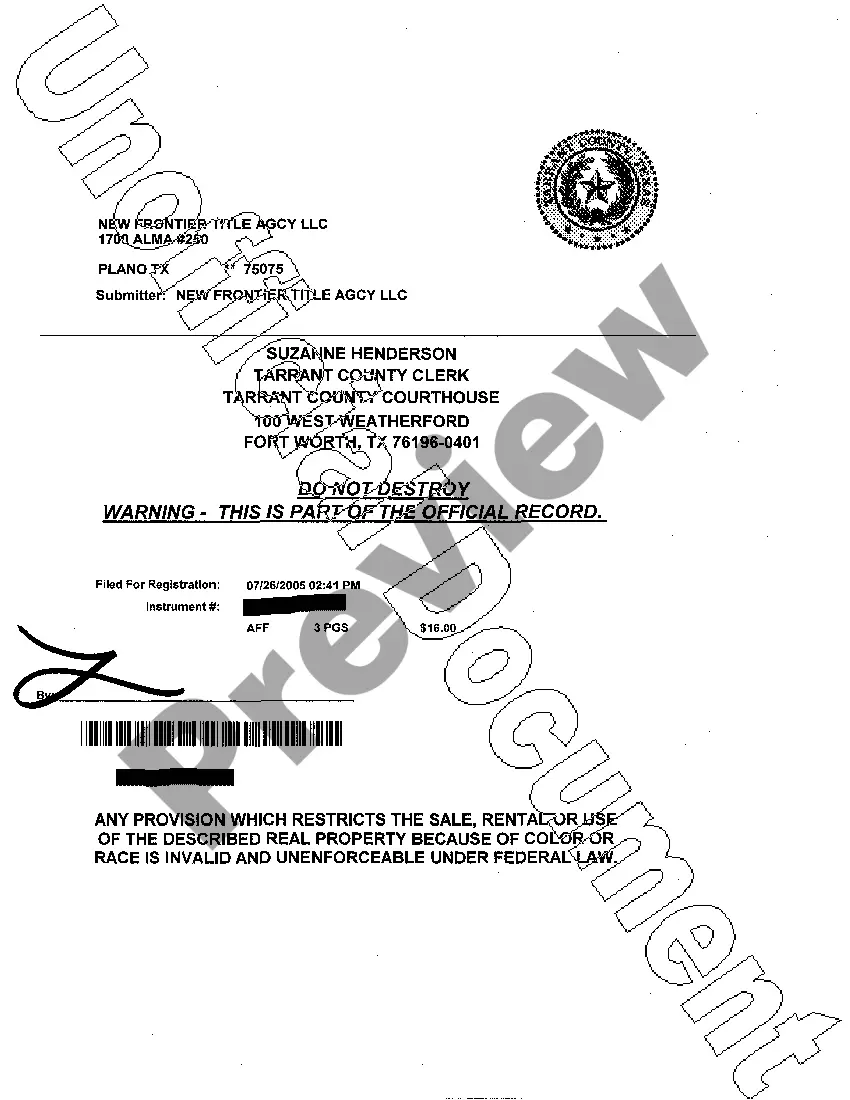

Affidavit of Death and Heirship or Descent

Free preview

How to fill out Plano Texas Affidavit Of Death And Heirship Or Descent?

If you’ve already utilized our service before, log in to your account and download the Plano Texas Affidavit of Death and Heirship or Descent on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple actions to obtain your document:

- Make certain you’ve found an appropriate document. Read the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t suit you, use the Search tab above to obtain the appropriate one.

- Purchase the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Obtain your Plano Texas Affidavit of Death and Heirship or Descent. Select the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to each piece of paperwork you have purchased: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to easily find and save any template for your personal or professional needs!