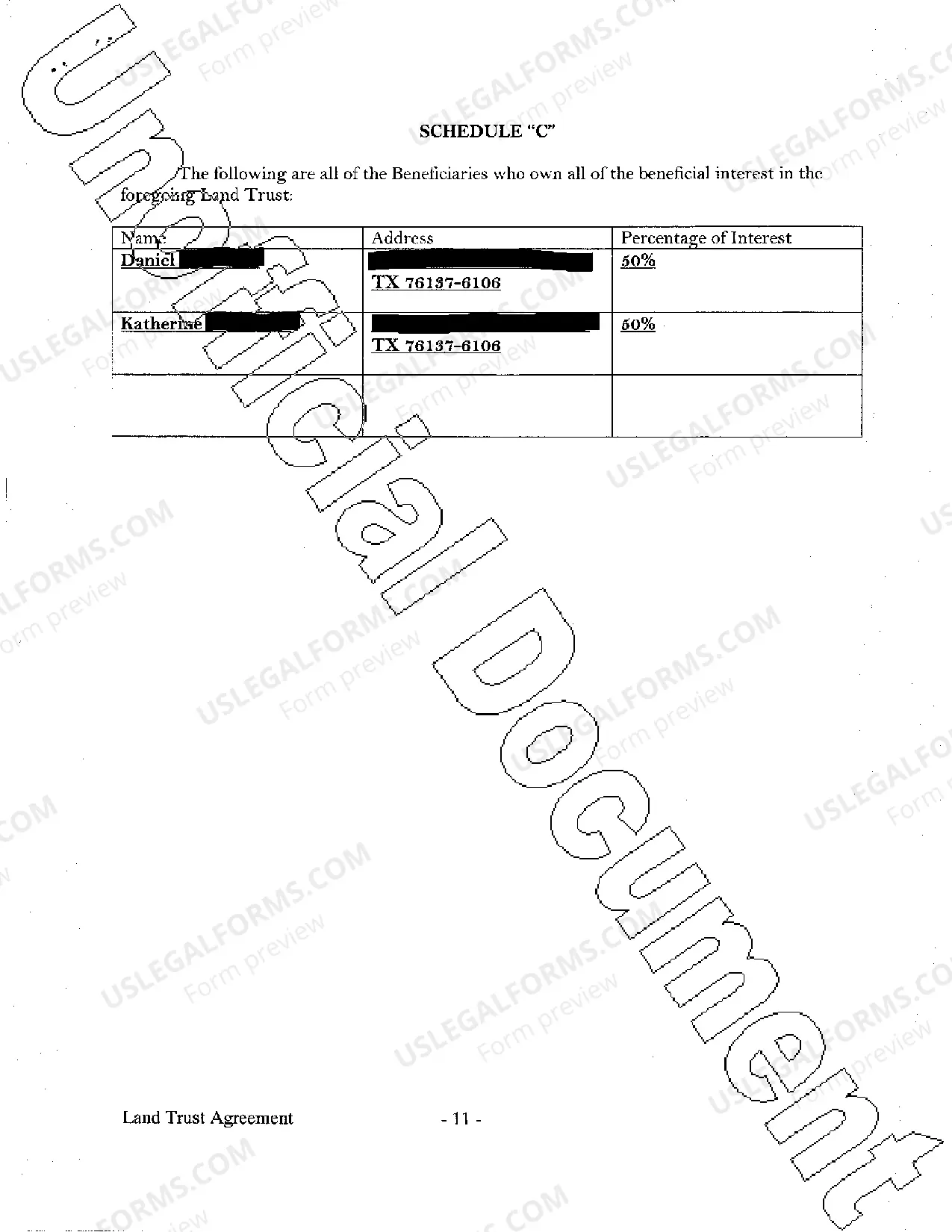

The Sugar Land Texas Land Trust Agreement is a legal document that outlines the terms and conditions regarding the ownership and management of land in the city of Sugar Land, Texas. This agreement is designed to protect and preserve the natural resources, environment, and cultural heritage of the land for future generations. The agreement is typically entered into between a landowner and a land trust organization. The Sugar Land Texas Land Trust Agreement serves as a means to limit development, conserve open space, protect wildlife habitats, and maintain the scenic beauty of the area. It often includes provisions for the ongoing monitoring and maintenance of the land, ensuring its long-term sustainability. The agreement helps prevent unauthorized alterations to the land and ensures that any changes are made in accordance with sustainable and environmentally-friendly practices. Within the realm of Sugar Land Texas Land Trust Agreements, there are several types that can be implemented based on the specific objectives and requirements of the landowner and the land trust organization. These may include: 1. Conservation Easement: This type of agreement restricts future development on the land, while still allowing the landowner to retain ownership. It sets permanent conservation goals focusing on protecting the natural resources, wildlife, or scenic qualities of the land. 2. Donation Agreement: In this arrangement, the landowner voluntarily donates their land to a land trust organization. The land trust then becomes the owner and assumes the responsibilities of managing and conserving the land, pursuant to the objectives outlined in the agreement. 3. Revocable Trust Agreement: This type of agreement provides flexibility to the landowner, allowing them to retain some control and ownership over the land. It can be modified or terminated during the landowner's lifetime if certain conditions are met. 4. Joint Ownership Agreement: In a joint ownership agreement, the landowner and the land trust organization become co-owners of the land. Responsibilities and management decisions are shared based on the terms mutually agreed upon in the agreement. It is important for landowners and land trust organizations to carefully consider the objectives, terms, and conditions of the Sugar Land Texas Land Trust Agreement before entering into it. Legal advice from qualified professionals experienced in land conservation law is highly recommended ensuring the agreement effectively serves the needs of both parties and aligns with the broader conservation goals of Sugar Land, Texas.

Sugar Land Texas Land Trust Agreement

Description

How to fill out Texas Land Trust Agreement?

Finding authenticated templates tailored to your regional regulations can be challenging unless you utilize the US Legal Forms database.

It’s a digital repository of over 85,000 legal documents catering to both individual and business requirements, as well as various real-world situations.

All the files are meticulously organized by usage area and jurisdiction, making it as simple and quick as ABC to find the Sugar Land Texas Land Trust Agreement.

Submit your credit card information or use your PayPal account to complete the payment for your subscription.

- Review the Preview mode and document description.

- Ensure that you’ve selected the correct one that aligns with your needs and fully complies with your local jurisdiction.

- Search for an alternative template, if necessary.

- If you notice any discrepancies, utilize the Search tab above to locate the appropriate one. If it fits your needs, proceed to the next step.

- Acquire the document.

Form popularity

FAQ

Setting up a land trust in Texas involves several clear steps. First, you need to choose a trustee who will manage the trust, which can be an individual or an institution. Next, you should draft a land trust agreement that outlines the terms and conditions, ensuring it aligns with the Sugar Land Texas Land Trust Agreement requirements. Finally, you must transfer the property title into the trust, which can be facilitated through Legal Forms, a great resource for creating and managing your land trust effectively.

Yes, you can write your own trust in Texas, but it is essential to ensure that it complies with state laws and includes all necessary components. In particular, clear definitions and terms can prevent misunderstandings in the future. Utilizing a Sugar Land Texas Land Trust Agreement can provide a solid framework to help you draft a valid trust document.

Some disadvantages of a trust in Texas include the initial setup costs and the potential complexity of managing trust assets. Trusts may also require ongoing administration and record-keeping efforts, which can be burdensome for some individuals. Understanding these aspects is crucial, and referring to a Sugar Land Texas Land Trust Agreement can help navigate these considerations.

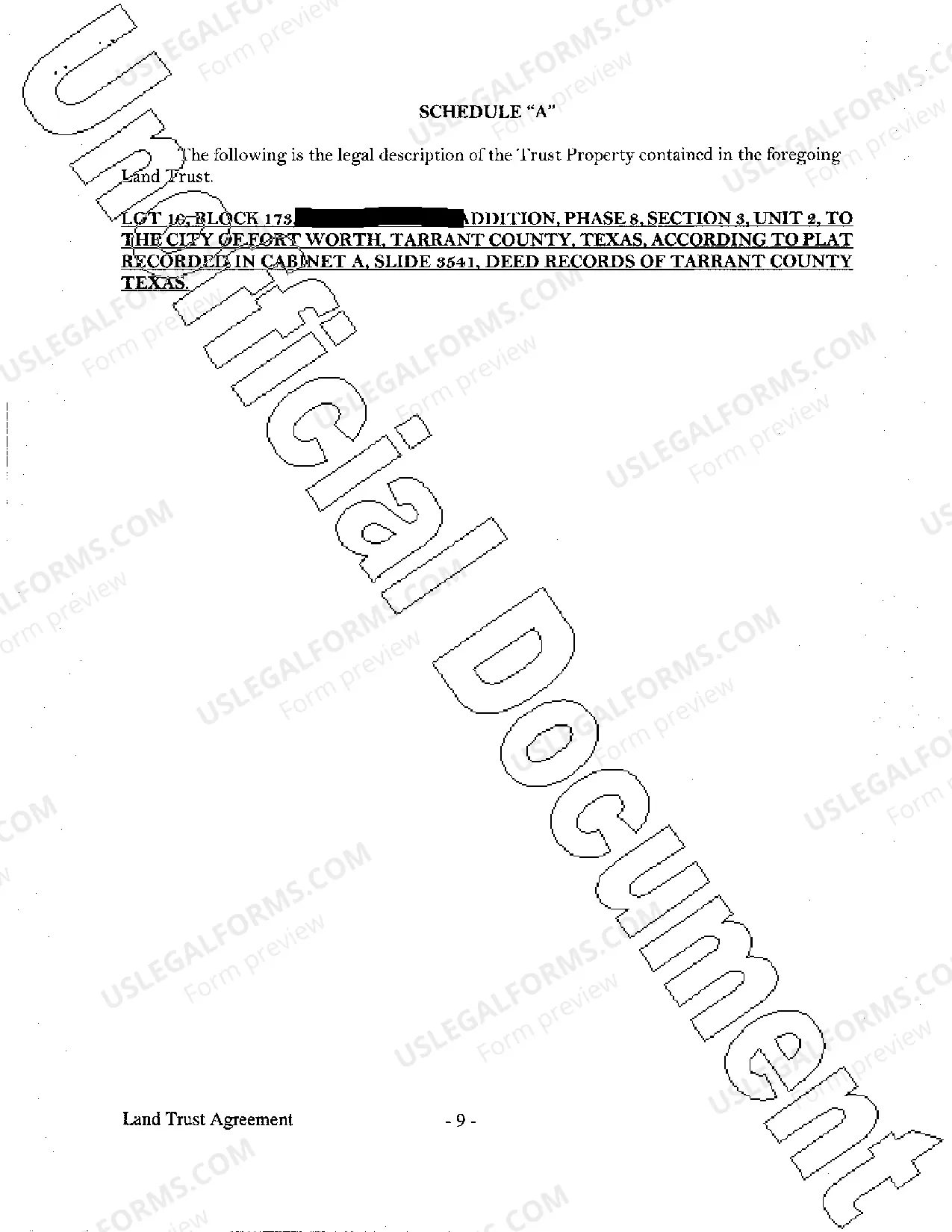

To place land in a trust in Texas, start by creating a trust document that explicitly identifies the land as trust property. You must then transfer the deed of the property into the trust's name, which often requires filing the new deed with the county clerk. Utilizing a Sugar Land Texas Land Trust Agreement can simplify this process and make sure all legal requirements are met.

For a trust to be valid in Texas, it must have a specific purpose, identifiable beneficiaries, and a clear declaration of trust property. Additionally, the creator should have the legal capacity to establish the trust. To ensure compliance with state laws, it is advisable to consult resources like the Sugar Land Texas Land Trust Agreement.

One downside of a land trust is the potential complexity involved in its setup and management. A Sugar Land Texas Land Trust Agreement may require ongoing legal and financial oversight, which can become burdensome. Additionally, if not structured properly, it could expose your assets to risks. Consulting with experts through platforms like US Legal Forms can help you navigate these challenges.

In Texas, a land trust works by allowing an individual or entity to hold legal title to a property while the beneficial interest remains with the trust beneficiaries. This setup can help manage estates more effectively and often encourages privacy. Understanding the nuances of a Sugar Land Texas Land Trust Agreement is vital for success. US Legal Forms simplifies this process by providing clear documents and instructions tailored to Texas laws.

Putting property in a trust can offer benefits like avoiding probate and providing tax advantages. However, a Sugar Land Texas Land Trust Agreement can also lead to complications such as ongoing trust management costs and potential limitations on your property rights. You'll want to carefully evaluate both sides before making a decision. Seeking guidance from US Legal Forms can streamline this process and provide valuable insights.

Typically, the beneficiaries of the land trust are responsible for paying taxes, as the income generated from the property is passed through to them. Depending on the structure of the Sugar Land Texas Land Trust Agreement, this can vary. It's crucial to consult with a tax professional to understand your obligations and ensure compliance. US Legal Forms can help clarify these tax responsibilities through appropriate documentation.

While land trusts offer numerous benefits, there are some disadvantages as well. For instance, a Sugar Land Texas Land Trust Agreement may limit your control over the property since the trustee holds legal title. Furthermore, if the trust is not managed properly, your assets could face tax implications or other legal issues. It's essential to weigh these factors when considering a land trust.