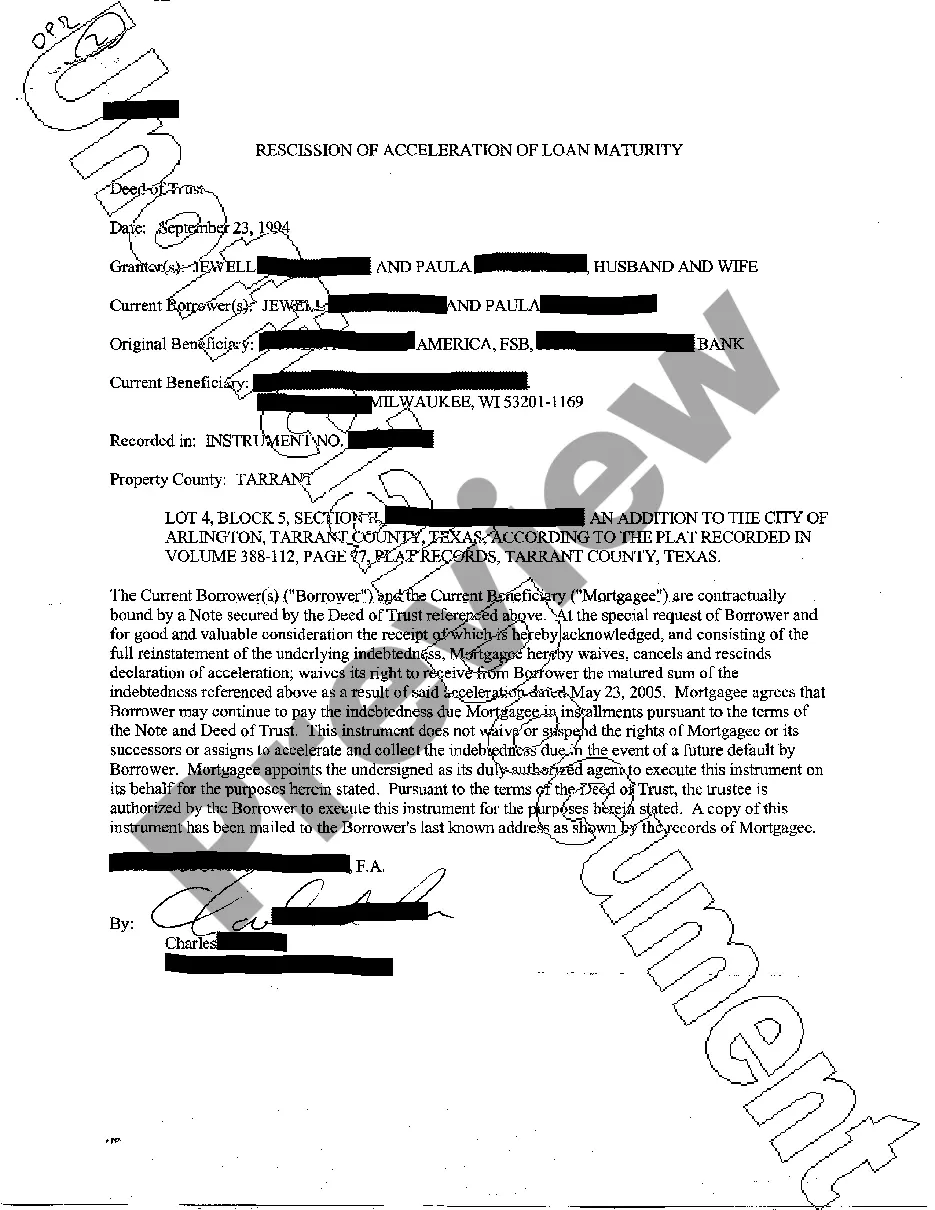

Bexar Texas Rescission of Acceleration of Loan Maturity is a legal term referring to the process of reversing the acceleration of a loan's maturity date in Bexar County, Texas. When a borrower defaults on their loan payments, the lender may choose to accelerate the maturity of the loan, requiring immediate payment of the entire outstanding balance instead of following the original repayment schedule. However, if the borrower is able to rectify the default, they may pursue a rescission of the acceleration to revert to the original loan terms. In Bexar County, Texas, there are several types of Rescission of Acceleration of Loan Maturity: 1. Residential Mortgage Loans: This pertains to homeowners who have defaulted on their mortgage payments and subsequently faced an acceleration of their loan maturity. By successfully resolving the default, homeowners in Bexar County can seek a rescission of the acceleration, allowing them to revert to their original payment schedule. 2. Commercial Loans: In the context of commercial lending, businesses or individuals who default on their commercial loans in Bexar Texas might face an acceleration of the loan maturity. However, with the successful rectification of the default, borrowers can petition for a rescission of the acceleration to revert to the original loan terms. 3. Personal Loans: Borrowers who default on personal loans, such as auto loans or personal lines of credit, in Bexar County may experience an acceleration of the loan maturity. By taking the necessary steps to rectify the default, individuals can pursue a rescission of the acceleration, allowing them to resume their original loan payment schedule. 4. Government-Backed Loans: Bexar Texas Rescission of Acceleration of Loan Maturity can also apply to government-backed loans, such as those insured or guaranteed by the Federal Housing Administration (FHA) or the Department of Veterans Affairs (VA). Borrowers who have defaulted on such loans may seek a rescission of the acceleration in Bexar County, provided they can rectify the default and meet the necessary criteria. It is important to note that the process of Bexar Texas Rescission of Acceleration of Loan Maturity may involve legal proceedings and should be approached with the assistance of an attorney familiar with real estate or lending laws in Bexar County, Texas.

Bexar Texas Rescission of Acceleration of Loan Maturity

Description

How to fill out Bexar Texas Rescission Of Acceleration Of Loan Maturity?

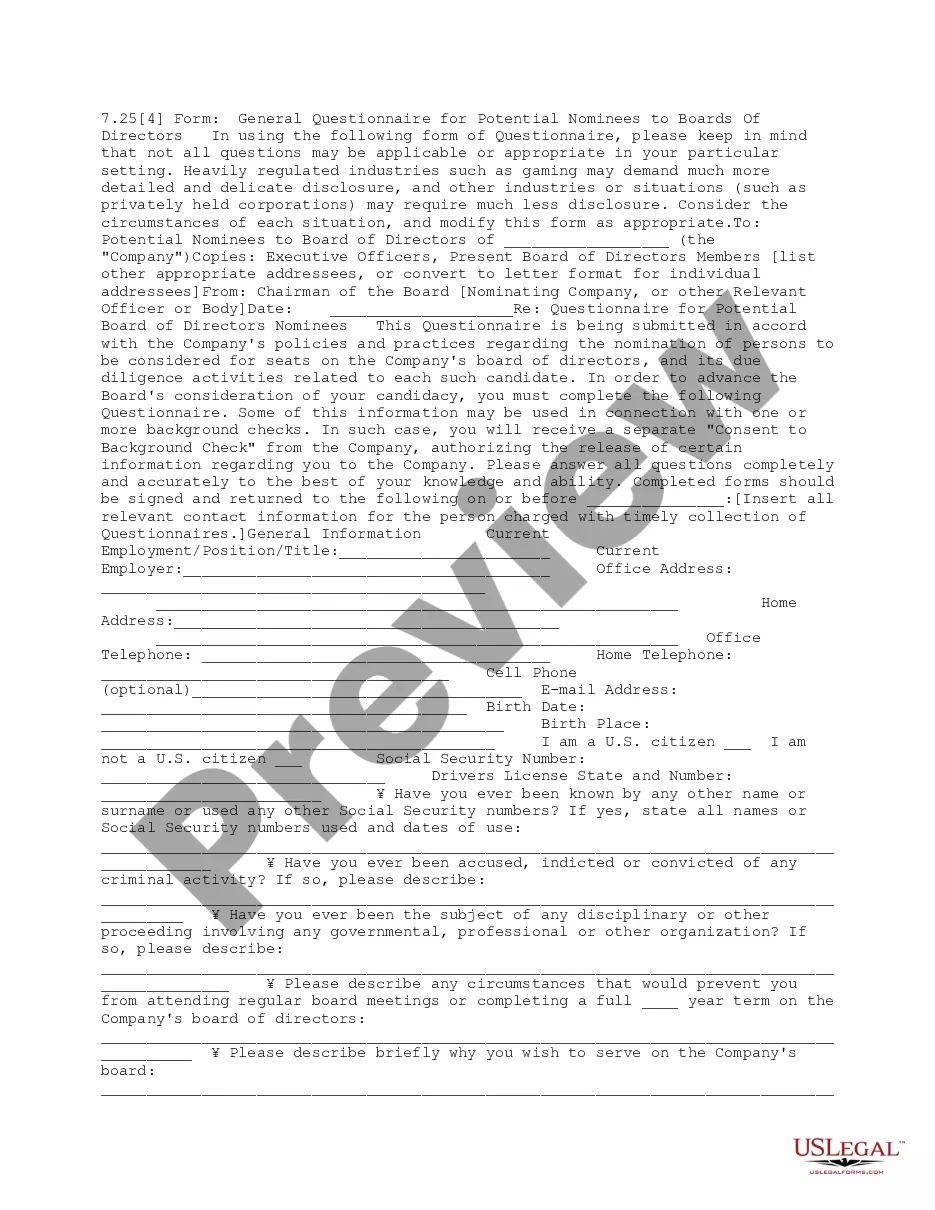

Getting verified templates specific to your local laws can be difficult unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both personal and professional needs and any real-life scenarios. All the documents are properly categorized by area of usage and jurisdiction areas, so searching for the Bexar Texas Rescission of Acceleration of Loan Maturity gets as quick and easy as ABC.

For everyone already acquainted with our service and has used it before, obtaining the Bexar Texas Rescission of Acceleration of Loan Maturity takes just a couple of clicks. All you need to do is log in to your account, opt for the document, and click Download to save it on your device. This process will take just a couple of more actions to complete for new users.

Adhere to the guidelines below to get started with the most extensive online form catalogue:

- Check the Preview mode and form description. Make certain you’ve picked the right one that meets your needs and totally corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you find any inconsistency, utilize the Search tab above to find the right one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and choose the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the subscription.

- Download the Bexar Texas Rescission of Acceleration of Loan Maturity. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Benefit from the US Legal Forms library to always have essential document templates for any demands just at your hand!

Form popularity

FAQ

It basically means that if you break any terms of your loan, your lender can demand ?accelerated? payment. In other words, rather than paying that money back over 15 or 30 years as planned, the whole amount is due immediately.

In most cases, if you don't pay the full amount back in 30 days then the lender will begin the foreclosure process.

An accelerated clause is a term in a loan agreement that requires the borrower to pay off the loan immediately under certain conditions. An accelerated clause is typically invoked when the borrower materially breaches the loan agreement.

Delayed or Missed Payments ? Repeated missed payments may force the lender to effectuate an acceleration clause. Thankfully, making full mortgage payments before can reverse the process.

After the loan is accelerated, the borrower can no longer pay off the loan in installments; the loan changes from an installment contract to a debt that's due in a single, lump-sum payment.

The good news is, borrowers are generally able to avoid acceleration by working out a loan modification or repayment plan with their lender to make up delinquent payments. This is called a mortgage reinstatement.

For mortgages that have an acceleration clause (most do), that means that, after breaching your contract by missing payments, your lender can demand that you either pay off the entire balance of your mortgage or be foreclosed upon.

The notice of acceleration cuts off the borrower's right to cure the default after the 20-day notice of default period expires. If the borrower fails to cure the default, the foreclosure sale proceeds unless the borrower pays: The full (accelerated) amount of the loan.

The Notice of Acceleration is just one name for a document from your lender which advises you that ALL of your mortgage payments, including past missed payments, will be due within the next 30 to 90 days.

Interesting Questions

More info

Gov is not designed to be an escrow service, all transactions should be verified before closing. Please do so. For your personal protection, if you are a new applicant, you should verify your address in Texas in “My Account” and complete the Application for Texas Address Verification (PDF×. A valid Texas driver's license or a Texas voter's registration card will be required to register at The applicant must sign all documents and provide a photocopy of their current voter registration card, a current utility bill, or an original or copy of a government issued photo identification card which is issued to an established Texas residence. All persons under the age of eighteen (18) must have their parents or legal guardians sign all documents.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.