Collin Texas Rescission of Acceleration of Loan Maturity is a legal process that allows borrowers in Collin County, Texas, to reverse the acceleration of loan maturity, which typically occurs when a borrower defaults on their loan payments. This rescission process provides borrowers with an opportunity to reinstate their loan agreement and avoid foreclosure. Keywords: Collin Texas, rescission, acceleration, loan maturity, borrowers, default, loan payments, legal process, foreclosure. There are generally two types of Collin Texas Rescission of Acceleration of Loan Maturity: 1. Judicial Rescission: This type of rescission involves the borrower filing a lawsuit against the lender in a Collin County court. The borrower must present evidence and argue that the acceleration of loan maturity was wrongful or unjustified. If the court rules in favor of the borrower, the loan maturity acceleration is rescinded, and the borrower may resume making regular loan payments. 2. Non-Judicial Rescission: Unlike the judicial process, this form of rescission does not involve court intervention. Instead, it follows a specific procedure outlined in Collin County's laws or the terms of the loan agreement itself. The borrower initiates the process by sending a written notice to the lender, expressing their intent to rescind the acceleration of loan maturity. If the lender agrees, the loan maturity acceleration is effectively reversed, and the borrower can resume making regular payments. In both cases, it is crucial for borrowers in Collin County, Texas, to consult with legal professionals who specialize in real estate law and foreclosure defense. These professionals can guide them through the complex rescission process, gather necessary evidence, help prepare legal documents, and protect their rights throughout the proceedings. By understanding Collin Texas Rescission of Acceleration of Loan Maturity and its different types, borrowers can take appropriate legal action to potentially reinstate their loan agreements and avoid the negative consequences of a foreclosure. However, it is important to note that individual circumstances may vary, and it is always recommended consulting with a legal expert to determine the best course of action.

Collin Texas Rescission of Acceleration of Loan Maturity

Description

How to fill out Collin Texas Rescission Of Acceleration Of Loan Maturity?

No matter what social or professional status, completing legal forms is an unfortunate necessity in today’s world. Too often, it’s practically impossible for someone with no legal background to create this sort of paperwork from scratch, mainly due to the convoluted jargon and legal subtleties they entail. This is where US Legal Forms comes to the rescue. Our platform offers a huge library with over 85,000 ready-to-use state-specific forms that work for pretty much any legal situation. US Legal Forms also is a great asset for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI tpapers.

Whether you need the Collin Texas Rescission of Acceleration of Loan Maturity or any other paperwork that will be good in your state or area, with US Legal Forms, everything is at your fingertips. Here’s how you can get the Collin Texas Rescission of Acceleration of Loan Maturity in minutes using our trusted platform. In case you are presently an existing customer, you can go ahead and log in to your account to download the needed form.

Nevertheless, if you are unfamiliar with our library, ensure that you follow these steps before obtaining the Collin Texas Rescission of Acceleration of Loan Maturity:

- Be sure the form you have found is good for your location considering that the rules of one state or area do not work for another state or area.

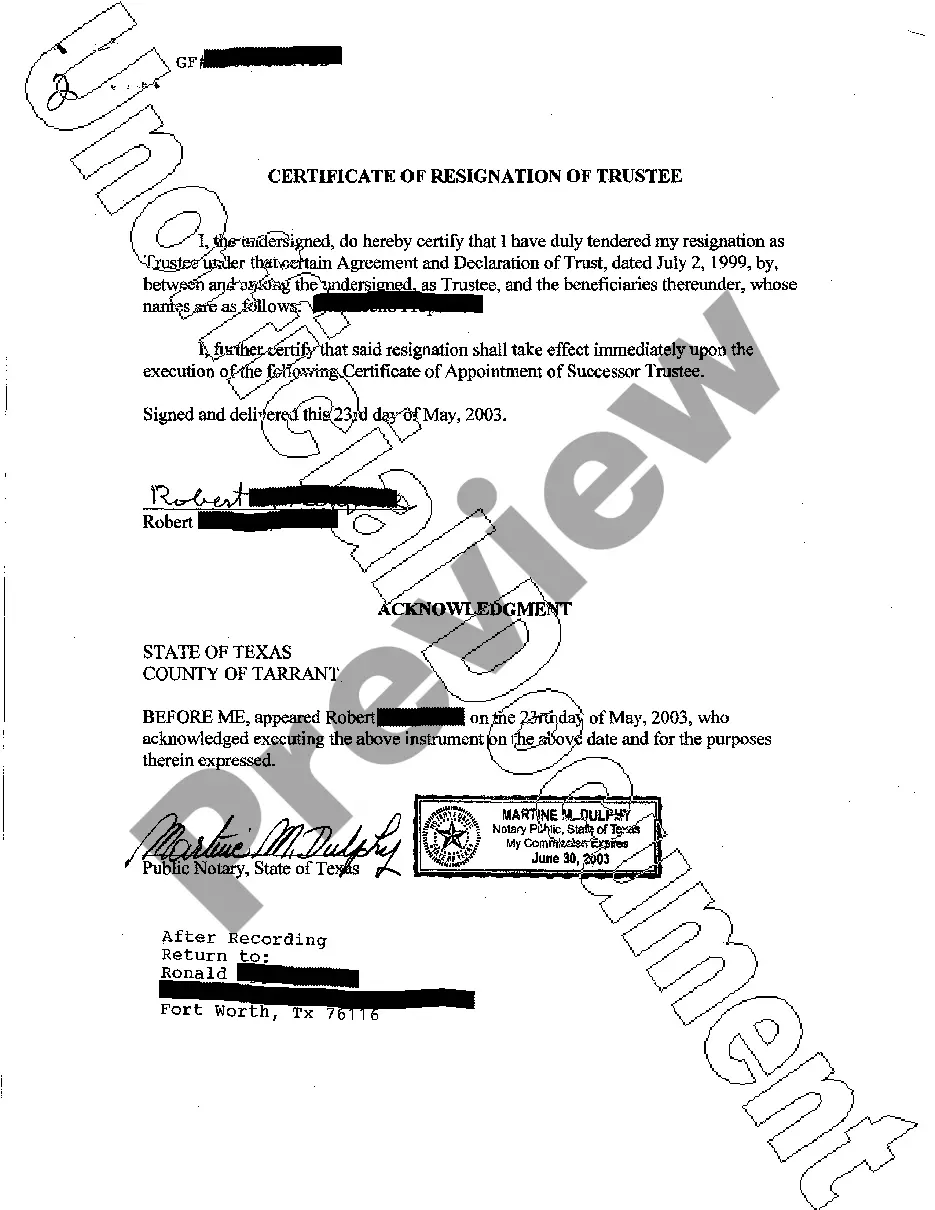

- Preview the form and go through a brief outline (if provided) of cases the paper can be used for.

- If the form you chosen doesn’t meet your needs, you can start over and search for the suitable document.

- Click Buy now and choose the subscription option that suits you the best.

- with your login information or register for one from scratch.

- Choose the payment gateway and proceed to download the Collin Texas Rescission of Acceleration of Loan Maturity as soon as the payment is done.

You’re all set! Now you can go ahead and print out the form or complete it online. In case you have any problems getting your purchased forms, you can easily find them in the My Forms tab.

Whatever case you’re trying to solve, US Legal Forms has got you covered. Give it a try now and see for yourself.