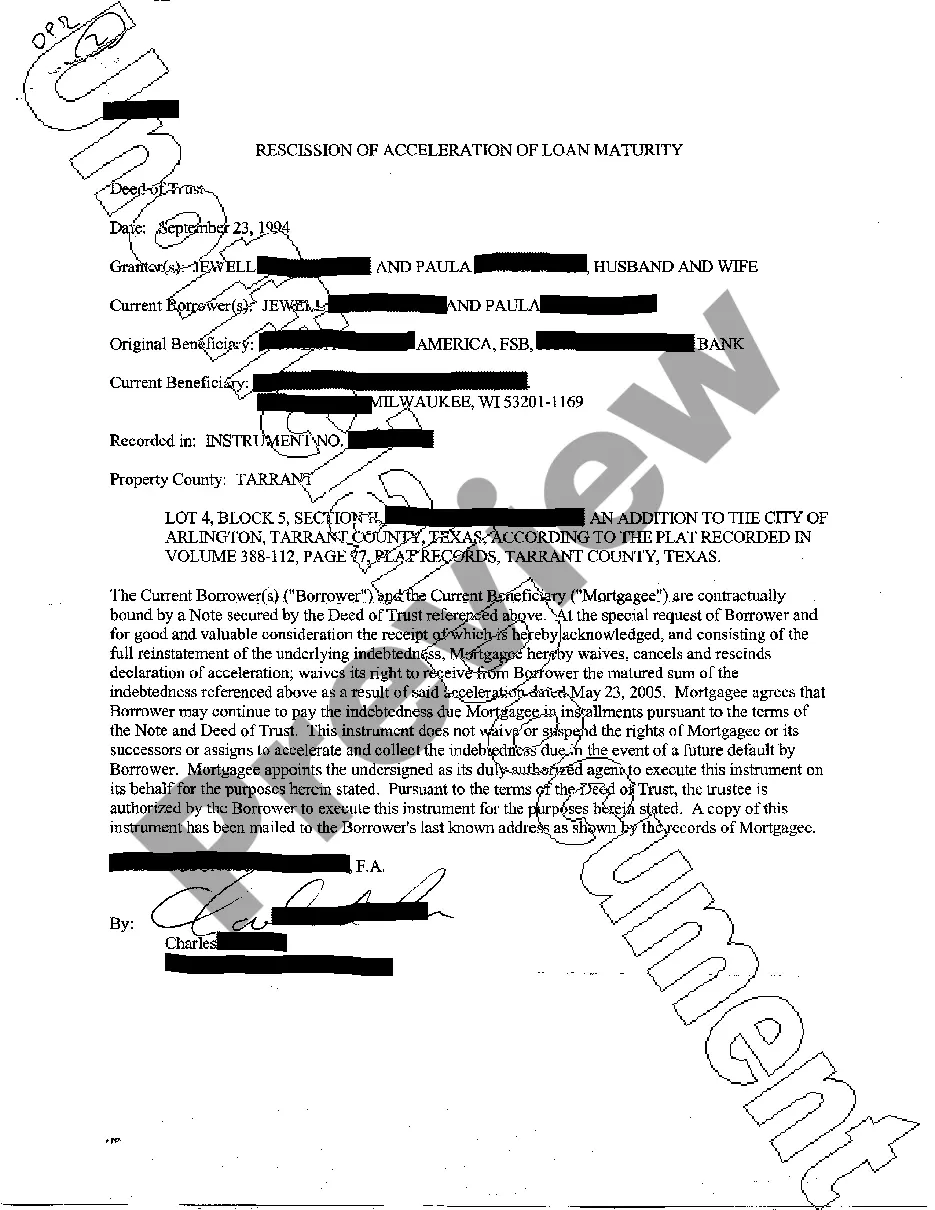

League City Texas Rescission of Acceleration of Loan Maturity refers to the process by which a borrower in League City, Texas has the opportunity to reverse the acceleration of loan maturity for their outstanding loan. This process allows borrowers to extend the loan period and regain control over the repayment terms. Here is a detailed description of the League City Texas Rescission of Acceleration of Loan Maturity. In League City, Texas, when a borrower falls behind on their loan payments, lenders have the right to accelerate the loan maturity. This means that the entire outstanding loan balance becomes due immediately, instead of allowing the borrower to continue making regular installment payments over the original loan term. However, the Texas legal system provides an avenue for borrowers in League City to initiate a Rescission of Acceleration of Loan Maturity. By taking advantage of this rescission process, borrowers can reverse the acceleration and revert to the original loan terms, giving them an opportunity to catch up on missed payments without facing foreclosure or other severe consequences. The League City Texas Rescission of Acceleration of Loan Maturity can be filed in various situations, including financial hardship, temporary job loss, medical emergencies, or any other legitimate circumstances that caused the borrower's default. It is crucial for borrowers to gather supporting documentation, such as financial statements, paycheck stubs, medical bills, or any other evidence that demonstrates their ability to resume regular payments and fulfill their loan obligations. Different types of League City Texas Rescission of Acceleration of Loan Maturity may include: 1. Financial Hardship Rescission: This type of rescission is applicable when borrowers face financial difficulties due to unexpected circumstances such as job loss, reduction in income, or other financial setbacks. 2. Medical Emergency Rescission: Borrowers who encounter significant medical expenses or health-related issues that impact their ability to make loan payments can seek this form of rescission. 3. Natural Disaster Rescission: When borrowers in League City, Texas are affected by natural disasters like hurricanes, floods, or wildfires, they can file for this type of rescission to regain control over their loan maturity. 4. Military Service Rescission: Active-duty military personnel who receive deployment orders or face other service-related challenges can apply for this rescission to prevent loan acceleration. To initiate the League City Texas Rescission of Acceleration of Loan Maturity, borrowers should consult with a qualified attorney specializing in real estate law or foreclosure defense. The attorney will guide them through the legal process, review their case, and assist in preparing the necessary documentation to support their request for rescission. It is essential for borrowers to act promptly after receiving the acceleration notice to ensure they have the best chance of success. Overall, the League City Texas Rescission of Acceleration of Loan Maturity provides a vital opportunity for borrowers to regain control over their loan repayment terms and avoid foreclosure. By understanding the different types of rescission available and seeking legal advice, borrowers in League City, Texas can take steps towards resolving their financial difficulties and securing a more manageable repayment plan.

League City Texas Rescission of Acceleration of Loan Maturity

Description

How to fill out League City Texas Rescission Of Acceleration Of Loan Maturity?

Do you need a trustworthy and affordable legal forms provider to buy the League City Texas Rescission of Acceleration of Loan Maturity? US Legal Forms is your go-to solution.

Whether you need a basic arrangement to set regulations for cohabitating with your partner or a package of forms to move your separation or divorce through the court, we got you covered. Our website provides more than 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t universal and framed based on the requirements of separate state and area.

To download the form, you need to log in account, find the needed template, and click the Download button next to it. Please remember that you can download your previously purchased form templates anytime from the My Forms tab.

Are you new to our platform? No worries. You can create an account in minutes, but before that, make sure to do the following:

- Check if the League City Texas Rescission of Acceleration of Loan Maturity conforms to the laws of your state and local area.

- Read the form’s details (if provided) to find out who and what the form is good for.

- Restart the search if the template isn’t suitable for your legal situation.

Now you can register your account. Then pick the subscription plan and proceed to payment. Once the payment is done, download the League City Texas Rescission of Acceleration of Loan Maturity in any provided file format. You can return to the website when you need and redownload the form without any extra costs.

Finding up-to-date legal forms has never been easier. Give US Legal Forms a go now, and forget about spending hours learning about legal papers online for good.