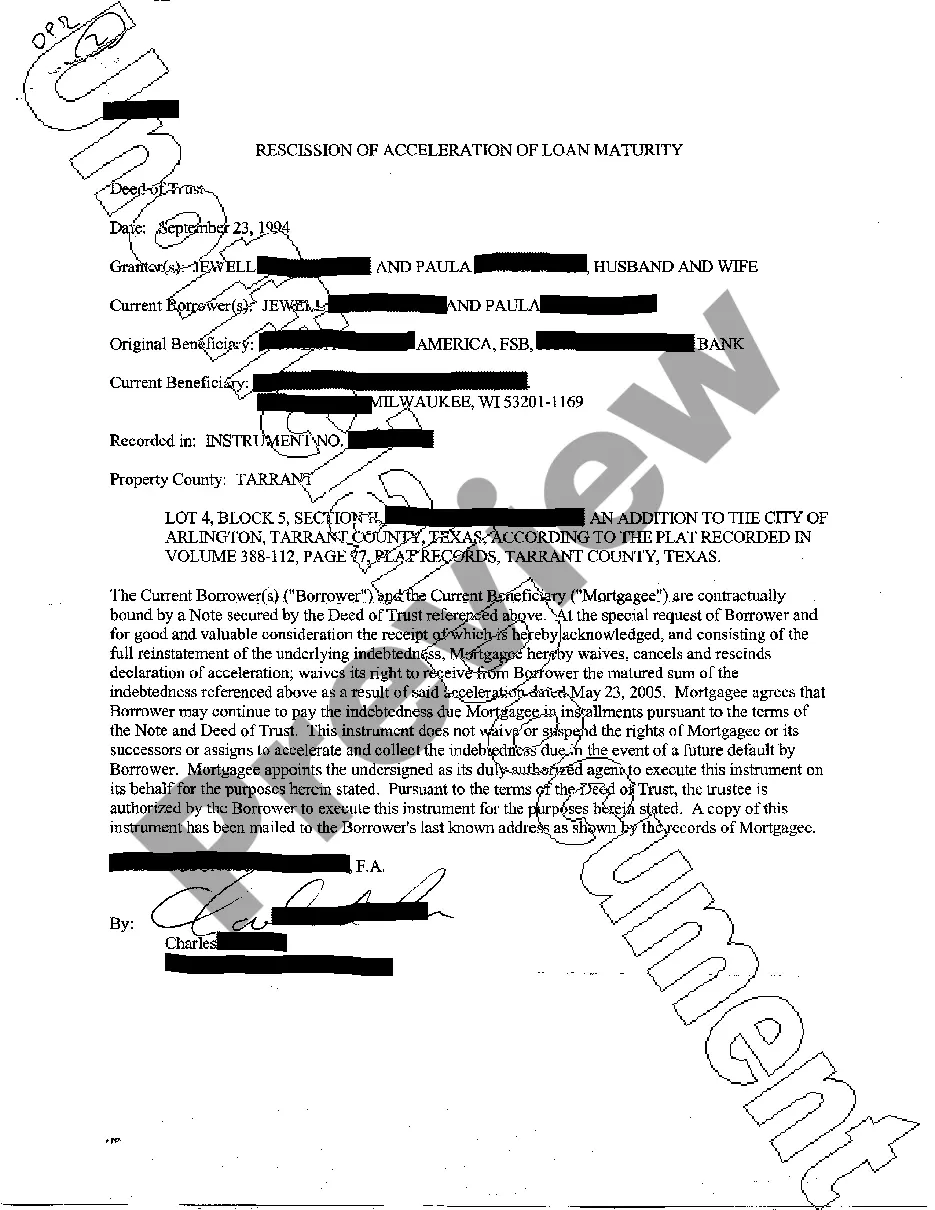

San Angelo Texas Rescission of Acceleration of Loan Maturity refers to the process of reversing or cancelling the acceleration of loan maturity in the city of San Angelo, Texas. When a borrower defaults on their loan payments, the lender may have the right to accelerate the loan, which means that the full outstanding balance becomes due immediately. However, in certain circumstances, the borrower may have the option to request the rescission of this acceleration, which allows them to resume regular loan payments and avoid the immediate repayment of the entire loan amount. The San Angelo Texas Rescission of Acceleration of Loan Maturity can be applicable to various types of loans, including residential mortgages, commercial loans, personal loans, or any other type of loan agreement. It is important to note that the specific terms and conditions for the rescission process may vary depending on the loan agreement and the lender. Key factors to consider in the San Angelo Texas Rescission of Acceleration of Loan Maturity process may include: 1. Written Request: The borrower must submit a written request to the lender, specifying their intent to request the rescission of the acceleration of loan maturity. It is crucial to accurately describe the reasons for the request and provide any supporting documentation or evidence. 2. Valid Justification: The borrower should provide valid reasons for the rescission, such as a temporary financial hardship, unforeseen circumstances, or a successful loan modification or repayment plan. The lender will assess the justification and determine whether to grant the request. 3. Compliance with Loan Agreement: The borrower must demonstrate their compliance with the terms and conditions of the loan agreement, including any requirements for timely payments, insurance coverage, or maintenance obligations. Non-compliance may weaken the chances of obtaining a rescission. 4. Negotiation and Mediation: In cases where the lender initially denies the rescission request, the borrower might seek negotiation or mediation to find a mutually agreeable solution. This could involve modifying the loan terms, extending the repayment period, or exploring alternative repayment plans. 5. Legal Considerations: If the lender continues to refuse the rescission request, seeking legal advice may be necessary to understand the borrower's rights, potential legal remedies, and applicable state and federal laws that might protect the borrower's interests. It is important to consult with legal professionals or financial advisors who have expertise in San Angelo, Texas, and its specific laws and regulations regarding the rescission of acceleration of loan maturity. Understanding the nuances and legal implications can significantly impact the outcome of the rescission process. In summary, the San Angelo Texas Rescission of Acceleration of Loan Maturity provides an opportunity for borrowers to reverse the acceleration of loan maturity and resume regular loan payments, subject to certain conditions and negotiations. This process can help borrowers avoid immediate repayment of the entire loan balance and provide a chance to rectify their financial situation.

San Angelo Texas Rescission of Acceleration of Loan Maturity

Description

How to fill out San Angelo Texas Rescission Of Acceleration Of Loan Maturity?

Are you looking for a trustworthy and inexpensive legal forms provider to get the San Angelo Texas Rescission of Acceleration of Loan Maturity? US Legal Forms is your go-to option.

Whether you require a simple arrangement to set regulations for cohabitating with your partner or a set of forms to advance your separation or divorce through the court, we got you covered. Our platform provides more than 85,000 up-to-date legal document templates for personal and company use. All templates that we offer aren’t generic and framed in accordance with the requirements of specific state and area.

To download the form, you need to log in account, find the required form, and hit the Download button next to it. Please take into account that you can download your previously purchased form templates at any time from the My Forms tab.

Are you new to our website? No worries. You can set up an account with swift ease, but before that, make sure to do the following:

- Find out if the San Angelo Texas Rescission of Acceleration of Loan Maturity conforms to the laws of your state and local area.

- Read the form’s description (if provided) to learn who and what the form is intended for.

- Start the search over if the form isn’t good for your legal situation.

Now you can register your account. Then choose the subscription plan and proceed to payment. Once the payment is done, download the San Angelo Texas Rescission of Acceleration of Loan Maturity in any provided file format. You can return to the website at any time and redownload the form without any extra costs.

Getting up-to-date legal forms has never been easier. Give US Legal Forms a try now, and forget about wasting your valuable time learning about legal paperwork online for good.