Travis Texas Rescission of Acceleration of Loan Maturity refers to a legal process that allows borrowers in Travis County, Texas, to reverse the acceleration of an outstanding loan balance. When a borrower defaults on a loan, the lender has the right to demand immediate payment of the entire loan amount, also known as acceleration. However, under certain circumstances, borrowers can seek rescission of acceleration to restore the original loan terms and repay the debt over an extended period. There are several types of Travis Texas Rescission of Acceleration of Loan Maturity that borrowers can explore: 1. Judicial Rescission: This involves seeking relief through the courts, where borrowers present their case to a judge who can decide whether to rescind the acceleration of loan maturity or not. The decision is typically based on factors such as the borrower's ability to repay, financial hardship, or any other grounds recognized by Texas state law. 2. Negotiated Rescission: Borrowers can also opt for a negotiated rescission, where they work directly with the lender to reach an agreement that allows for the rescission of acceleration. This often involves presenting a comprehensive financial plan to the lender, demonstrating the borrower's ability to repay the loan under revised terms. 3. Mortgage Assistance Programs: Travis County may offer various mortgage assistance programs to eligible borrowers facing financial hardship. These programs aim to facilitate loan modifications or provide financial support to borrowers struggling to meet their mortgage obligations. Participating in such programs can lead to a rescission of acceleration, enabling borrowers to repay the loan over an extended period with improved terms. 4. Statutory Rescission: Texas state law may also provide specific grounds under which a borrower can seek rescission of acceleration. These grounds may include lender violations of the Texas Property Code, failure to provide necessary notices, or other legal irregularities that may warrant the reversal of acceleration. To initiate the Travis Texas Rescission of Acceleration of Loan Maturity process, borrowers should consult with a qualified attorney familiar with Texas real estate and mortgage laws. The attorney can guide borrowers through the necessary steps and help present a compelling case for the rescission of acceleration. It is essential to gather and present all relevant documentation, financial statements, and evidence to support the case for rescission.

Travis Texas Rescission of Acceleration of Loan Maturity

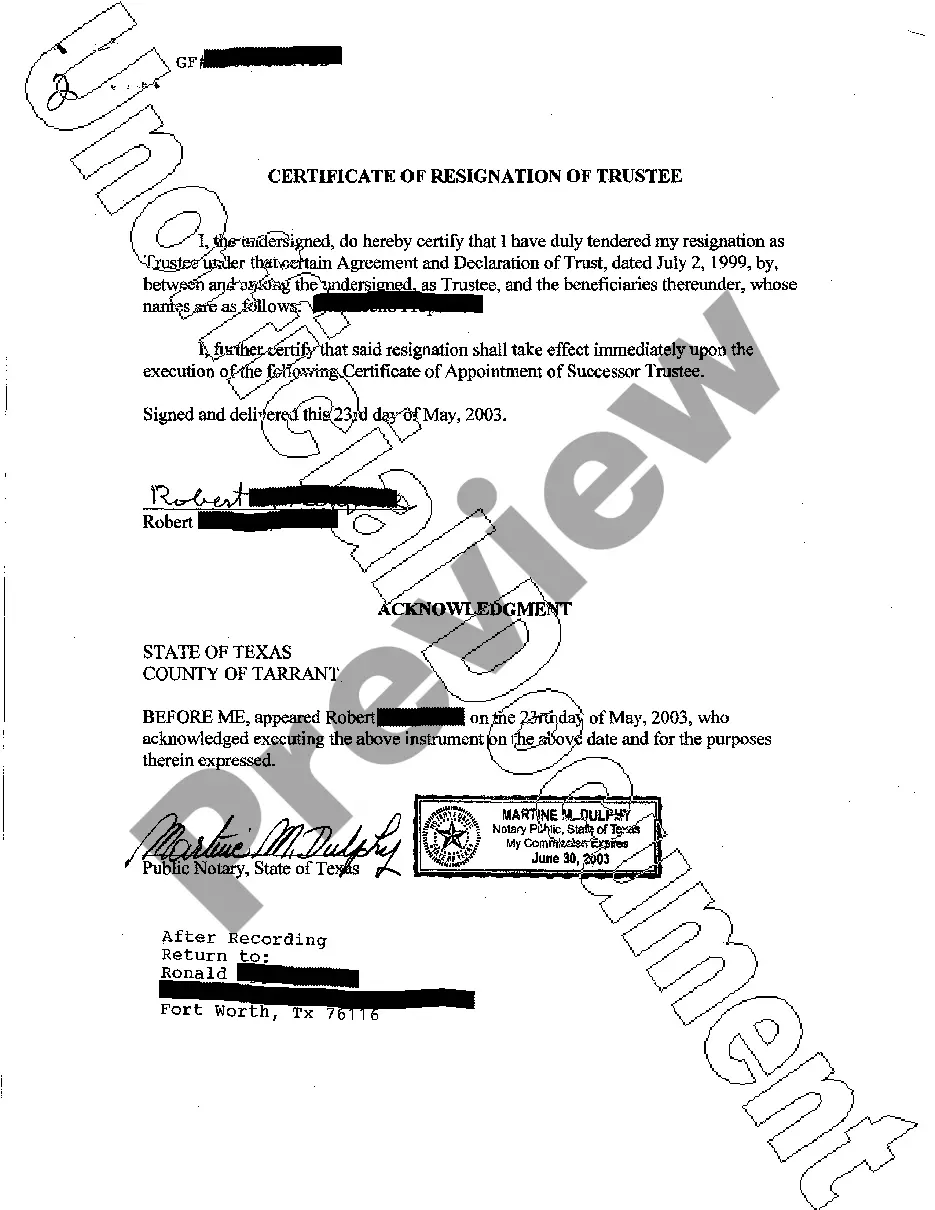

Description

How to fill out Travis Texas Rescission Of Acceleration Of Loan Maturity?

Are you looking for a trustworthy and inexpensive legal forms supplier to buy the Travis Texas Rescission of Acceleration of Loan Maturity? US Legal Forms is your go-to choice.

No matter if you need a simple agreement to set rules for cohabitating with your partner or a set of forms to move your separation or divorce through the court, we got you covered. Our platform offers more than 85,000 up-to-date legal document templates for personal and business use. All templates that we offer aren’t universal and frameworked based on the requirements of specific state and county.

To download the document, you need to log in account, find the needed form, and hit the Download button next to it. Please remember that you can download your previously purchased form templates anytime from the My Forms tab.

Are you new to our website? No worries. You can set up an account in minutes, but before that, make sure to do the following:

- Check if the Travis Texas Rescission of Acceleration of Loan Maturity conforms to the laws of your state and local area.

- Go through the form’s details (if available) to find out who and what the document is intended for.

- Restart the search in case the form isn’t suitable for your specific scenario.

Now you can register your account. Then select the subscription option and proceed to payment. Once the payment is done, download the Travis Texas Rescission of Acceleration of Loan Maturity in any available file format. You can get back to the website at any time and redownload the document without any extra costs.

Getting up-to-date legal forms has never been easier. Give US Legal Forms a try now, and forget about spending hours researching legal papers online for good.