The Killeen Texas Home Equity Affidavit and Agreement is a legal document that establishes the rights and obligations of individuals who are seeking to obtain home equity in Killeen, Texas. It is an important document for both homeowners and lenders involved in home equity transactions. The main purpose of this affidavit and agreement is to verify the accuracy of information provided by the homeowner regarding their property and to disclose potential risks associated with the home equity loan. It serves as a declaration of the homeowner's acknowledgment and understanding of the terms and conditions involved in the home equity loan process. Some relevant keywords related to the Killeen Texas Home Equity Affidavit and Agreement may include: 1. Home equity loan: This refers to a loan that allows homeowners to borrow against the equity they have built up in their property. It provides homeowners with access to funds for various purposes such as home improvements, debt consolidation, or other financial needs. 2. Affidavit and agreement: This refers to a legally binding document that signifies an individual's declaration and acceptance of the terms and conditions of a specific agreement. In the context of the Killeen Texas Home Equity Affidavit and Agreement, it denotes the homeowner's consent and understanding of the responsibilities and risks associated with the home equity loan process. 3. Property valuation: This refers to the process of determining the current value of a property, which is crucial in assessing the amount of home equity available for borrowing. A proper property valuation helps lenders evaluate the risk associated with lending against a property's equity. 4. Risk disclosure: This encompasses the identification and disclosure of potential risks associated with the home equity loan process, such as interest rate fluctuations, foreclosure risks, and financial obligations. This information ensures homeowners are fully informed about the potential consequences and uncertainties tied to their home equity loan. 5. Texas home equity law: This refers to the specific regulations and statutes governing home equity loans in the state of Texas. Understanding these laws is crucial for homeowners and lenders to ensure compliance and protection of rights throughout the home equity transaction. Types of Killeen Texas Home Equity Affidavit and Agreement: While there may not be different types of Killeen Texas Home Equity Affidavit and Agreement, variations in format or specific content requirements may exist within the document based on individual lending institutions or legal needs. However, the core purpose of the affidavit and agreement remains constant — to establish the consent, understanding, and acknowledgment of both parties involved in the home equity loan process.

Killeen Texas Home Equity Affidavit and Agreement

Description

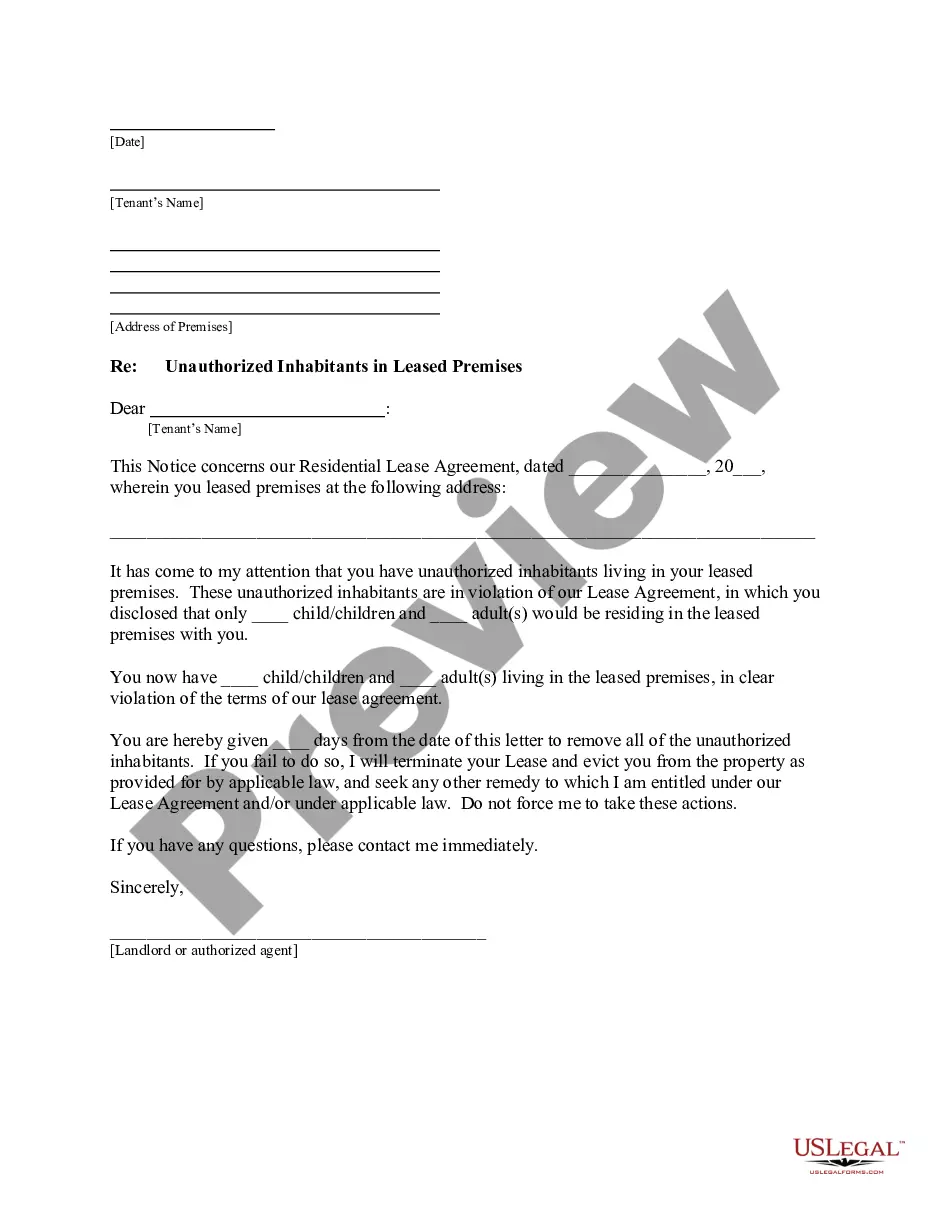

How to fill out Texas Home Equity Affidavit And Agreement?

If you are looking for a suitable form template, it’s challenging to find a superior service than the US Legal Forms website – likely the most extensive collections on the web.

Here you can discover a multitude of form samples for business and personal use categorized by type and region, or keywords.

With our premium search feature, obtaining the latest Killeen Texas Home Equity Affidavit and Agreement is as simple as 1-2-3.

Execute the purchase. Use your credit card or PayPal account to finish the registration process.

Obtain the template. Specify the file format and save it on your device.

- In addition, the pertinence of each document is validated by a team of experienced attorneys who consistently review the templates on our site and refresh them according to the latest state and county regulations.

- If you are already familiar with our platform and possess a registered account, all you need to do to acquire the Killeen Texas Home Equity Affidavit and Agreement is to Log In to your user account and click the Download button.

- If you’re utilizing US Legal Forms for the first time, simply follow the steps outlined below.

- Ensure you have selected the form you require. Review its description and use the Preview feature to examine its content. If it doesn’t meet your requirements, employ the Search field at the top of the screen to find the necessary document.

- Finalize your choice. Click on the Buy now button. Afterwards, choose the desired subscription plan and provide information to create an account.

Form popularity

FAQ

In Texas, the highest interest rate for home equity loans is capped at 18% per annum. This limit ensures that borrowers in Killeen, Texas, can enter into a Home Equity Affidavit and Agreement without worrying about exorbitant fees. By adhering to these guidelines, lenders and borrowers can maintain a positive and transparent relationship. Understanding these terms can help protect your financial interests.

In Texas, the law regarding home equity loans is quite specific and aims to protect homeowners. The Killeen Texas Home Equity Affidavit and Agreement guides the borrowing process, ensuring that borrowers understand their rights and obligations. Homeowners can typically access up to 80% of their home's equity, allowing them to use funds for various purposes such as home improvements or debt consolidation. It's essential to comply with all regulations to avoid potential legal issues, and the USLegalForms platform can provide you with the necessary documents to ensure you're following the law.

A home equity affidavit and agreement is a legal document that outlines the terms under which a homeowner can access the equity in their property. This document details the lender's requirements and the borrower's obligations, ensuring that both parties are clear on the arrangement. Familiarizing yourself with the terms in the Killeen Texas Home Equity Affidavit and Agreement can help you leverage your home's equity effectively.

Getting a HELOC in Texas can be challenging due to the state's strict lending regulations and guidelines. Lenders often impose strict criteria on creditworthiness, income verification, and equity assessment. By being familiar with the Killeen Texas Home Equity Affidavit and Agreement, you can navigate these challenges more effectively and better understand what lenders expect.

Several factors can disqualify you from obtaining a HELOC, including a low credit score, high debt-to-income ratio, or insufficient home equity. Additionally, red flags in your credit history, such as late payments or bankruptcies, can hinder your chances. A solid understanding of the Killeen Texas Home Equity Affidavit and Agreement may help you identify specific requirements and improve your qualifications.

Yes, the Texas home equity Affidavit and Agreement must be recorded with the county clerk's office where the property is located. This recording is necessary to provide legal notice of the claim on your home’s equity. By ensuring you have the correct Killeen Texas Home Equity Affidavit and Agreement, you can protect your interests and comply with state regulations.

Approval for a HELOC may be denied for several reasons, including insufficient equity in your home, a low credit score, or high levels of existing debt. Lenders often require that borrowers meet certain financial criteria, as specified in the Killeen Texas Home Equity Affidavit and Agreement. If you’re uncertain about your situation, consulting a professional can provide clarity on options you may have.

Many homeowners find that obtaining a Home Equity Line of Credit (HELOC) can be difficult due to various factors. Lenders typically require a thorough credit evaluation, and they often look for a strong credit score, low debt-to-income ratio, and sufficient equity in your home. Additionally, understanding the Killeen Texas Home Equity Affidavit and Agreement is crucial as it outlines specific conditions lenders expect from borrowers.