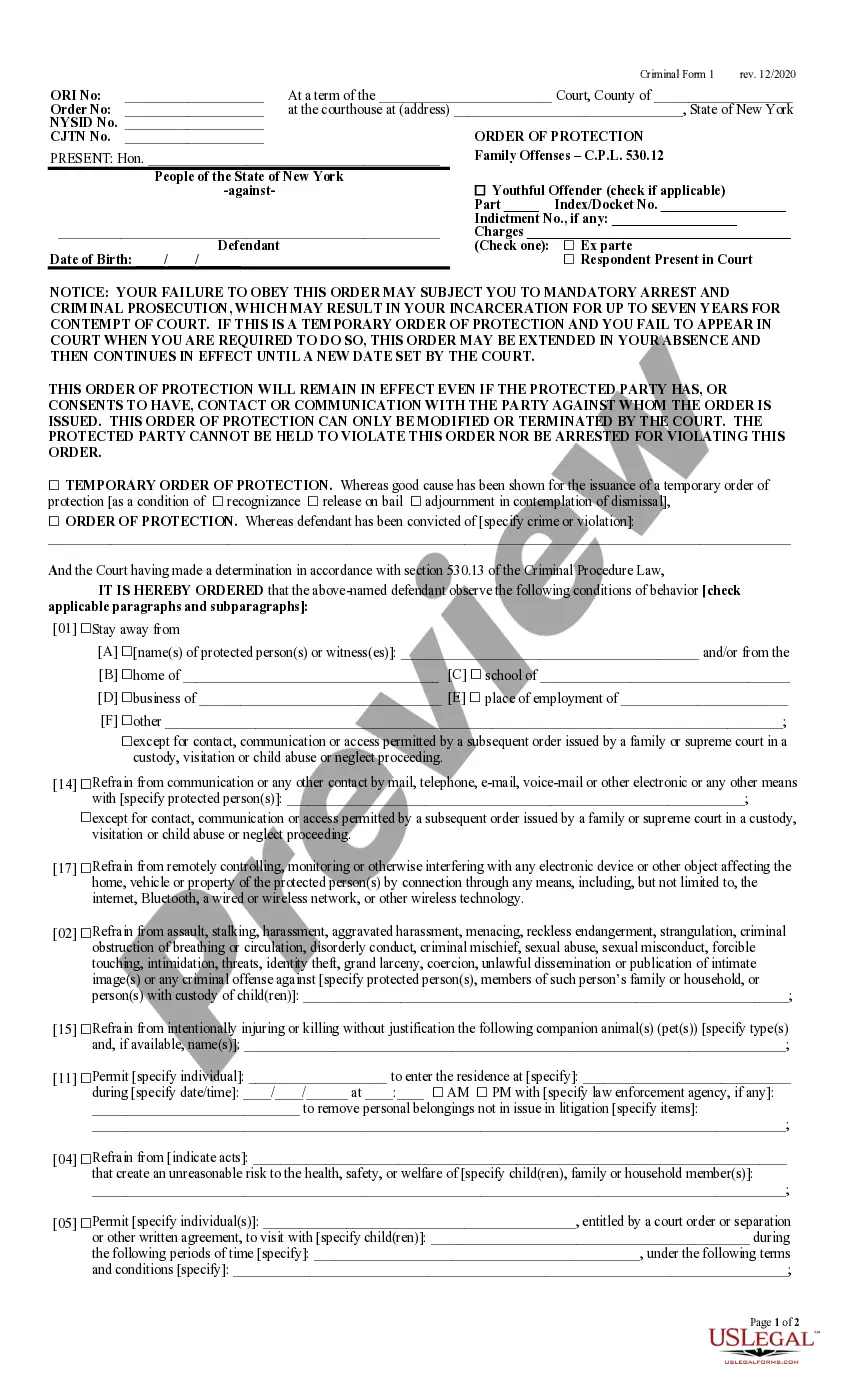

The Laredo Texas Home Equity Affidavit and Agreement is a legal document that establishes the terms and conditions of a home equity loan or mortgage for residents in Laredo, Texas. It is a binding agreement between the homeowner and the lender that outlines the rights and responsibilities of both parties. This affidavit serves as proof that the homeowner has a clear understanding of the terms and consequences associated with obtaining a home equity loan. It ensures that the borrower acknowledges the loan amount, interest rate, repayment terms, and the potential risks involved. The Laredo Texas Home Equity Affidavit and Agreement contain various sections that cover important aspects of the loan, including: 1. Loan Details: This section provides comprehensive information about the loan, such as the loan amount, interest rate, and the specific purpose for which the home equity loan will be used (e.g., home renovation, debt consolidation). 2. Repayment Terms: It includes the repayment schedule, which outlines the payment frequency, due dates, and the total number of payments required to fully repay the loan. This section also specifies any penalties or fees for late or missed payments. 3. Rights and Responsibilities: This portion details the rights and obligations of both the homeowner and the lender. It highlights the homeowner's responsibility to maintain the property, pay property taxes and insurance, and comply with all applicable laws. The lender's rights include property inspections, ability to enforce repayment, and foreclosure in case of default. 4. Interest Rate and Fees: This section discloses the interest rate charged on the loan and any additional fees or charges associated with the home equity loan, such as origination fees, appraisal fees, or closing costs. 5. Prepayment and Refinancing: The terms related to prepayment penalties, refinancing options, and the possibility of early loan repayment are outlined in this section. Some common types of Laredo Texas Home Equity Affidavit and Agreements include: 1. Fixed-Rate Home Equity Loan Agreement: This agreement establishes a fixed interest rate throughout the loan term, resulting in consistent monthly payments. 2. Variable-Rate Home Equity Loan Agreement: This agreement features an interest rate that fluctuates based on market conditions. The interest rate may adjust periodically, leading to potential changes in monthly payments. 3. Home Equity Line of Credit (HELOT) Agreement: This agreement grants the borrower access to a specified line of credit based on the appraised value of their home. The borrower can withdraw funds as needed during the draw period and may have the option to convert the outstanding balance into a fixed-rate loan. In summary, the Laredo Texas Home Equity Affidavit and Agreement is a crucial document that clearly outlines the terms and conditions of a home equity loan or mortgage in Laredo, Texas. It serves to protect both the homeowner and the lender by laying out their rights and responsibilities, ensuring transparency and understanding throughout the loan process.

Laredo Texas Home Equity Affidavit and Agreement

Description

How to fill out Laredo Texas Home Equity Affidavit And Agreement?

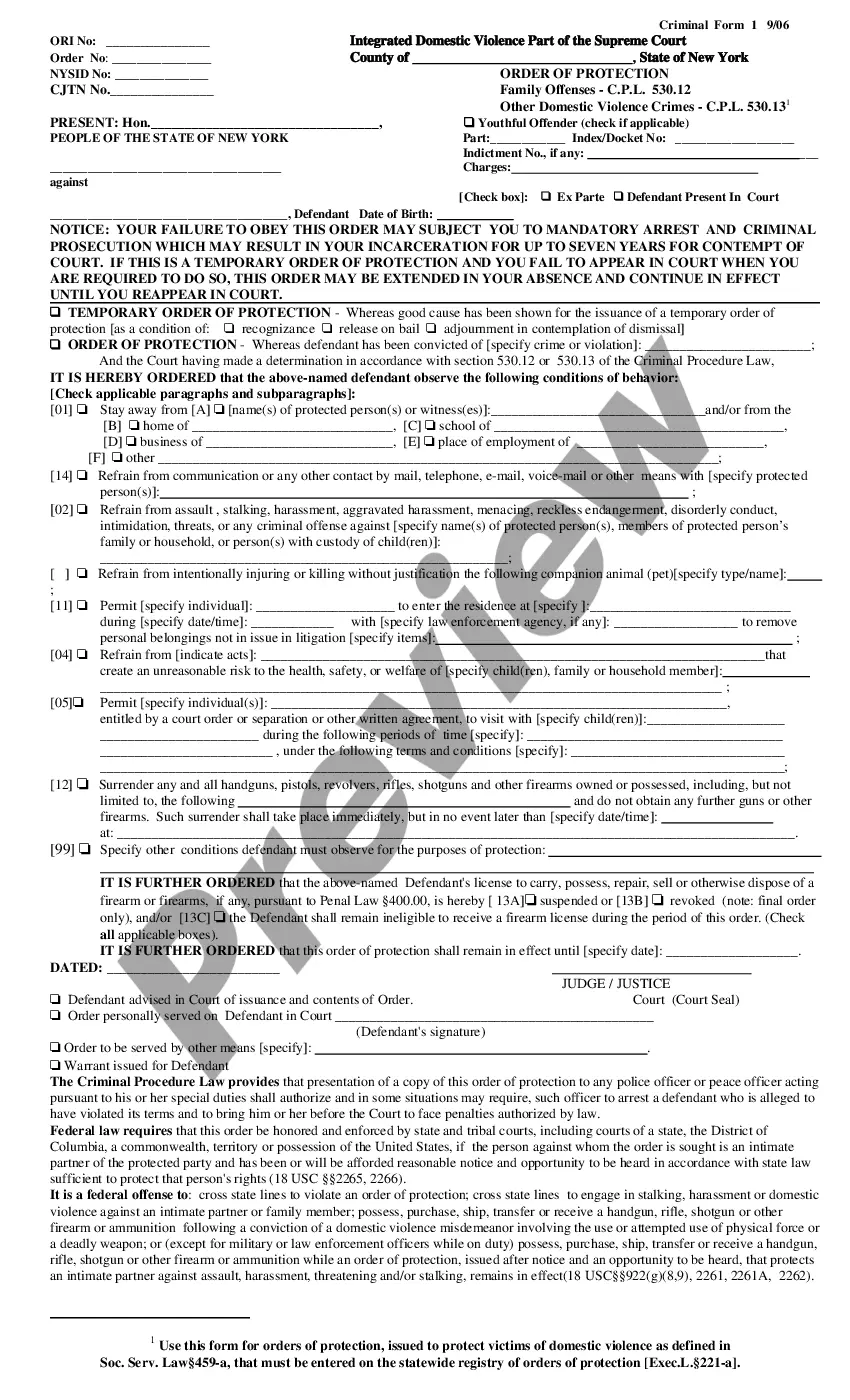

If you are looking for a valid form template, it’s difficult to find a better place than the US Legal Forms site – one of the most comprehensive online libraries. Here you can find a large number of document samples for company and individual purposes by types and regions, or key phrases. With the advanced search option, getting the newest Laredo Texas Home Equity Affidavit and Agreement is as elementary as 1-2-3. Additionally, the relevance of every record is confirmed by a team of professional attorneys that regularly check the templates on our platform and revise them according to the latest state and county regulations.

If you already know about our platform and have a registered account, all you should do to get the Laredo Texas Home Equity Affidavit and Agreement is to log in to your user profile and click the Download button.

If you make use of US Legal Forms for the first time, just follow the guidelines below:

- Make sure you have discovered the sample you want. Check its explanation and utilize the Preview function to check its content. If it doesn’t suit your needs, use the Search option near the top of the screen to discover the appropriate record.

- Confirm your decision. Select the Buy now button. After that, pick your preferred subscription plan and provide credentials to register an account.

- Make the transaction. Utilize your bank card or PayPal account to finish the registration procedure.

- Receive the template. Pick the file format and download it to your system.

- Make adjustments. Fill out, revise, print, and sign the received Laredo Texas Home Equity Affidavit and Agreement.

Every single template you add to your user profile has no expiration date and is yours forever. It is possible to access them using the My Forms menu, so if you want to receive an extra copy for enhancing or printing, you can return and save it once again at any moment.

Take advantage of the US Legal Forms extensive collection to gain access to the Laredo Texas Home Equity Affidavit and Agreement you were seeking and a large number of other professional and state-specific samples on one website!