The McKinney Texas Home Equity Affidavit and Agreement is a legal document that establishes the terms and conditions for obtaining a home equity loan in McKinney, Texas. This agreement is crucial as it outlines the rights and responsibilities of the borrower and the lender in relation to the home equity loan. A home equity loan allows homeowners in McKinney, Texas, to borrow money by using the equity they have built up in their property as collateral. This loan type can be beneficial for various purposes, such as home improvements, debt consolidation, or funding major expenses. The McKinney Texas Home Equity Affidavit and Agreement typically contains several key elements. These may include: 1. Identification of the parties involved: The agreement will specify the details of the borrower (homeowner) and the lender. It is essential to ensure accurate identification to avoid any potential disputes in the future. 2. Loan amount and interest rates: The agreement will outline the specific loan amount being provided to the borrower and the interest rates associated with it. These rates can be fixed or adjustable and should be clearly stated in the agreement. 3. Repayment terms: The document will outline the repayment terms, including the frequency of payments, the duration of the loan, and any penalties or fees for late payments or early repayment. 4. Lien on the property: The agreement will state that the lender has a lien on the borrower's property as security for repayment of the loan. This lien gives the lender the right to foreclose on the property if the borrower defaults on the loan. 5. Appraisal and closing costs: The agreement may include provisions related to property appraisal and any associated costs. These costs are typically paid for by the borrower. 6. Default and remedies: The agreement will specify the actions that can be taken by the lender in the event of default by the borrower. It will also outline any remedies available to the borrower in case of disputes or issues. It's worth noting that specific variations of the McKinney Texas Home Equity Affidavit and Agreement may exist depending on the lender or the nature of the home equity loan. For example, there could be variations for loans taken out for specific purposes like home renovations or debt consolidation. However, the fundamental elements mentioned above generally remain consistent across different types of agreements. In summary, the McKinney Texas Home Equity Affidavit and Agreement is a legal document that establishes the terms and conditions for obtaining a home equity loan in McKinney, Texas. It outlines the rights and responsibilities of both the borrower and the lender, serving as a crucial reference point for all parties involved in the lending process.

McKinney Texas Home Equity Affidavit and Agreement

Description

How to fill out McKinney Texas Home Equity Affidavit And Agreement?

Locating verified templates specific to your local regulations can be challenging unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both personal and professional needs and any real-life situations. All the documents are properly grouped by area of usage and jurisdiction areas, so locating the McKinney Texas Home Equity Affidavit and Agreement gets as quick and easy as ABC.

For everyone already familiar with our service and has used it before, obtaining the McKinney Texas Home Equity Affidavit and Agreement takes just a couple of clicks. All you need to do is log in to your account, choose the document, and click Download to save it on your device. The process will take just a few additional actions to make for new users.

Follow the guidelines below to get started with the most extensive online form library:

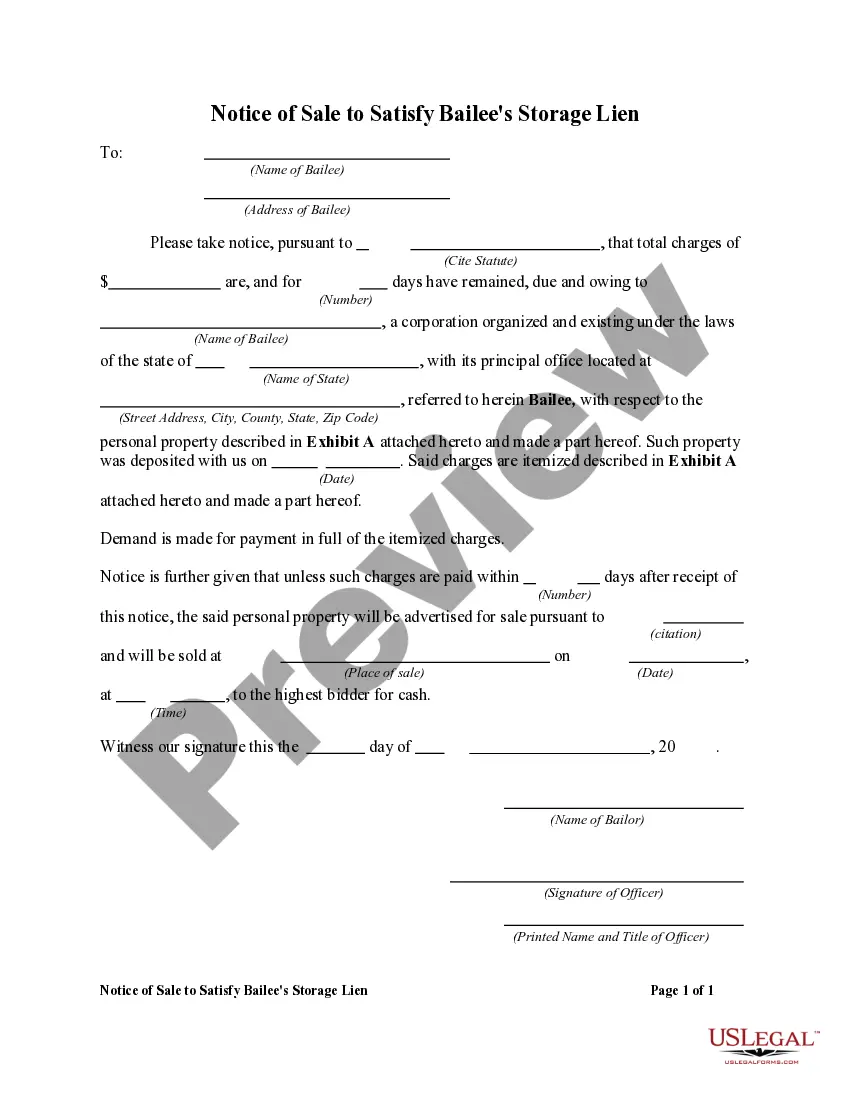

- Look at the Preview mode and form description. Make sure you’ve selected the correct one that meets your needs and fully corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you see any inconsistency, use the Search tab above to find the right one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and select the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the service.

- Download the McKinney Texas Home Equity Affidavit and Agreement. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Benefit from the US Legal Forms library to always have essential document templates for any needs just at your hand!