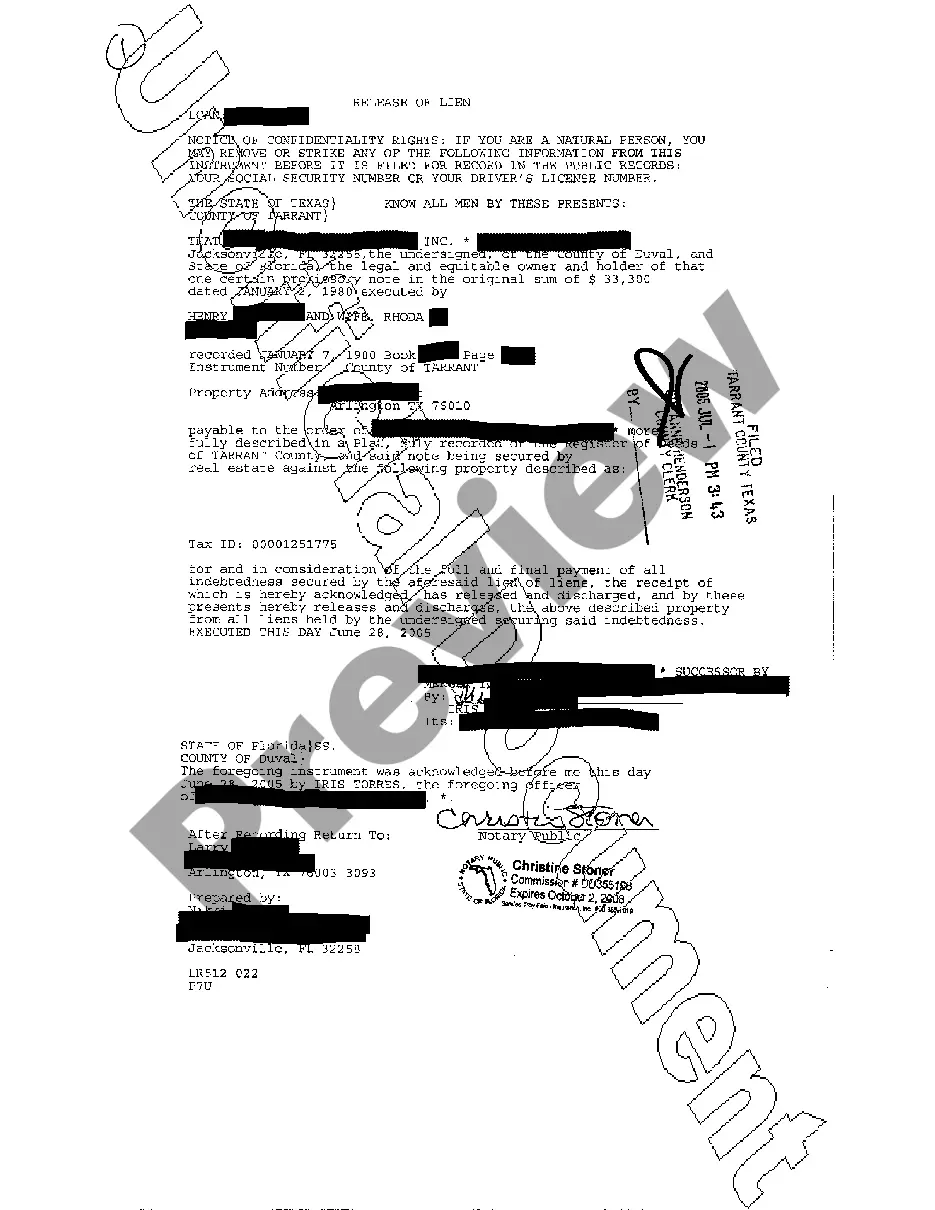

The Austin Texas Release of Lien refers to a legal document or action that releases a previously claimed lien on a property located in Austin, Texas. A lien is a legal claim against a property, typically used to secure payment for debts, such as outstanding taxes, unpaid bills, or mortgage obligations. However, once the debt is settled, a release of lien is necessary to remove the claim on the property. There are several types of Austin Texas Release of Lien, depending on the nature of the lien being released: 1. Mechanic's Lien Release: This type of release is specific to construction projects and is filed by contractors, subcontractors, or suppliers who have placed a lien on a property to ensure payment for work performed or materials supplied. Upon receiving full payment, the lien holder can file a Mechanic's Lien Release to remove the claim and clear the property title. 2. Tax Lien Release: This release is associated with unpaid property taxes or other tax-related debts. Once the outstanding taxes are paid in full, the local taxing authority will issue a Tax Lien Release, relinquishing its claim on the property. 3. Judgment Lien Release: A Judgment Lien Release applies to liens placed on a property as a result of a court judgment. These liens can arise from lawsuits, child support cases, or unpaid court fines. Once the judgment is satisfied or settled, the lien holder can file a Judgment Lien Release to release the claim. 4. Mortgage Lien Release: Mortgage lenders place liens on properties as a form of security for the loan given to the property owner. When the mortgage is fully paid off, either through refinancing or repayment, the lender issues a Mortgage Lien Release to release their claim on the property. To obtain an Austin Texas Release of Lien, the lien holder or their authorized representative typically files a release document with the appropriate county clerk's office or other relevant authority, depending on the type of lien. The release document must include details such as the property owner's name and address, the lien holder's information, details of the lien being released, and any necessary supporting documentation. Once filed and accepted, the lien release is recorded, updating the property records to reflect the removal of the lien.

Austin Texas Release of Lien

Description

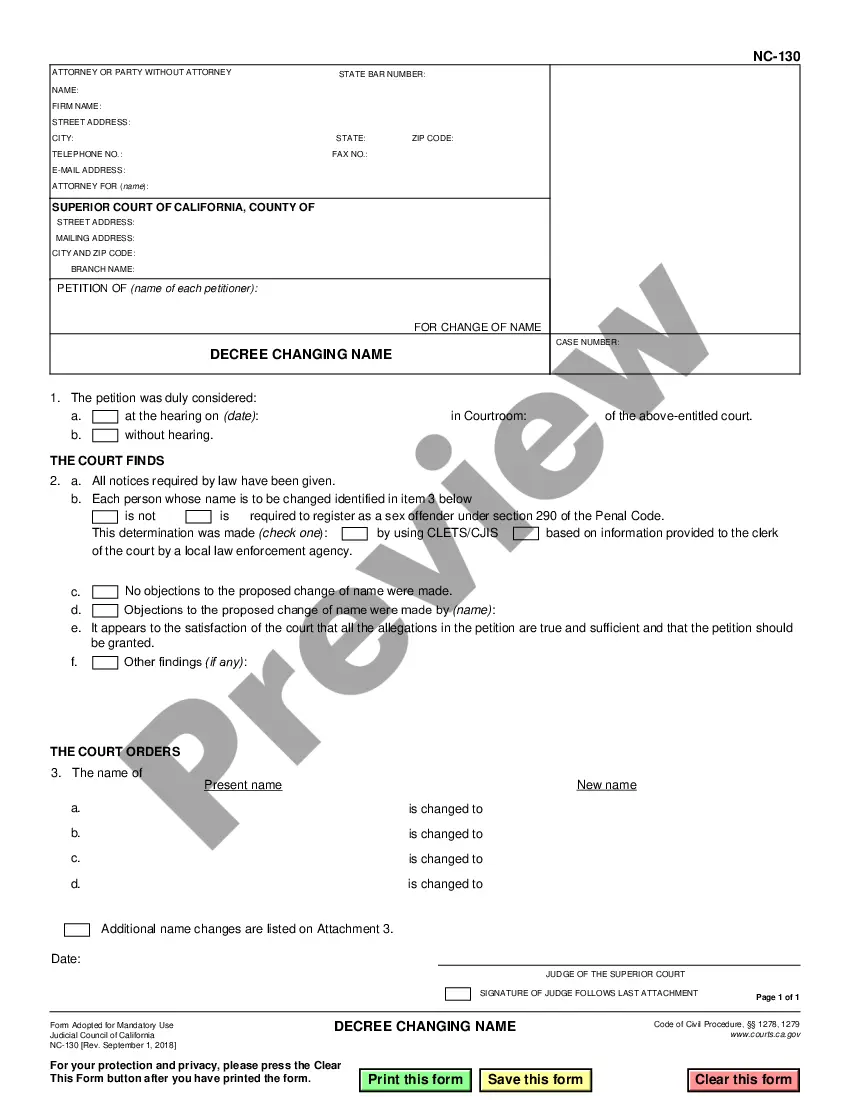

How to fill out Austin Texas Release Of Lien?

No matter one's societal or occupational rank, completing legal documents is an unfortunate obligation in the contemporary world.

Often, it’s nearly impossible for an individual lacking legal expertise to draft such paperwork from scratch, primarily due to the intricate language and legal subtleties involved.

This is where US Legal Forms comes to assist.

Confirm that the form you have selected is tailored to your locality as the laws of one state or county do not apply to another state or county.

Examine the form and review a brief summary (if available) of situations the document can address. If the one you chose does not meet your requirements, you can restart and search for the necessary form.

- Our service offers an extensive repository with over 85,000 ready-to-use documents tailored to each state, suitable for nearly any legal circumstance.

- US Legal Forms is also an excellent asset for associates or legal advisors who wish to save time by utilizing our DIY documents.

- Whether you need the Austin Texas Release of Lien or any other paperwork applicable in your jurisdiction, with US Legal Forms, everything is accessible.

- Here’s how to acquire the Austin Texas Release of Lien swiftly using our reliable service.

- If you are already a member, you can proceed to Log In to your account to obtain the correct document.

- However, if you are not familiar with our platform, make sure to follow these steps before obtaining the Austin Texas Release of Lien.

Form popularity

FAQ

You can remove a mechanics lien only by one of two ways: The contractor records a release of mechanics lien; or. You file a petition with the court to release the mechanics lien.

All Texas mechanics liens must be enforced no later than 1 year after the last date the claimant could have filed their affidavit of lien. Additionally, the enforcement deadline may be extended by filing an agreement signed by the claimant and the property owner.

Add or Remove a Lien on a Vehicle To add or remove a lien on your vehicle title, visit your local county tax office. The title fee is $28 or $33, depending on your county, and must be paid at time of application. Please contact your local county tax office for the exact cost.

Mechanic's liens only expire if the person who filed it does not file a lawsuit foreclose within the one year or two-year deadline, depending on whether it is a commercial or residential project.

The Austin County, Texas requirements for recording a mechanics lien are: Verify you have the right to file a valid lien.Draft your Texas affidavit of lien form (mechanics lien claim) for your specific role on the job.File your lien claim with the County Recorder's office where work was performed.

To check department records for tax liens, you may view homeownership records online or call our office at 1-800-500-7074, ext. 64471.

If contractors and suppliers don't get paid on a construction project in Texas, they can file a mechanics lien to secure payment. A mechanics lien is a legal tool that provides the unpaid party with a security interest in the property.

How to Remove a Mechanic's Lien in Texas Negotiating with the person who placed the lien to remove it. Getting a lien bond to discharge the lien. Filing a claim to vacate the lien. Waiting it out ? in Texas, a mechanic's lien expires after a year or two, depending on the project type.

Add or Remove a Lien on a Vehicle To add or remove a lien on your vehicle title, visit your local county tax office. The title fee is $28 or $33, depending on your county, and must be paid at time of application. Please contact your local county tax office for the exact cost.

Deposit the Lien Amount with the Court: A lien can be removed from the property if you file a lawsuit and deposit the lien amount into the court's registry. This allows the parties to litigate the validity of the claim, without the lien encumbering the property.