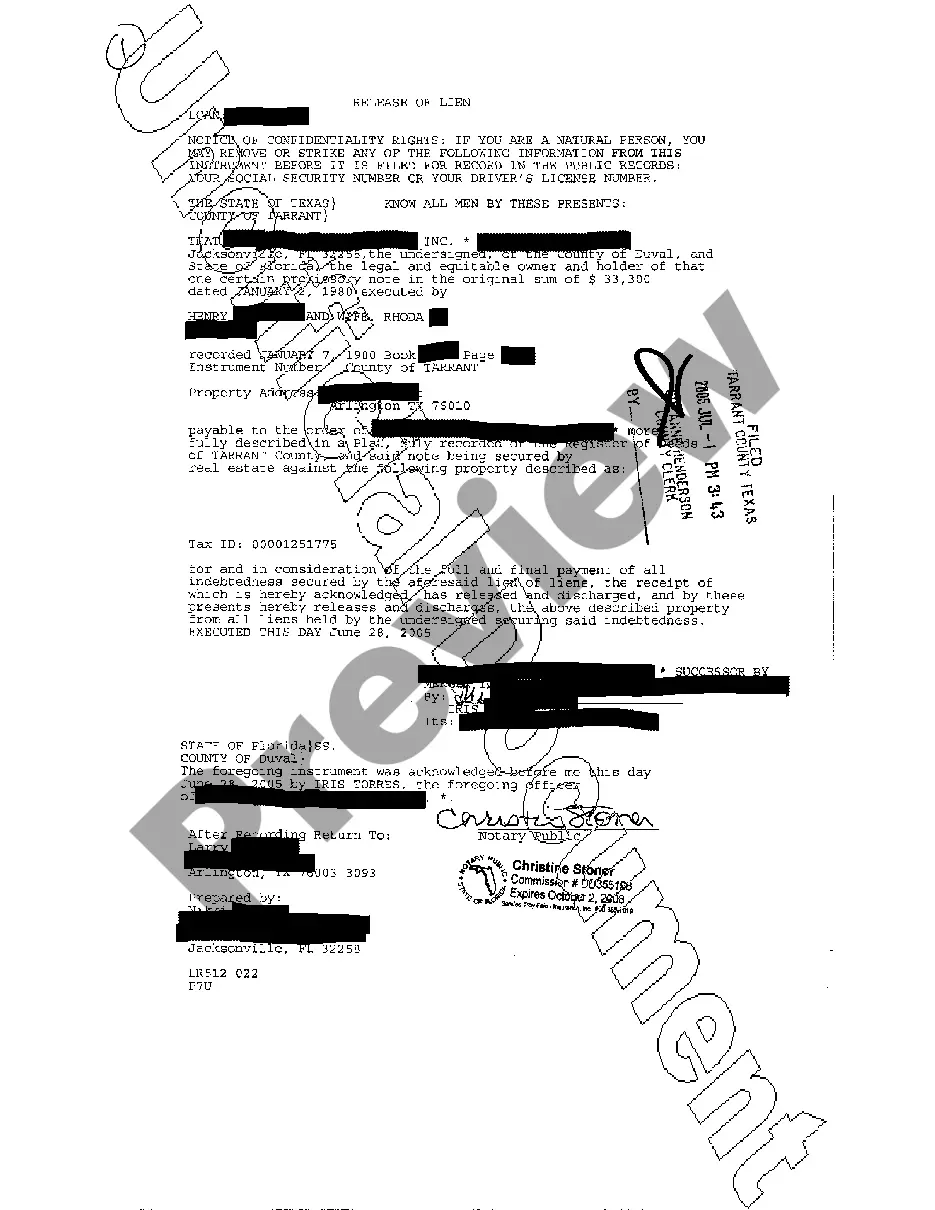

Collin Texas Release of Lien: Understanding its Importance and Types In Collin, Texas, a Release of Lien is an essential legal document used to remove any claim or encumbrances on a property title. This document serves as proof that a creditor or contractor's right to hold a lien on a property has been released, indicating that any outstanding debts or obligations have been settled or satisfied. When a property owner fulfills their financial obligations to a contractor, supplier, or lender, a Collin Texas Release of Lien helps clear the property title from any liens. This document provides protection to both the property owner and potential buyers, ensuring a smooth and unencumbered transfer of ownership. There are different types of Collin Texas Release of Lien, each serving a specific purpose: 1. Partial Release of Lien: If a property owner has paid a part of their debt, a partial release of lien allows for the removal of the lien up to the amount paid. This type of release provides evidence that a portion of the debt has been fulfilled, while the remaining balance still remains. 2. Full Release of Lien: A full release of lien is issued when the entire debt or financial obligation has been satisfied. This document legally releases any claims or encumbrances on the property, stating that the creditor or contractor no longer has any rights to hold a lien. 3. Conditional Release of Lien: In some cases, a contractor or supplier may issue a conditional release of lien. This type of release ensures the removal of the lien upon the occurrence of specific conditions stated in the release. These conditions could include the receipt of the final payment or the successful completion of specific tasks. 4. Unconditional Release of Lien: An unconditional release of lien becomes effective immediately upon its issuance. This type of release is granted when all financial obligations have been met, providing immediate relief from any claims or encumbrances against the property title. It's crucial for property owners in Collin, Texas, to obtain and keep records of the Collin Texas Release of Lien after fulfilling their financial obligations. This documentation acts as evidence to prove that all debts have been cleared, ensuring a hassle-free property transaction and protecting the property owner's legal rights. In conclusion, a Collin Texas Release of Lien is a vital legal document that removes any claims or encumbrances on a property title. Whether it's a partial release, full release, conditional release, or unconditional release, each type serves a specific purpose based on the level of debt satisfaction. Understanding these types and their significance is crucial for property owners and potential buyers to ensure a clear and unencumbered property title transfer in Collin, Texas.

Collin Texas Release of Lien

Description

How to fill out Collin Texas Release Of Lien?

Finding verified templates specific to your local laws can be difficult unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both personal and professional needs and any real-life scenarios. All the documents are properly categorized by area of usage and jurisdiction areas, so locating the Collin Texas Release of Lien gets as quick and easy as ABC.

For everyone already familiar with our service and has used it before, getting the Collin Texas Release of Lien takes just a couple of clicks. All you need to do is log in to your account, pick the document, and click Download to save it on your device. This process will take just a couple of more steps to make for new users.

Adhere to the guidelines below to get started with the most extensive online form catalogue:

- Look at the Preview mode and form description. Make certain you’ve selected the right one that meets your needs and fully corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you find any inconsistency, use the Search tab above to get the correct one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and select the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the subscription.

- Download the Collin Texas Release of Lien. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Benefit from the US Legal Forms library to always have essential document templates for any demands just at your hand!

Form popularity

FAQ

Do I have the right to file a mechanics lien in Collin, Texas? furnish labor or materials. send all required documents before filing a lien, such as monthly notices. if a homestead, have a proper written contract. and meet any state deadlines and fees for your lien claim.

Example: if you need birth or death certificates, land deeds, or vital information please contact the County Clerk's Office located at 2300 Bloomdale Road, Suite 2104. Please see the Public Information Office webpage for a list of commonly requested records, or call 972-424-1460.

County Clerk Stacey Kemp has come up with a great tool for those documenting their Collin County roots.

How much does it cost to file a mechanics lien in Texas? Generally, filing a mechanics lien in Texas costs $26.00 for the first page and an additional $4.00 for every additional page.

How to file a mechanics lien Complete a valid mechanics lien form. Each state has its own rules about the information and formatting required on the lien claim itself.Record the lien with the county.Serve notice to the property owner.

Do I have the right to file a mechanics lien in Collin, Texas? furnish labor or materials. send all required documents before filing a lien, such as monthly notices. if a homestead, have a proper written contract. and meet any state deadlines and fees for your lien claim.

Download the 2022 Texas Lien Deadline Calendar Generally speaking, Texas requires parties to file a mechanics lien by the 15th day of the 4th month after the month in which the lien claimant last furnished labor or material to the project.

Once a deed is acknowledged, it should be filed in the county where the land is located. If the tract extends into more than one county, the deed may be recorded in any county where part of the property is located (Texas Property Code, Sec- tion 11.001a).

You may obtain Texas land records, including deeds, from the county clerk in the Texas county in which the property is located. You can search online for a deed in some counties, or else request the deed from the clerk in person, by mail, phone, fax or email.

The County Clerk's office maintains Official Public Records beginning in 1836. The records include deeds, land patent records, mortgages, judgments and tax liens.