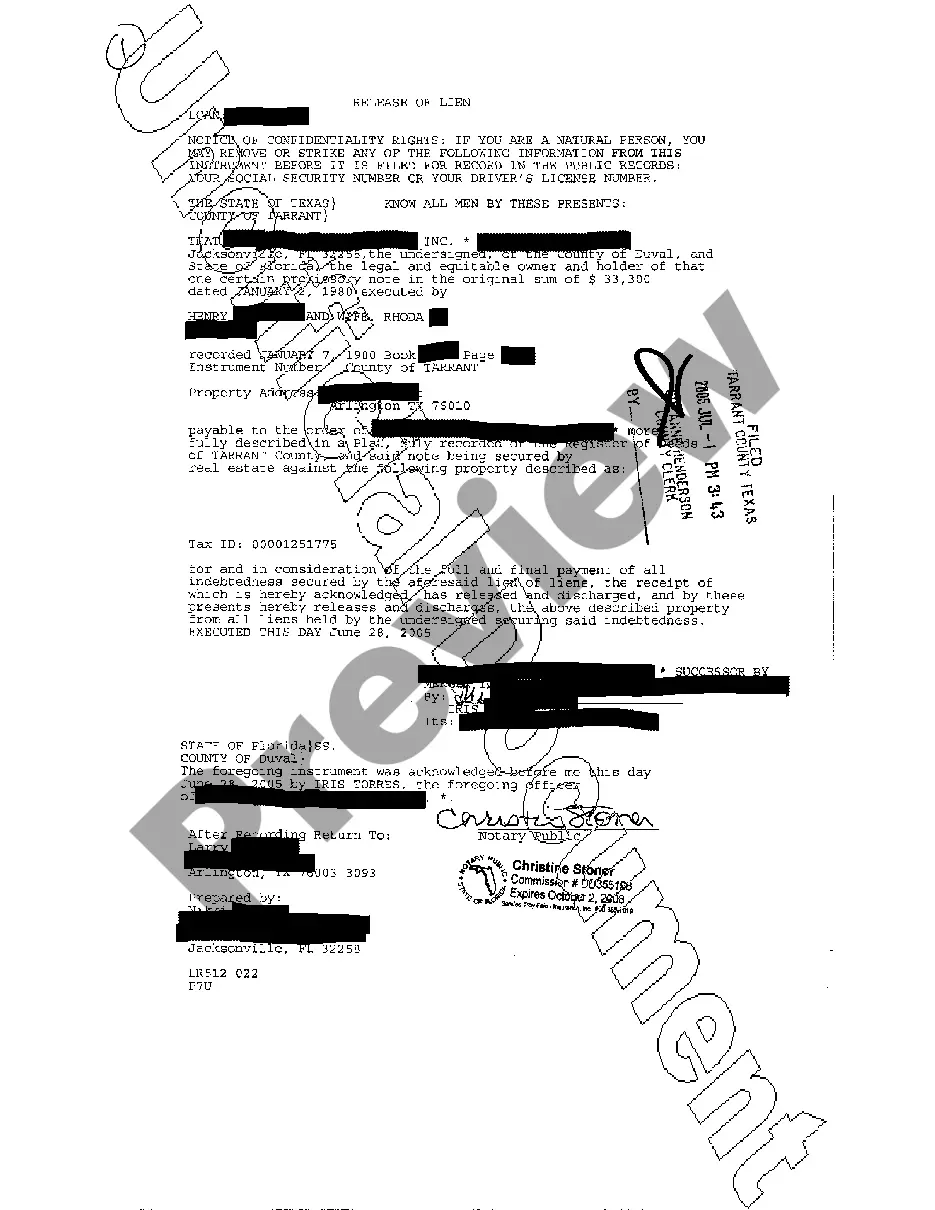

Laredo Texas Release of Lien: A Comprehensive Overview Laredo, Texas, like any other city in the United States, has specific regulations and procedures for handling liens on real estate and property. A release of lien serves as a legal document that eliminates a lien holder's claim on a property, providing the property owner with the freedom to transfer, sell, or refinance the property without any encumbrances. In this article, we will delve into the details of the Laredo Texas Release of Lien, exploring its types, processes, and key aspects. 1. Voluntary Release of Lien: A voluntary release of lien occurs when the lien holder willingly gives up their claim over the property after receiving full payment or satisfying the terms of the lien agreement. Property owners in Laredo can request a voluntary release of lien upon meeting the necessary obligations associated with the lien. 2. Involuntary Release of Lien: An involuntary release of lien occurs when the lien holder fails to maintain or enforce their lien rights due to a legal flaw or procedural error. This type of release may arise if the lien holder fails to file or renew the lien within the specified time limits or if they fail to adhere to the proper legal procedures required to enforce the lien. 3. Mechanic's and Material man's Lien Release: In Laredo, Texas, a common type of lien is the mechanic's and material man's lien, often used by contractors, subcontractors, or suppliers to ensure payment for their services or materials provided in construction projects. Once these parties receive full payment, they can file a mechanic's and material man's lien release to remove the claim from the property title. 4. Tax Lien Release: In certain cases, the government may place a tax lien on a property due to unpaid taxes. Once the property owner settles their tax debts, they can request a tax lien release from the relevant tax authority in Laredo, Texas, to clear the property title and regain full ownership rights. To initiate the Laredo Texas Release of Lien process, the property owner (or their authorized representative) must file the appropriate paperwork with the relevant county clerk's office or other appropriate governing authority. The process generally requires submitting a release of lien application, along with supporting documentation, such as proof of payment or a letter from the lien holder indicating their consent to release the lien. Upon successful submission and verification of the release of lien documents, the county clerk's office will update the property records to reflect the lien release. This ensures that any future title searches or transactions involving the property will not show any outstanding liens. In summary, the Laredo Texas Release of Lien is an essential legal procedure that allows property owners to remove any claims or encumbrances on their property. Understanding the different types of releases, such as voluntary and involuntary releases, as well as mechanic's and material man's lien releases and tax lien releases, is crucial for navigating the process effectively. Keywords: Laredo Texas, release of lien, voluntary release, involuntary release, mechanic's and material man's lien release, tax lien release, property owner, county clerk's office, paperwork, encumbrances, legal procedure.

Laredo Texas Release of Lien

Description

How to fill out Laredo Texas Release Of Lien?

We always want to minimize or prevent legal damage when dealing with nuanced legal or financial affairs. To do so, we sign up for legal services that, as a rule, are very expensive. Nevertheless, not all legal issues are as just complex. Most of them can be dealt with by ourselves.

US Legal Forms is an online catalog of updated DIY legal documents addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your affairs into your own hands without turning to an attorney. We offer access to legal document templates that aren’t always publicly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to find and download the Laredo Texas Release of Lien or any other document easily and securely. Simply log in to your account and click the Get button next to it. In case you lose the form, you can always re-download it in the My Forms tab.

The process is equally effortless if you’re new to the website! You can create your account in a matter of minutes.

- Make sure to check if the Laredo Texas Release of Lien adheres to the laws and regulations of your your state and area.

- Also, it’s imperative that you check out the form’s description (if available), and if you notice any discrepancies with what you were looking for in the first place, search for a different template.

- Once you’ve made sure that the Laredo Texas Release of Lien is proper for your case, you can choose the subscription option and proceed to payment.

- Then you can download the form in any available file format.

For more than 24 years of our presence on the market, we’ve helped millions of people by offering ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save efforts and resources!