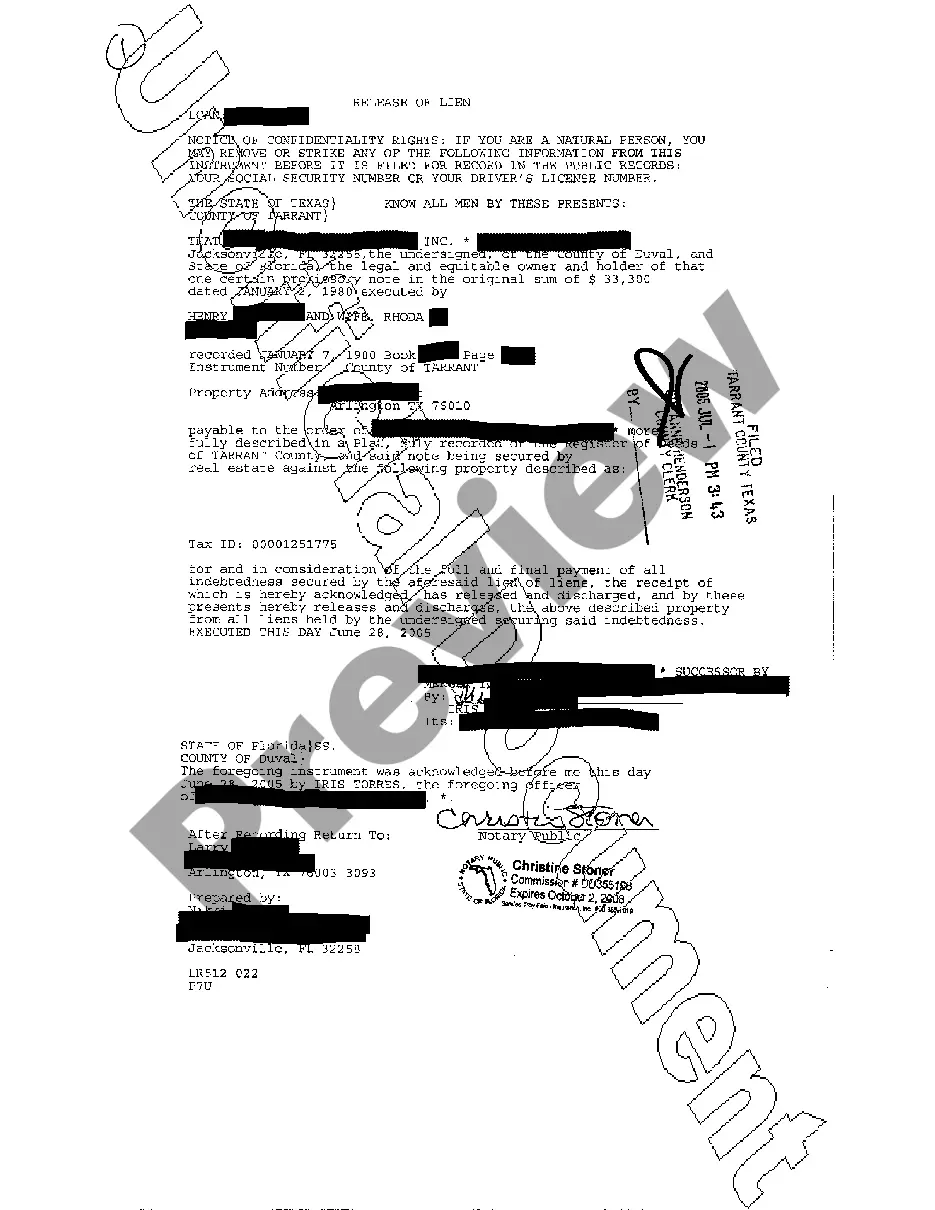

A McKinney Texas Release of Lien refers to a legal document that officially relieves a property from an existing lien, indicating that the debt or obligation tied to the property has been fully satisfied or released. This written instrument certifies that the lien holder or creditor no longer holds any legal claim on the property in question. The McKinney Texas Release of Lien is essential in real estate transactions, particularly during the final stages of property transfers or refinancing processes. When a lien is imposed on a property, it essentially serves as a security interest for the creditor or lender, ensuring that they can claim their due if the borrower defaults on their debt. Once the borrower or property owner successfully pays off the outstanding debt or fulfills the necessary obligations, the lien holder is required to issue the Release of Lien to clear the title and remove any encumbrances on the property. In McKinney, Texas, there can be various types of Releases of Lien depending on the nature of the lien. Some common examples include: 1. Mechanics Lien Release: This type of release is commonly associated with construction or property improvement projects. When contractors, subcontractors, or suppliers work on a property and are not paid for their services or materials, they can place a mechanics lien on the property. A Mechanics Lien Release is issued when the property owner pays all outstanding invoices, indicating that the claim against the property has been cleared. 2. Mortgage Lien Release: When a property is purchased through a mortgage loan, the lender places a mortgage lien on the property title as collateral until the loan is fully repaid. Once the borrower successfully pays off the mortgage in its entirety, the lender issues a Mortgage Lien Release, officially releasing their claim on the property. 3. Tax Lien Release: In cases where property owners fail to pay their property taxes, the local government may place a tax lien on the property. Upon clearing the outstanding tax debt, the government issues a Tax Lien Release, effectively removing the lien from the property title. It is crucial for property owners to acquire a McKinney Texas Release of Lien after fulfilling their obligations to ensure a clear and unencumbered title. This document guarantees that the property is free from any legal claims, providing peace of mind to both the property owner and future buyers or refinances.

McKinney Texas Release of Lien

Description

How to fill out McKinney Texas Release Of Lien?

Benefit from the US Legal Forms and obtain instant access to any form you want. Our helpful platform with a huge number of templates makes it easy to find and obtain virtually any document sample you will need. You can export, complete, and certify the McKinney Texas Release of Lien in just a few minutes instead of surfing the Net for many hours seeking an appropriate template.

Utilizing our catalog is a great way to raise the safety of your document filing. Our experienced attorneys regularly review all the documents to make sure that the forms are appropriate for a particular region and compliant with new laws and regulations.

How do you obtain the McKinney Texas Release of Lien? If you have a subscription, just log in to the account. The Download option will appear on all the samples you look at. Furthermore, you can find all the earlier saved files in the My Forms menu.

If you haven’t registered a profile yet, follow the instruction listed below:

- Open the page with the template you need. Ensure that it is the template you were looking for: check its headline and description, and utilize the Preview feature if it is available. Otherwise, make use of the Search field to look for the needed one.

- Launch the downloading process. Click Buy Now and choose the pricing plan that suits you best. Then, create an account and pay for your order using a credit card or PayPal.

- Save the file. Choose the format to get the McKinney Texas Release of Lien and revise and complete, or sign it according to your requirements.

US Legal Forms is among the most extensive and reliable template libraries on the web. Our company is always ready to assist you in virtually any legal procedure, even if it is just downloading the McKinney Texas Release of Lien.

Feel free to take advantage of our form catalog and make your document experience as convenient as possible!