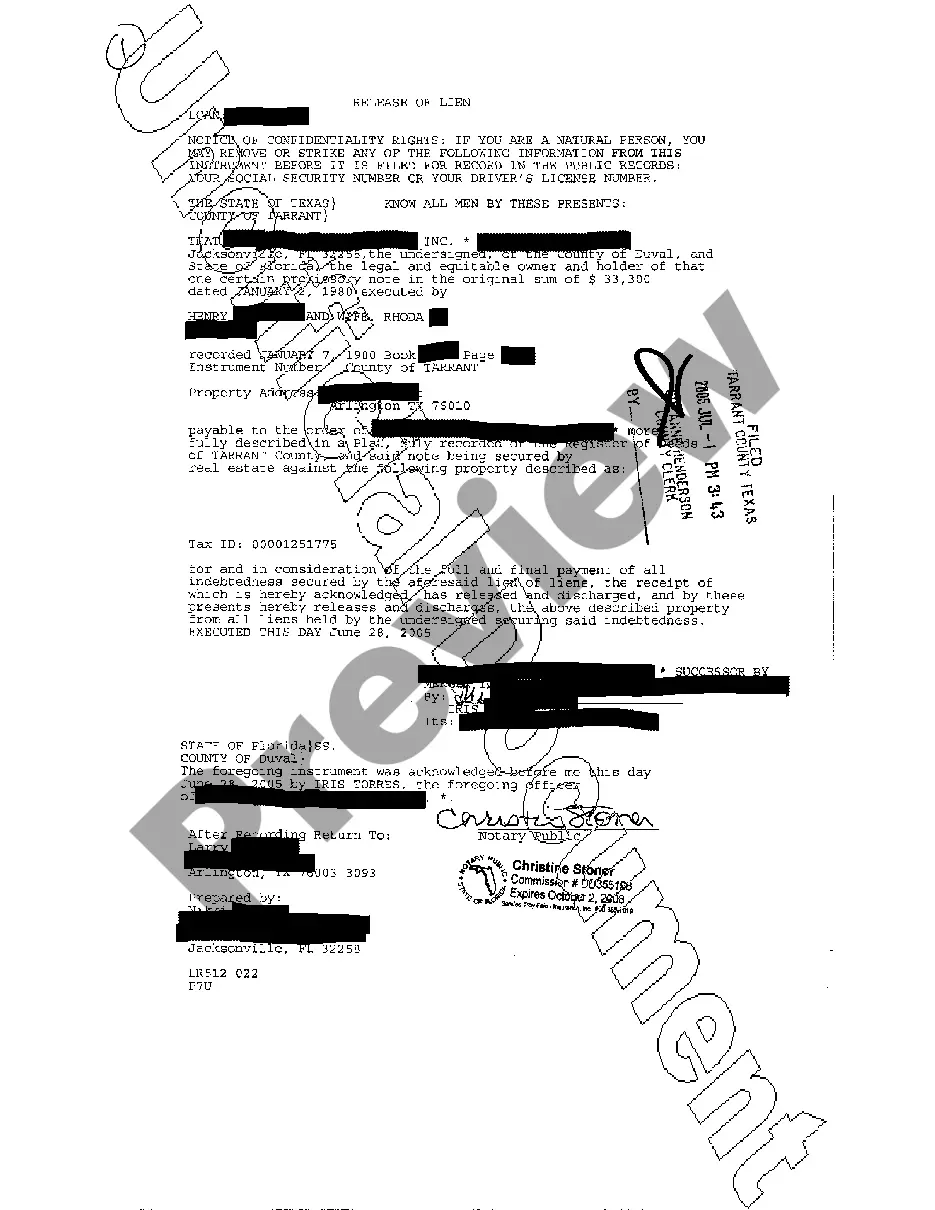

The San Antonio Texas Release of Lien is a legal document used to officially release a lien on a property located in the city of San Antonio, Texas. A lien is a claim that a creditor or contractor has on a property as security for the payment of a debt. This document is crucial in cases where a property owner has satisfied a debt and wants to remove the claim or cloud on the title of a property. There are different types of San Antonio Texas Release of Lien documents that vary based on the nature of the lien being released. Some common types include: 1. Mechanics Lien Release: This type of release is used when a contractor or subcontractor has filed a mechanics lien on a property due to unpaid construction work or materials. Once the contractor has been paid in full, they can issue a Mechanics Lien Release, which releases the lien and allows the property owner to proceed with selling or refinancing the property. 2. Tax Lien Release: A tax lien release is used when a property owner has settled their outstanding tax debt with the city or county. This release removes the claim placed on the property by the taxing authority, ensuring the property owner's clear title. 3. Judgment Lien Release: If a property owner has had a judgment lien placed on their property due to a court-ordered debt, they can use a Judgment Lien Release to remove the claim. This document is commonly used after a judgment has been satisfied, releasing the property from any encumbrances associated with the judgment. 4. HOA Lien Release: Homeowners' Association (HOA) liens can be placed on a property if the owner fails to pay their HOA fees or other assessments. Once the homeowner has paid the outstanding fees and penalties, an HOA Lien Release can be obtained to remove the lien and restore a clear title. In all cases, the San Antonio Texas Release of Lien document includes key information such as the property owner's name and contact information, the lien holder's details, details of the original lien, and a statement of release. It must be signed by the lien holder, notarized, and filed with the appropriate county records office to ensure its validity and clarity of title.

San Antonio Texas Release of Lien

Description

How to fill out San Antonio Texas Release Of Lien?

Benefit from the US Legal Forms and obtain instant access to any form you want. Our useful platform with thousands of templates allows you to find and get almost any document sample you need. You can download, complete, and certify the San Antonio Texas Release of Lien in just a few minutes instead of surfing the Net for many hours seeking a proper template.

Using our catalog is a superb way to improve the safety of your document filing. Our experienced attorneys on a regular basis review all the documents to make sure that the forms are relevant for a particular state and compliant with new acts and polices.

How do you get the San Antonio Texas Release of Lien? If you already have a subscription, just log in to the account. The Download option will appear on all the samples you look at. In addition, you can find all the previously saved documents in the My Forms menu.

If you don’t have an account yet, follow the tips listed below:

- Open the page with the form you need. Ensure that it is the template you were seeking: check its headline and description, and take take advantage of the Preview option if it is available. Otherwise, utilize the Search field to find the appropriate one.

- Launch the saving process. Select Buy Now and choose the pricing plan you prefer. Then, sign up for an account and pay for your order with a credit card or PayPal.

- Export the document. Select the format to get the San Antonio Texas Release of Lien and modify and complete, or sign it for your needs.

US Legal Forms is probably the most considerable and reliable form libraries on the web. We are always ready to help you in virtually any legal case, even if it is just downloading the San Antonio Texas Release of Lien.

Feel free to take full advantage of our platform and make your document experience as convenient as possible!