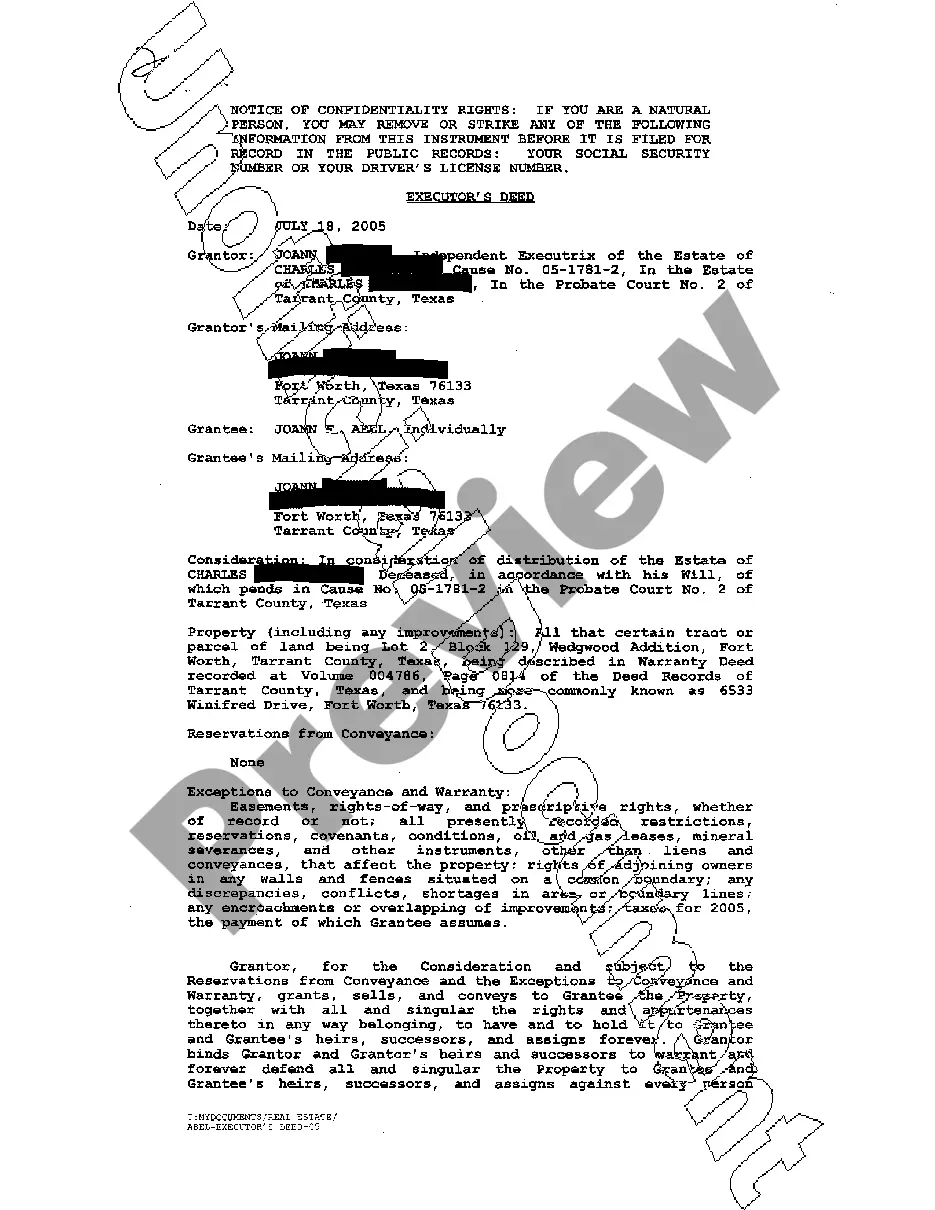

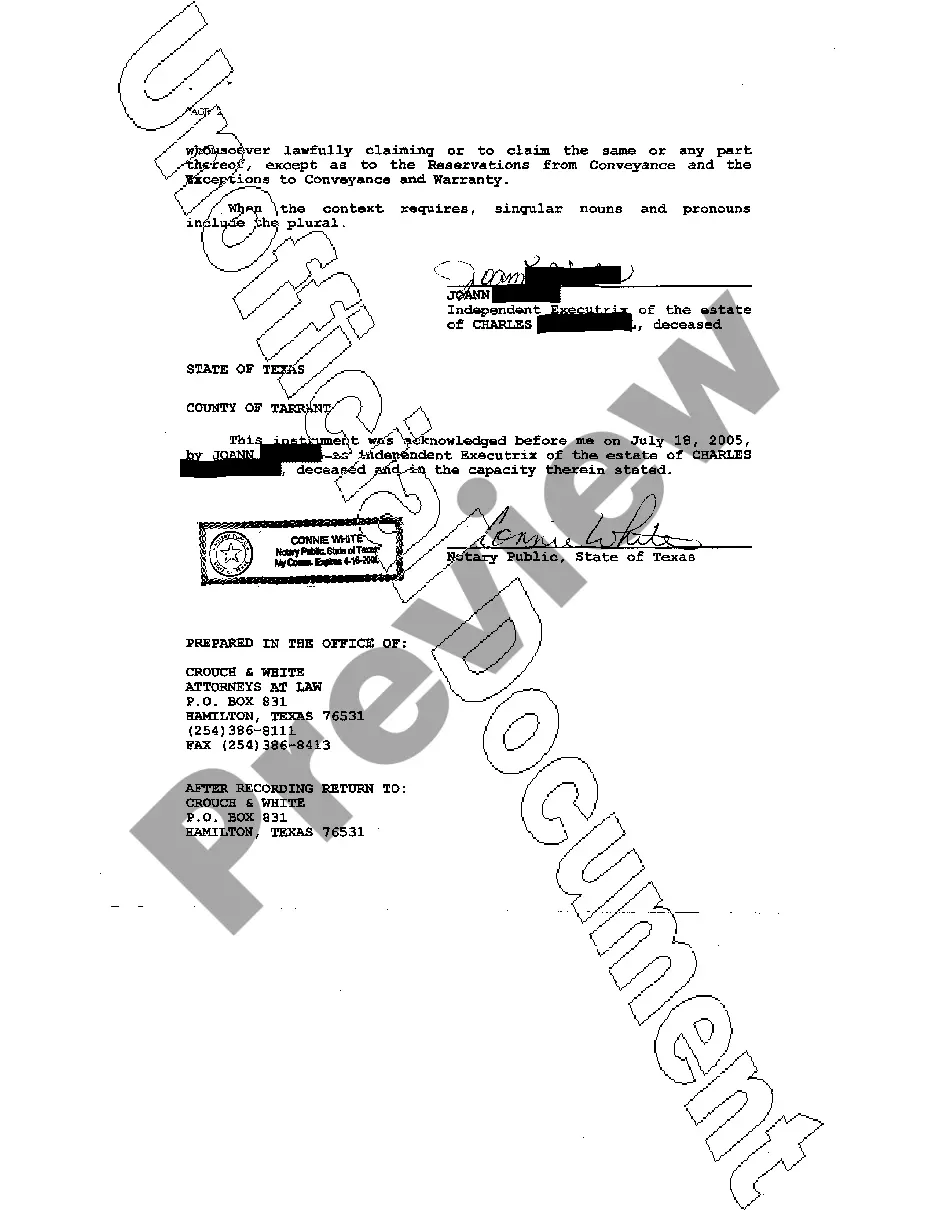

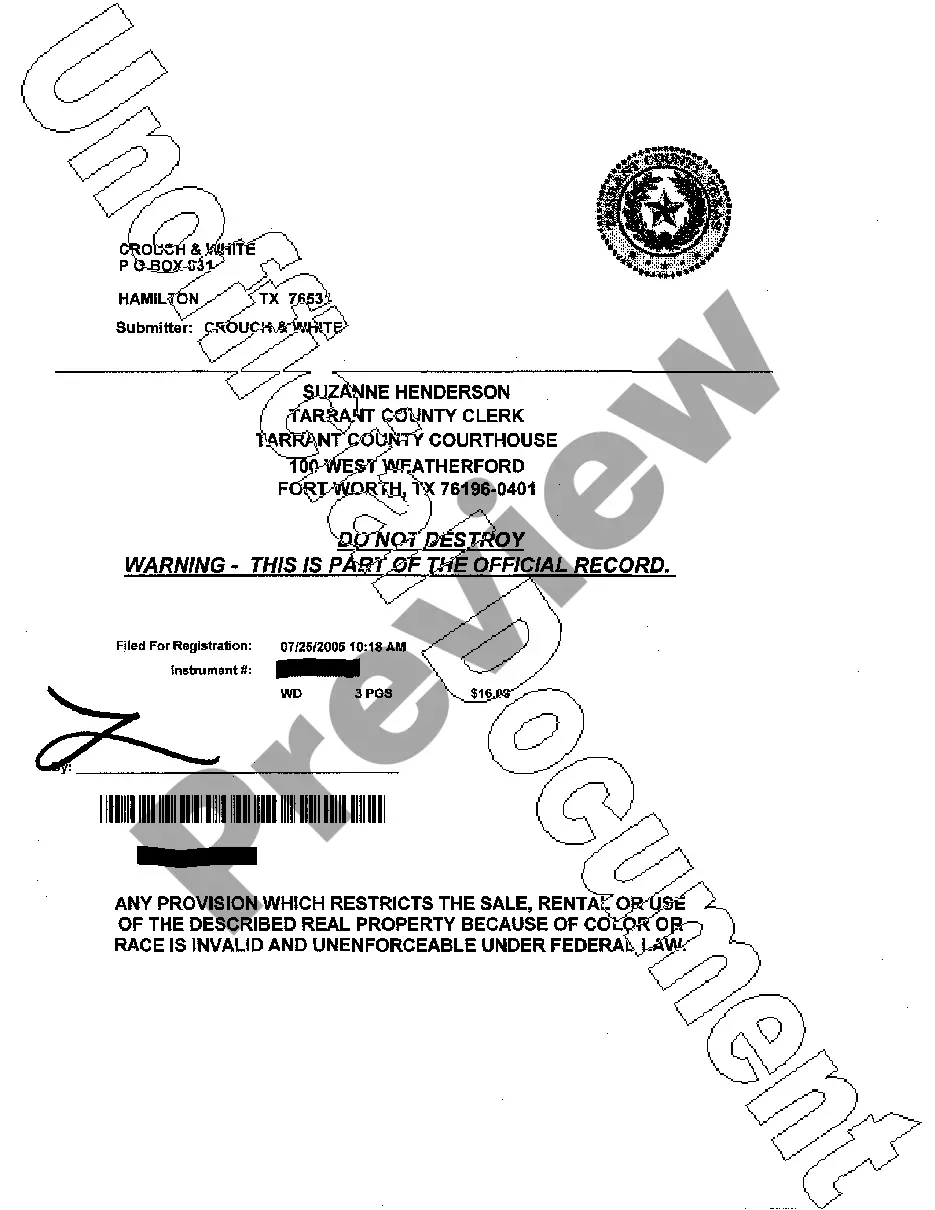

Austin Texas Executor's Deed

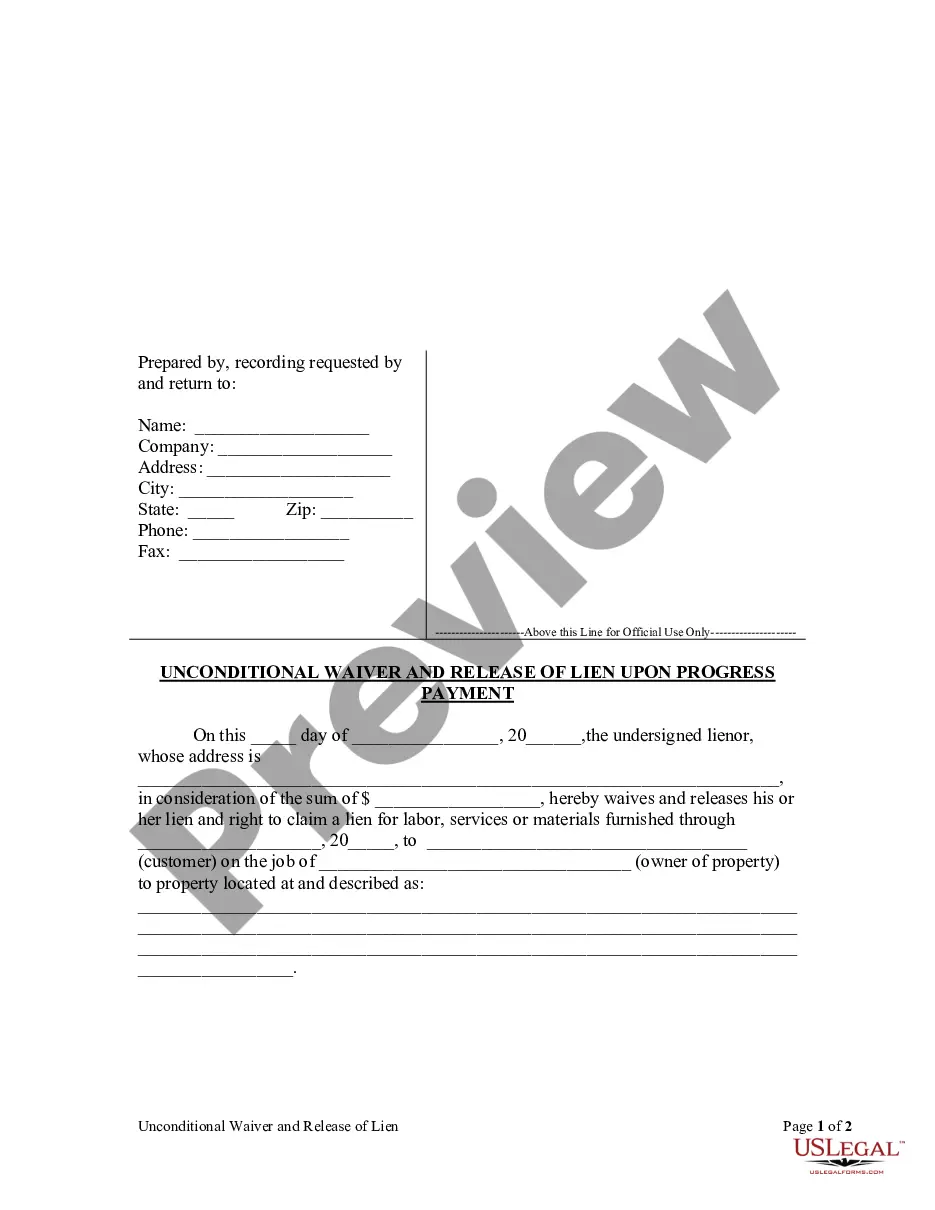

Description

How to fill out Texas Executor's Deed?

Do you require a reliable and economical provider of legal forms to purchase the Austin Texas Executor's Deed? US Legal Forms is your preferred choice.

Whether you need a simple agreement to establish guidelines for living with your partner or a collection of documents to progress your divorce through the court system, we have you sorted.

Our platform features more than 85,000 current legal document templates for individual and business purposes. All templates we provide are not generic and are tailored based on the specifications of specific states and counties.

To access the form, you need to Log In, locate the necessary template, and click the Download button adjacent to it. Please remember that you can redownload your previously acquired document templates at any time in the My documents section.

Now you can create your account. Then choose the subscription option and continue to payment. Once the payment is completed, download the Austin Texas Executor's Deed in any available file format. You can return to the website at any time and download the form again at no cost.

Locating current legal documents has never been simpler. Try US Legal Forms today, and say goodbye to wasting your precious time researching legal paperwork online permanently.

- Are you a newcomer to our site? No problem.

- You can easily set up an account, but beforehand, ensure you do the following.

- Verify that the Austin Texas Executor's Deed meets the legal requirements of your state and locality.

- Review the form’s details (if available) to determine who and what the form is designed for.

- Restart the search if the template does not align with your particular needs.

Form popularity

FAQ

When there is a will, the executor is responsible for selling the house, with the approval of the heirs. The executor may recruit a real estate agent or broker experienced in probate law to help with the sale. A formal appraisal may also be necessary. The selling process isn't quite like a traditional house sale.

Executors' year However, many beneficiaries don't realise that executors and administrators have twelve months before they are obliged to distribute the estate to the beneficiaries. Time runs from the date of death.

The executor generally has three years after their appointment to distribute the remaining assets (after debts and disputes are resolved). The Texas probate process can be fairly simple in most cases.

In Texas, while an executor of an estate does have to file an inventory, appraisement, and list of claims with the probate court, they are not necessarily required to show accountings to beneficiaries. A personal representative must file an inventory of the estate assets within 90 days of qualification.

The Transfer on Death Deed must: Be in writing, signed by the owner, and notarized, Have a legal description of the property (The description is found on the deed to the property or in the deed records.Have the name and address of one or more beneficiaries, State that the transfer will happen at the owner's death,

Executors must not unreasonably delay distributing the estate for their own gain or any other party. However, even after the executor's year, the court will not order a distribution of the estate if the executors can show there is good reason to wait.

For a simple estate, the entire probate process can be completed within six months. However, expect probate to go on for a year or more if the original will cannot be located or the will is contested.

The Will must give the executor the power to sell property; Letters Testamentary must be issued; and. The estate Inventory and Appraisal has been filed with the court.

The executor can sell property without getting all of the beneficiaries to approve. However, notice will be sent to all the beneficiaries so that they know of the sale but they don't have to approve of the sale.

Under the Texas Estates Code, the standard compensation is a five (5%) percent commission on (1) all amounts that the executor or administrator receives; or (2) pays out in cash in the administration of the estate (the Texas two-step on executor compensation).