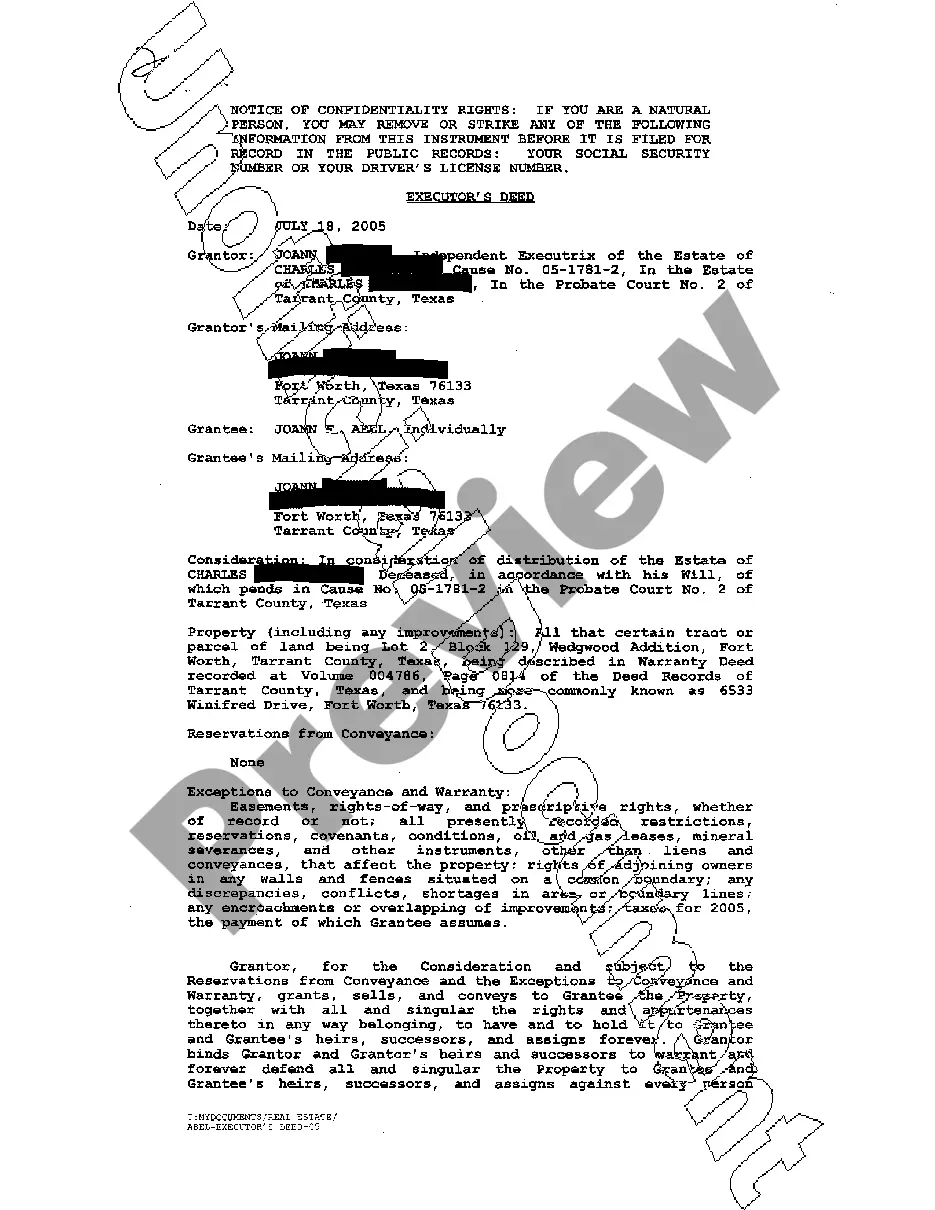

The Killeen Texas Executor's Deed is a legal document often used in the probate process to transfer real estate from a deceased person, known as the decedent, to their rightful beneficiaries or heirs. This deed is specifically designed for cases where the decedent had a valid will and appointed an executor to handle the distribution of their assets. The Executor's Deed plays a crucial role in resolving the decedent's estate by providing a clear and legal transfer of property ownership. It ensures that the beneficiaries receive the property they are entitled to, as outlined in the decedent's will. When the executor files this deed with the county clerk's office, it becomes part of the public record, providing evidence of the property's transfer. Key elements of a Killeen Texas Executor's Deed usually include: 1. Executor's Information: The deed will include the name, address, and contact details of the appointed executor responsible for administering the estate. 2. Decedent's Information: The deceased individual's name, date of death, and address are typically specified to establish their identity and acknowledge their passing. 3. Legal Description of the Property: This section contains the details of the property being transferred, such as street address, lot number, block number, and any other relevant identifiers that accurately describe the property's location. 4. Beneficiary Information: The names and contact information of the beneficiaries or heirs receiving the property are typically listed to identify the rightful recipients of the decedent's assets. 5. Terms and Conditions: This part usually includes terms and conditions that govern the transfer of the property, ensuring that all legal requirements are met and smooth transfer of ownership takes place. Types of Killeen Texas Executor's Deed: 1. Killeen Texas Executor's Deed with Warranty: In this type of deed, the executor guarantees that they have full authority to sell the property and that there are no undisclosed claims, liens, or encumbrances on the property. 2. Killeen Texas Executor's Deed without Warranty: This type of deed offers no warranties or guarantees regarding the title or condition of the property. It implies that the executor is transferring whatever interest they hold, but assumes no responsibility for existing liens or potential problems with the property. 3. Killeen Texas Executor's Deed by Independent Executor: If the decedent's will explicitly grant the executor the power of independent administration, this type of deed allows the executor to transfer the property without court supervision. In summary, the Killeen Texas Executor's Deed is a crucial legal instrument that allows the executor of a deceased person's estate to transfer real estate to the rightful beneficiaries or heirs named in the decedent's will. It ensures a smooth and clear transfer of property ownership while adhering to legal obligations and requirements.

Killeen Texas Executor's Deed

Description

How to fill out Killeen Texas Executor's Deed?

If you’ve already utilized our service before, log in to your account and download the Killeen Texas Executor's Deed on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, follow these simple actions to get your file:

- Ensure you’ve located an appropriate document. Look through the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t suit you, use the Search tab above to get the appropriate one.

- Buy the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the transaction.

- Get your Killeen Texas Executor's Deed. Pick the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to each piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to easily find and save any template for your individual or professional needs!

Form popularity

FAQ

Even if you are appointed executor by the will, you cannot act as executor until the court appoints you. You must also qualify by taking the executor's oath and posting any required bond, although, sometimes the bond is waived by the court or by the will itself.

HOW DO I GET APPOINTED EXECUTOR? Be at least 18 years old and of a sound mind ? that is, not judged incapacitated by a court.Not have been convicted of a felony under any state or federal law, unless he or she has been pardoned or had all civil rights restored.

The Will must give the executor the power to sell property; Letters Testamentary must be issued; and. The estate Inventory and Appraisal has been filed with the court.

What are the Executor Fees in Texas? According to the Estates Code, an executor in Texas is entitled to up to 5% of the estate's total financial transactions.

Under the Texas Estates Code, the standard compensation is a five (5%) percent commission on (1) all amounts that the executor or administrator receives; or (2) pays out in cash in the administration of the estate (the Texas two-step on executor compensation).

Once the probate process has begun, however, there is no deadline by which an estate must be completed in Texas. If an estate is not completed within 15 months, the executor or administrator can, in most cases, be ordered to provide an accounting of all estate assets, debts, and expenses.

For a simple estate, the entire probate process can be completed within six months. However, expect probate to go on for a year or more if the original will cannot be located or the will is contested.

The Transfer on Death Deed must: Be in writing, signed by the owner, and notarized, Have a legal description of the property (The description is found on the deed to the property or in the deed records.Have the name and address of one or more beneficiaries, State that the transfer will happen at the owner's death,

If the estate is ready to be distributed, but the executor is delaying distribution for some reason, a beneficiary can apply to the Court for an order to grant an interim distribution; and, The Court has the power to remove the executor for truly egregious delays, and to appoint someone else in his or her place.

In Texas, state and local court rules govern the various time periods that the executor must follow in probating a will. The general rule in Texas is that the executor has four years from the date of death of the testator (person who drafted the will) to file for probate.