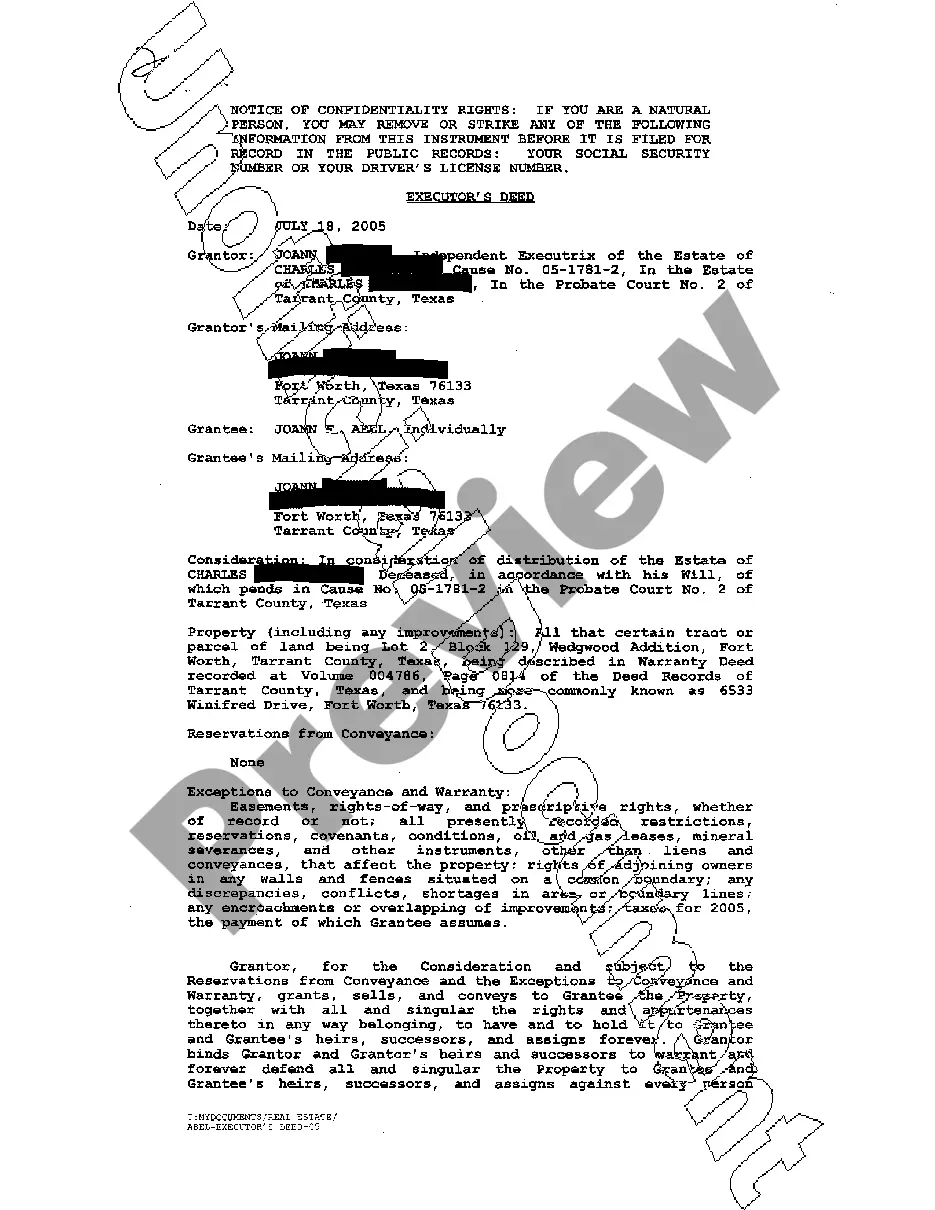

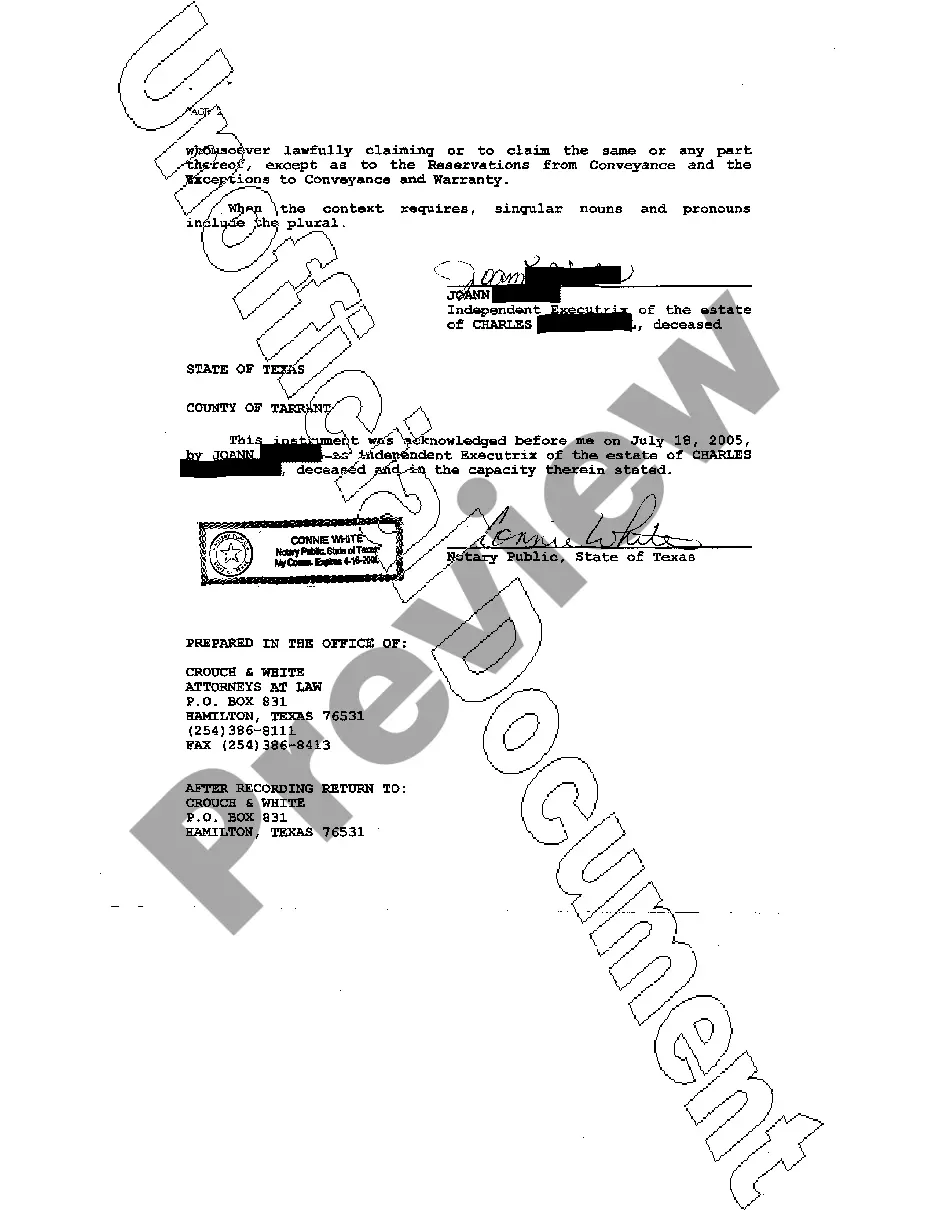

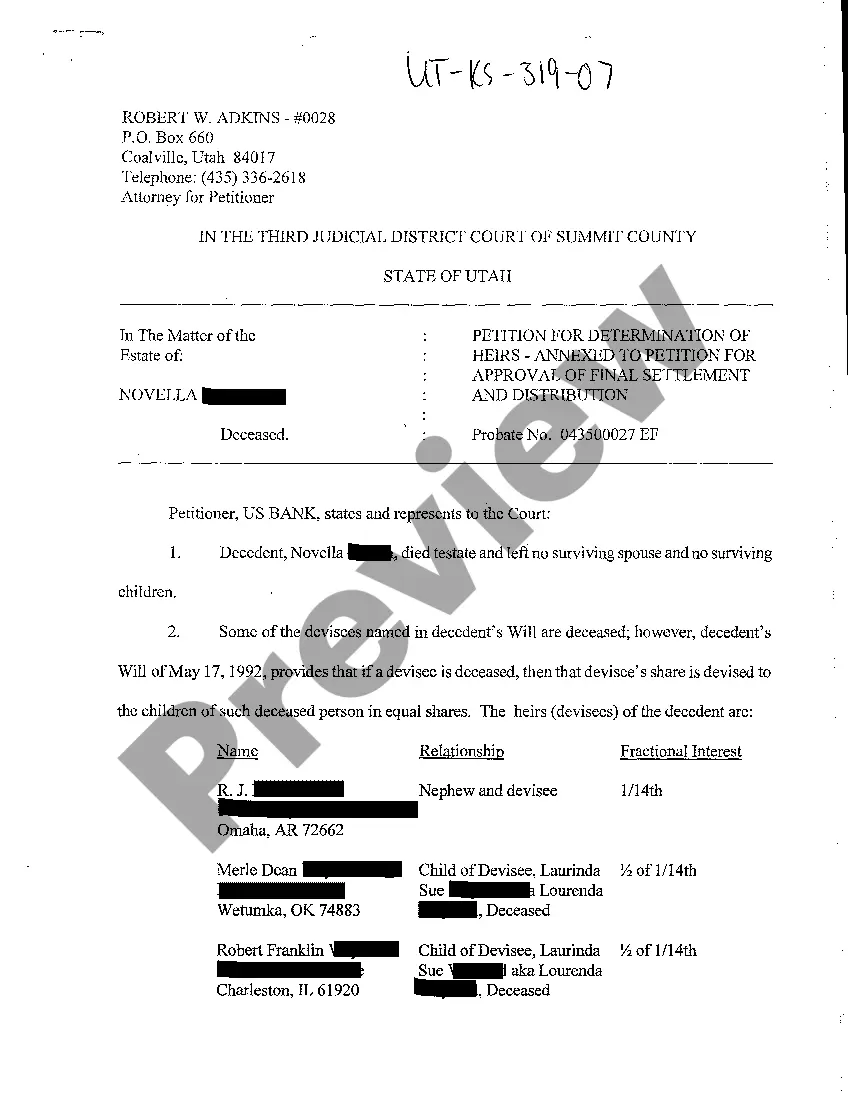

McKinney Texas Executor's Deed is a legal document specifically used when a deceased person's property needs to be transferred to their beneficiaries or heirs. This deed is executed by the appointed executor, who is responsible for distributing the deceased individual's assets according to their will or state laws. The McKinney Texas Executor's Deed acts as a proof of ownership transfer and provides legal protection to the beneficiaries. It ensures that the property is appropriately transferred without any complications. There are various types of McKinney Texas Executor's Deed depending on the situation: 1. General Executor's Deed: This type of deed is used when the deceased person had a will, and the executor distributes the property according to the terms mentioned in the will. 2. Independent Executor's Deed: This deed is utilized when the executor has been granted independent powers by the court. This allows the executor to administer the estate independently without court approval. 3. Dependent Administrator's Deed: In situations where the court oversees the administration of the estate, the dependent administrator executes this deed. The court's involvement is necessary for every step of the process. 4. Monument of Title: This type of deed is specific to McKinney, Texas, and is used when the deceased person left a valid will, but there is no need for a formal administration process. The Monument of Title allows the executor to transfer the property to the named beneficiaries without court supervision. 5. Warship Affidavit with Executor's Deed: When the deceased person did not leave a will, a warship affidavit may be used alongside an executor's deed. This document establishes the legal heirs and their respective shares in the estate. Overall, the McKinney Texas Executor's Deed serves as a crucial legal instrument that enables the smooth transfer of a deceased person's property to their beneficiaries or heirs in accordance with their wishes or state laws. Executors must carefully execute these deeds to ensure the proper and lawful distribution of assets.

McKinney Texas Executor's Deed

Description

How to fill out McKinney Texas Executor's Deed?

Are you searching for a dependable and affordable legal forms provider to purchase the McKinney Texas Executor's Deed? US Legal Forms is your ideal solution.

Whether you need a straightforward agreement to establish rules for living together with your partner or a collection of documents to progress your separation or divorce through the court, we have you covered.

Our website offers over 85,000 current legal document templates for personal and business usage. All templates we provide are not generic and tailored based on the requirements of individual states and counties.

To download the document, you must Log In to your account, find the necessary form, and click the Download button next to it. Please remember that you can retrieve your previously purchased form templates anytime in the My documents section.

You can now register for your account. Then select the subscription plan and proceed to payment. Once the payment is finalized, download the McKinney Texas Executor's Deed in any available format. You can return to the website at any time to redownload the document without incurring any additional costs.

Locating current legal documents has never been simpler. Try US Legal Forms today, and stop wasting hours researching legal paperwork online once and for all.

- Are you unfamiliar with our platform? No worries.

- You can create an account in minutes, but prior to that, ensure to do the following.

- Verify that the McKinney Texas Executor's Deed adheres to the laws of your state and locality.

- Review the form’s specifics (if accessible) to understand who and what the document is suitable for.

- Begin the search again if the form isn’t appropriate for your legal situation.

Form popularity

FAQ

How long does the administrator have to distribute the inheritance to the heirs? In most instances, an administrator may be removed after notice if he or she fails to make a final distribution of the estate within three years after letters of administration have been granted.

HOW DO I GET APPOINTED EXECUTOR? Be at least 18 years old and of a sound mind ? that is, not judged incapacitated by a court.Not have been convicted of a felony under any state or federal law, unless he or she has been pardoned or had all civil rights restored.

An Executor's Deed in Texas is used to transfer real property from the estate of a deceased property owner to the heir or heirs designated in their Will. It is signed by a court appointed Executor, who is the person named in a will to execute the terms of a Will.

The Will must give the executor the power to sell property; Letters Testamentary must be issued; and. The estate Inventory and Appraisal has been filed with the court.

The executor can sell property without getting all of the beneficiaries to approve. However, notice will be sent to all the beneficiaries so that they know of the sale but they don't have to approve of the sale.

The Transfer on Death Deed must: Be in writing, signed by the owner, and notarized, Have a legal description of the property (The description is found on the deed to the property or in the deed records.Have the name and address of one or more beneficiaries, State that the transfer will happen at the owner's death,

What Are Executor Duties in Texas? Locate and notify all beneficiaries of the will; Give notice to the decedent's creditors; Identify and collect all the decedent's assets; Take steps to maintain and protect the assets; Pay all the decedent's debts; Bring a wrongful death suit, if appropriate, if family members do not;

The executor will notify all creditors about the person's death and validate any claims before paying them to ensure that they are legitimate debts. Other duties include: Filing tax returns for the decedent and the estate and paying any taxes due. Notifying the Social Security Administration regarding benefits payments.

For a simple estate, the entire probate process can be completed within six months. However, expect probate to go on for a year or more if the original will cannot be located or the will is contested.

Executors must not unreasonably delay distributing the estate for their own gain or any other party. However, even after the executor's year, the court will not order a distribution of the estate if the executors can show there is good reason to wait.