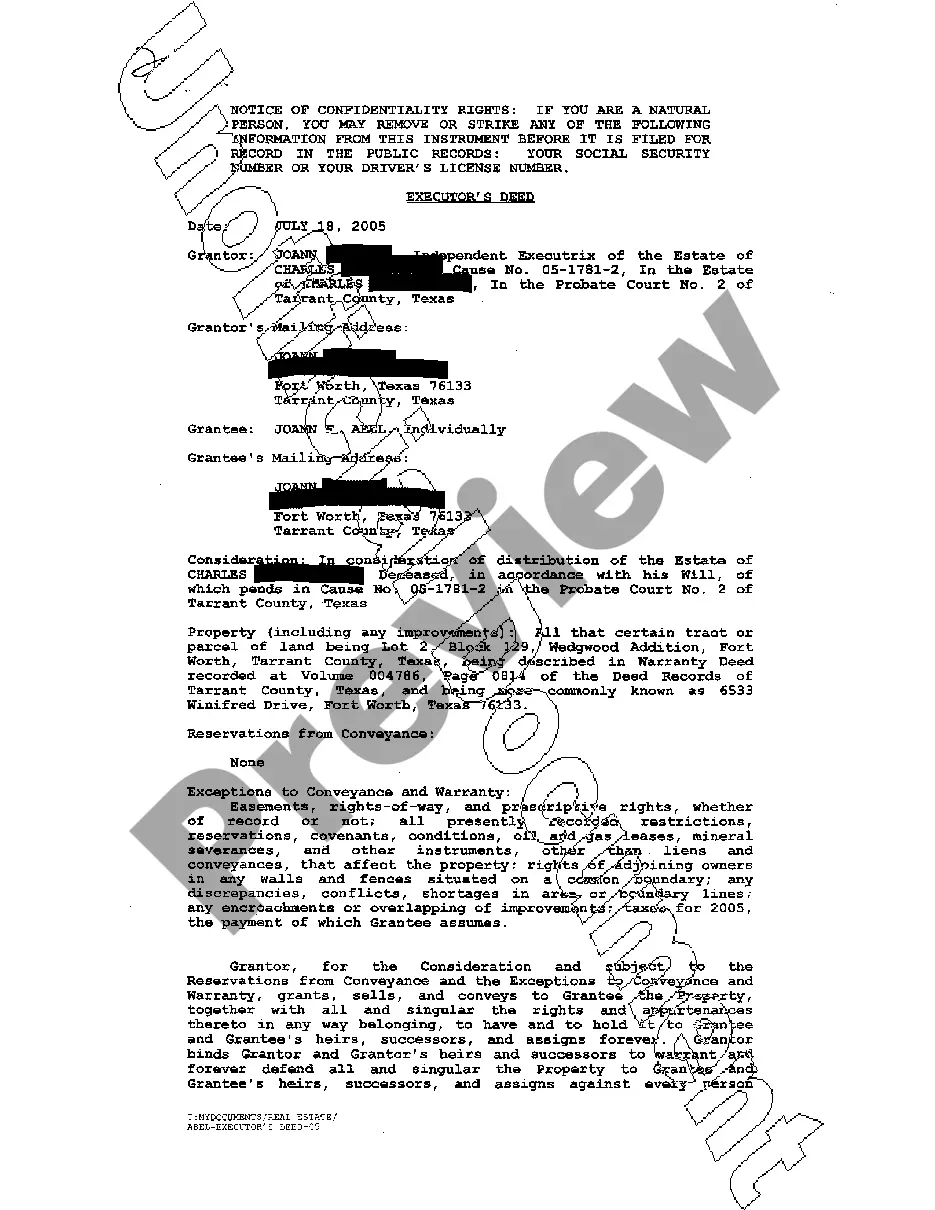

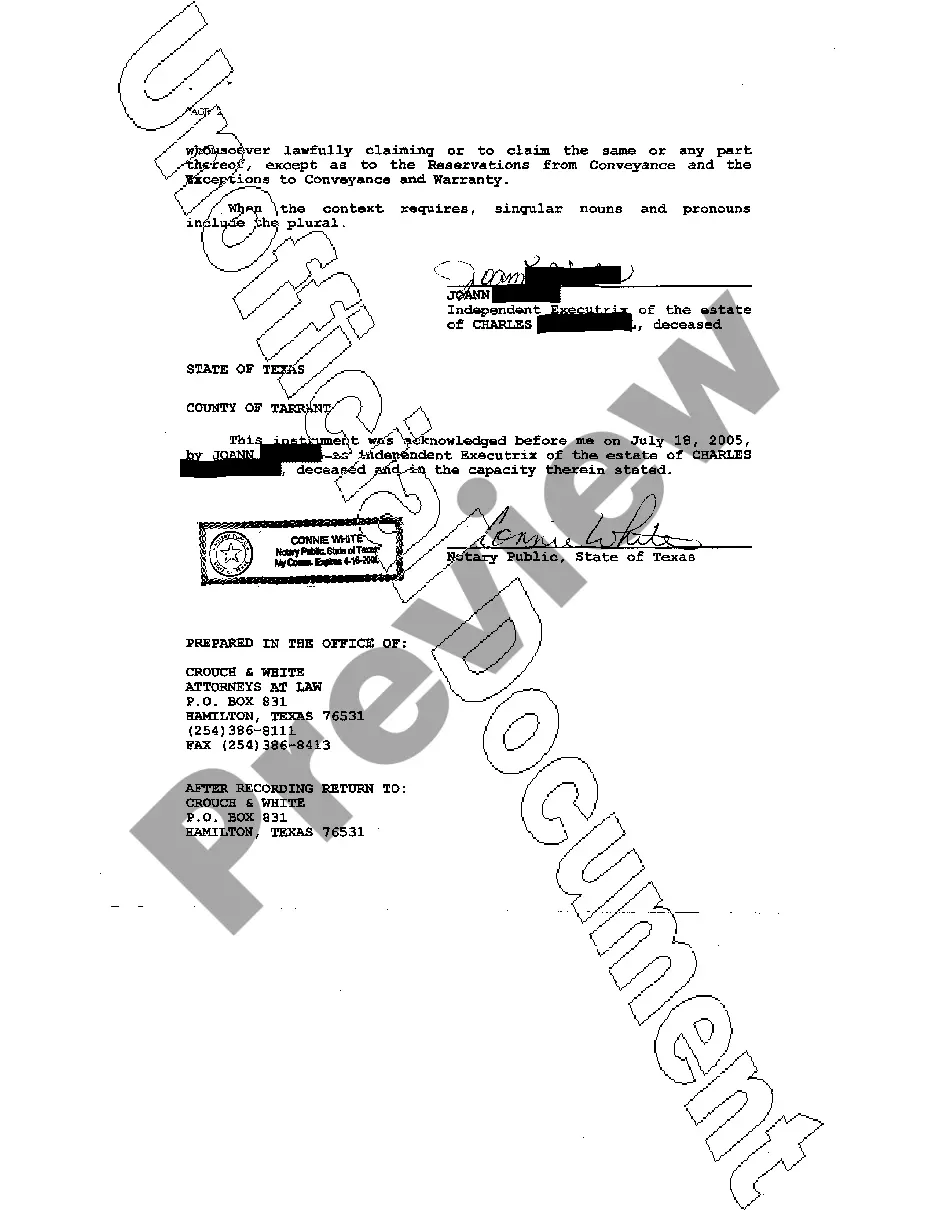

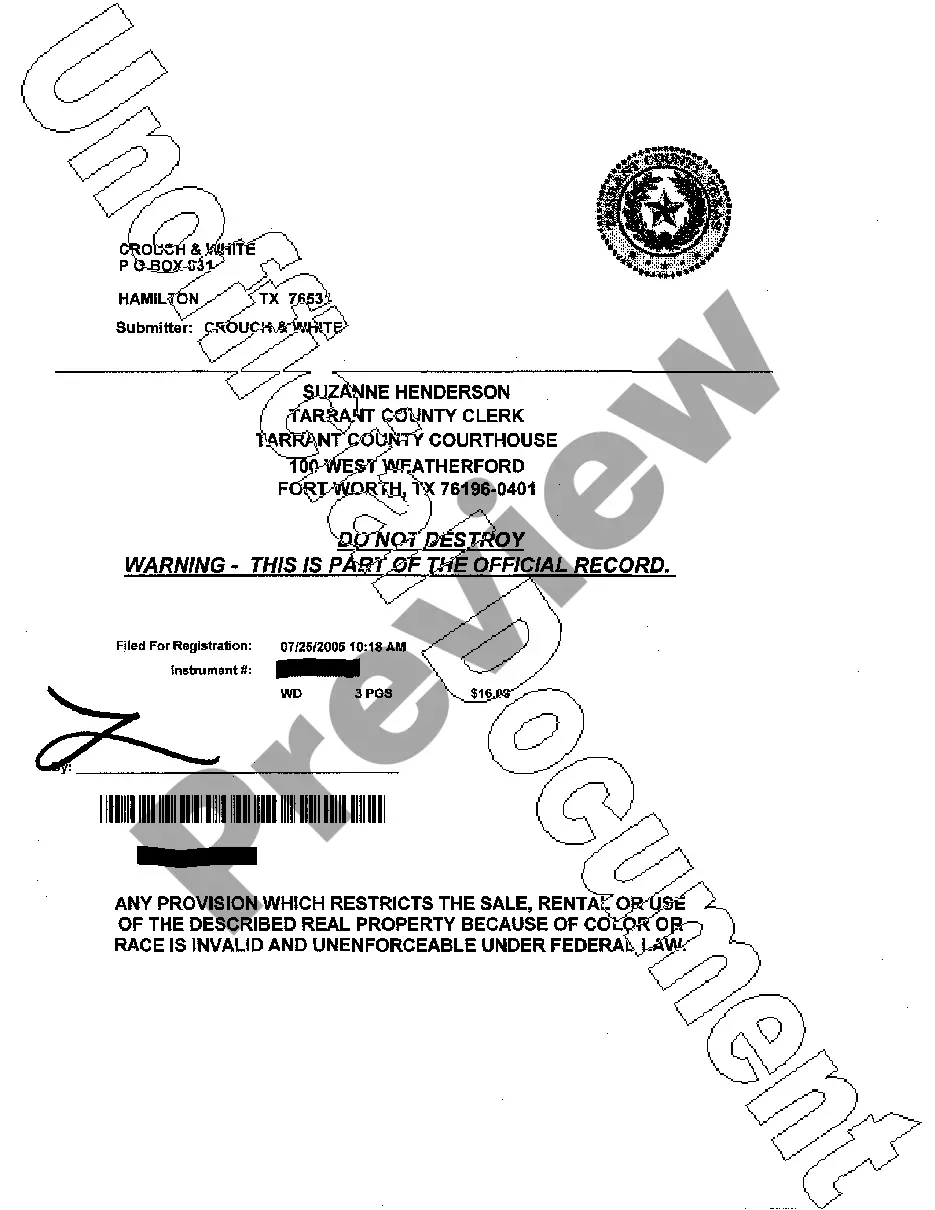

A San Antonio Texas Executor's Deed is a legal document that transfers real estate ownership from a deceased person's estate to the designated beneficiaries or heirs as determined by the deceased individual's will or by the laws of intestate succession. This deed serves as proof of the authority granted to the executor of the deceased person's estate, allowing them to sell or transfer the property to the rightful beneficiaries. The Executor's Deed is typically used when an executor, who is appointed by the probate court, needs to distribute property from the decedent's estate. It is important to note that an executor can only transfer property that is specifically mentioned in the decedent's will or included as part of the probate process. If the property is not subject to probate or not addressed in the will, alternative methods of transfer may be required. There are two main types of San Antonio Texas Executor's Deeds: 1. Executor's Deed with Full Authority: This type of deed grants the executor complete authority to sell, convey, and transfer the property without any limitations. It is commonly used when the deceased individual has left clear instructions in their will regarding the distribution of the property. 2. Executor's Deed with Limited Authority: In some cases, the court may issue an Executor's Deed with limited authority, providing restrictions on the executor's power to transfer the property. This may occur if there are legal disputes or concerns regarding the validity of the will or if certain beneficiaries contest the distribution of the property. The limitations placed on the executor's authority will be specified in the deed. To create a valid San Antonio Texas Executor's Deed, it is crucial to follow the legal requirements set forth by the state. These requirements include proper execution, notarization, and compliance with specific county recording regulations. It is highly recommended consulting with an experienced attorney familiar with probate laws and real estate transactions to ensure the correct preparation and recording of the Executor's Deed.

San Antonio Texas Executor's Deed

Description

How to fill out San Antonio Texas Executor's Deed?

If you are looking for a pertinent form template, it's incredibly challenging to discover a more user-friendly platform than the US Legal Forms site – one of the most extensive online repositories.

Here you can locate numerous templates for organizational and personal uses categorized by types and states, or keywords. With the high-quality search functionality, retrieving the most current San Antonio Texas Executor's Deed is as simple as 1-2-3.

Moreover, the relevance of each document is validated by a team of professional attorneys who consistently review the templates on our platform and refresh them according to the latest state and county regulations.

Acquire the template. Select the file format and store it on your device.

Modify the document. Complete, edit, print, and endorse the obtained San Antonio Texas Executor's Deed. Every template you save in your account is permanent and has no expiration date. You can access them via the My documents menu, so if you wish to have an extra copy for editing or printing, feel free to return and download it again anytime.

- If you already have knowledge about our platform and possess an account, all you need to do to obtain the San Antonio Texas Executor's Deed is to Log In to your account and click the Download option.

- If you are using US Legal Forms for the first time, simply follow the instructions below.

- Ensure you have opened the template you need. Review its description and utilize the Preview feature (if available) to examine its content. If it doesn't satisfy your needs, use the Search field at the top of the screen to find the suitable file.

- Confirm your selection. Opt for the Buy now option. Following that, choose your preferred subscription plan and provide details to create an account.

- Complete the payment. Use your credit card or PayPal account to finalize the registration process.

Form popularity

FAQ

The Transfer on Death Deed must: Be in writing, signed by the owner, and notarized, Have a legal description of the property (The description is found on the deed to the property or in the deed records.Have the name and address of one or more beneficiaries, State that the transfer will happen at the owner's death,

Lastly, it is important to remember that executor fees are considered income and are taxable. Being an executor is an important job and can be time-consuming. Most of the time, guidance from a probate attorney is necessary.

(a) An executor, administrator, or temporary administrator a court finds to have taken care of and managed an estate in compliance with the standards of this title is entitled to receive a five percent commission on all amounts that the executor or administrator actually receives or pays out in cash in the

For a simple estate, the entire probate process can be completed within six months. However, expect probate to go on for a year or more if the original will cannot be located or the will is contested.

The Will must give the executor the power to sell property; Letters Testamentary must be issued; and. The estate Inventory and Appraisal has been filed with the court.

In Texas, state and local court rules govern the various time periods that the executor must follow in probating a will. The general rule in Texas is that the executor has four years from the date of death of the testator (person who drafted the will) to file for probate.

The executor generally has three years after their appointment to distribute the remaining assets (after debts and disputes are resolved). The Texas probate process can be fairly simple in most cases.

What are the Executor Fees in Texas? According to the Estates Code, an executor in Texas is entitled to up to 5% of the estate's total financial transactions.

The executor is entitled to the following fee: on the gross value of assets in an estate: 3,5%; on income accrued and collected after death of the deceased: 6%

Executors must not unreasonably delay distributing the estate for their own gain or any other party. However, even after the executor's year, the court will not order a distribution of the estate if the executors can show there is good reason to wait.