Title: Beaumont Texas Release of State Tax Lien Filed in Error: Resolving Mistakenly Filed Tax Liens Introduction: Beaumont, Texas residents may occasionally encounter situations where a state tax lien is incorrectly filed against their property. Fortunately, solutions exist to rectify such errors and alleviate any potential financial burdens caused by the filing. This article will provide a detailed description of the Beaumont Texas Release of State Tax Lien Filed in Error process, its significance, and possible variations of this occurrence. 1. Understanding a Beaumont Texas Release of State Tax Lien Filed in Error: When a state tax lien is mistakenly filed against an individual or business within Beaumont, Texas, it can lead to complications, including restricted access to credit, property, and financial stability. However, through the Beaumont Texas Release of State Tax Lien Filed in Error process, affected parties can seek relief from the unwarranted lien. 2. The Importance of Resolving Incorrectly Filed Tax Liens: Clearing a wrongly filed tax lien is crucial for individuals and businesses within Beaumont, Texas, as it ensures that their assets are protected and their creditworthiness restored. By resolving an erroneously filed tax lien, individuals can avoid potential consequences, such as damage to their credit scores and legal complications. 3. Initiating the Release of State Tax Lien Filed in Error Process: To begin the process of rectifying a mistakenly filed tax lien in Beaumont, Texas, individuals or their legal representatives must contact the relevant state tax authority responsible for the error. They can guide you through the required steps to provide evidence and documentation to support the claim of an improper lien filing. 4. Common Variations of Beaumont Texas Release of State Tax Lien Filed in Error: There can be various circumstances under which a tax lien may be mistakenly filed, leading to variations in the resolution process. Some potential types of Beaumont Texas Release of State Tax Lien Filed in Error include: a) Clerical Errors: These occur when a state tax authority unintentionally inputs incorrect information or files a lien against the wrong taxpayer. b) Timing Errors: Mistaken filings can stem from discrepancies in timing, such as the submission of a lien after a tax bill has been paid or when the taxpayer is in bankruptcy, and the lien should have been stayed or discharged. c) Identity Errors: State tax authorities may mistakenly file a lien against an individual or business in Beaumont with a similar name, leading to unjustified encumbrances. 5. Seeking Professional Assistance: If you find yourself navigating the Beaumont Texas Release of State Tax Lien Filed in Error process and encounter challenges, it may be beneficial to seek professional guidance from tax attorneys, accountants, or relevant legal experts. These professionals possess the knowledge and experience necessary to effectively advocate for your rights and rectify the filing error efficiently. Conclusion: A Beaumont Texas Release of State Tax Lien Filed in Error situation can bring undue stress and financial troubles. However, by understanding the importance of resolving the issue and following the appropriate steps, individuals and businesses can seek relief from mistakenly filed tax liens and protect their financial well-being. Promptly addressing such errors is crucial to avoid any potential legal complications or damage to credit scores.

Beaumont Texas Release of State Tax Lien Filed in Error

Description

How to fill out Beaumont Texas Release Of State Tax Lien Filed In Error?

Getting verified templates specific to your local laws can be difficult unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both individual and professional needs and any real-life situations. All the documents are properly grouped by area of usage and jurisdiction areas, so searching for the Beaumont Texas Release of State Tax Lien Filed in Error becomes as quick and easy as ABC.

For everyone already familiar with our catalogue and has used it before, obtaining the Beaumont Texas Release of State Tax Lien Filed in Error takes just a couple of clicks. All you need to do is log in to your account, select the document, and click Download to save it on your device. The process will take just a couple of additional steps to make for new users.

Adhere to the guidelines below to get started with the most extensive online form library:

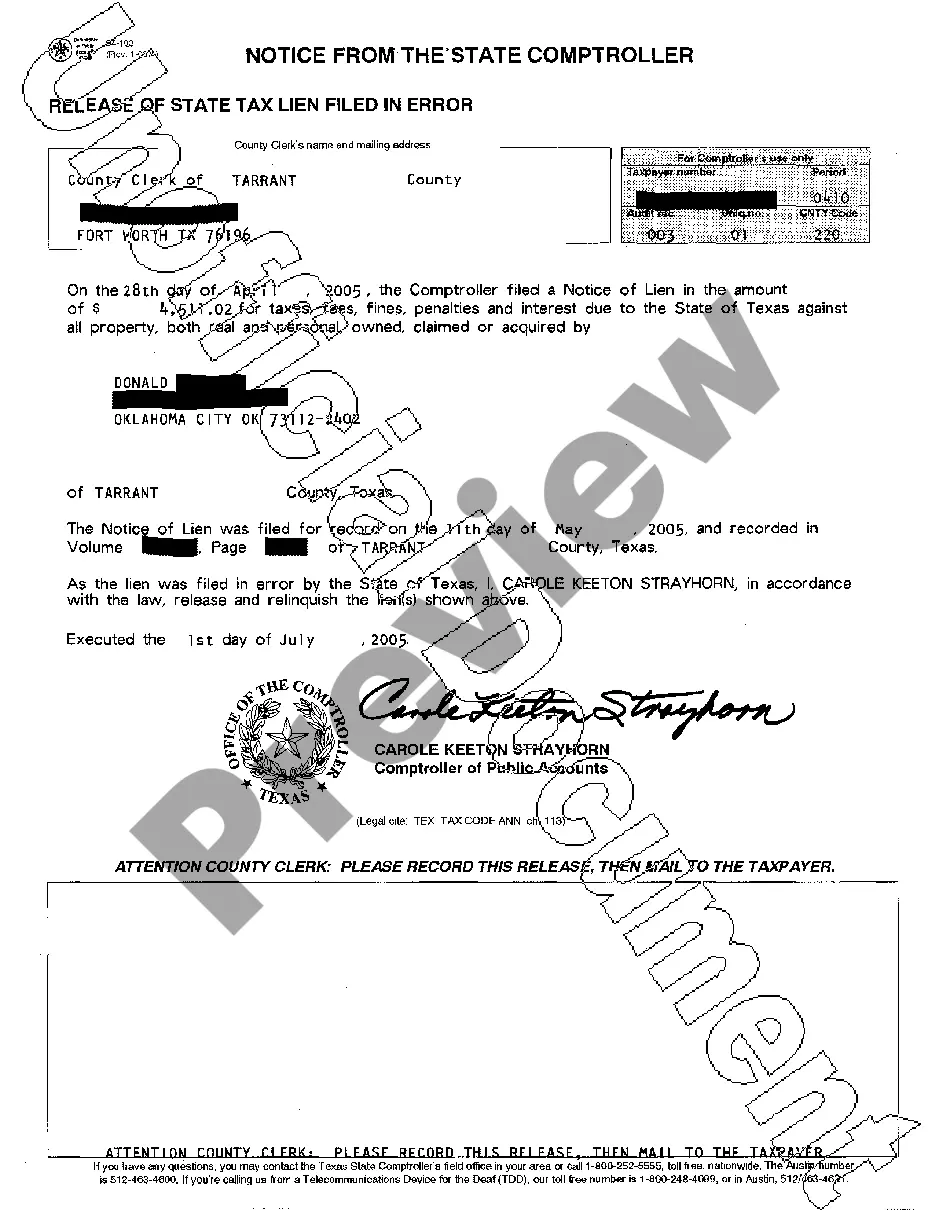

- Check the Preview mode and form description. Make sure you’ve picked the right one that meets your requirements and fully corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you find any inconsistency, use the Search tab above to obtain the correct one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and choose the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the service.

- Download the Beaumont Texas Release of State Tax Lien Filed in Error. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Take advantage of the US Legal Forms library to always have essential document templates for any needs just at your hand!