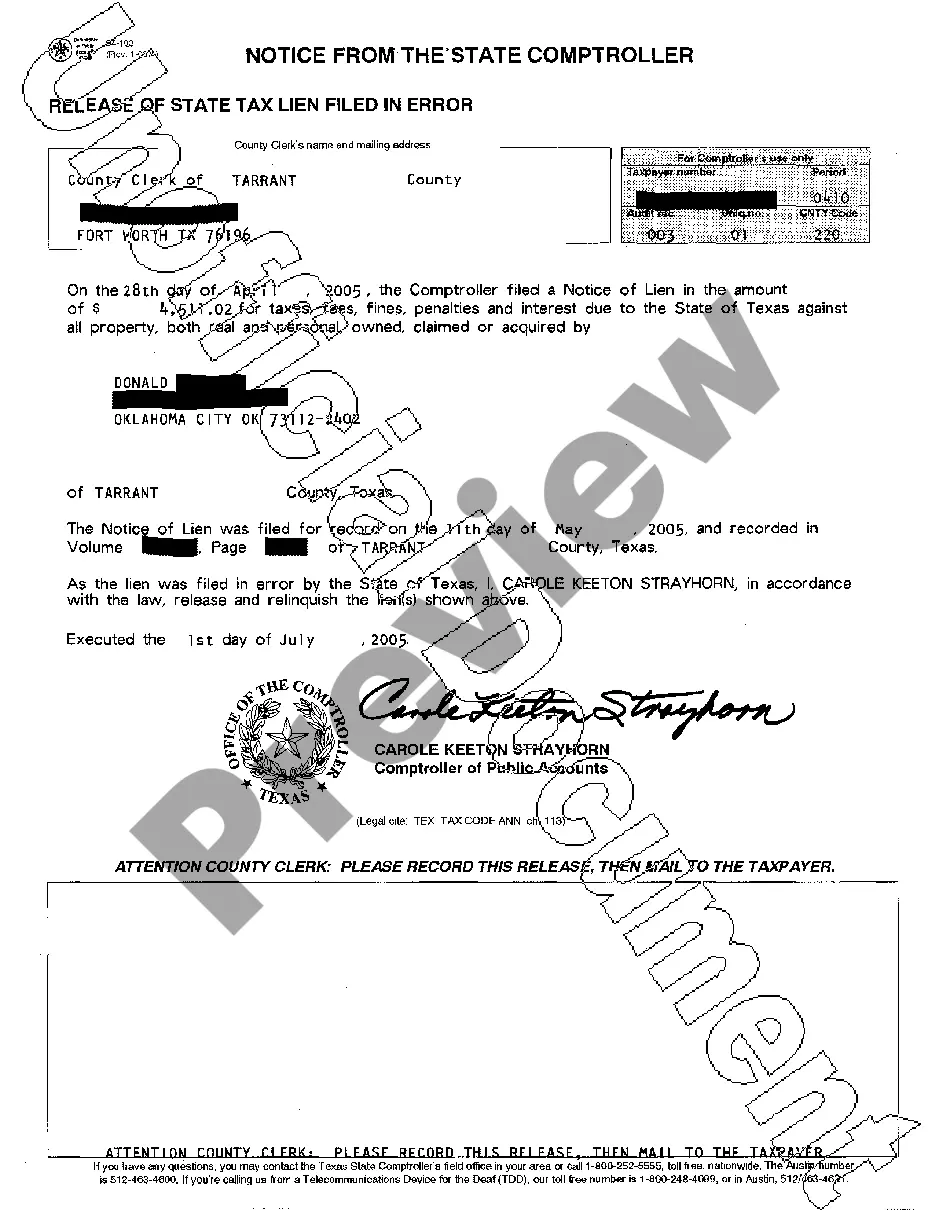

Title: Understanding the Process of Brownsville Texas Release of State Tax Lien Filed in Error Keywords: Brownsville Texas, release of state tax lien, filed in error Introduction: In Brownsville, Texas, individuals and businesses that have experienced an erroneous imposition of a state tax lien can seek a release by following specific procedures. This article provides a detailed description of the process and highlights the different types of Brownsville Texas release of state tax lien filed in error. 1. Brownsville Texas Release of State Tax Lien Filed in Error Explained: When a state tax lien is mistakenly filed against your property in Brownsville, Texas, you have the right to request a release. This process corrects an error that may have occurred due to misunderstandings, administrative errors, or any other genuine mistake made by the state's tax authority in filing the lien. 2. Types of Brownsville Texas Release of State Tax Lien Filed in Error: a) Incorrect Property Identification: In some cases, the state tax lien is filed against the wrong property due to address or parcel identification errors. Such errors may result from clerical mistakes or outdated property records. If a lien is filed against a property that does not belong to you, you can request its release by providing evidence supporting the claim. b) Paid Liens or Overpayments: Occasionally, a lien is mistakenly filed despite the underlying taxes being paid or overpaid. This could be due to delays in record updates or miscommunications between the taxpayer and the tax authority. In such cases, you can request a release by furnishing proof of payment or overpayment. c) Statute of Limitations Expired: When the state tax authority files a lien after the expiration of the applicable statute of limitations, it can be considered an error. Tax authorities must adhere to specific time limits for filing liens, and exceeding these limits can render the lien invalid. To seek a release in such cases, you need to demonstrate that the filing was made beyond the legally permitted time frame. 3. Process for Requesting Release of State Tax Lien Filed in Error: a) Gather Documentation: Assemble all relevant documents, such as tax payment receipts, property ownership records, correspondence with the tax authority, and any evidence supporting your case. b) Contact the State Tax Authority: Initiate contact with the appropriate state tax authority in Brownsville, Texas, responsible for the filing of the lien. Notify them of the error and provide any evidence you have gathered to support your claim. c) Submitting Request: Fill out the necessary release request form (if provided) or draft a written request outlining the error and supporting documentation. Ensure all required information is included and submit it to the tax authority by mail, email, or online portal, as per their instructions. d) Follow-Up: After submitting the release request, follow up with the tax authority to ensure that your request is being processed. Maintain regular communication to keep track of the progress and address any additional requirements promptly. Conclusion: The Brownsville Texas release of state tax lien filed in error provides individuals and businesses affected by erroneous tax liens with a mechanism to seek relief. By understanding the process and the different types of errors, individuals and businesses can take appropriate steps to rectify the situation and safeguard their assets from unwarranted encumbrances.

Brownsville Texas Release of State Tax Lien Filed in Error

Description

How to fill out Brownsville Texas Release Of State Tax Lien Filed In Error?

Do you need a trustworthy and affordable legal forms provider to buy the Brownsville Texas Release of State Tax Lien Filed in Error? US Legal Forms is your go-to option.

No matter if you require a simple arrangement to set rules for cohabitating with your partner or a package of forms to move your divorce through the court, we got you covered. Our website offers more than 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t universal and frameworked based on the requirements of separate state and area.

To download the document, you need to log in account, locate the required template, and hit the Download button next to it. Please take into account that you can download your previously purchased document templates at any time in the My Forms tab.

Is the first time you visit our website? No worries. You can create an account in minutes, but before that, make sure to do the following:

- Find out if the Brownsville Texas Release of State Tax Lien Filed in Error conforms to the laws of your state and local area.

- Go through the form’s description (if available) to learn who and what the document is good for.

- Restart the search in case the template isn’t suitable for your specific situation.

Now you can register your account. Then choose the subscription option and proceed to payment. Once the payment is done, download the Brownsville Texas Release of State Tax Lien Filed in Error in any available file format. You can get back to the website at any time and redownload the document without any extra costs.

Getting up-to-date legal forms has never been easier. Give US Legal Forms a go now, and forget about spending hours researching legal paperwork online once and for all.