College Station, Texas Release of State Tax Lien Filed in Error: A Comprehensive Overview A Release of State Tax Lien Filed in Error in College Station, Texas refers to the process of rectifying an erroneous filing of a state tax lien on a property or individual. This occurrence may arise due to various reasons, such as clerical errors, misunderstandings, or invalid tax assessments. The release is crucial to clear the affected party from the burden of an incorrect tax lien and restore their financial standing. When a State Tax Lien is mistakenly filed in College Station, Texas, it can have serious consequences for the property owner or individual. This erroneous lien creates a cloud on the title, negatively impacting the affected party's ability to sell, refinance, or transfer the property. Additionally, it damages their creditworthiness and financial reputation, leading to challenges in obtaining loans or credit. To rectify this error, the Texas Comptroller's Office and the College Station Tax Assessor-Collector collaborate to process the Release of State Tax Lien. Depending on the circumstances, there may be different types of Releases of State Tax Lien in College Station, Texas, each with its own specific requirements. These releases could include: 1. Release of State Tax Lien Filed in Error — Incorrect Identifier: This release type is applicable when an incorrect legal description, address, or property identification number is used when filing the state tax lien. The affected party must provide ample evidence and documentation to prove the mistaken identity and request the release. 2. Release of State Tax Lien Filed in Error — Incorrect Assessment: If the state tax lien was filed based on an incorrect assessment or calculation of owed taxes, the affected party can apply for this release. They must diligently gather proof of the miscalculation or inaccurate tax determination, such as payment records, receipts, or legal documentation. 3. Release of State Tax Lien Filed in Error — Administrative Mistake: In cases where the lien was filed due to an administrative error, such as a typo or data entry mistake, this release type is pursued. The affected party needs to collaborate with the Texas Comptroller's Office or the College Station Tax Assessor-Collector to rectify the mistake by providing convincing evidence of the error. It is essential to note that the process of obtaining a Release of State Tax Lien Filed in Error in College Station, Texas can be intricate and time-consuming. The affected party must follow specific procedures, including submitting a formal request, providing supporting documents, and potentially attending hearings or meetings to present their case. Engaging an experienced tax attorney or legal professional familiar with College Station's tax laws may be immensely helpful during this process. In conclusion, a Release of State Tax Lien Filed in Error is a critical step for individuals in College Station, Texas, who have erroneously had a state tax lien placed on their properties or themselves. By promptly taking action and following the correct procedures, it is possible to rectify the error, restore one's financial standing, and prevent negative consequences such as credit issues and hindered property transactions.

College Station Texas Release of State Tax Lien Filed in Error

Description

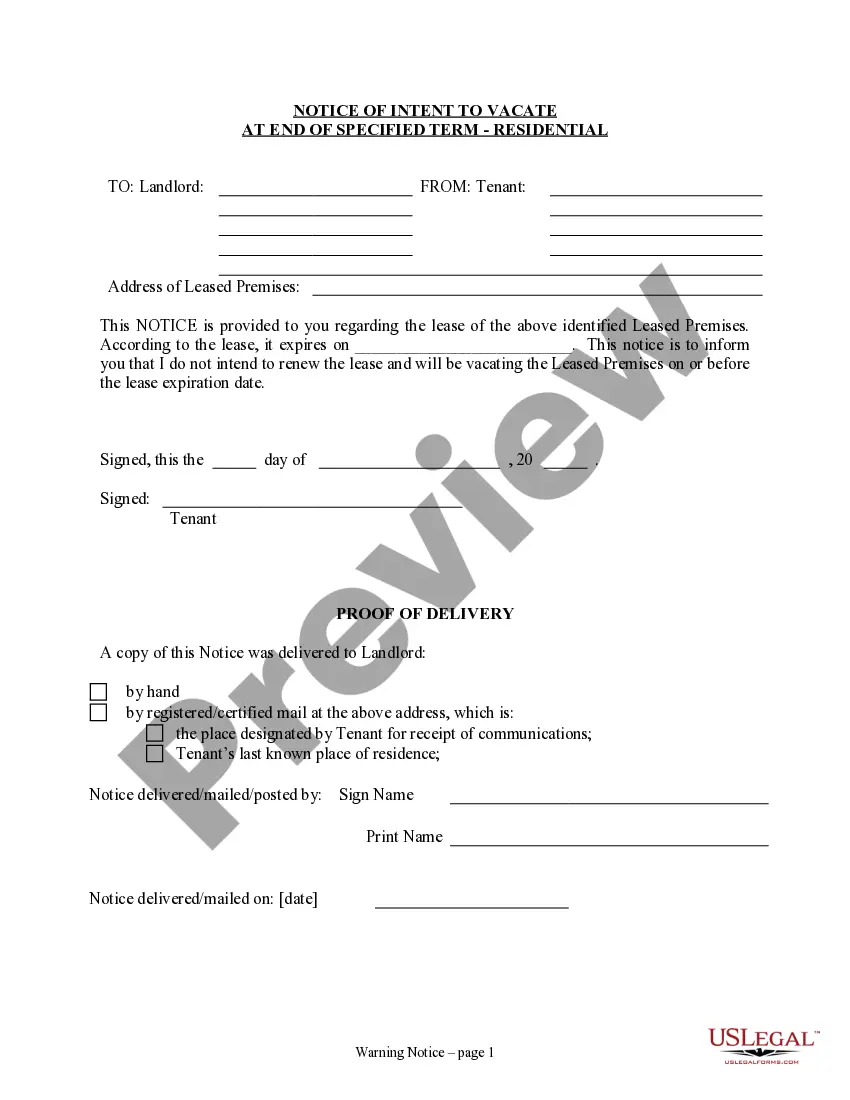

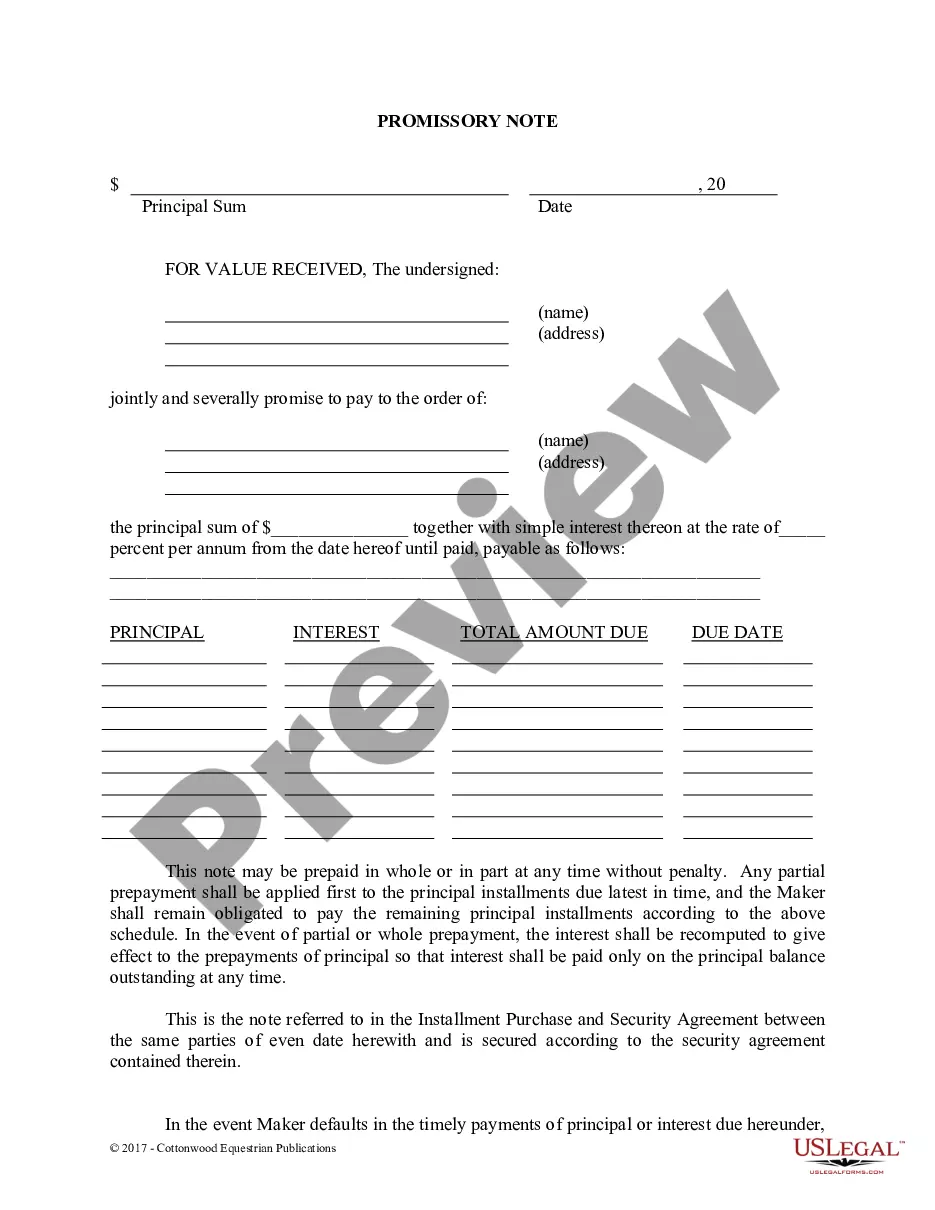

How to fill out College Station Texas Release Of State Tax Lien Filed In Error?

We always want to minimize or avoid legal issues when dealing with nuanced legal or financial affairs. To accomplish this, we apply for legal services that, as a rule, are extremely costly. However, not all legal issues are equally complex. Most of them can be dealt with by ourselves.

US Legal Forms is an online catalog of updated DIY legal forms covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your affairs into your own hands without using services of a lawyer. We provide access to legal document templates that aren’t always openly available. Our templates are state- and area-specific, which considerably facilitates the search process.

Take advantage of US Legal Forms whenever you need to find and download the College Station Texas Release of State Tax Lien Filed in Error or any other document quickly and safely. Simply log in to your account and click the Get button next to it. In case you lose the document, you can always download it again in the My Forms tab.

The process is equally effortless if you’re unfamiliar with the platform! You can create your account in a matter of minutes.

- Make sure to check if the College Station Texas Release of State Tax Lien Filed in Error adheres to the laws and regulations of your your state and area.

- Also, it’s crucial that you go through the form’s outline (if available), and if you spot any discrepancies with what you were looking for in the first place, search for a different form.

- As soon as you’ve ensured that the College Station Texas Release of State Tax Lien Filed in Error is suitable for you, you can select the subscription option and make a payment.

- Then you can download the document in any available format.

For more than 24 years of our existence, we’ve served millions of people by offering ready to customize and up-to-date legal forms. Take advantage of US Legal Forms now to save efforts and resources!