Dallas Texas Release of State Tax Lien Filed in Error is a legal process that allows taxpayers in Dallas, Texas, to rectify an incorrectly filed state tax lien. A state tax lien is a legal claim filed by the state government against a taxpayer's property or assets when they fail to pay their state taxes. However, errors in the filing process can sometimes occur, and the release process helps taxpayers resolve these mistakes and clear their records. The Dallas Texas Release of State Tax Lien Filed in Error is crucial for taxpayers who have been wrongly burdened with a tax lien, as it can have severe financial repercussions and negatively impact their creditworthiness. By resolving the error, individuals can reinstate their financial standing and prevent potential issues such as foreclosure or seizure of assets. There are different types of Dallas Texas Release of State Tax Lien Filed in Error, including: 1. Factual error release: This occurs when the state tax lien was filed based on incorrect information or a factual mistake. For example, the lien might have been filed against the wrong taxpayer or property. In such cases, taxpayers have the right to present evidence and request the release of the lien due to the error. 2. Procedural error release: This type of release happens when there were errors in the filing process itself. It could be that the state did not follow the correct legal procedures or failed to notify the taxpayer properly. Proving a procedural error is grounds for requesting the release of the tax lien. 3. Release due to payment resolution: Occasionally, a state tax lien may be filed in error if the taxpayer has already paid the outstanding amount or entered into an agreement for payment with the state tax authorities. In such cases, taxpayers can provide evidence of payment or payment plans and request the release of the lien. To initiate the Dallas Texas Release of State Tax Lien Filed in Error, taxpayers should contact the appropriate state tax agency or consult with a qualified tax attorney who specializes in tax lien matters. They can guide individuals through the necessary procedures, help gather evidence, and facilitate communication with the state tax authorities. Resolving an erroneously filed tax lien may involve filing a formal request for release, providing documentation to support the claim, attending hearings if required, and actively addressing the issue until it is resolved. Overall, the Dallas Texas Release of State Tax Lien Filed in Error is a crucial process for taxpayers to rectify inaccurately filed state tax liens that may have negative implications on their financial standing and creditworthiness. By addressing these errors promptly and effectively, individuals can alleviate unnecessary burdens and regain their financial stability.

Dallas Texas Release of State Tax Lien Filed in Error

Description

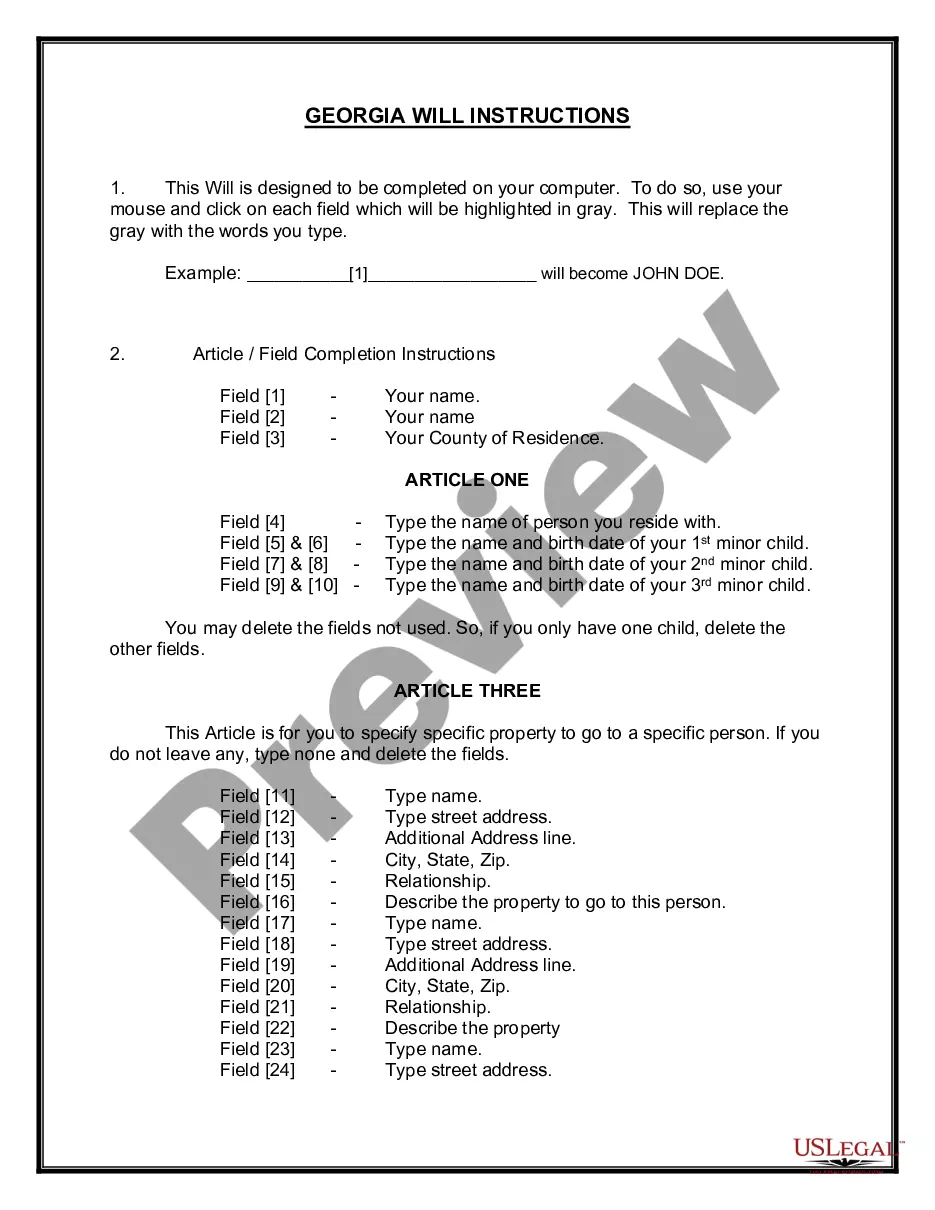

How to fill out Dallas Texas Release Of State Tax Lien Filed In Error?

We always strive to reduce or prevent legal damage when dealing with nuanced law-related or financial matters. To do so, we sign up for legal services that, usually, are extremely expensive. However, not all legal issues are as just complex. Most of them can be dealt with by ourselves.

US Legal Forms is a web-based catalog of up-to-date DIY legal forms addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your matters into your own hands without using services of legal counsel. We offer access to legal form templates that aren’t always openly available. Our templates are state- and area-specific, which significantly facilitates the search process.

Benefit from US Legal Forms whenever you need to get and download the Dallas Texas Release of State Tax Lien Filed in Error or any other form quickly and securely. Simply log in to your account and click the Get button next to it. In case you lose the document, you can always download it again from within the My Forms tab.

The process is equally easy if you’re unfamiliar with the platform! You can register your account within minutes.

- Make sure to check if the Dallas Texas Release of State Tax Lien Filed in Error complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you check out the form’s outline (if provided), and if you spot any discrepancies with what you were looking for in the first place, search for a different template.

- As soon as you’ve ensured that the Dallas Texas Release of State Tax Lien Filed in Error would work for you, you can choose the subscription option and make a payment.

- Then you can download the document in any suitable format.

For more than 24 years of our existence, we’ve served millions of people by providing ready to customize and up-to-date legal forms. Make the most of US Legal Forms now to save time and resources!