In Fort Worth, Texas, a Release of State Tax Lien Filed in Error refers to the process of correcting a mistake made by the state authorities in filing a tax lien against a taxpayer. When a state agency mistakenly files a tax lien against a taxpayer's property or assets, a Release of State Tax Lien Filed in Error is issued to rectify the error. This allows the taxpayer to clear their record from an unjust lien and remove any negative consequences associated with it. A Release of State Tax Lien Filed in Error can take various forms, depending on the nature of the error and specific circumstances. Some common types of Release of State Tax Lien Filed in Error in Fort Worth, Texas include: 1. Administrative Error Release: This type of release is issued when the state tax authorities admit to making an administrative mistake in filing a tax lien. It could be a result of a clerical error, miscommunication, or inaccurate information on the taxpayer's record. 2. Identity Theft Release: When a taxpayer falls victim to identity theft and unauthorized individuals falsely use their identity to commit tax fraud, the state tax authorities may inadvertently file a tax lien against the innocent taxpayer. A Release of State Tax Lien Filed in Error is then issued once the taxpayer proves their identity theft claim, clearing their record from any liability. 3. Factual Error Release: If the state tax authorities make a factual mistake, such as incorrectly calculating tax amounts or misapplying tax laws, a Release of State Tax Lien Filed in Error may be issued. This corrects the inaccuracies and grants relief to the taxpayer. To initiate the process for a Release of State Tax Lien Filed in Error in Fort Worth, Texas, the taxpayer must contact the appropriate state agency responsible for tax lien filings. They will need to present evidence or proof of the error, such as documented communication, identity theft reports, or legal documentation. The agency will review the case and determine the appropriate action to rectify the mistake. Overall, a Release of State Tax Lien Filed in Error in Fort Worth, Texas, is a legal tool used to correct mistakes made by state tax authorities in filing tax liens against taxpayers. It ensures that taxpayers are not unfairly burdened with tax liabilities or negative consequences resulting from erroneous tax lien filings.

Fort Worth Texas Release of State Tax Lien Filed in Error

Category:

State:

Texas

City:

Fort Worth

Control #:

TX-JW-0163

Format:

PDF

Instant download

This form is available by subscription

Description

Release of State Tax Lien Filed in Error

In Fort Worth, Texas, a Release of State Tax Lien Filed in Error refers to the process of correcting a mistake made by the state authorities in filing a tax lien against a taxpayer. When a state agency mistakenly files a tax lien against a taxpayer's property or assets, a Release of State Tax Lien Filed in Error is issued to rectify the error. This allows the taxpayer to clear their record from an unjust lien and remove any negative consequences associated with it. A Release of State Tax Lien Filed in Error can take various forms, depending on the nature of the error and specific circumstances. Some common types of Release of State Tax Lien Filed in Error in Fort Worth, Texas include: 1. Administrative Error Release: This type of release is issued when the state tax authorities admit to making an administrative mistake in filing a tax lien. It could be a result of a clerical error, miscommunication, or inaccurate information on the taxpayer's record. 2. Identity Theft Release: When a taxpayer falls victim to identity theft and unauthorized individuals falsely use their identity to commit tax fraud, the state tax authorities may inadvertently file a tax lien against the innocent taxpayer. A Release of State Tax Lien Filed in Error is then issued once the taxpayer proves their identity theft claim, clearing their record from any liability. 3. Factual Error Release: If the state tax authorities make a factual mistake, such as incorrectly calculating tax amounts or misapplying tax laws, a Release of State Tax Lien Filed in Error may be issued. This corrects the inaccuracies and grants relief to the taxpayer. To initiate the process for a Release of State Tax Lien Filed in Error in Fort Worth, Texas, the taxpayer must contact the appropriate state agency responsible for tax lien filings. They will need to present evidence or proof of the error, such as documented communication, identity theft reports, or legal documentation. The agency will review the case and determine the appropriate action to rectify the mistake. Overall, a Release of State Tax Lien Filed in Error in Fort Worth, Texas, is a legal tool used to correct mistakes made by state tax authorities in filing tax liens against taxpayers. It ensures that taxpayers are not unfairly burdened with tax liabilities or negative consequences resulting from erroneous tax lien filings.

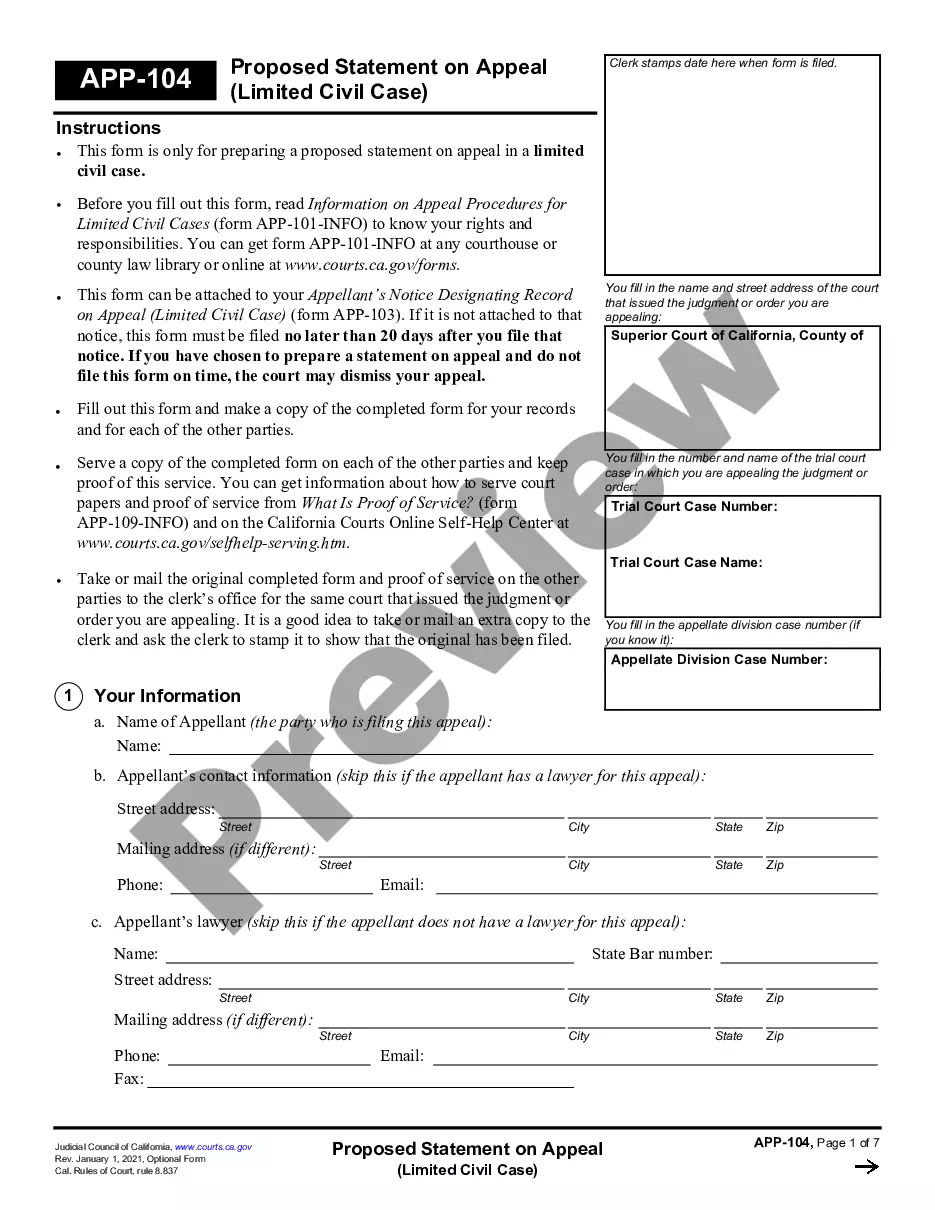

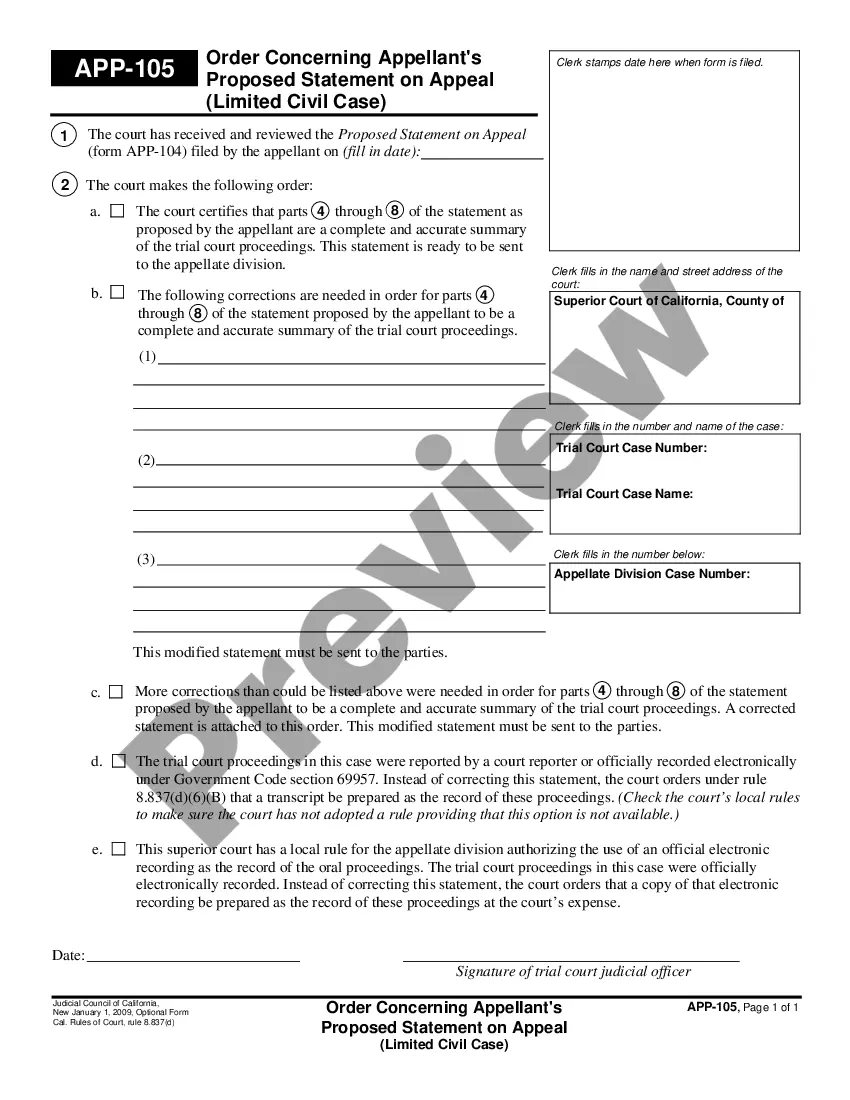

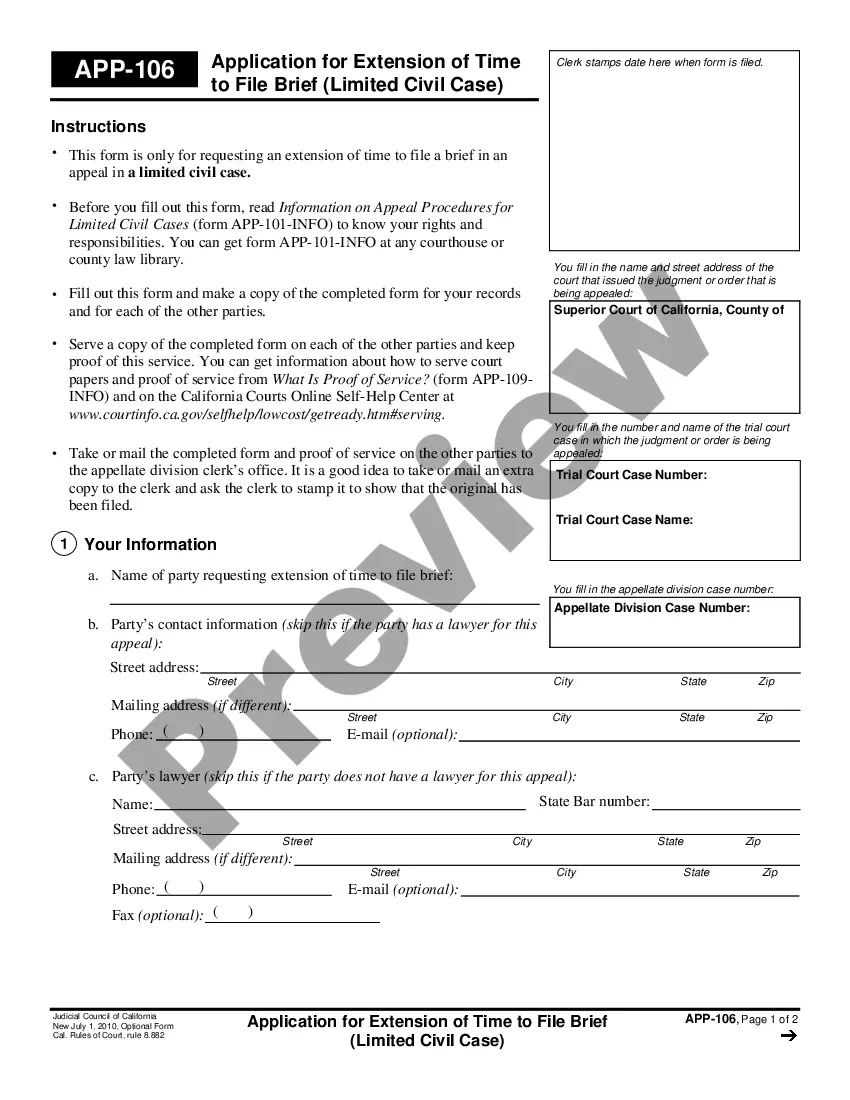

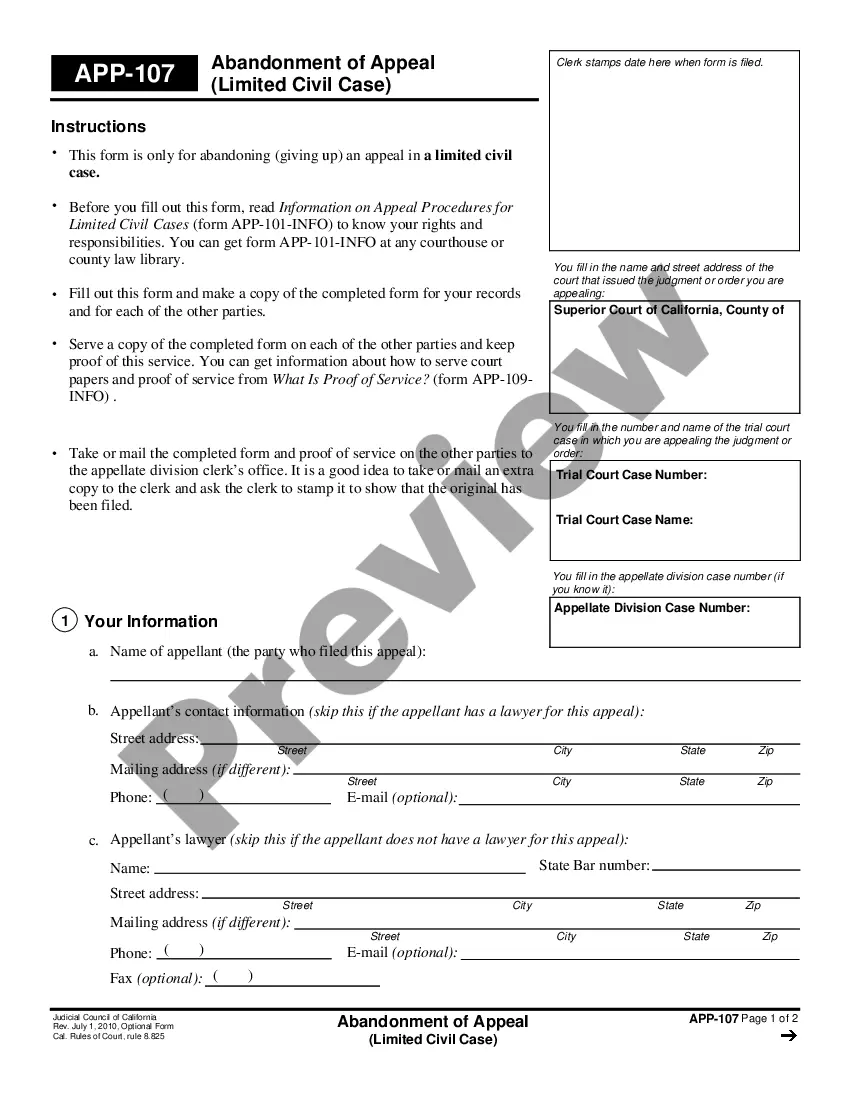

Free preview

How to fill out Fort Worth Texas Release Of State Tax Lien Filed In Error?

If you are in search of an appropriate document, it’s exceedingly challenging to discover a more suitable service than the US Legal Forms site – arguably the most extensive online collections.

With this collection, you can locate a vast array of document templates for commercial and personal uses by categories and states, or keywords.

With the sophisticated search functionality, obtaining the latest Fort Worth Texas Release of State Tax Lien Filed in Error is as straightforward as 1-2-3.

Complete the transaction. Use your credit card or PayPal account to finalize the registration process.

Obtain the document. Choose the file format and save it to your device.

- Furthermore, the pertinence of each entry is verified by a team of professional lawyers who frequently review the templates on our site and update them in accordance with the most recent state and county laws.

- If you are already familiar with our platform and possess an account, all you have to do to obtain the Fort Worth Texas Release of State Tax Lien Filed in Error is to sign in to your profile and select the Download option.

- If you are using US Legal Forms for the first time, simply refer to the instructions below.

- Ensure you have located the document you desire. Review its description and utilize the Preview feature to examine its contents. If it doesn’t meet your requirements, use the Search option at the top of the page to find the necessary entry.

- Confirm your choice. Select the Buy now option. After that, choose your preferred pricing plan and provide information to create an account.