The Houston Texas Release of State Tax Lien Filed in Error is a legal process that involves the removal or cancellation of a state tax lien that was filed mistakenly. Here, the state tax agency recognizes its error and takes the necessary steps to rectify it, ensuring that the lien is released. This allows individuals or businesses to regain their financial freedom by no longer having the burden of the tax lien on their property or assets. Keywords: Houston Texas, Release, State Tax Lien, Filed in Error, legal process, removal, cancellation, state tax agency, rectify, financial freedom, burden, property, assets. Different types of Houston Texas Release of State Tax Lien Filed in Error may include: 1. Individual Tax Lien Release: This occurs when the state tax agency acknowledges that a tax lien was mistakenly filed against an individual taxpayer and takes appropriate measures to release the lien. 2. Business Tax Lien Release: In this case, a tax lien wrongly filed against a business entity is resolved by the state tax agency, ensuring the release of the lien and relieving the business from any associated financial constraints. 3. Property Tax Lien Release: When a property tax lien is filed in error, property owners in Houston Texas can pursue the release of the lien through the proper legal channels, resulting in the elimination of the lien and the restoration of their property's value and marketability. 4. Asset Tax Lien Release: This refers to the release of a tax lien filed mistakenly against certain assets, such as vehicles, real estate, or personal property. The state tax agency acknowledges the error and takes steps to release the lien, allowing individuals or businesses to retain full control over their assets. Overall, the Houston Texas Release of State Tax Lien Filed in Error is a crucial process for individuals and businesses who have been burdened with an unjust tax lien. By utilizing the appropriate legal means and working closely with the state tax agency, taxpayers can correct the filing error and enjoy the freedom and peace of mind that comes with the release of the tax lien.

Houston Texas Release of State Tax Lien Filed in Error

Description

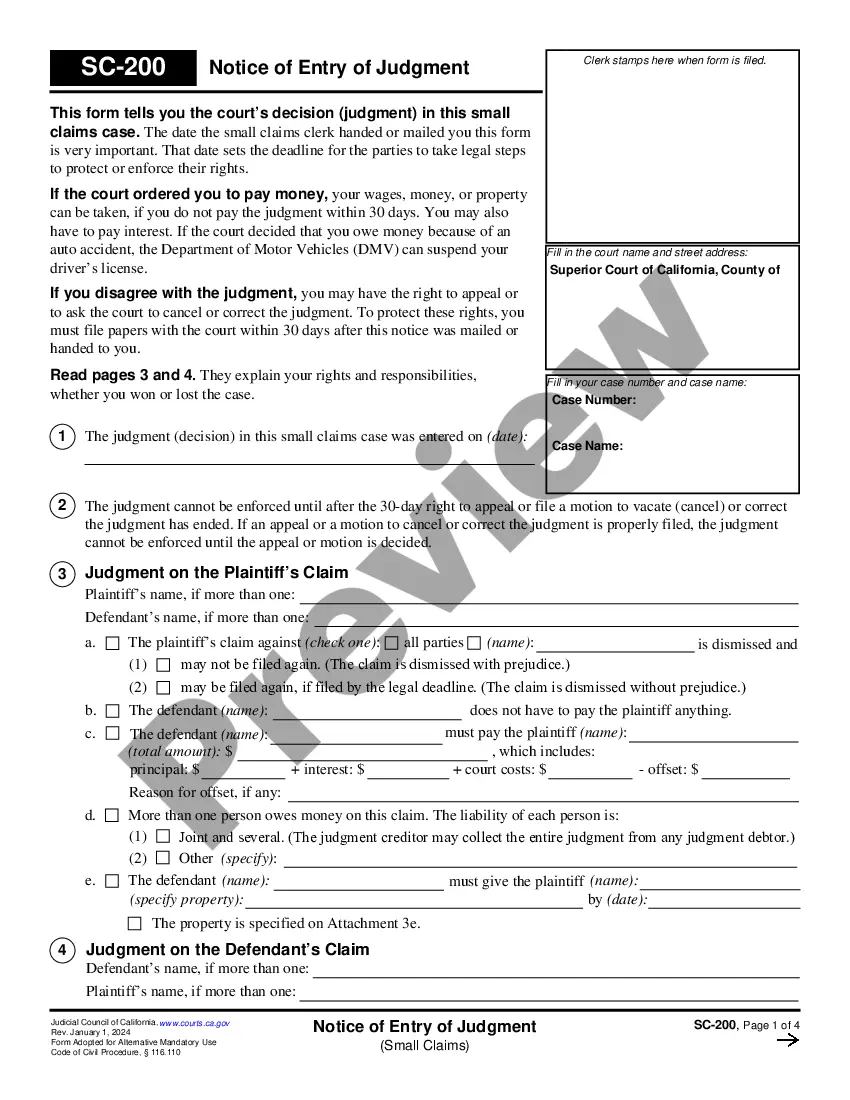

How to fill out Houston Texas Release Of State Tax Lien Filed In Error?

Do you need a trustworthy and inexpensive legal forms supplier to buy the Houston Texas Release of State Tax Lien Filed in Error? US Legal Forms is your go-to choice.

Whether you require a basic agreement to set rules for cohabitating with your partner or a package of forms to advance your divorce through the court, we got you covered. Our website provides more than 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t universal and framed in accordance with the requirements of specific state and county.

To download the document, you need to log in account, locate the required template, and click the Download button next to it. Please remember that you can download your previously purchased document templates anytime in the My Forms tab.

Is the first time you visit our website? No worries. You can create an account with swift ease, but before that, make sure to do the following:

- Check if the Houston Texas Release of State Tax Lien Filed in Error conforms to the regulations of your state and local area.

- Read the form’s details (if provided) to find out who and what the document is good for.

- Start the search over in case the template isn’t suitable for your legal scenario.

Now you can register your account. Then choose the subscription option and proceed to payment. Once the payment is done, download the Houston Texas Release of State Tax Lien Filed in Error in any provided file format. You can return to the website at any time and redownload the document free of charge.

Finding up-to-date legal forms has never been easier. Give US Legal Forms a try today, and forget about spending your valuable time learning about legal papers online once and for all.