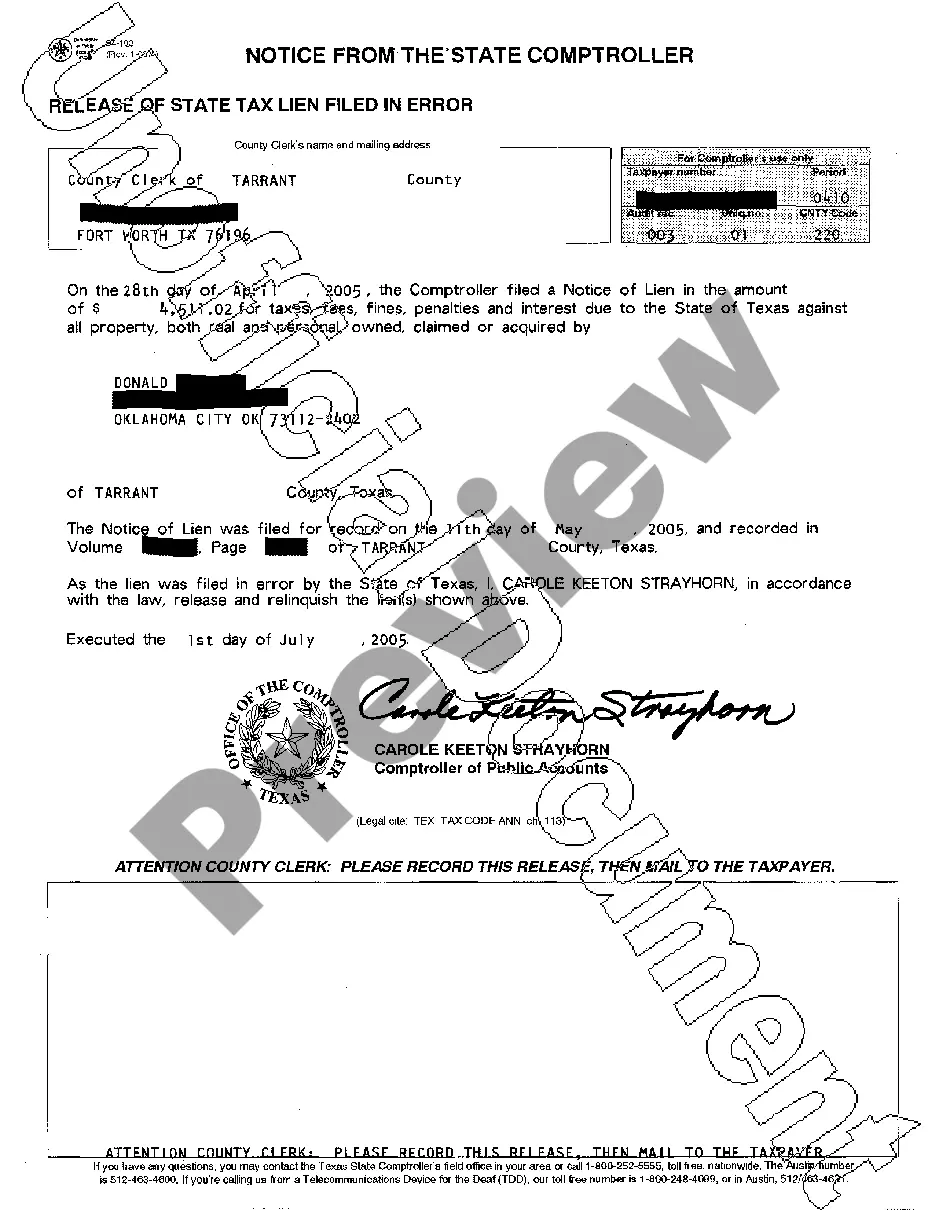

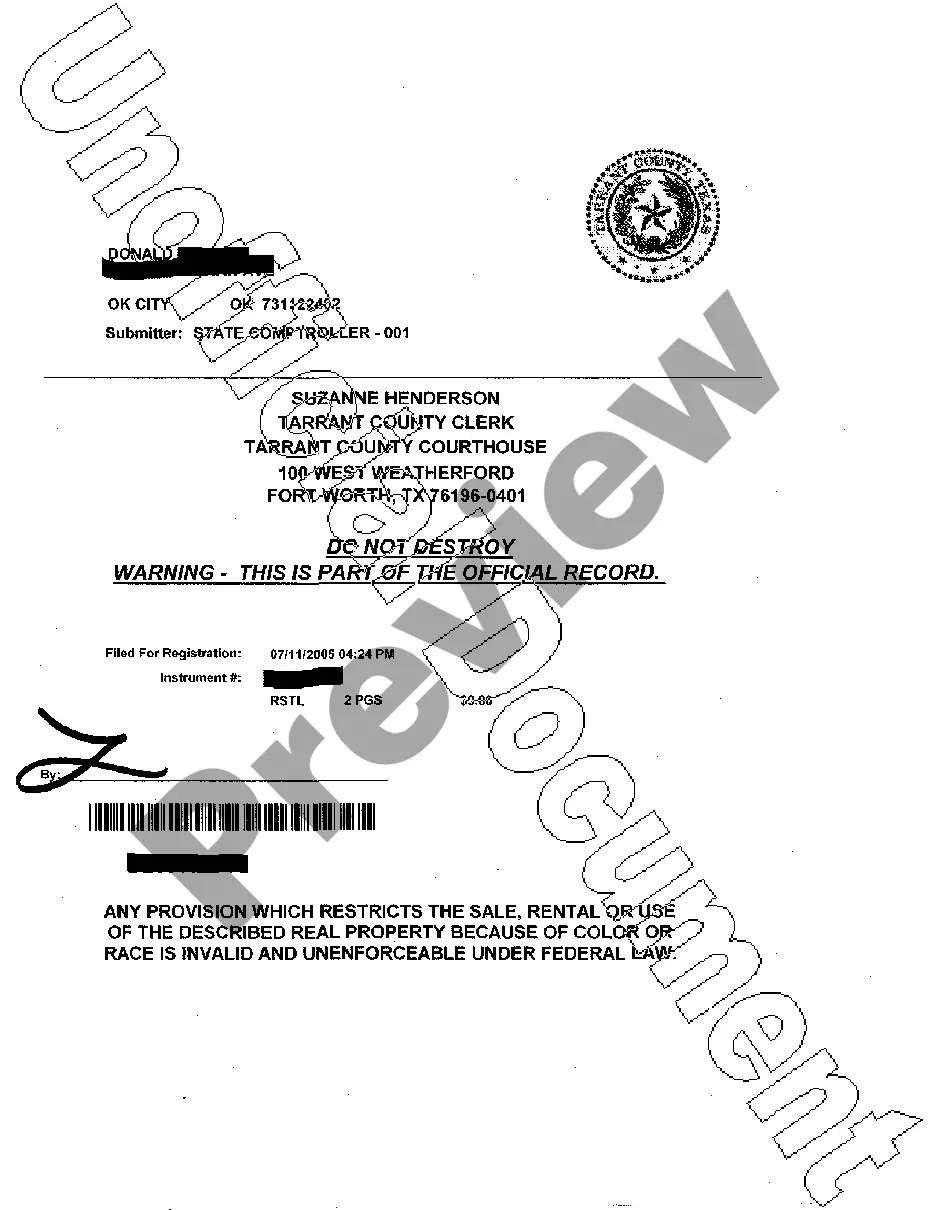

Killeen Texas Release of State Tax Lien Filed in Error: Understanding the Process and Types What is a Killeen Texas Release of State Tax Lien Filed in Error? A Killeen Texas Release of State Tax Lien Filed in Error refers to the legal process by which a state tax lien on a property is released, revoked, or removed due to an error made during the filing process. This occurs when the state tax authority realizes that the tax lien was filed in error, either due to incorrect information, miscalculation of taxes owed, or any other administrative mistake. Types of Killeen Texas Release of State Tax Lien Filed in Error: 1. Incorrect Property Assessment: In some cases, a Killeen Texas Release of State Tax Lien Filed in Error might occur because the state tax authority mistakenly assessed the tax lien on the wrong property. This could happen due to similar addresses, outdated property records, or human error during data entry. 2. Calculation Error: In instances where the state tax authority miscalculates the amount of taxes owed and mistakenly files a tax lien against the property owner, a Killeen Texas Release of State Tax Lien Filed in Error may be requested. This could happen due to inaccurate data or a failure to consider eligible deductions, resulting in an overstated tax liability. 3. Procedural Errors: Sometimes, administrative errors made by the state tax authority can lead to the improper filing of a tax lien. This may include failure to follow proper notification procedures, violation of statutory requirements, or any other violation of established regulations. If such errors are identified, a Killeen Texas Release of State Tax Lien Filed in Error can be pursued. Process of Killeen Texas Release of State Tax Lien Filed in Error: 1. Identifying the Error: The property owner or their legal representative must first discover the error made during the filing of the state tax lien. This may occur through routine property audits, notification from the tax authority, or other means. 2. Gathering Documentation: The property owner should gather all relevant documentation that supports the claim of an error in the tax lien filing. This may include property records, tax assessment documents, payment receipts, or any other evidence that disputes the accuracy of the tax lien. 3. Contacting the State Tax Authority: The property owner should contact the relevant state tax authority to inform them about the error and request a Killeen Texas Release of State Tax Lien Filed in Error. This can usually be done through a formal written request, accompanied by the supporting documentation. 4. Resolution and Lien Removal: The state tax authority will review the claim and supporting documents provided by the property owner. If the authority confirms the error, they will initiate the necessary steps to release the tax lien. This may involve revising records, updating databases, and issuing an official release. 5. Property Owner's Responsibilities: Once the Killeen Texas Release of State Tax Lien Filed in Error is granted, it is the property owner's responsibility to ensure that all records and public documents reflect the lien's removal. This may involve updating title deeds, notifying credit bureaus, and providing proof of lien release when necessary. In conclusion, a Killeen Texas Release of State Tax Lien Filed in Error is a legal process that rectifies the filing of a tax lien that was erroneously imposed on a property. It involves identifying the error, gathering documentation, contacting the tax authority, and eventually obtaining a lien release. Different types of errors can cause such releases, including incorrect property assessments, calculation errors, and procedural mistakes.

Killeen Texas Release of State Tax Lien Filed in Error

Description

How to fill out Killeen Texas Release Of State Tax Lien Filed In Error?

Benefit from the US Legal Forms and get instant access to any form you want. Our useful website with a huge number of templates allows you to find and obtain virtually any document sample you require. You can export, fill, and certify the Killeen Texas Release of State Tax Lien Filed in Error in a few minutes instead of browsing the web for hours searching for the right template.

Utilizing our catalog is a superb way to raise the safety of your record filing. Our professional attorneys on a regular basis review all the records to ensure that the forms are appropriate for a particular state and compliant with new acts and polices.

How can you get the Killeen Texas Release of State Tax Lien Filed in Error? If you have a subscription, just log in to the account. The Download option will be enabled on all the samples you view. Furthermore, you can find all the previously saved documents in the My Forms menu.

If you haven’t registered a profile yet, follow the tips listed below:

- Find the template you need. Make sure that it is the template you were hoping to find: examine its title and description, and utilize the Preview feature if it is available. Otherwise, use the Search field to find the appropriate one.

- Start the downloading procedure. Select Buy Now and select the pricing plan that suits you best. Then, sign up for an account and process your order using a credit card or PayPal.

- Export the file. Indicate the format to obtain the Killeen Texas Release of State Tax Lien Filed in Error and edit and fill, or sign it according to your requirements.

US Legal Forms is among the most considerable and trustworthy template libraries on the web. Our company is always ready to help you in virtually any legal procedure, even if it is just downloading the Killeen Texas Release of State Tax Lien Filed in Error.

Feel free to make the most of our form catalog and make your document experience as efficient as possible!

Form popularity

FAQ

In Texas, a lien release generally must be notarized to be legally effective. The notarization process verifies the identity of the person signing the form and confirms that they are doing so willingly. If you encounter issues related to a Killeen Texas Release of State Tax Lien Filed in Error, obtaining notarized documents may enhance your credibility in the filing and release process.

Removing a lien from your property in Texas usually requires filing a lien release form with the appropriate county office. Ensure that you have fulfilled all obligations tied to the lien, and gather supporting documentation before submission. If you are facing a Killeen Texas Release of State Tax Lien Filed in Error, U.S. Legal Forms can assist you in navigating the necessary procedures effectively.

Doing a release of lien in Texas involves a few key steps. First, confirm the payment of the debt associated with the lien. Next, complete the total amount due release document and file it with the local county clerk where the lien was initially recorded. To streamline your experience with a Killeen Texas Release of State Tax Lien Filed in Error, consider using services like U.S. Legal Forms for guidance and support.

To file a release of a lien in Texas, you must first gather the required documents that demonstrate the lien is satisfied. You then need to complete the appropriate release form and submit it to the county clerk’s office where the original lien was recorded. If you are dealing with a Killeen Texas Release of State Tax Lien Filed in Error, utilizing U.S. Legal Forms can help simplify your filing process.

The duration for obtaining a lien release in Texas can vary based on several factors. Typically, once the necessary documentation is submitted and processed, it may take a few days to a few weeks to receive the lien release. If you believe you have a case regarding a Killeen Texas Release of State Tax Lien Filed in Error, ensure you provide all relevant information promptly to expedite this process.

Yes, in most cases, the IRS does forgive tax debt after 10 years from the date of assessment. This is known as the statute of limitations on tax debt collection. If you are working through a Killeen Texas Release of State Tax Lien Filed in Error, knowing this timeline can provide peace of mind. It may also motivate you to strategize your financial plan effectively while awaiting potential relief.

Resolving a tax lien can take anywhere from a few weeks to several months, depending on the complexity of your case. Factors such as the accuracy of your paperwork and the responsiveness of the IRS impact the timeline. If your situation involves a Killeen Texas Release of State Tax Lien Filed in Error, leveraging reliable resources can help streamline the resolution process. Staying organized can make all the difference in how smoothly your case progresses.

Getting a lien release from the IRS usually takes around 30 days after you submit the necessary paperwork. However, it can be quicker if you provide all required documents upfront and use the proper channels. If you are facing issues like a Killeen Texas Release of State Tax Lien Filed in Error, acting quickly and following the correct procedures can expedite the process. Make sure to stay in communication with the IRS for updates on your case.

The amount the IRS settles for can vary widely based on individual circumstances. Generally, the IRS may accept a lower amount if you can demonstrate genuine financial hardship. If you're navigating a Killeen Texas Release of State Tax Lien Filed in Error, consider exploring all your options with a professional to negotiate a reasonable settlement. Remember, a knowledgeable advisor can guide you through the process effectively.

In Texas, the statute of limitations on a tax lien is typically 20 years. This means that a tax lien remains in effect for that duration unless it is resolved sooner. For those dealing with a Killeen Texas Release of State Tax Lien Filed in Error, understanding this timeframe is crucial. Prompt action can prevent complications that arise from unresolved tax issues.