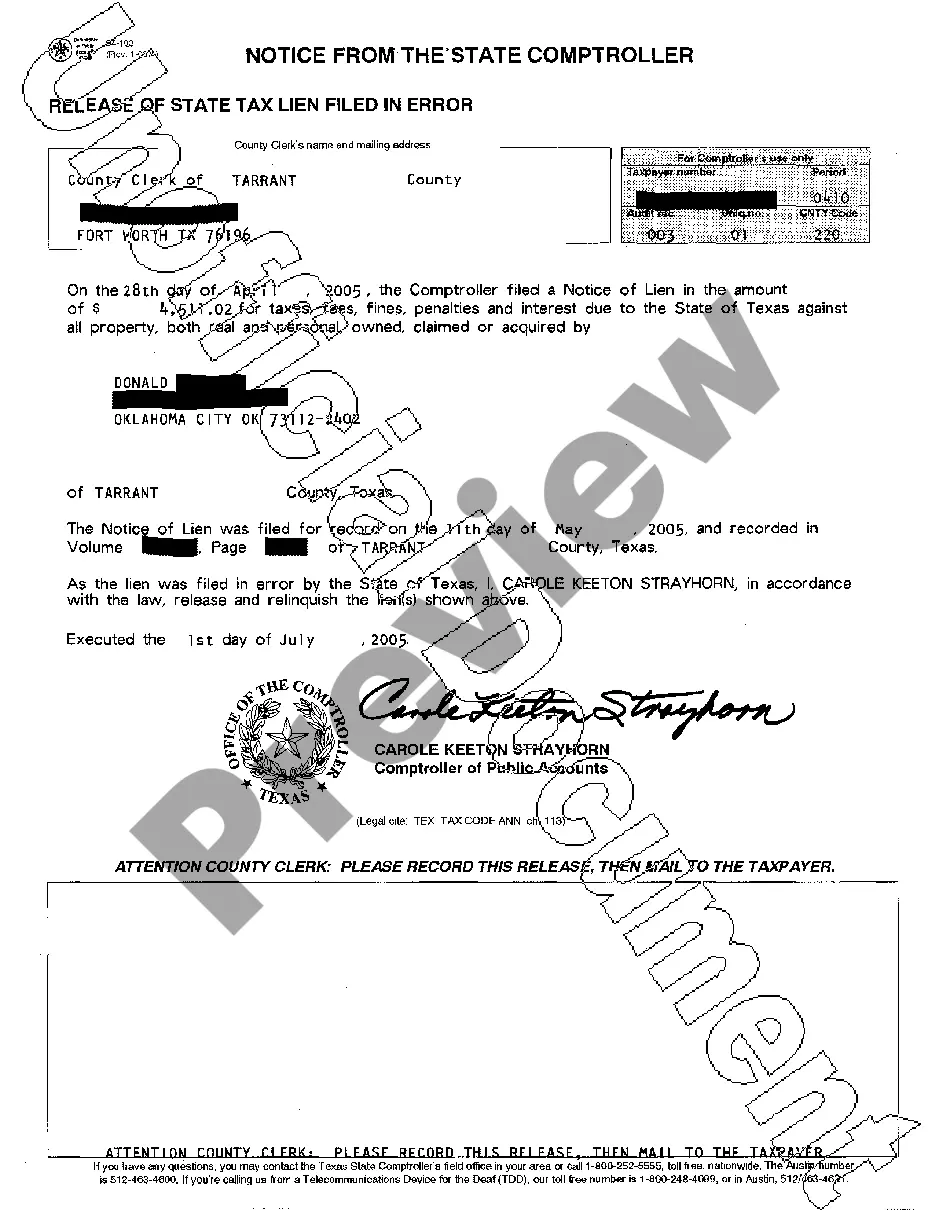

League City Texas Release of State Tax Lien Filed in Error: A Comprehensive Overview In League City, Texas, a release of state tax lien filed in error refers to a corrective legal process undertaken to rectify a mistaken filing of a state tax lien on a property or an individual. This occurrence can happen due to various reasons, such as administrative errors, miscommunication, or incorrect information provided by the taxpayer or taxpayer's representative. The release of state tax lien filed in error can have different types, which include: 1. Administrative Error Release: This type of release occurs when a state taxing authority acknowledges and rectifies an error made by its administrative department during the processing of tax documents. The release ensures that the lien, which was incorrectly filed, is removed from the property or individual's records. 2. Taxpayer Error Release: In certain cases, a release may be requested by the taxpayer if they can demonstrate that they have provided accurate information, but the state tax lien was filed in error. This release type requires the taxpayer to provide evidence supporting their claim and work through the necessary legal procedures to remove the lien. 3. Expert/Professional Error Release: Occasionally, an error may occur due to mistakes made by professionals, such as tax attorneys, accountants, or consultants, who were responsible for preparing and submitting the tax documents. In such instances, the taxpayer can seek a release of the lien filed in error, provided they can prove that the mistake was made by the hired professional. The process for obtaining a release of a state tax lien filed in error in League City, Texas involves several steps. Initially, the taxpayer or their representative must identify the error and gather all relevant information and documentation supporting their claim. This may include tax returns, correspondence with the state tax authority, and records of payments made. Once all necessary documentation is compiled, the taxpayer needs to submit a formal request to the state tax authority, explaining the error and providing evidence to support their claim. The authority will review the case and determine the validity of the claim. If they find the claim to be legitimate, a release will be issued, and the erroneous lien will be removed from the taxpayer's records. It is important to note that the process of obtaining a release of a state tax lien filed in error can be complex and time-consuming. Seeking legal representation or professional assistance can be helpful in navigating through the necessary procedures and ensuring a successful outcome. In conclusion, a League City Texas release of state tax lien filed in error refers to the correction of an erroneously filed state tax lien on a property or individual. The release types may vary, including administrative errors, taxpayer errors, and expert/professional errors. The process for obtaining a release involves identifying the error, gathering supporting documentation, submitting a formal request to the state tax authority, and awaiting their review. Seeking professional assistance is advisable for a smooth resolution of this matter.

League City Texas Release of State Tax Lien Filed in Error

Description

How to fill out League City Texas Release Of State Tax Lien Filed In Error?

We always want to minimize or avoid legal issues when dealing with nuanced legal or financial matters. To do so, we apply for legal solutions that, usually, are extremely costly. However, not all legal issues are as just complex. Most of them can be dealt with by ourselves.

US Legal Forms is an online collection of up-to-date DIY legal forms addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your matters into your own hands without using services of a lawyer. We offer access to legal form templates that aren’t always publicly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to get and download the League City Texas Release of State Tax Lien Filed in Error or any other form easily and safely. Simply log in to your account and click the Get button next to it. In case you lose the document, you can always download it again from within the My Forms tab.

The process is just as straightforward if you’re unfamiliar with the platform! You can register your account in a matter of minutes.

- Make sure to check if the League City Texas Release of State Tax Lien Filed in Error complies with the laws and regulations of your your state and area.

- Also, it’s crucial that you go through the form’s description (if available), and if you spot any discrepancies with what you were looking for in the first place, search for a different template.

- As soon as you’ve ensured that the League City Texas Release of State Tax Lien Filed in Error is proper for you, you can pick the subscription option and make a payment.

- Then you can download the document in any suitable file format.

For over 24 years of our existence, we’ve served millions of people by offering ready to customize and up-to-date legal forms. Take advantage of US Legal Forms now to save efforts and resources!