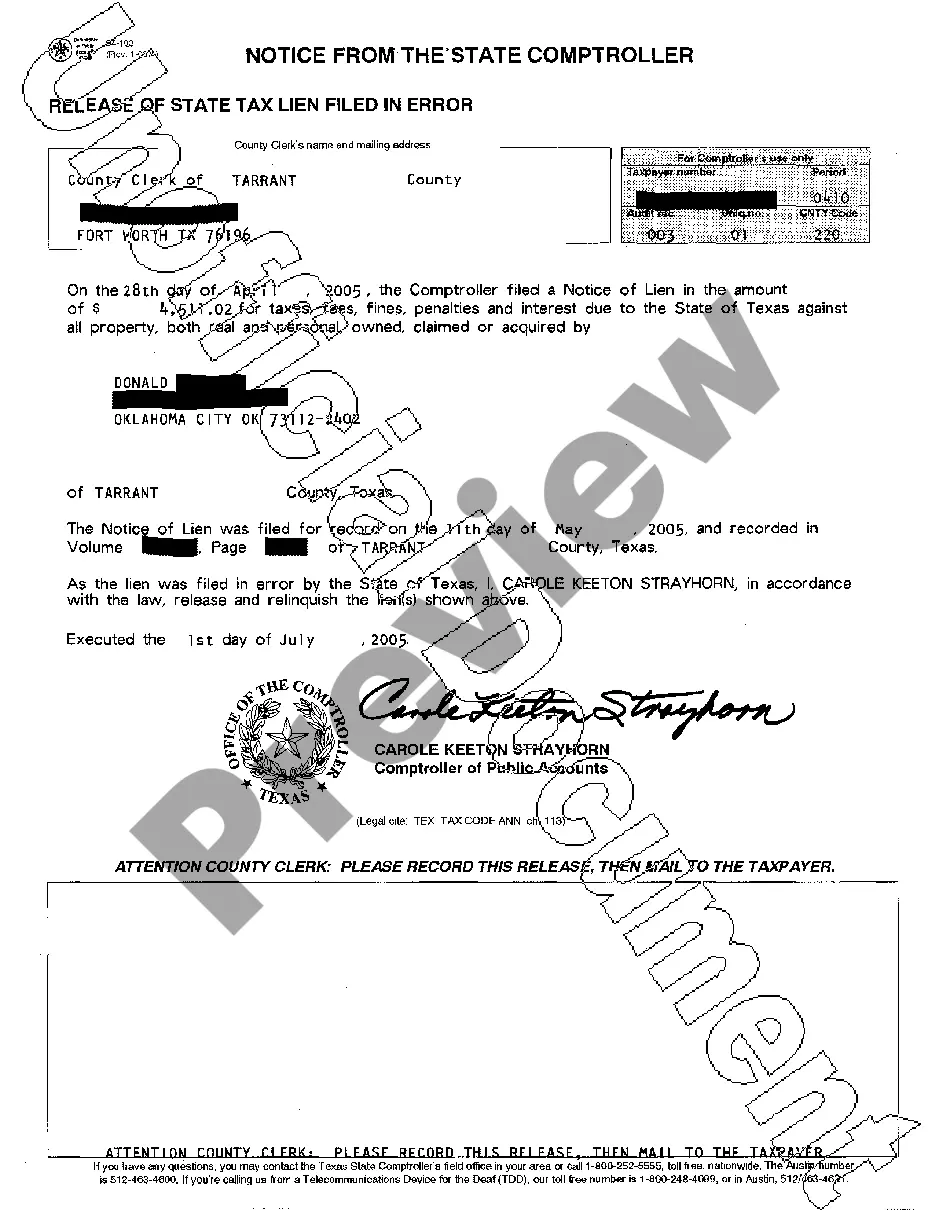

Title: Understanding the Pearland Texas Release of State Tax Lien Filed in Error Introduction: Discover all you need to know about the Pearland Texas Release of State Tax Lien Filed in Error, including its significance, process, and potential types. Avoid confusion and gain clarity regarding this matter to ensure accurate handling of state tax liens. 1. Understanding the Pearland Texas Release of State Tax Lien Filed in Error: The Pearland Texas Release of State Tax Lien Filed in Error refers to a legal process that rectifies an unintentional filing of a state tax lien against a taxpayer. This release allows individuals or businesses to clear their records of erroneous and undeserved tax liens. 2. Importance of Pearland Texas Release of State Tax Lien Filed in Error: The release is crucial as it clears the taxpayer's name and credit history from any wrongdoing or unpaid taxes. Additionally, it protects the taxpayer's assets, ensures financial stability, and eliminates the potential negative impact on future borrowing or business endeavors. 3. Process of Pearland Texas Release of State Tax Lien Filed in Error: a) Identification: Taxpayers must first identify if a state tax lien has been wrongly filed against them. This can be done by reviewing their tax records, credit reports, or consulting with qualified tax professionals. b) Documentation: The taxpayer needs to gather all relevant documentation, including proof of payment, error notices, or any other supporting evidence that proves the filing was an error. c) Notification: The taxpayer should promptly notify the appropriate state tax authority, either through written correspondence or via electronic channels, providing details of the error and accompanying evidence. d) Collaborative Resolution: To resolve the issue, taxpayers may need to work with the state tax authority, provide additional requested information, or attend meetings to present their case and request the release of the tax lien filed in error. e) Verification and Release: After thorough evaluation, the state tax authority verifies the error and, upon confirmation, initiates the release process, thereby removing the incorrect state tax lien from the taxpayer's record. 4. Different Types of Pearland Texas Release of State Tax Lien Filed in Error: a) Administrative Errors: Occur due to mistakes made by the state tax authority during the process of recording or filing tax liens, including incorrect names, social security numbers, or misplaced records. b) Payment Errors: Arise when taxpayers provide evidence of timely payments or satisfying tax obligations, which were incorrectly recorded as unpaid or delinquent, prompting the release of the lien. c) Statute of Limitations: This release occurs when the state tax authority mistakenly files a tax lien after the expiration of the allowable time frame, rendering it invalid. Conclusion: Understanding the Pearland Texas Release of State Tax Lien Filed in Error is vital for individuals and businesses to rectify wrongful filings promptly. By taking the necessary steps to clear erroneous tax liens, taxpayers can protect their financial reputation, credit score, and overall financial standing. Seek professional guidance from qualified tax experts or state tax authorities to ensure a smooth and successful resolution.

Pearland Texas Release of State Tax Lien Filed in Error

Description

How to fill out Pearland Texas Release Of State Tax Lien Filed In Error?

We always strive to minimize or avoid legal issues when dealing with nuanced legal or financial affairs. To accomplish this, we apply for legal services that, usually, are extremely costly. However, not all legal matters are equally complex. Most of them can be taken care of by ourselves.

US Legal Forms is an online library of up-to-date DIY legal forms covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your affairs into your own hands without the need of turning to an attorney. We offer access to legal document templates that aren’t always publicly accessible. Our templates are state- and area-specific, which significantly facilitates the search process.

Benefit from US Legal Forms whenever you need to get and download the Pearland Texas Release of State Tax Lien Filed in Error or any other document quickly and safely. Simply log in to your account and click the Get button next to it. In case you lose the document, you can always re-download it in the My Forms tab.

The process is equally effortless if you’re unfamiliar with the website! You can create your account within minutes.

- Make sure to check if the Pearland Texas Release of State Tax Lien Filed in Error adheres to the laws and regulations of your your state and area.

- Also, it’s crucial that you go through the form’s description (if available), and if you notice any discrepancies with what you were looking for in the first place, search for a different template.

- As soon as you’ve ensured that the Pearland Texas Release of State Tax Lien Filed in Error would work for you, you can pick the subscription plan and make a payment.

- Then you can download the document in any available file format.

For more than 24 years of our presence on the market, we’ve helped millions of people by providing ready to customize and up-to-date legal forms. Make the most of US Legal Forms now to save efforts and resources!