Title: Understanding the Round Rock Texas Release of State Tax Lien Filed in Error Introduction: The Round Rock Texas Release of State Tax Lien Filed in Error refers to a legal procedure undertaken to rectify an accidentally filed state tax lien. This process aims to release individuals or businesses from any unwarranted tax burdens imposed due to an error or incorrect filing by the state tax authority. In Round Rock, Texas, taxpayers who find themselves in such a situation have the opportunity to correct the mistake and remove the burden of a state tax lien. Types of Round Rock Texas Release of State Tax Lien Filed in Error: 1. Individual Taxpayer Error: This type of release occurs when an individual taxpayer unintentionally provides incorrect information to the state tax authority, leading to the filing of a state tax lien in error. Such errors can arise from miscalculations, inaccuracies in reporting income, or misunderstanding of tax obligations. 2. Business Taxpayer Error: Businesses in Round Rock may also experience a release of state tax lien when they make inadvertent errors in their tax filings. This can include issues related to incorrect sales tax reporting, errors in payroll tax calculations, or inaccurately reported deductible expenses. 3. State Tax Authority Error: In certain cases, the release of state tax lien is the result of an error made by the Texas state tax authority during their tax assessment or collection process. Such errors can stem from miscalculations, misinterpretation of tax laws, or incorrect implementation of taxpayer information. Process of Correcting a Round Rock Texas Release of State Tax Lien Filed in Error: 1. Identification of Error: The taxpayer or their representative must identify the discrepancy or error that resulted in the incorrect filing of the state tax lien. This can be achieved by reviewing tax returns, records, and correspondence exchanged with the state tax authority. 2. Documentation: Gather all relevant documents and evidence that support the claim of an erroneous state tax lien. These may include revised tax returns, income statements, receipts, and any other documentation to substantiate the correction. 3. Notifying the State Tax Authority: Contact the appropriate branch of the Texas state tax authority to inform them about the filing error and request a review. This can typically be done by writing a formal letter or contacting the authority's helpline. 4. Providing Supporting Evidence: Submit all necessary documents and evidence to the state tax authority, demonstrating the error and the need for a release of the state tax lien. This may involve completing certain forms or providing supplementary explanations to facilitate the review process. 5. Review and Resolution: The state tax authority will assess the provided information and supporting documents to determine whether the claim of an erroneous state tax lien is valid. If successful, they will issue a release of the lien, absolving the taxpayer of any unintended tax obligations. Conclusion: The Round Rock Texas Release of State Tax Lien Filed in Error offers a mechanism for taxpayers to rectify unintentionally filed state tax liens. Whether caused by individual or business taxpayer error or an error on the part of the state tax authority, the process involves identifying the mistake, gathering supporting documents, and notifying the state tax authority. By following this procedure, individuals and businesses can ensure they are relieved of any undue financial obligations resulting from an incorrect state tax lien filing.

Round Rock Texas Release of State Tax Lien Filed in Error

Description

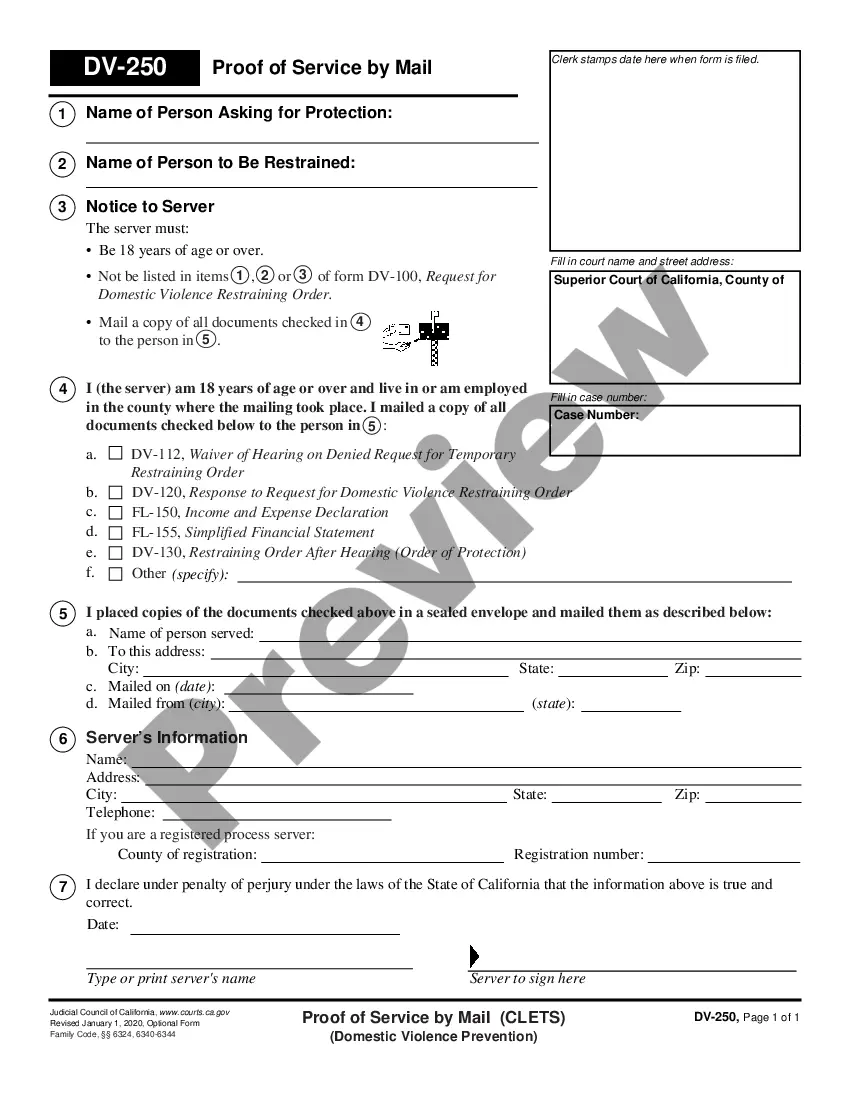

How to fill out Round Rock Texas Release Of State Tax Lien Filed In Error?

Locating verified templates specific to your local regulations can be challenging unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both individual and professional needs and any real-life scenarios. All the documents are properly grouped by area of usage and jurisdiction areas, so locating the Round Rock Texas Release of State Tax Lien Filed in Error becomes as quick and easy as ABC.

For everyone already familiar with our service and has used it before, getting the Round Rock Texas Release of State Tax Lien Filed in Error takes just a few clicks. All you need to do is log in to your account, choose the document, and click Download to save it on your device. This process will take just a couple of more actions to complete for new users.

Adhere to the guidelines below to get started with the most extensive online form collection:

- Check the Preview mode and form description. Make sure you’ve chosen the correct one that meets your requirements and fully corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you see any inconsistency, use the Search tab above to find the right one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and choose the subscription plan you prefer. You should sign up for an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the service.

- Download the Round Rock Texas Release of State Tax Lien Filed in Error. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Benefit from the US Legal Forms library to always have essential document templates for any needs just at your hand!