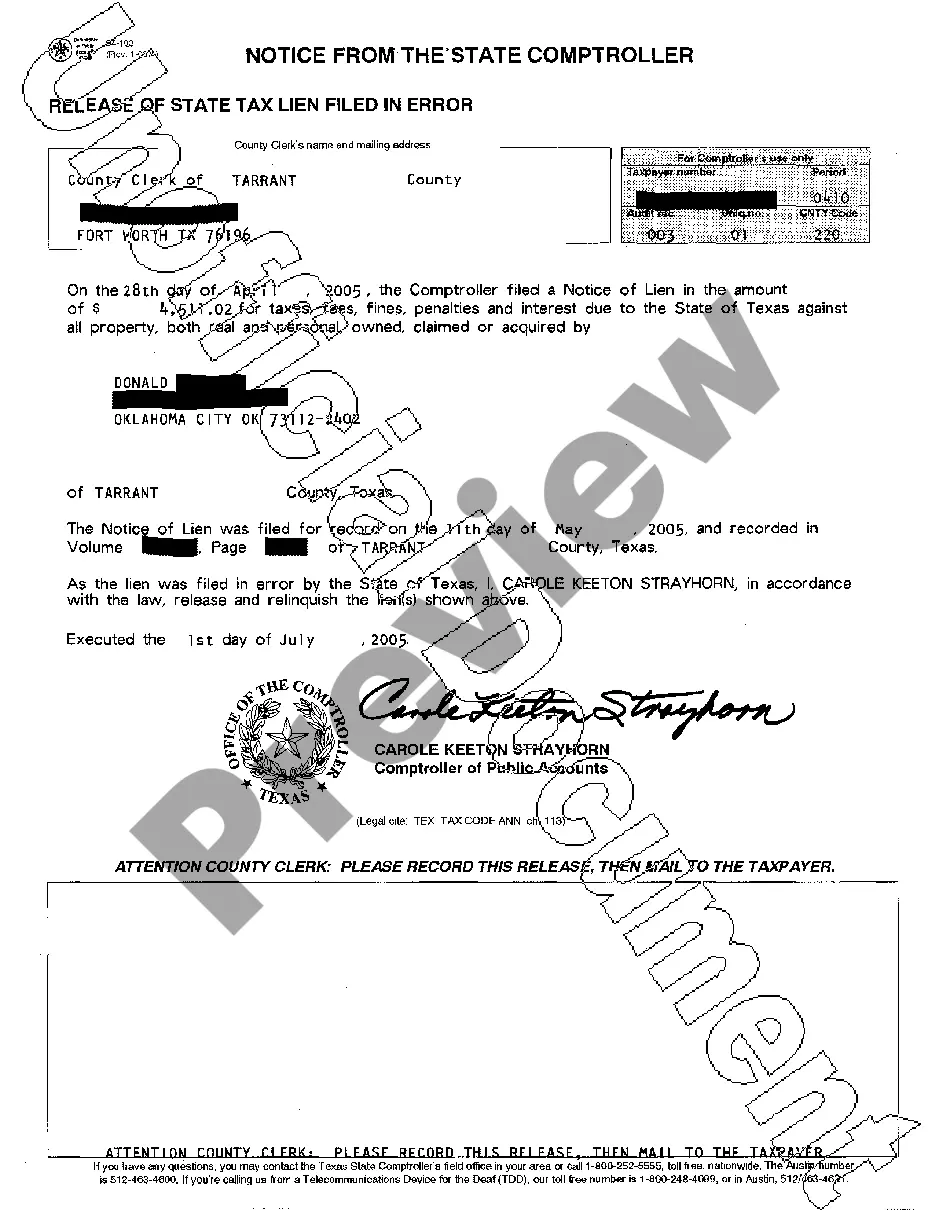

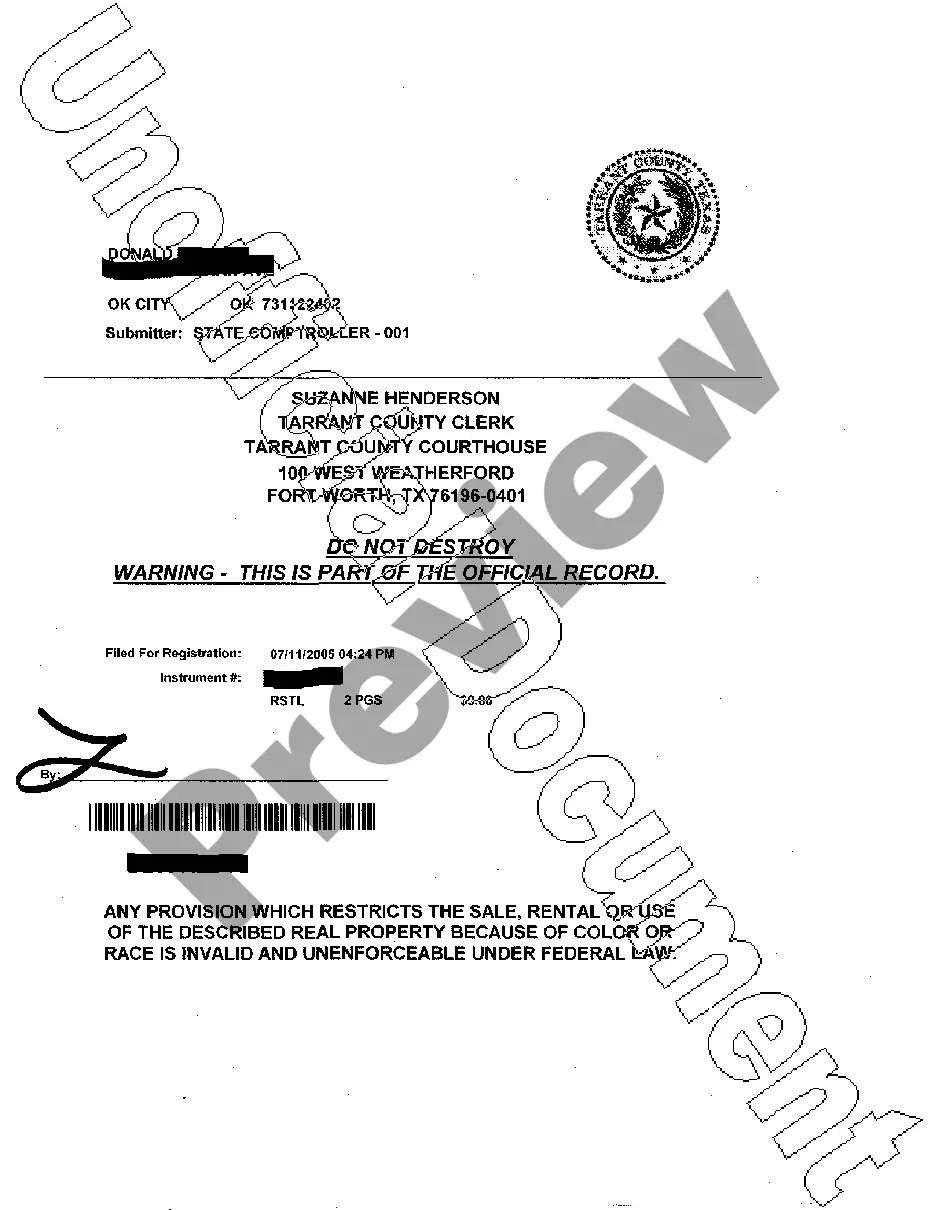

A San Antonio Texas Release of State Tax Lien Filed in Error refers to a legal document issued by the state of Texas acknowledging an error in the filing of a tax lien against an individual or entity in San Antonio, Texas. This release acts as an official declaration that the tax lien was mistakenly filed and should be removed from public records. State tax liens are typically placed on individuals or businesses by the government authorities when there are unpaid taxes or tax debts. However, sometimes mistakes can occur during the filing process, leading to the erroneous placement of a tax lien against a taxpayer. The San Antonio Texas Release of State Tax Lien Filed in Error serves as a remedy for such an error and ensures that the affected party is no longer burdened with the consequences of the wrongful tax lien placement. It is an important document as it establishes the release of the lien and compels the relevant government agencies to update their records accordingly. Some types of San Antonio Texas Release of State Tax Lien Filed in Error might include: 1. Individual Release: This type of release is issued for individuals who have been wrongfully subjected to a state tax lien in San Antonio, Texas. 2. Business Release: This release is specific to businesses or commercial entities that have faced an error in the filing of a state tax lien in San Antonio, Texas. The specific details of the release, including the taxpayer's name, tax identification number, lien identification number, date of release, and a statement declaring the error in the initial filing, will be included in the document. Obtaining a San Antonio Texas Release of State Tax Lien Filed in Error requires the affected taxpayer to follow a prescribed procedure outlined by the state tax authorities. This typically involves submitting a formal request or application along with supporting documentation to prove the error. Upon verification of the error, the state tax authorities will issue the release, which can then be filed with the appropriate county office to remove the erroneous lien from public records. Overall, a San Antonio Texas Release of State Tax Lien Filed in Error serves as a crucial legal document that rectifies mistakes made during the filing of a tax lien, granting relief to individuals and businesses in San Antonio, Texas, from the burdensome consequences of an incorrect tax lien placement.

San Antonio Texas Release of State Tax Lien Filed in Error

Category:

State:

Texas

City:

San Antonio

Control #:

TX-JW-0163

Format:

PDF

Instant download

This form is available by subscription

Description

Release of State Tax Lien Filed in Error

A San Antonio Texas Release of State Tax Lien Filed in Error refers to a legal document issued by the state of Texas acknowledging an error in the filing of a tax lien against an individual or entity in San Antonio, Texas. This release acts as an official declaration that the tax lien was mistakenly filed and should be removed from public records. State tax liens are typically placed on individuals or businesses by the government authorities when there are unpaid taxes or tax debts. However, sometimes mistakes can occur during the filing process, leading to the erroneous placement of a tax lien against a taxpayer. The San Antonio Texas Release of State Tax Lien Filed in Error serves as a remedy for such an error and ensures that the affected party is no longer burdened with the consequences of the wrongful tax lien placement. It is an important document as it establishes the release of the lien and compels the relevant government agencies to update their records accordingly. Some types of San Antonio Texas Release of State Tax Lien Filed in Error might include: 1. Individual Release: This type of release is issued for individuals who have been wrongfully subjected to a state tax lien in San Antonio, Texas. 2. Business Release: This release is specific to businesses or commercial entities that have faced an error in the filing of a state tax lien in San Antonio, Texas. The specific details of the release, including the taxpayer's name, tax identification number, lien identification number, date of release, and a statement declaring the error in the initial filing, will be included in the document. Obtaining a San Antonio Texas Release of State Tax Lien Filed in Error requires the affected taxpayer to follow a prescribed procedure outlined by the state tax authorities. This typically involves submitting a formal request or application along with supporting documentation to prove the error. Upon verification of the error, the state tax authorities will issue the release, which can then be filed with the appropriate county office to remove the erroneous lien from public records. Overall, a San Antonio Texas Release of State Tax Lien Filed in Error serves as a crucial legal document that rectifies mistakes made during the filing of a tax lien, granting relief to individuals and businesses in San Antonio, Texas, from the burdensome consequences of an incorrect tax lien placement.

Free preview

How to fill out San Antonio Texas Release Of State Tax Lien Filed In Error?

If you’ve already used our service before, log in to your account and save the San Antonio Texas Release of State Tax Lien Filed in Error on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple actions to get your file:

- Make sure you’ve found the right document. Look through the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t fit you, utilize the Search tab above to find the appropriate one.

- Buy the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Get your San Antonio Texas Release of State Tax Lien Filed in Error. Opt for the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to every piece of paperwork you have bought: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to rapidly locate and save any template for your individual or professional needs!